1/ Over the last year there has been a growing presence of non-IBC assets coming to Cosmos.

The integration of $AVAX and $MATIC liquidity within @osmosiszone depicts some of the strongest growth of liquidity this year.

Let's breakdown it down.🧵👇

The integration of $AVAX and $MATIC liquidity within @osmosiszone depicts some of the strongest growth of liquidity this year.

Let's breakdown it down.🧵👇

2/ The addition of @avalancheavax and @0xPolygon brought with it, some of the most liquid assets within crypto right to the Cosmos Ecosystem.

Both $AVAX and $MATIC have vibrant ecosystems ranking in the top 10 largest projects by TVL.

Both $AVAX and $MATIC have vibrant ecosystems ranking in the top 10 largest projects by TVL.

3/ With $MATIC being added in late December 2022 and $AVAX January 2023.

We will breakdown both Avalanche and Polygon's:

1️⃣ Trading Activity

2️⃣ Transfers

3️⃣ Liquidity Source

Let's dig in 👇

We will breakdown both Avalanche and Polygon's:

1️⃣ Trading Activity

2️⃣ Transfers

3️⃣ Liquidity Source

Let's dig in 👇

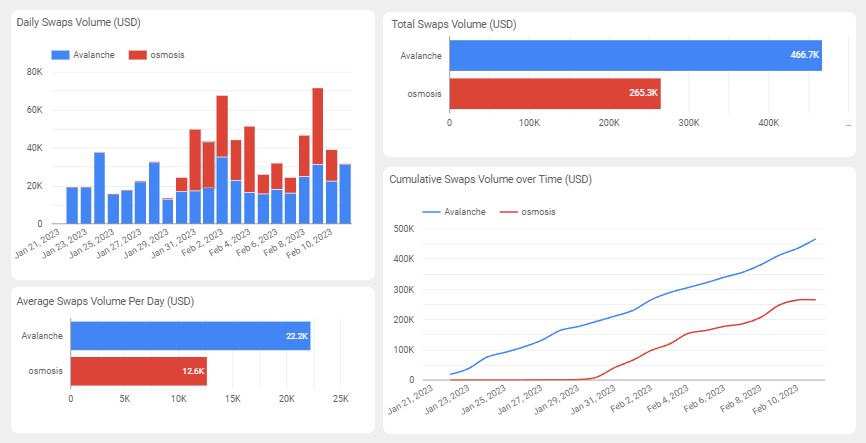

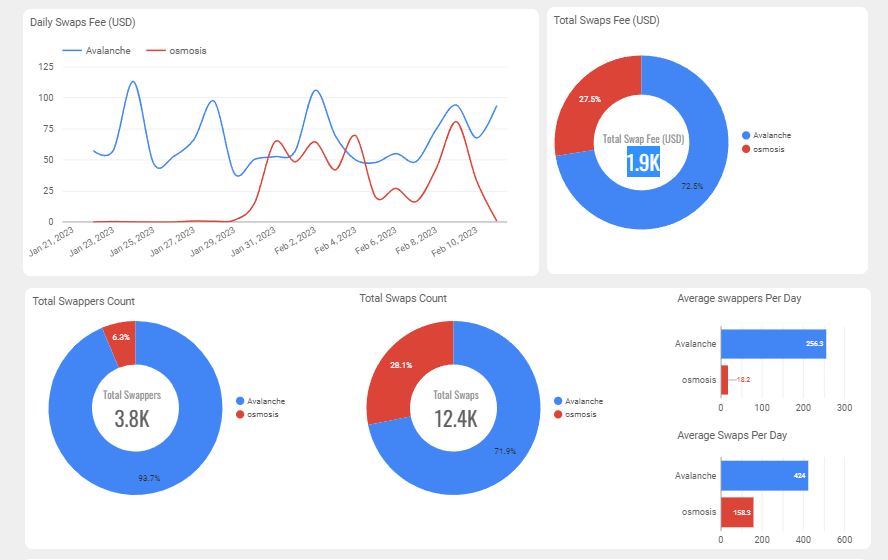

4/ $AVAX Trading Activity Pool

Analyzing the trading activity of $OSMO/ $AVAX

- Since the listing, the majority of trades have come from Avalanche.

- Avalanche is volume $466K USD and for Osmosis $256K USD

- Majority of fees derive from Avalanche liquidity

Analyzing the trading activity of $OSMO/ $AVAX

- Since the listing, the majority of trades have come from Avalanche.

- Avalanche is volume $466K USD and for Osmosis $256K USD

- Majority of fees derive from Avalanche liquidity

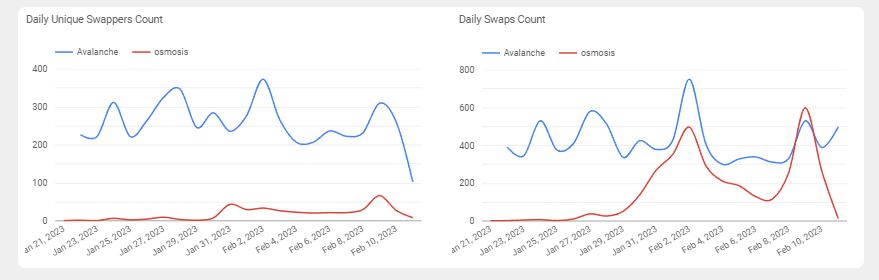

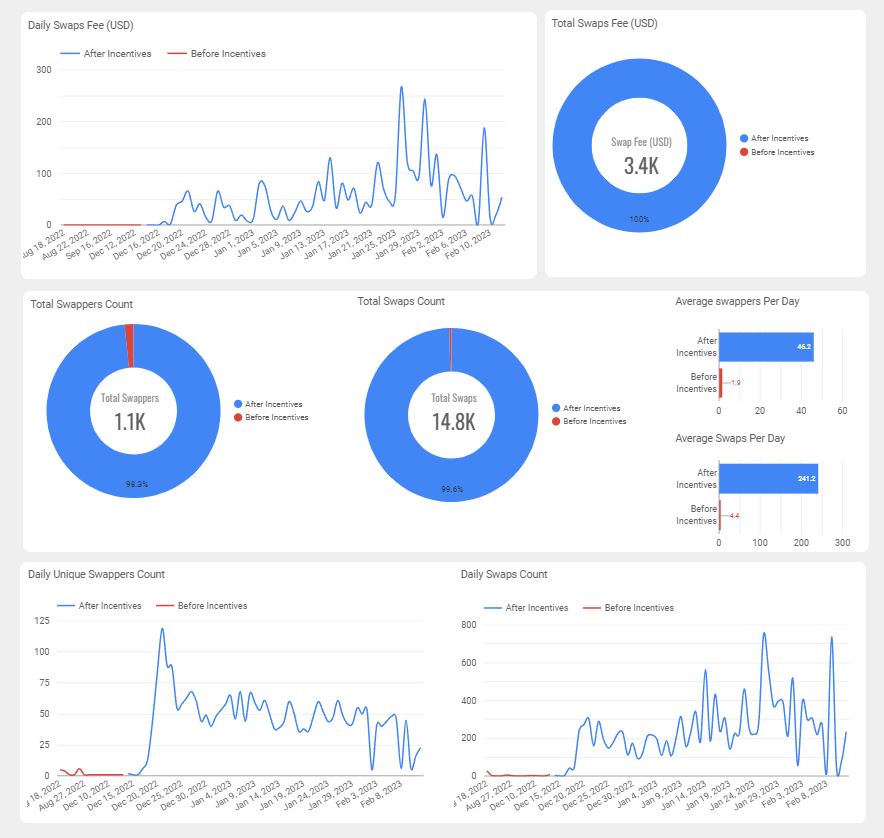

5/ $MATIC Trading Activity

The bulk of the trading activity occurred after incentives 12/19, since then:

- $1.7M in trading volume vs. $147K prior

- Swap size increased from $30 to >$200.00

- 98% swaps occurred after incentives

The bulk of the trading activity occurred after incentives 12/19, since then:

