I'd Like To Solve The Puzzle:

A 60-Page Report detailing the Marriage of Carl Icahn and Bed Bath & Beyond,

A 60-Page Report detailing the Marriage of Carl Icahn and Bed Bath & Beyond,

🍎 WHAT: Leveraged Buy-Out, Spin-off BABY

📙 HOW: Bond Exchange, The Team & Kastin

🌲 WHY: Merger with WestPoint and Newell

🫐 WHEN: Filings, Earnings, Bond Payment

📙 HOW: Bond Exchange, The Team & Kastin

🌲 WHY: Merger with WestPoint and Newell

🫐 WHEN: Filings, Earnings, Bond Payment

🍎 WHAT: Leveraged Buy-Out, Spin-off BABY

On Jan 13th, an input into Pitchbook indicates a rumored leveraged buy-out was negotiated. The same day, certain events of default were triggered with the JPM loan. The ABL mentions a change in control is considered an event of default.

On Jan 13th, an input into Pitchbook indicates a rumored leveraged buy-out was negotiated. The same day, certain events of default were triggered with the JPM loan. The ABL mentions a change in control is considered an event of default.

The suggestion to perform a sale of the company was first supported by Cohen in his March letter. Bloomberg confirms the company is working with advisors mentioned in Pitchbook. Kirkland & Ellis was hired by the company in August. Lazard is a world leading asset management firm.

Carl Icahn and Bed Bath & Beyond have several connections to AlixPartners. Carol Flaton is a Bed Bath & Beyond board member. David Willets is CEO of Icahn Enterprises. Holly Etlin is interim CFO at Bed Bath & Beyond. Ronak Tamra joined as director at AlixPartners.

The suggestion to spin-off or sell buybuy Baby was first supported by Cohen in his March letter. Bed Bath & Beyond completed its offering for Series A Convertible Preferred Stock and Warrant securities, detailing Dividends, New Subsidiary, and Successor Shares.

Hudson Bay is reportedly involved with Bed Bath & Beyond. A Pitchbook search of Hudson Bay shows extensive experience with PIPE, IPO, and other transactions. Carl Icahn has extensive history advocating for asset spin-off or sales, including; Ebay, BEA Systems, and Tappan.

A photo of Carl Icahn and Ryan Cohen is published October 17th.

https://twitter.com/ryancohen/status/1582212373985005569?s=20

📙 HOW: Bond Exchange, The Team & Kastin

October 18th, Bed Bath & Beyond announced an offering to exchange its notes. A payout analysis of the notes shows there isn't enough money to distribute to all holders. We can conclude holders are incentivized to accept the exchange.

October 18th, Bed Bath & Beyond announced an offering to exchange its notes. A payout analysis of the notes shows there isn't enough money to distribute to all holders. We can conclude holders are incentivized to accept the exchange.

Bonds were downgraded and prices collapsed after announcement. Then, on Nov 2nd, Bloomberg reports 30% of 2024 holders wanted better terms. The company proceeded with four extensions rejecting holders requested for sweetened terms. The exchange was ultimately terminated Jan 5th.

On Nov 9th and 14th, two exchange agreements converted notes to equity, totaling $154.5 million debt serviced for 14.5m shares at $12.50 and $10.51 cost basis. A mathematical study on the debt remaining. Perella Weinberg advised 2024 holders in the exchange.

Jake Freeman proposed a competing exchange, convertible bond issuance, and slapped a $350m valuation on Baby while calling first lien rights. He opposed a sale of the company and spin-off of assets. Some details suggest Jake Freeman might be a fraud, a cleaning project for later.

Cohen hired Icahn solicitor Harkins Kovler for his successful proxy fight with Bed Bath & Beyond. His cooperation agreement allows him three directors and the creation of a Strategy Committee focused on exploring alternatives to unlock value from Baby. CEO Mark Tritton leaves.

Ben Rosenzweig, Marjorie Bowen, and Shelly C. Lombard were installed on the Board. Ben and Shelly have experience advising clients on multiple M&A transactions. Ben resigned Dec 20th. Marjorie has extensive experience with companies undergoing transactions. She resigned Feb 11th.

On Dec 12th, David Kastin was hired as Chief Legal Officer. He managed an IPO/going public transaction of Clever Leaves. He was point person in the sale of The Vitamin Shoppe. He was point person with the buy-out of Sequa. He was point person in the $6.6b buy-out of Toys "R" Us.

🌲 WHY: Merger with WestPoint and Newell

Icahn Enterprises purchased WestPoint Home in a similar debt transaction. WestPoint is a home fashion company with some brands selling at Bed Bath & Beyond. WestPoint filed a $600,000 civil suit against the company on Feb 2nd.

Icahn Enterprises purchased WestPoint Home in a similar debt transaction. WestPoint is a home fashion company with some brands selling at Bed Bath & Beyond. WestPoint filed a $600,000 civil suit against the company on Feb 2nd.

Icahn Enterprises entered a cooperation agreement with Newell Brands in 2018 with 6.9% ownership. Brett Icahn sits on the Board. Several Newell brands are sold at Bed Bath & Beyond.

On Jan 23, Newell announced Project Phoenix, a savings initiative targeting $250m by leveraging scale to reduce complexity, streamline its operating model, and drive operational efficiencies. On Feb 10, Newell mentions a collaborative, win-win partnership with Bed Bath & Beyond.

Bed Bath & Beyond continues to struggle selling legacy inventory from the criticized private label decisions by then CEO Mark Tritton. Bed Bath announced an update in August with plans to reduce SG&A and CapEx expenses, achieving cash flow neutrality by end of FY22, Feb 25th.

A mathematical study of the bonds shows an acquirer might own more than $150 million in notes. A fair value study of Baby per Cohen suggests the asset may be worth $3b. If Bed Bath & Beyond can achieve profitability, relevant precedents suggest fair value may be $5b - $30b+.

🫐 WHEN: Filings, Earnings, Bond Payment

In early November, Carl Icahn appeared in CNBC and Forbes interviews and mentioned a long stock he can't talk about because earnings aren't out. On Nov 21st, Icahn Enterprises announced a $400m ATM offering to fund potential acquisitions.

In early November, Carl Icahn appeared in CNBC and Forbes interviews and mentioned a long stock he can't talk about because earnings aren't out. On Nov 21st, Icahn Enterprises announced a $400m ATM offering to fund potential acquisitions.

Bed Bath & Beyond announced earnings on Jan 10th. The following three days, the stock price rose 300% from to $5.87. Pitchbook indicates a leveraged buy-out was negotiated Jan 13th. The company triggered an event of default on their ABL on Jan 13th.

On Feb 14, Icahn Enterprises filed 13F stating Confidential Treatment Requested, omitting one or more holdings. IEP reported Q4 earnings on Feb 24th. Bed Bath & Beyond 2022 fiscal year concluded Feb 25th. The company announced Special Record Date for bond payment Feb 27th.

Calendar: between October 2022 and February 2023 involving; Bed Bath & Beyond, Icahn Enterprises, and Newell.

If a leveraged buy-out has occurred, it's possible we will learn an update of the debt restructuring at the company's Special Record Date, after market hours today.

If a leveraged buy-out has occurred, it's possible we will learn an update of the debt restructuring at the company's Special Record Date, after market hours today.

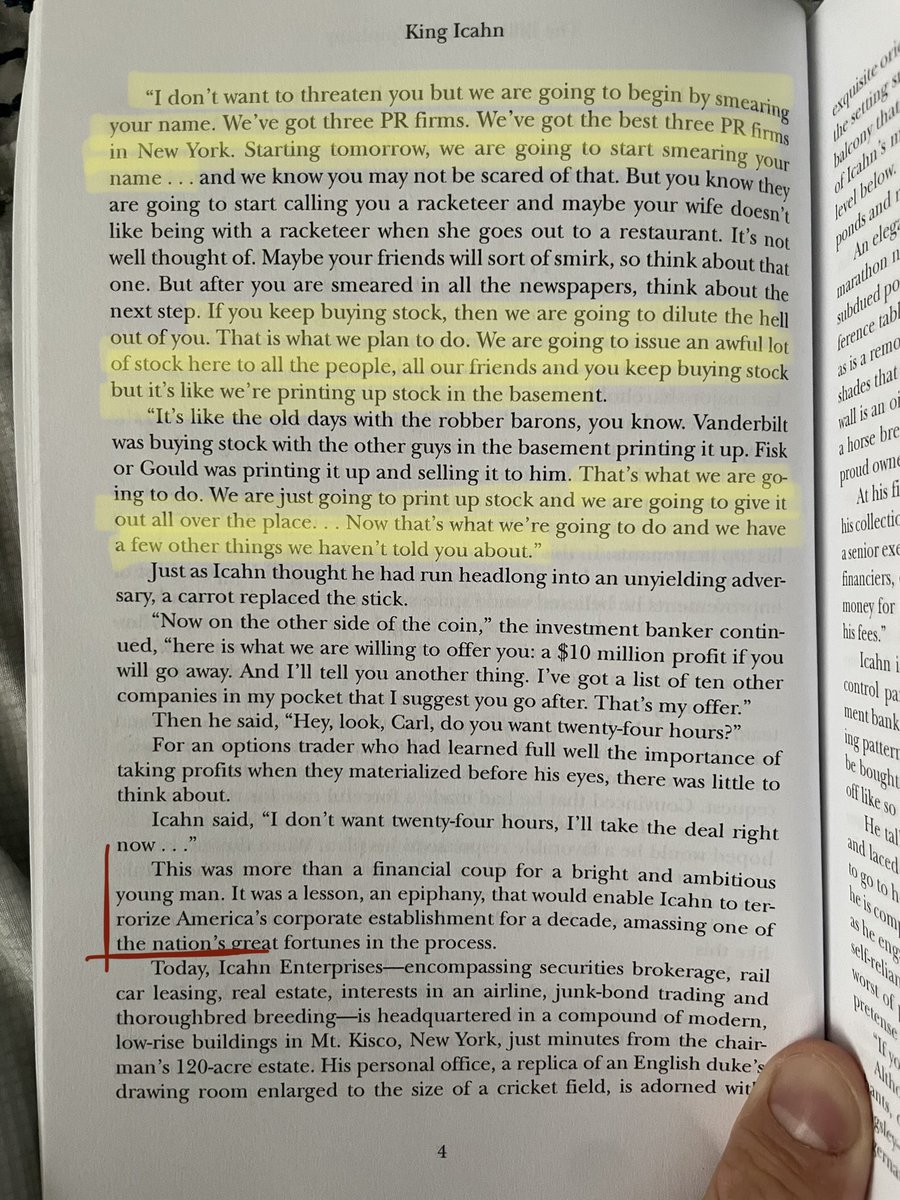

Extra: I've included some of my favorite quotes from the documentary, Icahn: The Relentless Billionaire.

Disclaimer: I am an Architect and have no experience in corporate finance. This is not financial advice. You are responsible for your own investments.

Positions pinned 🏴☠️🏴☠️

Disclaimer: I am an Architect and have no experience in corporate finance. This is not financial advice. You are responsible for your own investments.

Positions pinned 🏴☠️🏴☠️

• • •

Missing some Tweet in this thread? You can try to

force a refresh