About -

Greaves is one of the leading diversified engineering companies with presence in Automotive, Non-Automotive, Aftermarket, Retail , Electric mobility solutions & Finance. The Company has a unique positioning in the last-mile mobility ecosystem.

Greaves is one of the leading diversified engineering companies with presence in Automotive, Non-Automotive, Aftermarket, Retail , Electric mobility solutions & Finance. The Company has a unique positioning in the last-mile mobility ecosystem.

Manufacturing Facilities -

Greaves Cotton has 6 manufacturing facilities across India which include the recently inaugurated largest EV manufacturing facility and an Experience Center at Ranipet, Tamil Nadu.

Greaves Cotton has 6 manufacturing facilities across India which include the recently inaugurated largest EV manufacturing facility and an Experience Center at Ranipet, Tamil Nadu.

Revenue Break-Up -

Greaves Cotton earns 44% from Engines Segment, 27% from Aftermarket, 27% from E- Mobility & Others 1%.

Greaves Cotton earns 44% from Engines Segment, 27% from Aftermarket, 27% from E- Mobility & Others 1%.

◾Engines Segment:

🔹Automotive Engines: Greaves manufactures automotive engines across fuel range- Diesel, CNG.

Co continues to invest in the automotive business R&D for providing affordable fuel-agnostic solution to its customers on

continuous basis.

🔹Automotive Engines: Greaves manufactures automotive engines across fuel range- Diesel, CNG.

Co continues to invest in the automotive business R&D for providing affordable fuel-agnostic solution to its customers on

continuous basis.

🔹Non-Auto Engines: With its IOT-enabled Genius series of DG Sets up to 500kVA & enhanced range of DG sets up to 2500 kVA, was able to penetrate untapped segments with a greater focus on both pvt & govt sectors.

🔹Industrial Engines: There has been a surge in demand in the fire-fighting engines segment.

Market seeing good traction for FMUL engines for both domestic and global OEMs. With special Govt focus on the inland waterways & fishing segment, marine segment has seen growth.5

Market seeing good traction for FMUL engines for both domestic and global OEMs. With special Govt focus on the inland waterways & fishing segment, marine segment has seen growth.5

◾Greaves Retail:

Greaves launched (AutoEVmart), India’s largest multi-brand EV outlet. This is a multi-brand experiential store for the

e-mobility ecosystem. This will further strengthen the Greaves retail business with widened play in the multi-brand EV segment.

Greaves launched (AutoEVmart), India’s largest multi-brand EV outlet. This is a multi-brand experiential store for the

e-mobility ecosystem. This will further strengthen the Greaves retail business with widened play in the multi-brand EV segment.

◾ Aftermarket:

Greaves has remained the supplier of choice over decades in the aftermarket due to its unflinching commitment to world-class quality & service. Co has been successfully providing uninterrupted and high-quality mobility solutions for the customers.

Greaves has remained the supplier of choice over decades in the aftermarket due to its unflinching commitment to world-class quality & service. Co has been successfully providing uninterrupted and high-quality mobility solutions for the customers.

◾Electric mobility:

🔹Two-wheeler: Ampere Electric Scooters has emerged as one of the fastest growing E2W brand in 🇮🇳. Ampere is spread over length & breadth of the country & continues to play a vital role in driving India’s switch to cleaner & greener mobility.

🔹Two-wheeler: Ampere Electric Scooters has emerged as one of the fastest growing E2W brand in 🇮🇳. Ampere is spread over length & breadth of the country & continues to play a vital role in driving India’s switch to cleaner & greener mobility.

🔹3-wheeler : ELE playing a crucial role in transforming last-mile mobility uplifting several cycle rickshaw drivers with superior motorised solutions.

ELE continues to be a partner in progress for several businesses, the brand caters to B2B players, retail businesses & -

ELE continues to be a partner in progress for several businesses, the brand caters to B2B players, retail businesses & -

-individual buyers with wide range of products in E-rickshaw & cargo to suit the customisable needs. The brand has strong equity in several parts of the country as it resonates the spirit of clean & affordable mobility.

3 wheeler new product portfolio showcased at Auto Expo👇

3 wheeler new product portfolio showcased at Auto Expo👇

◾ Enabling Business:

🔹Finance Business: Greaves Cotton Group forayed into the retail financing business in H2 FY 2019-20, through its wholly-owned subsidiary (Greaves Finance Ltd).

🔹Finance Business: Greaves Cotton Group forayed into the retail financing business in H2 FY 2019-20, through its wholly-owned subsidiary (Greaves Finance Ltd).

Greaves Finance leveraged its partnership with other NBFCs that focus & specialise in the 2W and 3W financing businesses respectively.

🔹Greaves Technologies: It aspires to be a technology convergence catalyser for the Company’s products, looping back cutting-edge technology & solutions from around the world.

Growth Drivers -

• Partners with UK-based design firm, Eta Green Power Ltd to bring exclusive technology to the Indian market.

• New product acceptance of 3W multi-brand parts & increased market share.

• Partners with UK-based design firm, Eta Green Power Ltd to bring exclusive technology to the Indian market.

• New product acceptance of 3W multi-brand parts & increased market share.

• Further increase in fuel prices expected to boost growth. Govt policies regarding battery tech could redefine the industry.

• With strong demand continuing from both FFP & marine segments, Co expects sustained growth for the industrial engines business.

• With strong demand continuing from both FFP & marine segments, Co expects sustained growth for the industrial engines business.

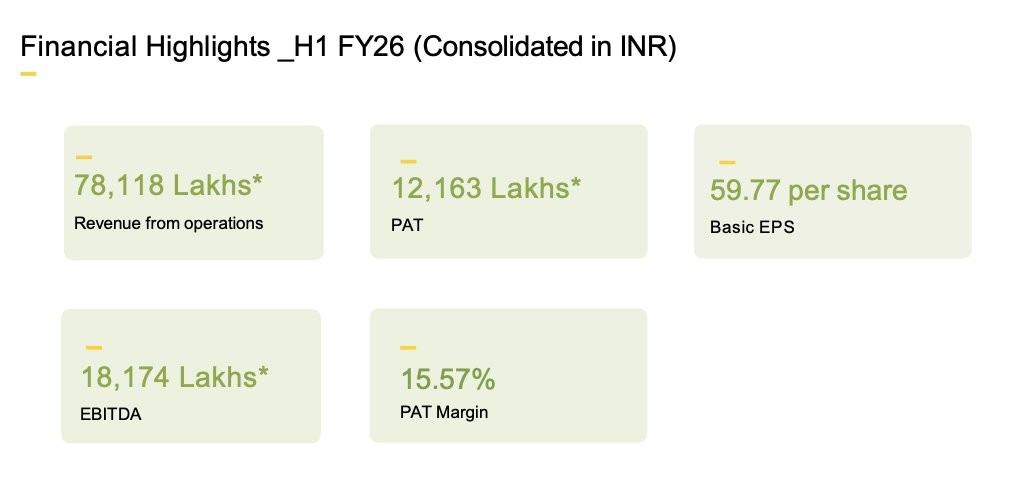

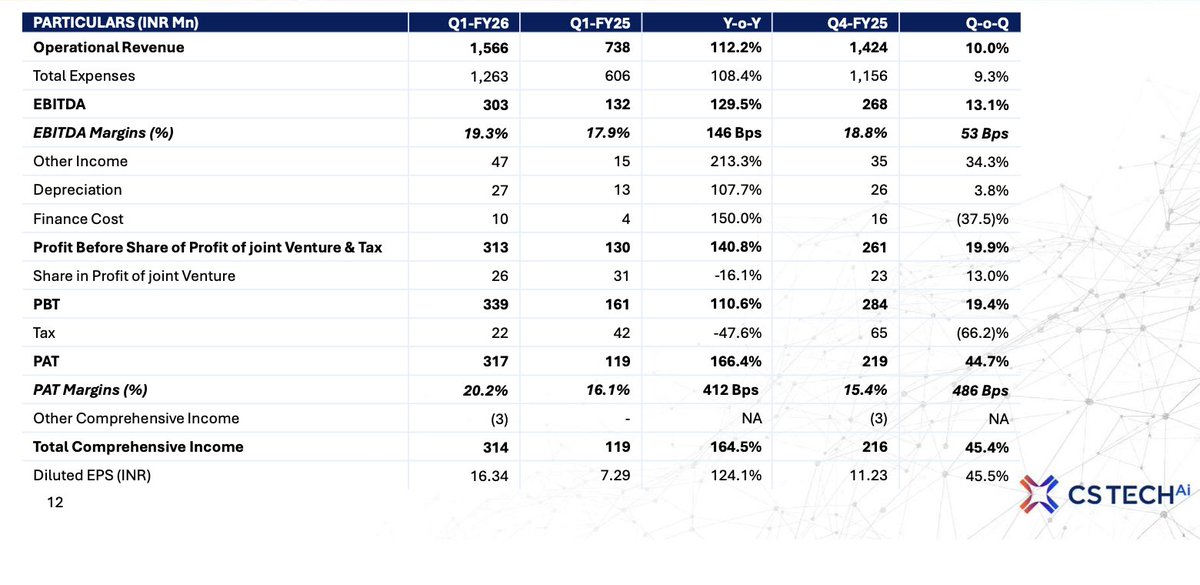

Financial Summary -

Q3 FY23 (YoY)

Revenue were at Rs.514 Cr.⬆️6%

PAT at Rs.6 Cr.⬆️200%

EBITDA at Rs.3 Cr.⬇️77%

Q3 FY23 (YoY)

Revenue were at Rs.514 Cr.⬆️6%

PAT at Rs.6 Cr.⬆️200%

EBITDA at Rs.3 Cr.⬇️77%

Risks -

• Commodity price increase puts pressure on margins.

• Increased competitive intensity due to entry of multiple players.

• Sustained slowdown in auto engine

sales.

• Inability to sustain growth in EV-Mobility segment.

• Commodity price increase puts pressure on margins.

• Increased competitive intensity due to entry of multiple players.

• Sustained slowdown in auto engine

sales.

• Inability to sustain growth in EV-Mobility segment.

Acquisition -

Greaves Cotton to acquire Excel Controlinkage for ₹385 Cr

Catering to customer segment like Commercial vehicles, Industrial mobile equipment, Construction equipment, Marine and SPVs, supplying directly to 80% of the OEMs as well as to the aftermarket.

Greaves Cotton to acquire Excel Controlinkage for ₹385 Cr

Catering to customer segment like Commercial vehicles, Industrial mobile equipment, Construction equipment, Marine and SPVs, supplying directly to 80% of the OEMs as well as to the aftermarket.

Fundamentals -

Market Cap : ₹ 3,029 Cr

P/E (Stock): 44.62

P/E (Industry): 36.51

P/B : 4.04

Debt to equity : 0.06

ROE : -4.61%

ROCE : -1%

EV/EBITDA : 10.6

Market Cap : ₹ 3,029 Cr

P/E (Stock): 44.62

P/E (Industry): 36.51

P/B : 4.04

Debt to equity : 0.06

ROE : -4.61%

ROCE : -1%

EV/EBITDA : 10.6

Conclusion -

The robust demand outlook of E-mobility & company’s strong thrust over improving capacity affirms the better performance over the long term.

The improved product mix with higher Hi-speed variants will boost the margins.

The robust demand outlook of E-mobility & company’s strong thrust over improving capacity affirms the better performance over the long term.

The improved product mix with higher Hi-speed variants will boost the margins.

https://twitter.com/LnprCapital/status/1629843394578235394?t=auksSZIJZ936CdTcSG4D6A&s=19

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@VVVStockAnalyst @Sharad9Dubey @SumitResearch @AvadhMaheshwar2 @EnSaluja @VarunDubey85 @caniravkaria @abhymurarka

• • •

Missing some Tweet in this thread? You can try to

force a refresh