- $1.7M in trading volume vs. $147K prior

- Swap size increased from $30 to >$200.00

- 98% swaps occurred after incentives

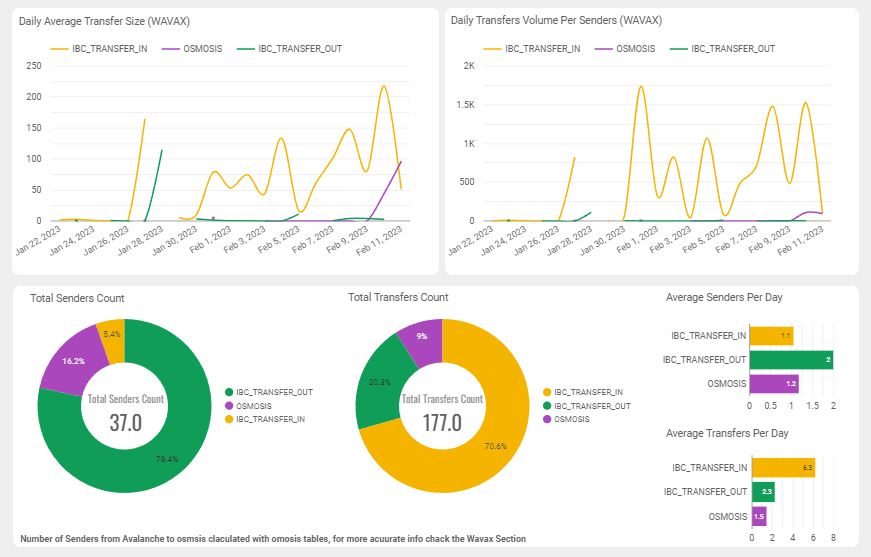

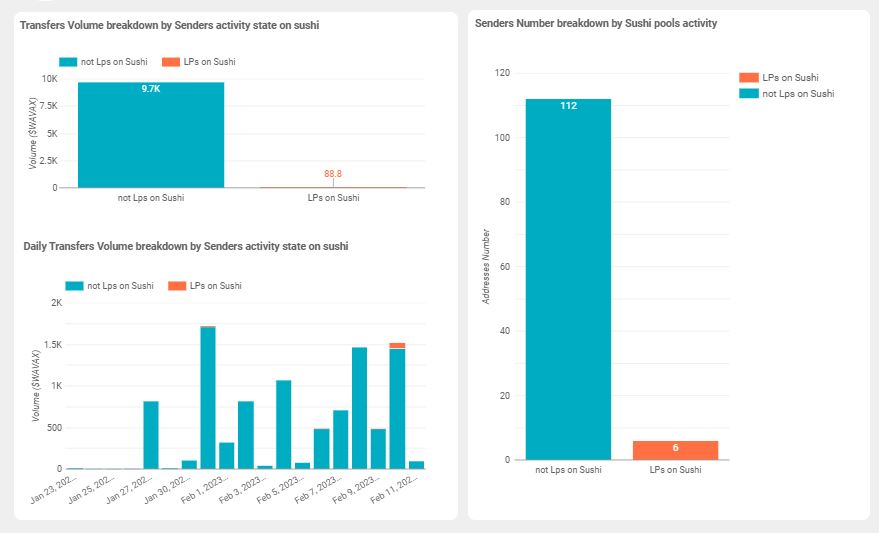

6/ 2️⃣ $AVAX Transfers

Daily volume has primarily come from @avalancheavax liquidity coming into Osmosis.

- 492 $AVAX come into Osmosis per day.

- Senders are concentrated amongst a few users

Since incentive launch, 239 unique wallets have swapped $AVAX on Osmosis

Daily volume has primarily come from @avalancheavax liquidity coming into Osmosis.

- 492 $AVAX come into Osmosis per day.

- Senders are concentrated amongst a few users

Since incentive launch, 239 unique wallets have swapped $AVAX on Osmosis

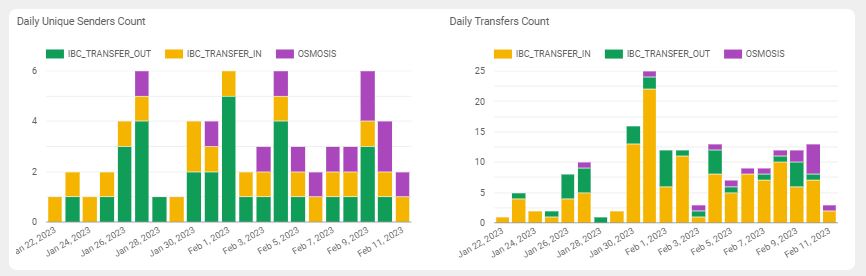

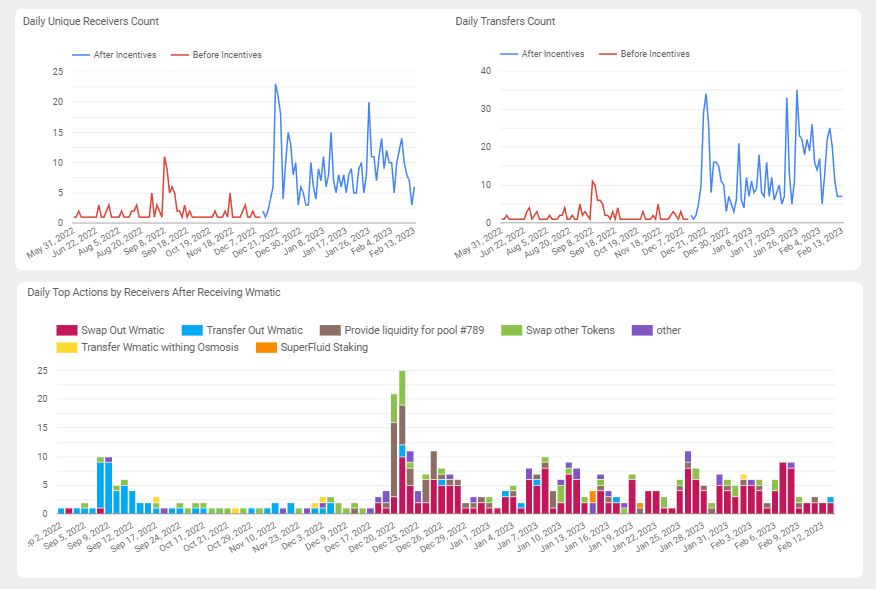

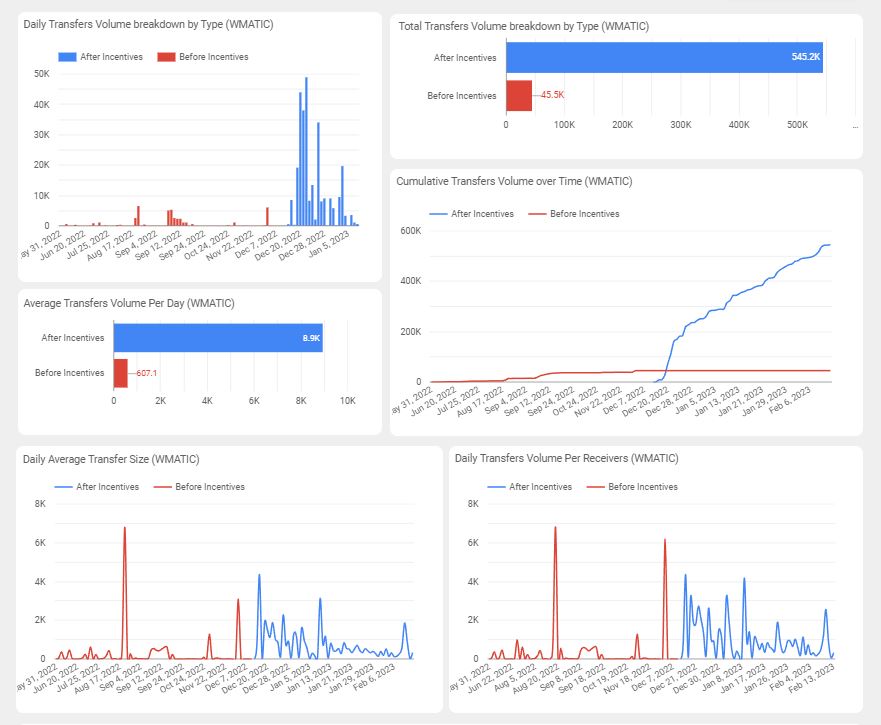

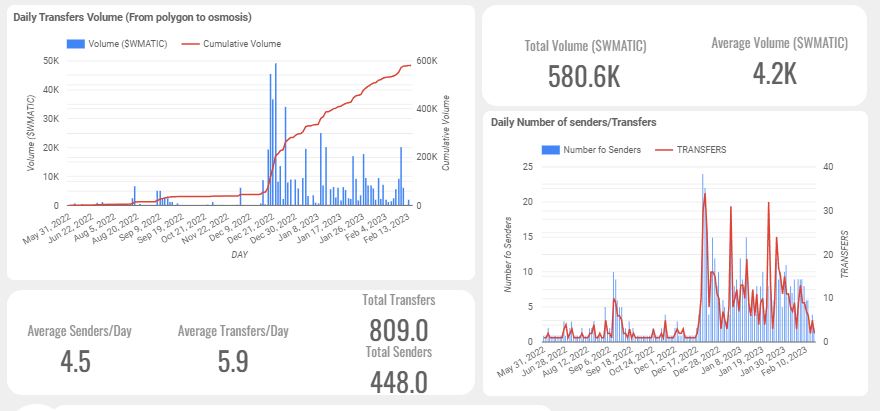

7/ 2️⃣ $MATIC Transfers

The majority of transfers occurred after $OSMO incentives were added.

