Good Saturday Morning Chart Fans!

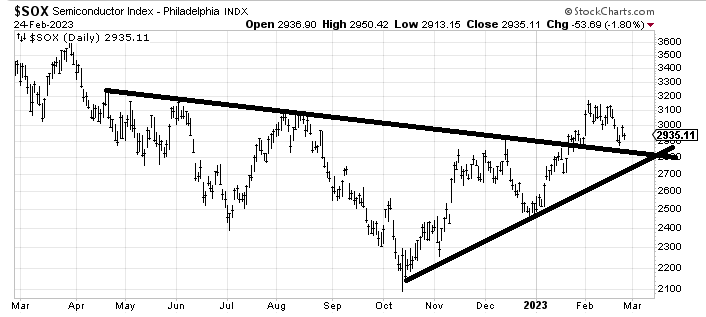

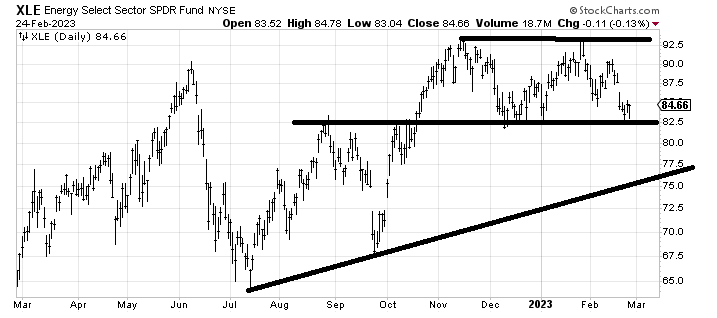

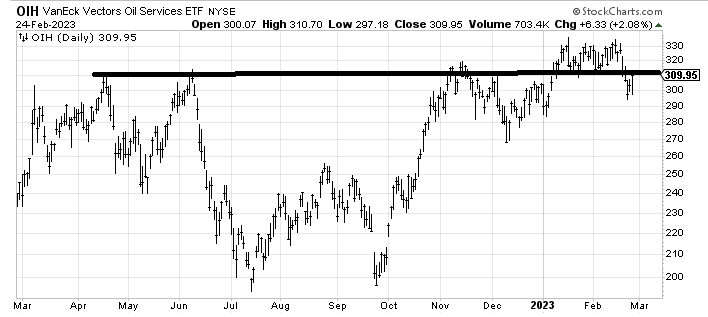

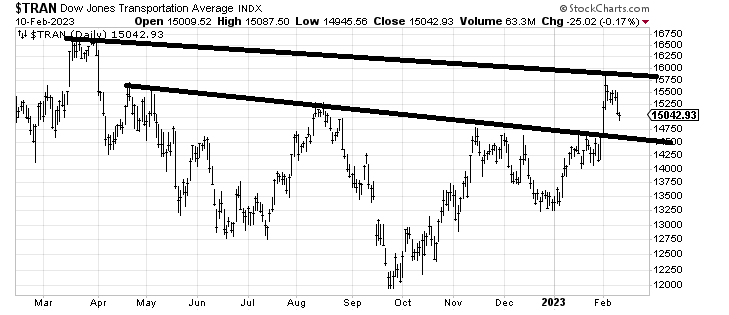

On most charts we find ourselves at the intersection of the support lines I have been drawing here for a few weeks. Of course now everyone sees them!!!

On most charts we find ourselves at the intersection of the support lines I have been drawing here for a few weeks. Of course now everyone sees them!!!

SPX. The blue line is support. Because we have only had a foray under it twice & for short periods of time.

XME. There is a lot going on here but the black lines are fan lines. (#GIK)

• • •

Missing some Tweet in this thread? You can try to

force a refresh