#𝗗𝗘𝗘𝗣𝗗𝗜𝗩𝗘 𝗣𝗮𝗿𝘁-𝗜

Building Database of Setups to Conduct a Deep Dive -

In series of threads, I will explain you complete process of conducting deepdives.

You'll also learn about the way to create proper scanners for any setup in this thread. (1/n)

Building Database of Setups to Conduct a Deep Dive -

In series of threads, I will explain you complete process of conducting deepdives.

You'll also learn about the way to create proper scanners for any setup in this thread. (1/n)

First thing, what is a #deepdive in trading?

Deep dive in trading is popularized by the veteran trader and exceptional mentor @PradeepBonde who revolutionized the way we approach momentum trading.

Deepdive is a process through which we conduct acid test of our beliefs (2/n)

Deep dive in trading is popularized by the veteran trader and exceptional mentor @PradeepBonde who revolutionized the way we approach momentum trading.

Deepdive is a process through which we conduct acid test of our beliefs (2/n)

@PradeepBonde about a particular setup or strategy. It helps us carve out proper trade management rules for the setup which are backed by the repetitive behavior seen in the setup, rather than managing them based on hopes, emotions and a few good or bad past experiences in the setup. (3/n)

Deep Dive answers the most asked questions in the trading community, such as -

1) How to sell?

2) Should I hold a trade or exit it?

3) What if I sold and the price shoots up?

4) What if I didn't and the price reverses and stops us out?

I believe you all struggle with (4/n)

1) How to sell?

2) Should I hold a trade or exit it?

3) What if I sold and the price shoots up?

4) What if I didn't and the price reverses and stops us out?

I believe you all struggle with (4/n)

such questions and confusions, but the good news is - the solution is in your own hands, and the solution is conducting a deep dive.

When you decide to conduct a deep dive on any setup, the first thing you need to do is to create a large enough sample size of such setups (5/n)

When you decide to conduct a deep dive on any setup, the first thing you need to do is to create a large enough sample size of such setups (5/n)

occurred in the past, which will act as a database to conduct the deep dive.

There are three things you need to pay attention to while creating this database -

1) This database should be panned out across a few cycles of bull and bear market, basically panning out over (6/n)

There are three things you need to pay attention to while creating this database -

1) This database should be panned out across a few cycles of bull and bear market, basically panning out over (6/n)

past 4-5 years at minimum.

Whenever I do #deepdive, I usually start looking for setups from 2017, because it includes at least two complete bull and bear markets and several transformation phases between them.

It also includes quick crash and recovery kind of situation (7/n)

Whenever I do #deepdive, I usually start looking for setups from 2017, because it includes at least two complete bull and bear markets and several transformation phases between them.

It also includes quick crash and recovery kind of situation (7/n)

of the covid crash as well.

Some trading strategies are not dependent on larger degree of bull and bear market cycles, rather they follow the bull and bear swings more closely. Though the overall market situation does have an impact on them.

In such strategies, you can (8/n)

Some trading strategies are not dependent on larger degree of bull and bear market cycles, rather they follow the bull and bear swings more closely. Though the overall market situation does have an impact on them.

In such strategies, you can (8/n)

even take one complete cycle of the bull and bear market. The #velocity trading strategy is also the same.

2) While conducting a #deepdive or even research or a survey of any kind in any field, you need a large enough sample size. The authenticity of the outcome of any (9/n)

2) While conducting a #deepdive or even research or a survey of any kind in any field, you need a large enough sample size. The authenticity of the outcome of any (9/n)

such exercise is directly dependent on the size on which the deep dive is conducted upon.

Trading is a game of probability and any bias which is developed only one or few good or bad experiences often keeps on misleading us throughout the journey.

#Deepdive is a way to (10/n)

Trading is a game of probability and any bias which is developed only one or few good or bad experiences often keeps on misleading us throughout the journey.

#Deepdive is a way to (10/n)

to challenge such beliefs and biases, hence always conduct it on a large enough sample size, which can also be addressed if you are conducting this exercise over at least couple of bull and bear cycles.

3) Include all kinds of trades in the deep dive regardless of the (11/n)

3) Include all kinds of trades in the deep dive regardless of the (11/n)

outcome it has achieved - i.e. regardless of whether it succeeded or failed as a trade.

This is one huge problem I saw among people who advice to do a deep dive - they ask you to conduct it on setups which had proven out to be a success, rather than including those setups (12/n)

This is one huge problem I saw among people who advice to do a deep dive - they ask you to conduct it on setups which had proven out to be a success, rather than including those setups (12/n)

too which were perfect but failed as a trade.

This happens because often we try to approach the deep dive by looking at the biggest movers over a period of time - in a year, month, on quarterly basis or so on or so forth.

Only seeing success results in developing wrong (13/n)

This happens because often we try to approach the deep dive by looking at the biggest movers over a period of time - in a year, month, on quarterly basis or so on or so forth.

Only seeing success results in developing wrong (13/n)

expectations about the setup and the strategy and doesn't help you in handling the failure during the live market application of it, which always happens and can happen in any trade, any setup and in any strategy.

It almost eliminates the purpose of doing the deep dive. (14/n)

It almost eliminates the purpose of doing the deep dive. (14/n)

Now coming to the part where I will tell you how to create the database for any such #deepdive.

As I mentioned earlier too, this same process will also be applied to develop a proper stock screening process for any setup or strategy. (15/n)

As I mentioned earlier too, this same process will also be applied to develop a proper stock screening process for any setup or strategy. (15/n)

Here the first thing is, think about one such non-negotiable characteristic of the setup, without which the setup won't form.

For example, in my #EP deepdive, it is the gap-up. EPs which we trade and in the way we trade it, won't happen without a gap-up in price. (16/n)

For example, in my #EP deepdive, it is the gap-up. EPs which we trade and in the way we trade it, won't happen without a gap-up in price. (16/n)

Now the question is, how much gap-up I need? 1%? 2%? Or 5%-10%? How much gap-up will help me validate the demand for an EP?

So the next step is to quantify the behavior in a percentage or so. Like for EP deepdive, I took a 3% gap-up criteria. Any stock which is gapping (17/n)

So the next step is to quantify the behavior in a percentage or so. Like for EP deepdive, I took a 3% gap-up criteria. Any stock which is gapping (17/n)

up 3% is a probable EP candidate.

Remember, it was a very wider net, through which I identified probable candidates since 2017, and got approx. 22000+ such gap-up in last 21 quarters (I did the research in 2022 start).

My objective was to not to miss even a setup, but (18/n)

Remember, it was a very wider net, through which I identified probable candidates since 2017, and got approx. 22000+ such gap-up in last 21 quarters (I did the research in 2022 start).

My objective was to not to miss even a setup, but (18/n)

you can strike a fair balance, by not making it too loose or too tight. Keeping it loose will overwhelm you with lots of results and you will soon loose your enthusiasm to do the deep dive, while keeping it too tight will again not let it remain closer to the original (19/n)

scenario which you will face day in and day out in the market.

Now put the essential liquidity filters in the scan. Again important point is - liquidity increase with time and if you are going much back in history, make criterias which will be adequately balanced for (20/n)

Now put the essential liquidity filters in the scan. Again important point is - liquidity increase with time and if you are going much back in history, make criterias which will be adequately balanced for (20/n)

the earlier years you are taking into your deep dive.

Liquidity criteria help us filter out stocks which are not tradable for us in any situation. It can include these things -

• Price Range Filters (>20 & / or < 10000)

• Volume Filters (> 100000 or so)

(21/n)

Liquidity criteria help us filter out stocks which are not tradable for us in any situation. It can include these things -

• Price Range Filters (>20 & / or < 10000)

• Volume Filters (> 100000 or so)

(21/n)

• Average Daily Turnover Filter ( > 3 Crores)

• Market Cap Filters ( > 500 Crore & / or < 300000 Cr) etc.

As I use turnover filter, I don't pay much attention to volume filter, as both almost try to address the same thing, but turnover has an upper hand over volume. (22/n)

• Market Cap Filters ( > 500 Crore & / or < 300000 Cr) etc.