- 99% of the volume occurred after incentives

- Volume went from $400 ➡$9k per day

- 83% of $MATIC transfers occurred after incentives

The majority of transfers occurred after $OSMO incentives were added.

- 99% of the volume occurred after incentives

- Volume went from $400 ➡$9k per day

- 83% of $MATIC transfers occurred after incentives

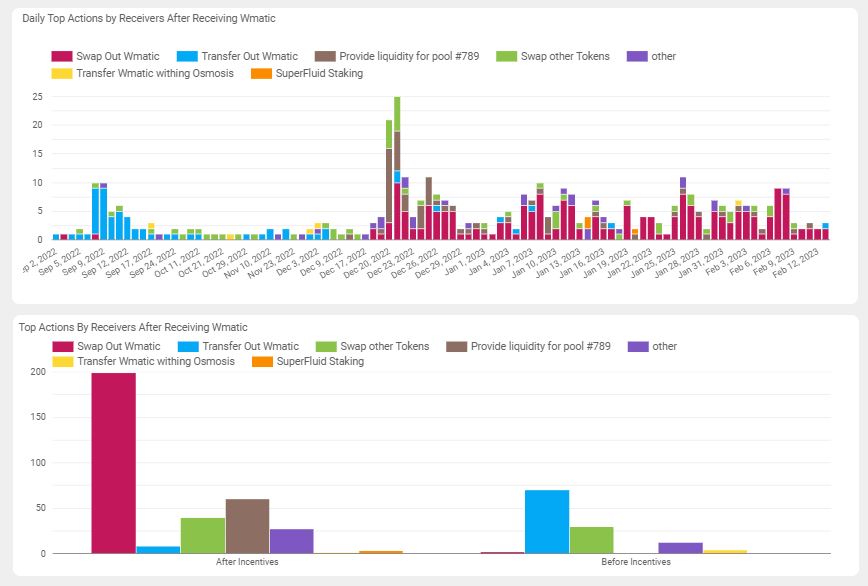

8/ Additionally users bringing @0xPolygon liquidity are not only depositing in the LPs.

Top $MATIC activities occurring by rank:

1. Swapping out MATIC

2. Depositing in LP

3. Trading for other tokens

The other category could be users simply holding their $MATIC

Top $MATIC activities occurring by rank:

1. Swapping out MATIC

2. Depositing in LP

3. Trading for other tokens

The other category could be users simply holding their $MATIC

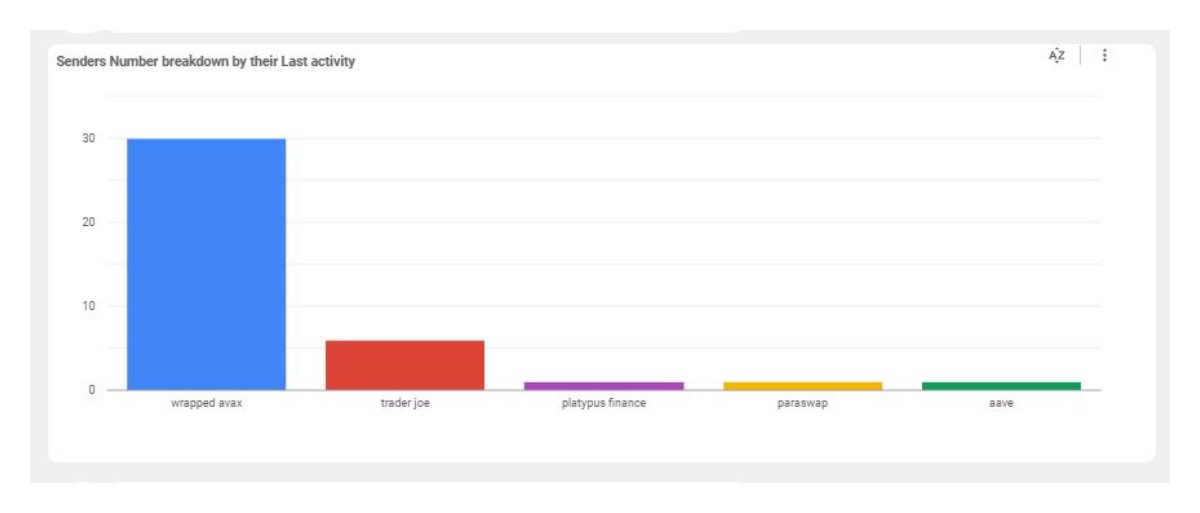

9/ 3️⃣ Where is $AVAX coming from?

The bulk of the liquidity is coming from wrapped $AVAX tokens followed by @traderjoe_xyz

Interestingly, some of the Avalanche liquidity made its way to Osmosis from $SUSHI.

The bulk of the liquidity is coming from wrapped $AVAX tokens followed by @traderjoe_xyz

Interestingly, some of the Avalanche liquidity made its way to Osmosis from $SUSHI.

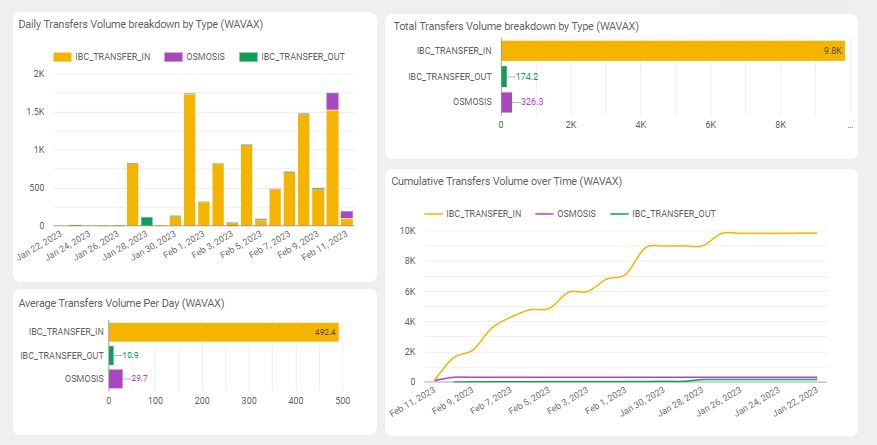

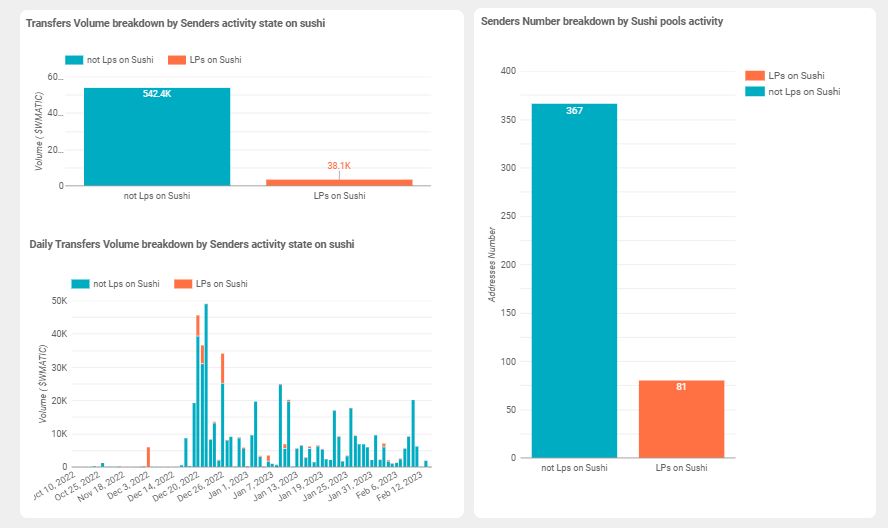

10/ 3️⃣ Where is $MATIC coming from?

A total of 580K $MATIC ($4.2K per day) were transferred into @osmosiszone

- Most which came from @HopProtocol

- The users which did transfer to Osmosis had a large correlation with $SUSHI

- Of the 401 senders over 50% had over 100 TXs.

A total of 580K $MATIC ($4.2K per day) were transferred into @osmosiszone

- Most which came from @HopProtocol

- The users which did transfer to Osmosis had a large correlation with $SUSHI

- Of the 401 senders over 50% had over 100 TXs.

11/ The data suggest that the incentives offered on @osmosiszone have been effective at bootstrapping and attracting users to #Cosmos.

The growth in $MATIC and $AVAX liquidity, has resulted in increased usage and popularity of the tokens outside the native network.

The growth in $MATIC and $AVAX liquidity, has resulted in increased usage and popularity of the tokens outside the native network.

13/ I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Be sure to Like/Retweet the first tweet below if you found this information useful 👇

Follow me @Flowslikeosmo for more.

Be sure to Like/Retweet the first tweet below if you found this information useful 👇

https://twitter.com/Flowslikeosmo/status/1629300182595809280

• • •

Missing some Tweet in this thread? You can try to

force a refresh