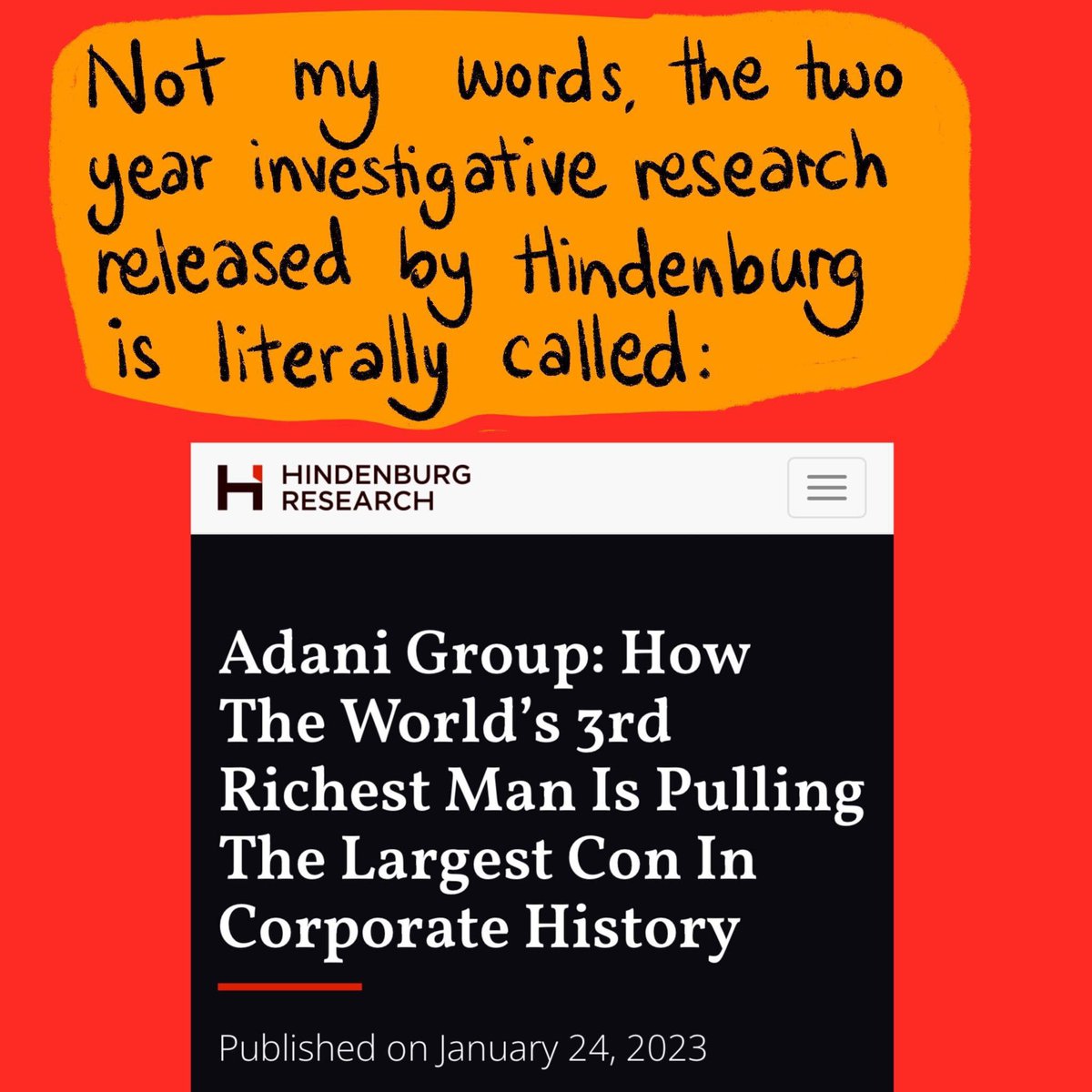

It's been 1 month since #Hindenburg accused coal giant #Adani of the "largest con in corporate history". How are things looking for Adani? Ahem...

Here’s a round up of bad news rocking Adani’s land-grabbing, climate-wrecking, ecosystem-destroying coal empire this week. 🧵

Here’s a round up of bad news rocking Adani’s land-grabbing, climate-wrecking, ecosystem-destroying coal empire this week. 🧵

"The rout in #Adani Group shares has room to run based on charts that show key stocks in #GautamAdani’s empire may still extend declines to the 85% downside flagged by #HindenburgResearch."

@MSCI_Inc @MoodysInvSvc @BlackRock @Vanguard_Group @Barclays

bloomberg.com/news/articles/…

@MSCI_Inc @MoodysInvSvc @BlackRock @Vanguard_Group @Barclays

bloomberg.com/news/articles/…

“Apart from the future of the billionaire & his business empire, something bigger is on the line: 🇮🇳’s probity in corporate governance & pursuit of a development model in which the state has entrusted a few ultra-rich men with running 🇮🇳’s infrastructure"

telegraphindia.com/india/indias-p…

telegraphindia.com/india/indias-p…

"...the review committee was formed following the report that Bangladesh will incur a financial loss of Tk700 crore per month... due to the "faulty deal" signed with #Adani Power to import electricity from its coal-fired 1,600MW Godda plant..."

tbsnews.net/bangladesh/ene…

tbsnews.net/bangladesh/ene…

"Indian billionaire Gautam #Adani has decided against bidding for a stake in state-backed electricity trader PTC India Ltd., people familiar with the matter said, as his business empire looks to preserve cash amid criticism from a US short-seller."

livemint.com/market/stock-m…

livemint.com/market/stock-m…

Can Adani's new spin doctors @KekstCNC come up with a more sophisticated comms strategy than this?

"Wikipedia editors now said employees of the #Adani Group have "almost certainly" manipulated Wikipedia entries with non-neutral PR versions." @MSCI_Inc

economictimes.indiatimes.com/markets/stocks…

"Wikipedia editors now said employees of the #Adani Group have "almost certainly" manipulated Wikipedia entries with non-neutral PR versions." @MSCI_Inc

economictimes.indiatimes.com/markets/stocks…

“No gloss of stock-market valuation can hide the wrinkles in the underlying economics. The group says refinancing its $24 billion in net debt should pose no problems. However, if capital turns more expensive, the #Adani juggernaut could stumble.” @MSCI_Inc

bloomberg.com/opinion/featur…

bloomberg.com/opinion/featur…

"S&P has downgraded #Adani Ports & SEZ and Adani Electricity from ‘stable’ to ‘negative’ and @MoodysInvSvc 's has revised its ratings of Adani Green Energy...Adani Transmission Step-One, and Adani Electricity Mumbai to ‘negative’ from ‘stable’." @MSCI_Inc

outlookindia.com/business/sebi-…

outlookindia.com/business/sebi-…

"Yields on overseas bonds of the #Adani Group continued to rise since the Hindenburg report flagged concerns over the group’s high debt level and accounting irregularities, data showed, suggesting a sell-off of the securities in the secondary market."

moneycontrol.com/news/business/…

moneycontrol.com/news/business/…

"At the close of trade on Thursday, February 23, the fall in share prices of the #Adani Group was enough to ensure that India’s largest institutional investor, the publicly held @TheLICForever investments in Adani firms turned negative." @TheOfficialSBI

thewire.in/business/lic-i…

thewire.in/business/lic-i…

"According to industry experts, foreign funds will not touch #Adani Group companies for a long time if they are thrown out of the @MSCI_Inc indices." @BlackRock @Vanguard_Group @TIAA @Barclays @Citi @mufgbk_official @BNPParibas @abrdnInv_UK @PIMCO

thehindubusinessline.com/markets/global…

thehindubusinessline.com/markets/global…

"A month has passed since short seller #Hindenburg...warned investors of 85% potential downside in #Adani group stocks...three of group names Adani Total Gas, Adani Transmission & Adani Green Energy are close to breaching that mark." @MSCI_Inc

businesstoday.in/markets/compan…

businesstoday.in/markets/compan…

"The ports-to-power group has lost about $146B in equity market value since Jan. 24... The #Adani firms have hired legal and communication teams, cut expenses and repaid debt as they seek to calm traders concerned about the group’s access to financing.”

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

"“We are not going to issue any injunction ever against the media,” Chief Justice of India D Y Chandrachud, heading a three-judge bench, told Advocate M L Sharma, who filed the plea contending that the media was sensationalising the issue." #Adani

indianexpress.com/article/india/…

indianexpress.com/article/india/…

"At a time of deep economic distress, PM Modi has been selling the nation's critical infrastructure to the #Adani Group, bending India's foreign policy & forcing public institutions like @TheOfficialSBI & @TheLICForever to invest in the Adani Group."

livemint.com/news/india/par…

livemint.com/news/india/par…

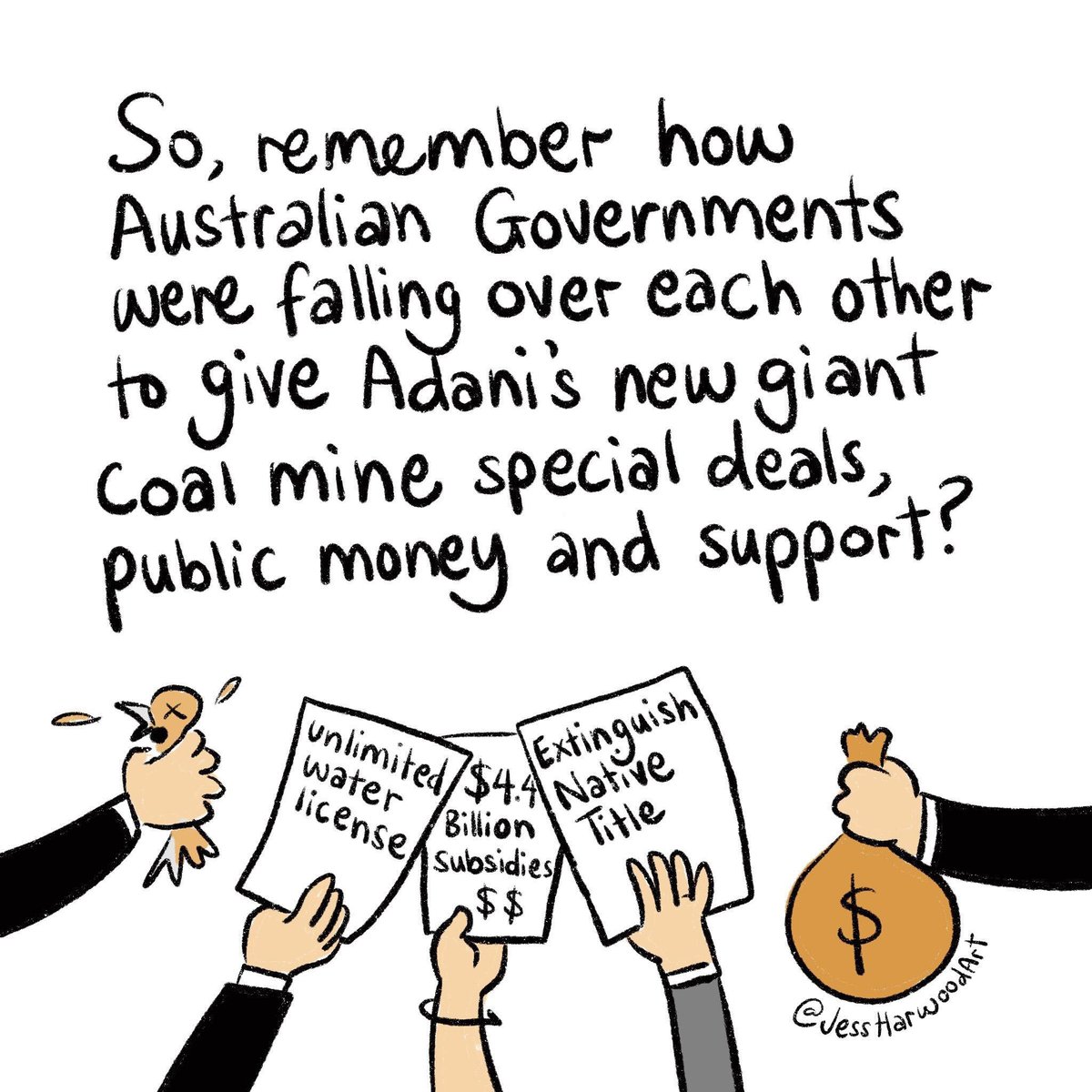

“These funds have used members’ money to prop up #Adani’s unacceptable coal expansion plans, including the disastrous Carmichael mine, and failed to see glaring investment risks that existed for years before being outlined in the #Hindenburg report.”

news.com.au/finance/busine…

news.com.au/finance/busine…

• • •

Missing some Tweet in this thread? You can try to

force a refresh