As I use turnover filter, I don't pay much attention to volume filter, as both almost try to address the same thing, but turnover has an upper hand over volume. (22/n)

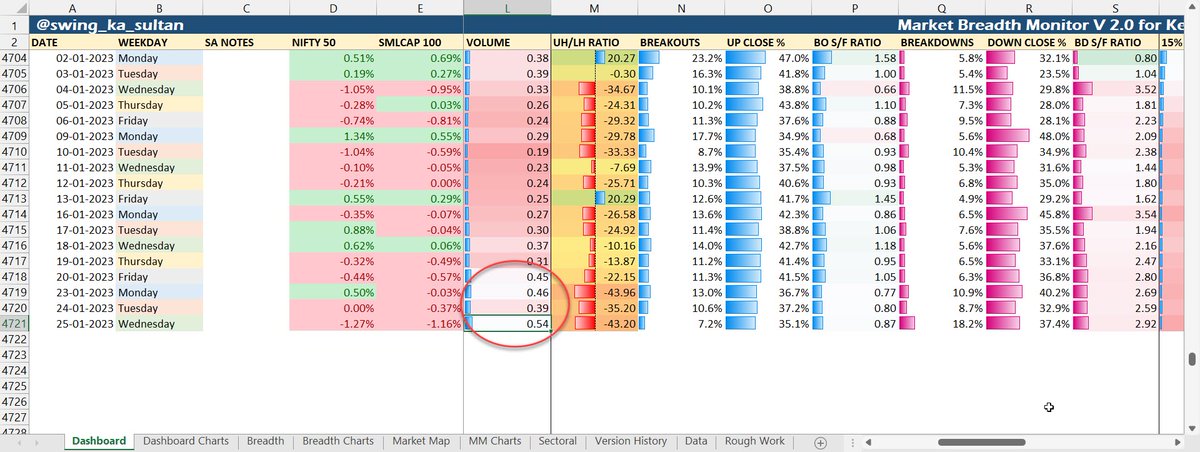

To run such historic scans, I use the Amibroker software, which always excels in such situations. I don't have much idea about what the other good alternatives are for this purpose.

I can also put the columns of my own choice in Amibroker which helps me further in (23/n)

I can also put the columns of my own choice in Amibroker which helps me further in (23/n)

my #deepdives.

Now put the results into a spread sheet, convert it into trading view format and start going through them one by one.

This manual scanning is always good, despite all the efforts it takes, because to be very honest, the results or the numerical values you (24/n)

Now put the results into a spread sheet, convert it into trading view format and start going through them one by one.

This manual scanning is always good, despite all the efforts it takes, because to be very honest, the results or the numerical values you (24/n)

will get upon completion of deep dive will be not of much use, but the experience you will obtain while going through so many setups definitely will be the game changer.

Keep the valid setups from the results and discard rest. Your database for the deep dive is ready. (25/n)

Keep the valid setups from the results and discard rest. Your database for the deep dive is ready. (25/n)

Use the same 3 step process for creating scan for any setup or strategy as well -

1) Identify a non-negotiable characteristic of the setup

2) Quantify it in terms of percentages or any other value, and

3) Put the liquidity filters to remove absolutely non-tradable stocks. (26/n)

1) Identify a non-negotiable characteristic of the setup

2) Quantify it in terms of percentages or any other value, and

3) Put the liquidity filters to remove absolutely non-tradable stocks. (26/n)

Only caution - never put too many criterias in a scan, max one or two apart from liquidity filters.

I never keep more than one non-negotiable criteria in any scanner, as I love manual work because it helps me develop procedural memory, but you can keep up to two at max. (27/n)

I never keep more than one non-negotiable criteria in any scanner, as I love manual work because it helps me develop procedural memory, but you can keep up to two at max. (27/n)

Follow me @swing_ka_sultan as I explore technical analysis and trading and challenge the associated conventional knowledge and myths.

If you loved the thread, please help it reach more people by retweeting the first tweet given below -

(28/28)

If you loved the thread, please help it reach more people by retweeting the first tweet given below -

(28/28)

https://twitter.com/swing_ka_sultan/status/1629842663741734913?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh