#Syrma #Kaynes #Dixon #PGEL

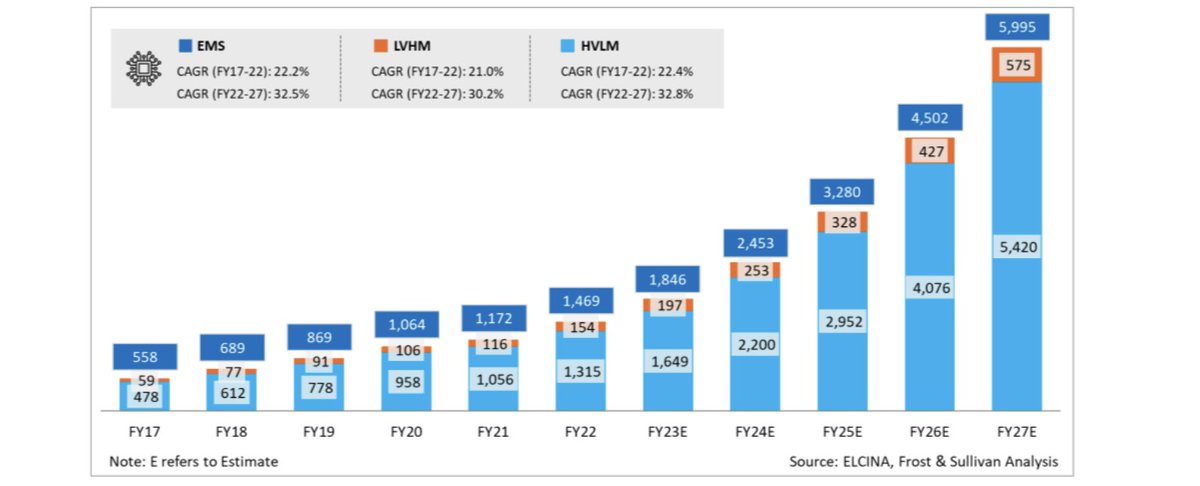

#EMS market is set to grow at +30% CAGR for at least next 5 years from ₹1,469Bn to ₹6,000Bn by FY27.

🧵 on some spl. business insights from Q3FY23 concall & other sources

@soicfinance @ishmohit1

1 can't miss this decadal opp.

Retweet♻️ & Like👍

#EMS market is set to grow at +30% CAGR for at least next 5 years from ₹1,469Bn to ₹6,000Bn by FY27.

🧵 on some spl. business insights from Q3FY23 concall & other sources

@soicfinance @ishmohit1

1 can't miss this decadal opp.

Retweet♻️ & Like👍

There are 2 models that business generally follow:

1. Low Value High Mix (LVHM) - eg. consumer

2. High Value Low Mix (HVLM) - eg. Industrial

This data suggests both type of businesses are set for long-term high growth.

1. Low Value High Mix (LVHM) - eg. consumer

2. High Value Low Mix (HVLM) - eg. Industrial

This data suggests both type of businesses are set for long-term high growth.

This is a crowded space with Indian and large MNC players. However, the industry as a whole is set to grow exponentially and established players who can achieve scale & offer wider capabilities stand to win bigger + mgt. are saying they are just scratching the surface ryt now.

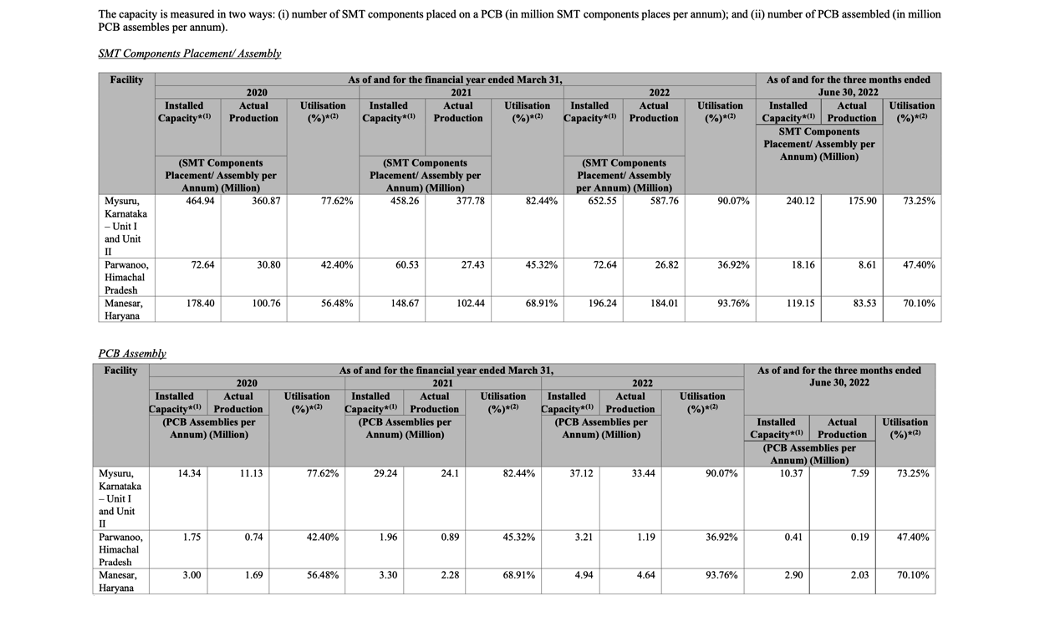

Some tracking variables for both businesses from Q3 FY23 concall. #Kaynes #Syrma

- ODM (IP/designing is developed in-house) & Exports are higher margin

- Box build - is generally high margins but depends on type & segment

- ODM (IP/designing is developed in-house) & Exports are higher margin

- Box build - is generally high margins but depends on type & segment

P/E on Screener can be misleading:

#Kaynes guidance based on current order book:

FY23 - Sales 1200 Cr./ PAT 86 Cr. (P/E 62x)

FY24 - Sales 1700 - 1800 Cr. (Fwd P/E 37x E)

#Kaynes guidance based on current order book:

FY23 - Sales 1200 Cr./ PAT 86 Cr. (P/E 62x)

FY24 - Sales 1700 - 1800 Cr. (Fwd P/E 37x E)

Similarly based on the order book one can come up with estimated sales & PAT and TTM P/E for #Syrma.

Your homework (Hint - its cheaper than #Kaynes)

Kaynes may grow faster.

Your homework (Hint - its cheaper than #Kaynes)

Kaynes may grow faster.

#Kaynes Old Narrative China +1, new narrative "Minus China + One" wah !!!

Very interesting insights on large deals taking place (final discussions) with huge tech transfer and shift from China/Europe.

Even Syrma is adding clients but didn't share such details.

Very interesting insights on large deals taking place (final discussions) with huge tech transfer and shift from China/Europe.

Even Syrma is adding clients but didn't share such details.

There are several other details that I am not sharing here. Read DRHP & Q3FY23 concall.

This space seems very interesting with long runway, as Syrma mgt says, "this is a huge industry and we have barely even touched the surface of this industry"

"Y2k moment"

This space seems very interesting with long runway, as Syrma mgt says, "this is a huge industry and we have barely even touched the surface of this industry"

"Y2k moment"

Given huge growth🏃way, large TAM, 30% CAGR industry level growth, and no barriers 4 est. players to enter new segments -> likely that every player will deliver nos. what may differentiate one is efficiency, WC mgt., Inventory mgt., scale & capabilities, facilities near customer.

One may take a bet on EMS co. or could also consider electronic component proxies like #SBCL #XPROindia. I have been looking at #PGEL since CY21 when #Dixon the Indian's "Universal Champion" & #Amber where flying but its High Debt keeps me away.

Dixon's Moat👇

Dixon's Moat👇

Sources: DRHPs, Research Reports, Concalls, Investor Presentations.

This should give you an idea of where to look for info. when researching co. DRHP is the sweetest place to understand the Industry. Look for the most recently published DRHP of a co. in that industry.

This should give you an idea of where to look for info. when researching co. DRHP is the sweetest place to understand the Industry. Look for the most recently published DRHP of a co. in that industry.

Discl: Closely tracking/studying #SBCL #XPROINDIA #Kaynes #Syrma, may have a position in some.

#Cyient is another one. Looking fwrd to @soicfinance Sunday video on that biz.

#Cyient is another one. Looking fwrd to @soicfinance Sunday video on that biz.

Just to add:

Dixon, Amber, PG Elect WC days & CCC

Theres a stark difference compared to Kaynes & Syrma.

Industry is heavily dependent on electric components imports, not sure how inventory days are kept so low. Commonality, these are all consumer heavy biz. with low CCC.

Dixon, Amber, PG Elect WC days & CCC

Theres a stark difference compared to Kaynes & Syrma.

Industry is heavily dependent on electric components imports, not sure how inventory days are kept so low. Commonality, these are all consumer heavy biz. with low CCC.

Adding more value to 🧵

No. of Customers #Kaynes #Syrma

Reading both co. DRHP & Concalls, its clear Kaynes is more open to sharing details with shareholders.

No. of Customers #Kaynes #Syrma

Reading both co. DRHP & Concalls, its clear Kaynes is more open to sharing details with shareholders.

Another eg. of how open is #Kaynes mgt. in sharing details that #Syrma didn't.

They even shared no. of Orders Cancelled (OC) in FY. However, not sure of value of such order.

OC % - 7%, 3%, 1%, 1% in FY20, FY21, FY22 & Q1FY23 respectively, seems reasonable.

They even shared no. of Orders Cancelled (OC) in FY. However, not sure of value of such order.

OC % - 7%, 3%, 1%, 1% in FY20, FY21, FY22 & Q1FY23 respectively, seems reasonable.

Asset Turnover ratio: measures the efficiency with which a company uses its assets to produce sales

For the period ending FY22

#Kaynes 4.79x

#Syrma 4.43x

For the period ending FY22

#Kaynes 4.79x

#Syrma 4.43x

#EMS stocks have rallied ferociously, starting valuations not cheap but this story is at very early stage. LT earnings CAGR could deliver good returns.

Only problem, my style doesn't allow me to take big bets here, but one could have some exposure post some correction.

Only problem, my style doesn't allow me to take big bets here, but one could have some exposure post some correction.

• • •

Missing some Tweet in this thread? You can try to

force a refresh