📣 Announcing our integration and vault partnership with @SushiSwap.

This will give vault creators direct access to Sushi liquidity and assets, and future potential for cross chain swaps.

We'll also create custom Bento vaults in conjunction with the Sushi team.

/1

This will give vault creators direct access to Sushi liquidity and assets, and future potential for cross chain swaps.

We'll also create custom Bento vaults in conjunction with the Sushi team.

/1

🍣 Most of you will know Sushi - a leading DEX with deep liquidity and volume on multiple Arbitrum assets.

In addition they offer a broad suite of DeFi products that open up a world of potential for Factor vault and strategy creators.

/2

In addition they offer a broad suite of DeFi products that open up a world of potential for Factor vault and strategy creators.

/2

🏭 Factor offers the building blocks for modular asset management vaults.

We integrate multiple DeFi assets to enable these protocols to optimize their products.

We enable vault creators to utilize these products to create innovative strategies.

The mutual benefits?

/3

We integrate multiple DeFi assets to enable these protocols to optimize their products.

We enable vault creators to utilize these products to create innovative strategies.

The mutual benefits?

/3

🔀 Firstly, integrations:

* Enables our Factor strategists to utilize Sushi liquidity/LP

* As well as direct access to the full suite of Sushi products

* Creates potential for cross chain swaps within vaults

* Drives TVL and revenue to both Factor and Sushi

/4

* Enables our Factor strategists to utilize Sushi liquidity/LP

* As well as direct access to the full suite of Sushi products

* Creates potential for cross chain swaps within vaults

* Drives TVL and revenue to both Factor and Sushi

/4

🏦 Secondly, partner vaults:

* Unique vault structures with one-click access to Bento yields

* Additional potential to incorporate Sushi LP yields

* Drives additional TVL to Sushi via the partner vault

* Factor and Sushi both earn vault fees as a revenue stream

/5

* Unique vault structures with one-click access to Bento yields

* Additional potential to incorporate Sushi LP yields

* Drives additional TVL to Sushi via the partner vault

* Factor and Sushi both earn vault fees as a revenue stream

/5

🤝 Interesting vault options to explore include integrating Sushi Bento strategies into Factor vault structures.

As well as the potential for diversified one click, auto-compounding and auto-rebalancing Sushi LP yields.

/6

As well as the potential for diversified one click, auto-compounding and auto-rebalancing Sushi LP yields.

/6

🧑🤝🧑 We're integrating with leading protocols to build the infrastructure and liquidity layer for DeFi.

Sushi is a long standing market leader and we are delighted to be working with them.

We're looking forward to growing Arbitrum DeFi together.

/7

Sushi is a long standing market leader and we are delighted to be working with them.

We're looking forward to growing Arbitrum DeFi together.

/7

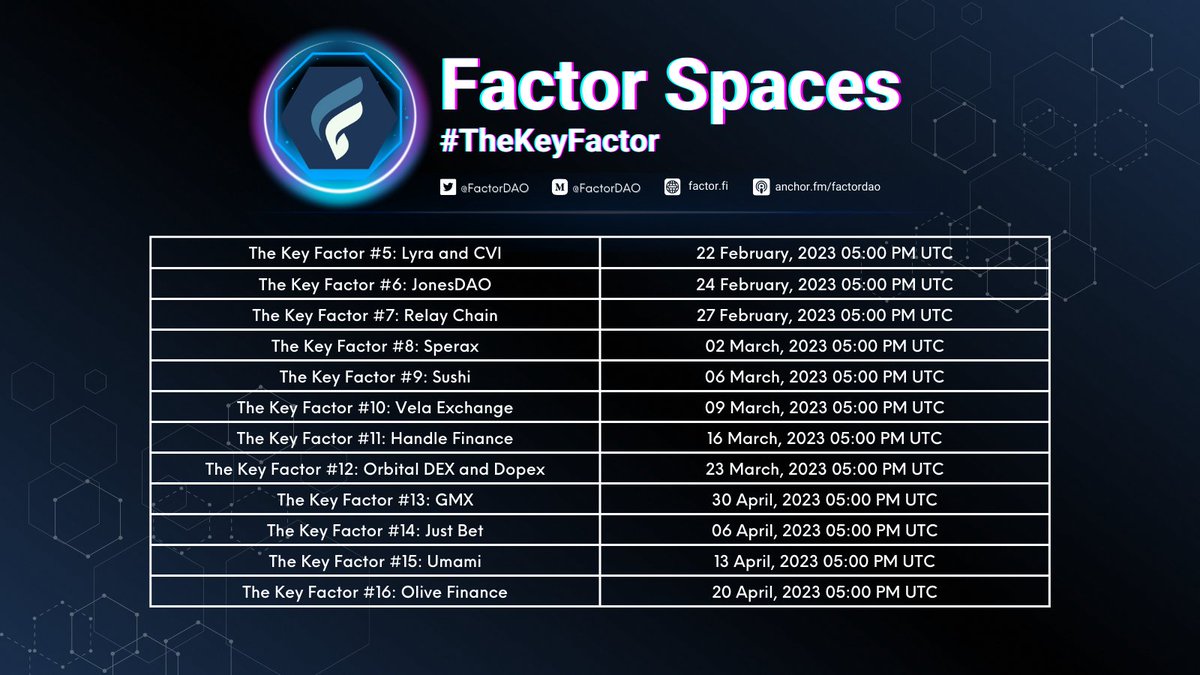

🎙️ We are hosting Sushi on #TheKeyFactor podcast on 6 March 2023.

If you'd like to learn more about both projects and how we will work together then make sure to tune in.

Check out our great line up of guests!

/8

If you'd like to learn more about both projects and how we will work together then make sure to tune in.

Check out our great line up of guests!

/8

🧑🏫 Learn more about @FactorDAO and $FCTR here:

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/factor

/9

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/factor

/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh