How I look at TPO charts 📊

I will discuss what I use/don't use and why.

SETTINGS shared throughout

//COMPLETE TPO THREAD ✅ / Template RELEASE

To receive revamped Daily TPO & Session TPO template for @ExochartsC which is being discussed -

Follow, RETWEET & like this tweet

I will discuss what I use/don't use and why.

SETTINGS shared throughout

//COMPLETE TPO THREAD ✅ / Template RELEASE

To receive revamped Daily TPO & Session TPO template for @ExochartsC which is being discussed -

Follow, RETWEET & like this tweet

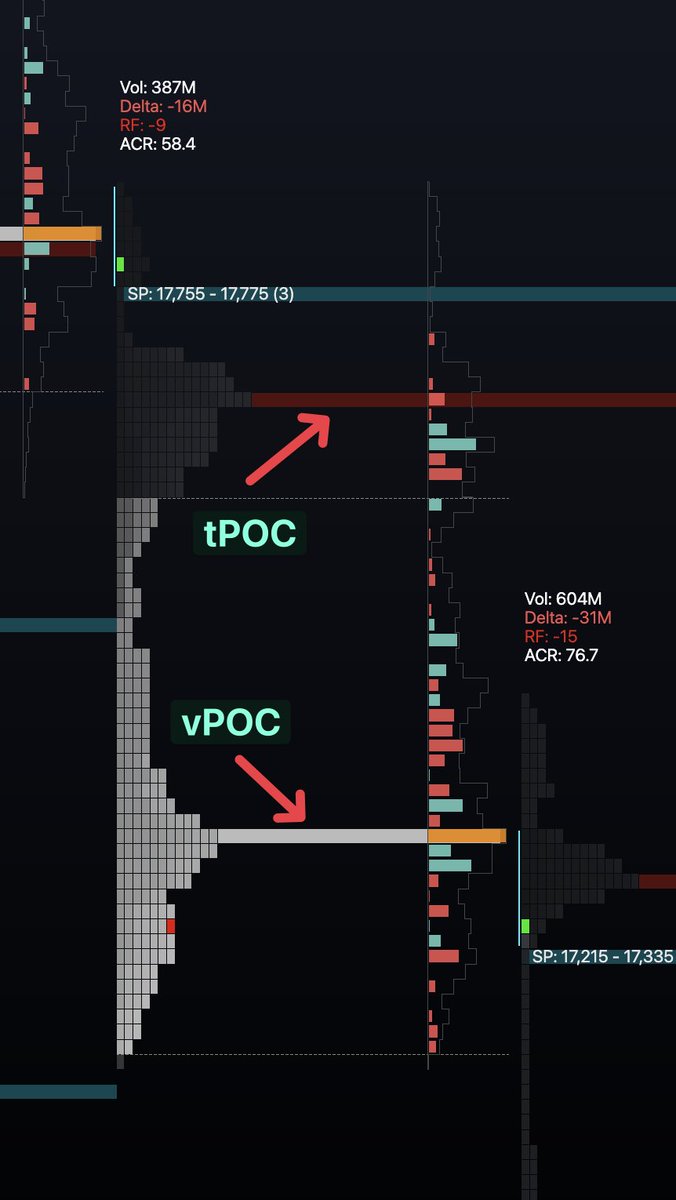

@ExochartsC 1️⃣ vPOC/tPOCs

• VOLUME point of control

• TIME point of control

tPOC - where has price spent the most TIME within this profile?

vPOC - where was the most volume transacted within this profile?

I place more weight on the VOLUME POC.

• VOLUME point of control

• TIME point of control

tPOC - where has price spent the most TIME within this profile?

vPOC - where was the most volume transacted within this profile?

I place more weight on the VOLUME POC.

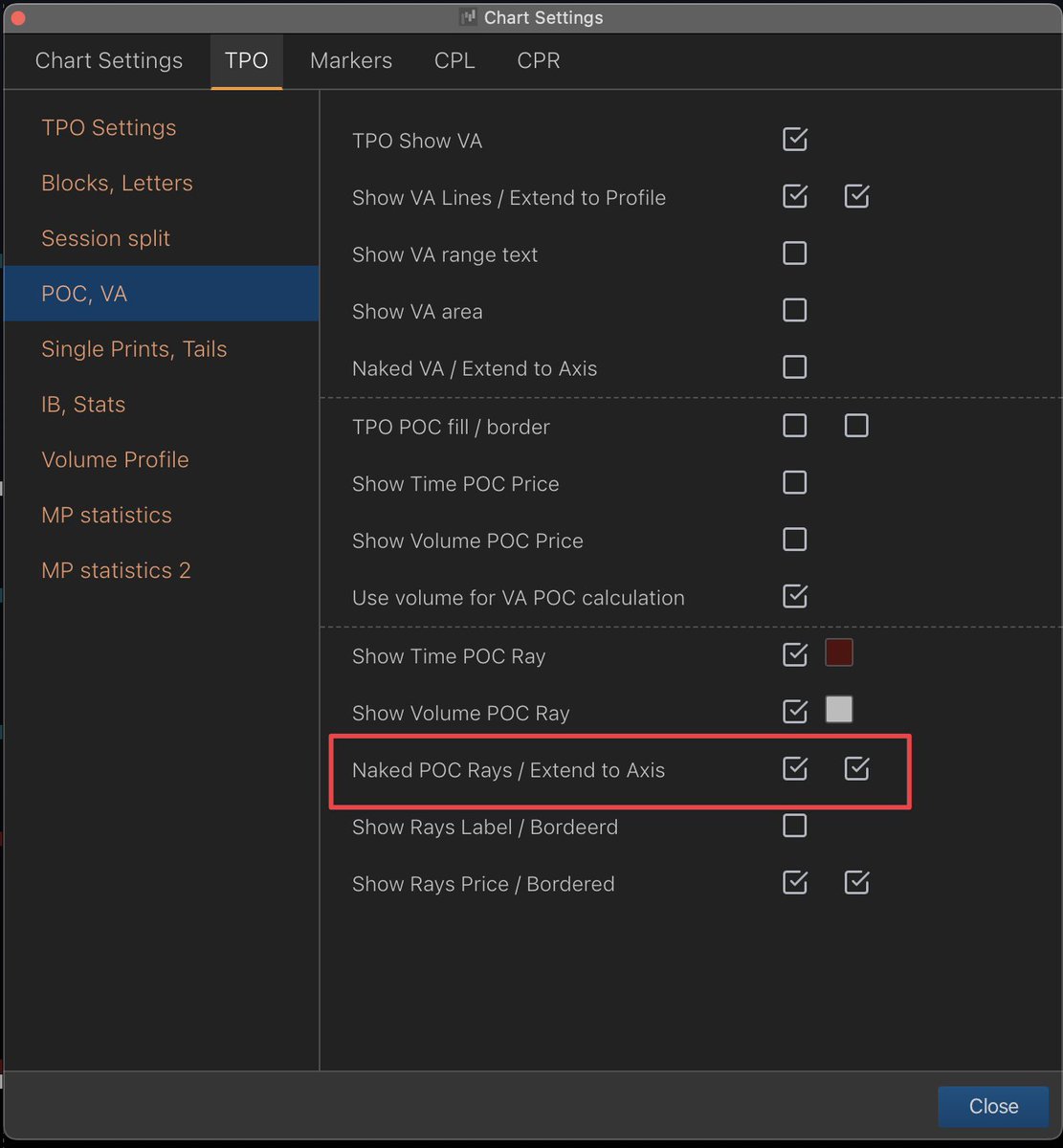

@ExochartsC 1️⃣🅱️ vPOC/tPOCs (Use case)

naked/untapped POCs are the most powerful.

Hence why I extend the naked ones out to mark onto TV

These levels can be key S/R levels with the correct confluence.

(Each TPO session is commonly split up as a daily profile)

naked/untapped POCs are the most powerful.

Hence why I extend the naked ones out to mark onto TV

These levels can be key S/R levels with the correct confluence.

(Each TPO session is commonly split up as a daily profile)

@ExochartsC 2️⃣ Single prints

Inefficiencies in the chart

where single blocks are printed on the TPO chart creating "gaps"

Can be viewed as a magnet to be filled or tested as S/R Levels

I will prefer to see the SP filled as from my testing this is where we will get a better reaction.

Inefficiencies in the chart

where single blocks are printed on the TPO chart creating "gaps"

Can be viewed as a magnet to be filled or tested as S/R Levels

I will prefer to see the SP filled as from my testing this is where we will get a better reaction.

@ExochartsC 2️⃣🅱️ Single prints

In Exo, we created a setting to show once the single print is filled

• "Show only first print range"

Is an option which will show you this.

I extend this ray also as the first touch of these levels can provide good reactions.

In Exo, we created a setting to show once the single print is filled

• "Show only first print range"

Is an option which will show you this.

I extend this ray also as the first touch of these levels can provide good reactions.

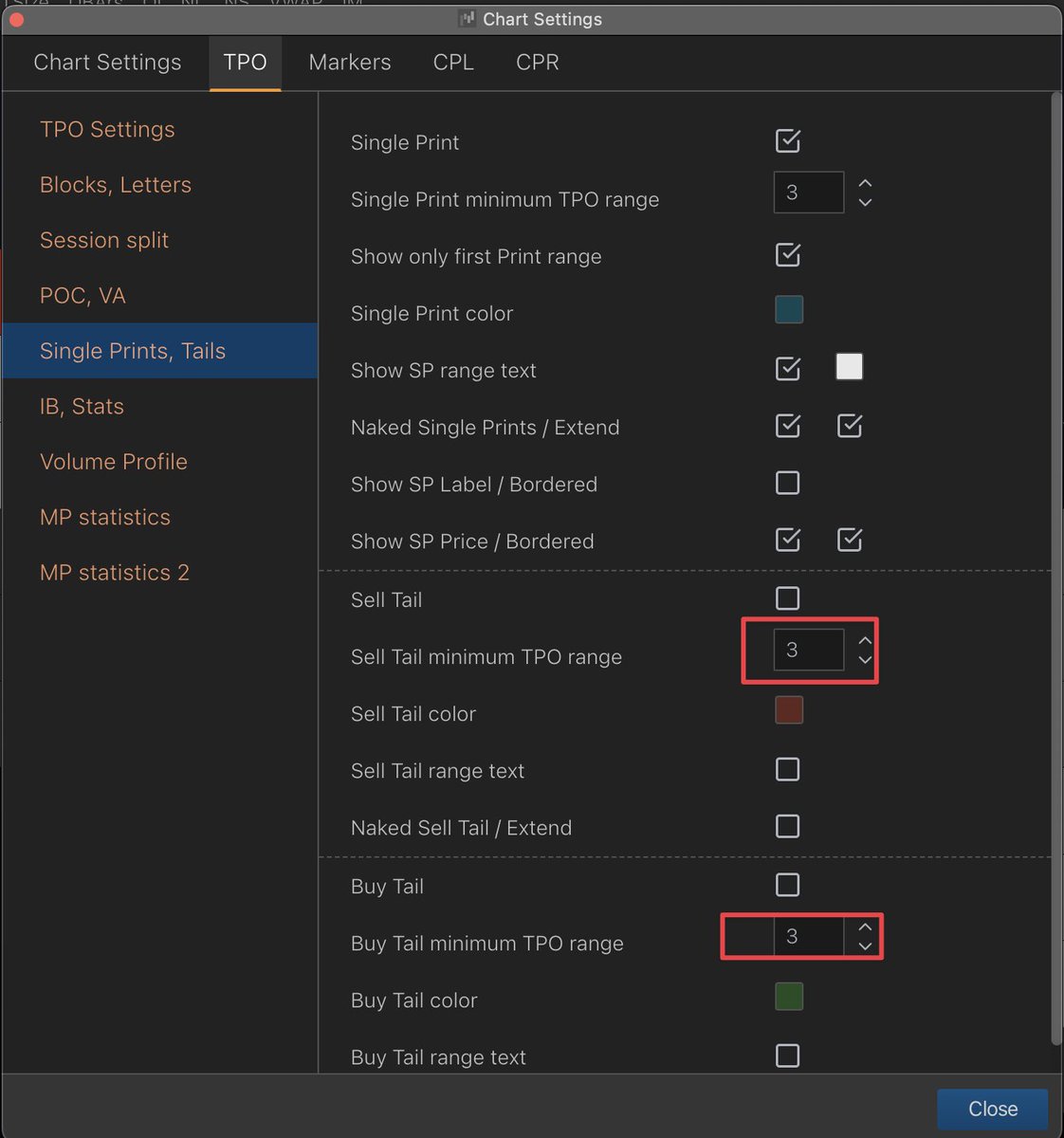

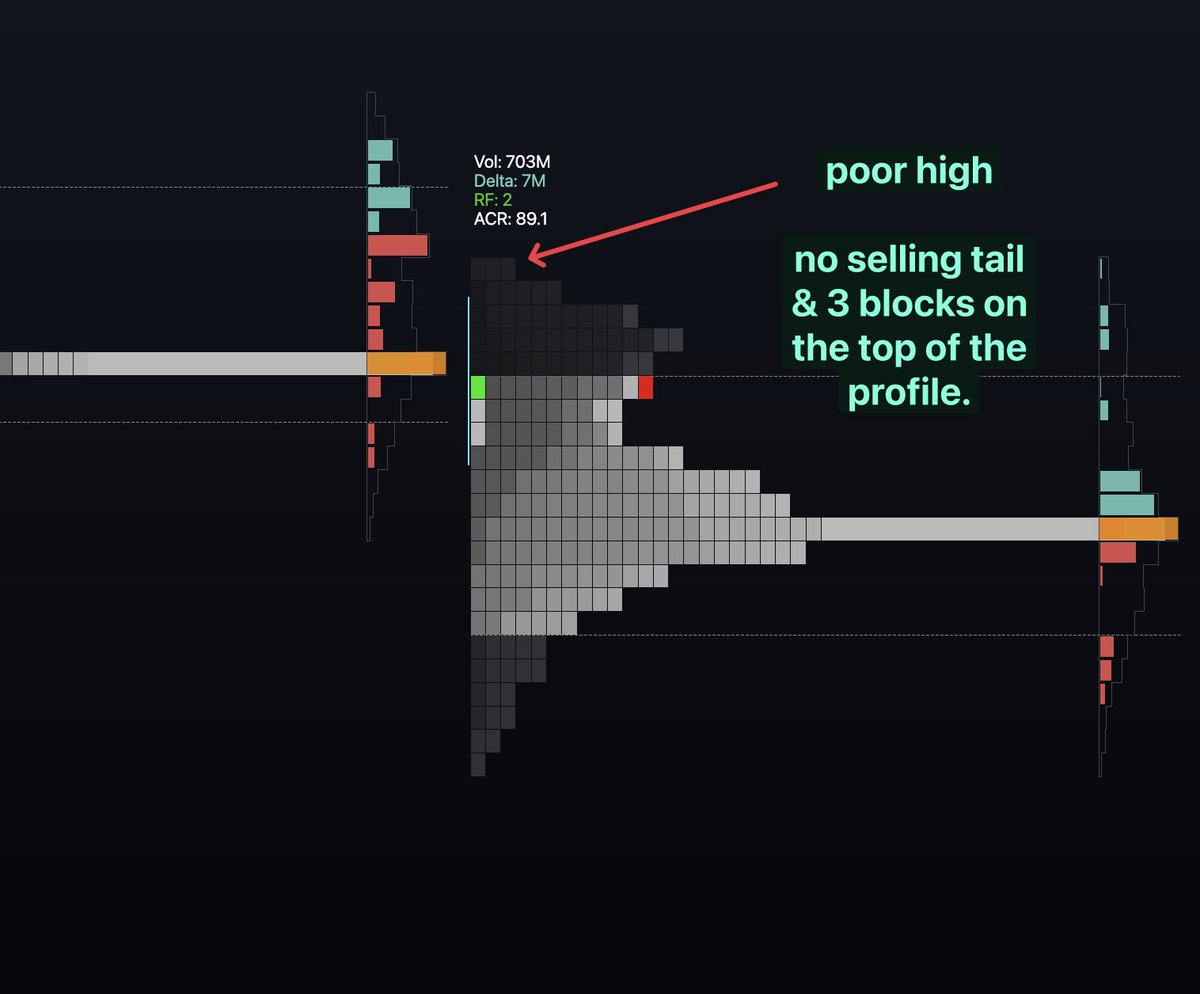

@ExochartsC 3️⃣ ST/BT - poor highs and lows

ST - Selling tail

BT - Buying tail

Single prints occur in the middle of a TPO profile

STs or BTs occur at the top or bottom end.

ST - Selling tail

BT - Buying tail

Single prints occur in the middle of a TPO profile

STs or BTs occur at the top or bottom end.

@ExochartsC 3️⃣🅱️ ST/BT - poor highs and lows

If I do not see one of these at an expected pivot point then we can expect that pivot point h/l still will be taken out.

a poor high or poor low is a TPO profile which does not have either an ST or BT at either end of its profile.

If I do not see one of these at an expected pivot point then we can expect that pivot point h/l still will be taken out.

a poor high or poor low is a TPO profile which does not have either an ST or BT at either end of its profile.

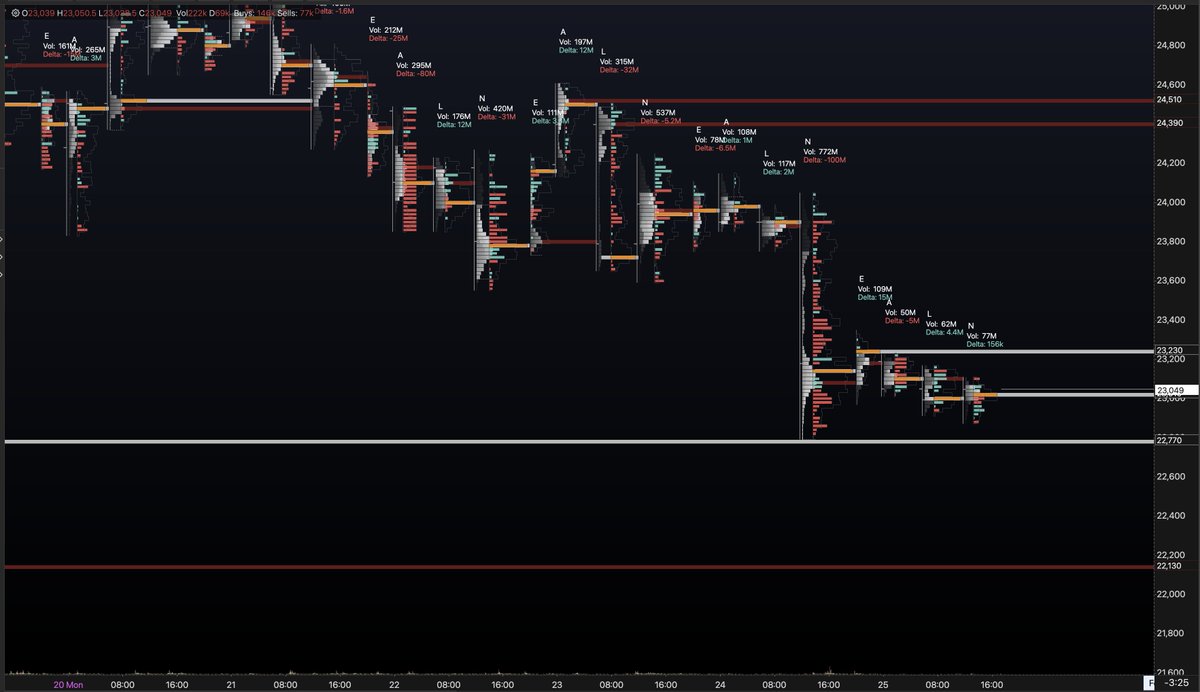

@ExochartsC 4️⃣ Session TPOs

Daily TPO sessions are typical they are split by dOpen.

Session TPOs are more often related to trading hours determined by different regions around the world.

I use this for trading intra-day nPOCs and in particular the vPOCs

5min 40tick - nPOCs extended

Daily TPO sessions are typical they are split by dOpen.

Session TPOs are more often related to trading hours determined by different regions around the world.

I use this for trading intra-day nPOCs and in particular the vPOCs

5min 40tick - nPOCs extended

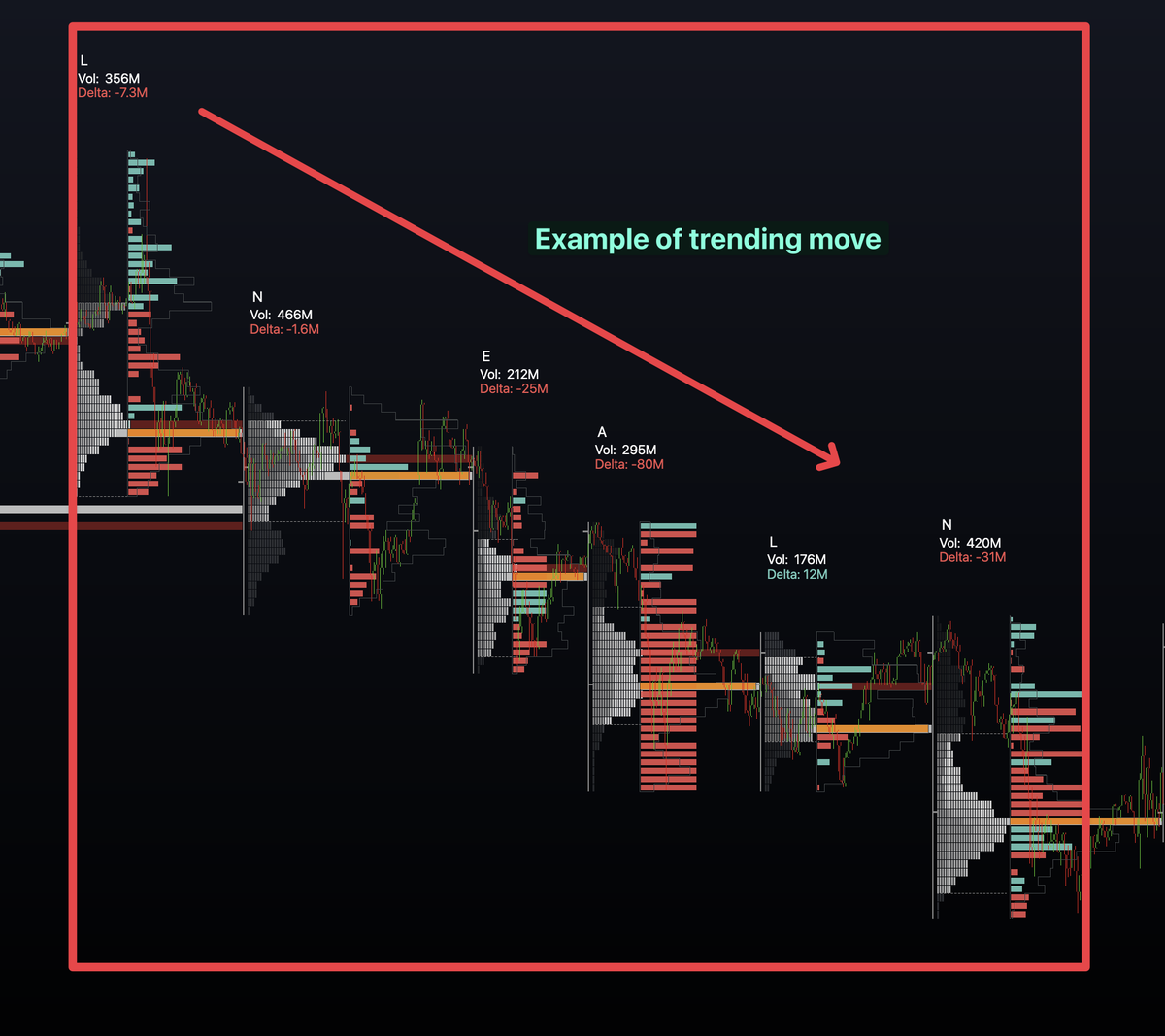

@ExochartsC 5️⃣ Merging sessions

I merge sessions which fit the following criteria:

• Directional trends

• Ranges I've identified via TV

• Sessions with similar VA values

The POC of these merges can have significance with confluence and provide key S/R levels to trade off.

I merge sessions which fit the following criteria:

• Directional trends

• Ranges I've identified via TV

• Sessions with similar VA values

The POC of these merges can have significance with confluence and provide key S/R levels to trade off.

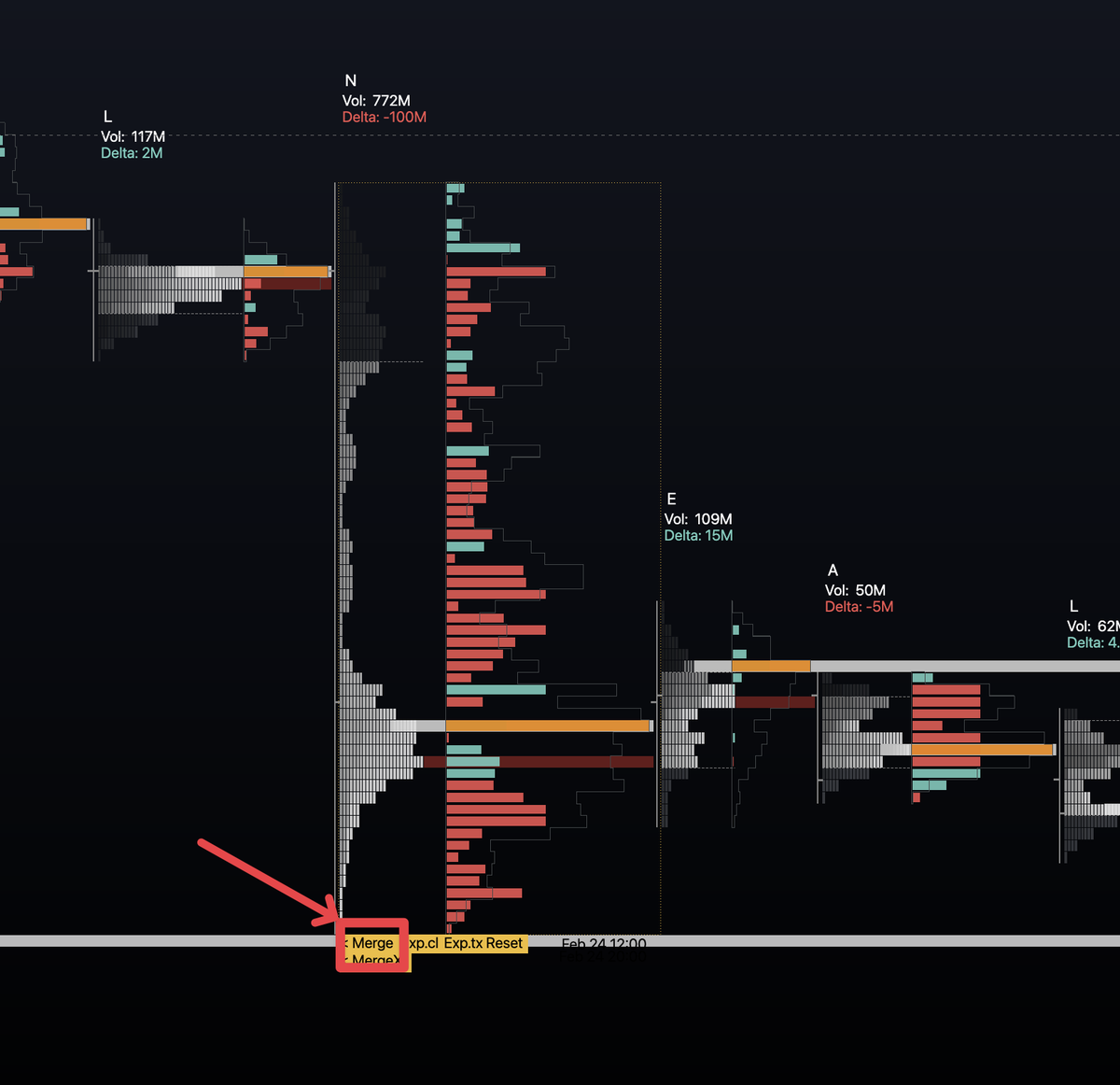

@ExochartsC 5️⃣🅱️ Merging sessions

• Double-click any profile

• Hit the merge button to merge back a profile

OR use merge X to merge back a certain number of profiles.

• Double-click any profile

• Hit the merge button to merge back a profile

OR use merge X to merge back a certain number of profiles.

@ExochartsC 6️⃣ POC Discrepancies

Where is the tPOC in relation to the vPOC?

Typically these 2 levels are either very close to one another or at the same level in relation to each TPO profile.

A discrepancy is when these 2 POCs are NOT together.

So what does that mean? 👇

Where is the tPOC in relation to the vPOC?

Typically these 2 levels are either very close to one another or at the same level in relation to each TPO profile.

A discrepancy is when these 2 POCs are NOT together.

So what does that mean? 👇

@ExochartsC 6️⃣🅱️ POC Discrepancies

If we see a break of a range or a trend change & the vPOC is within the direction of the break which then leaves behind the tPOC.

- That would show strength in that move to me as it tells me volume is following the break of the range/trend change

If we see a break of a range or a trend change & the vPOC is within the direction of the break which then leaves behind the tPOC.

- That would show strength in that move to me as it tells me volume is following the break of the range/trend change

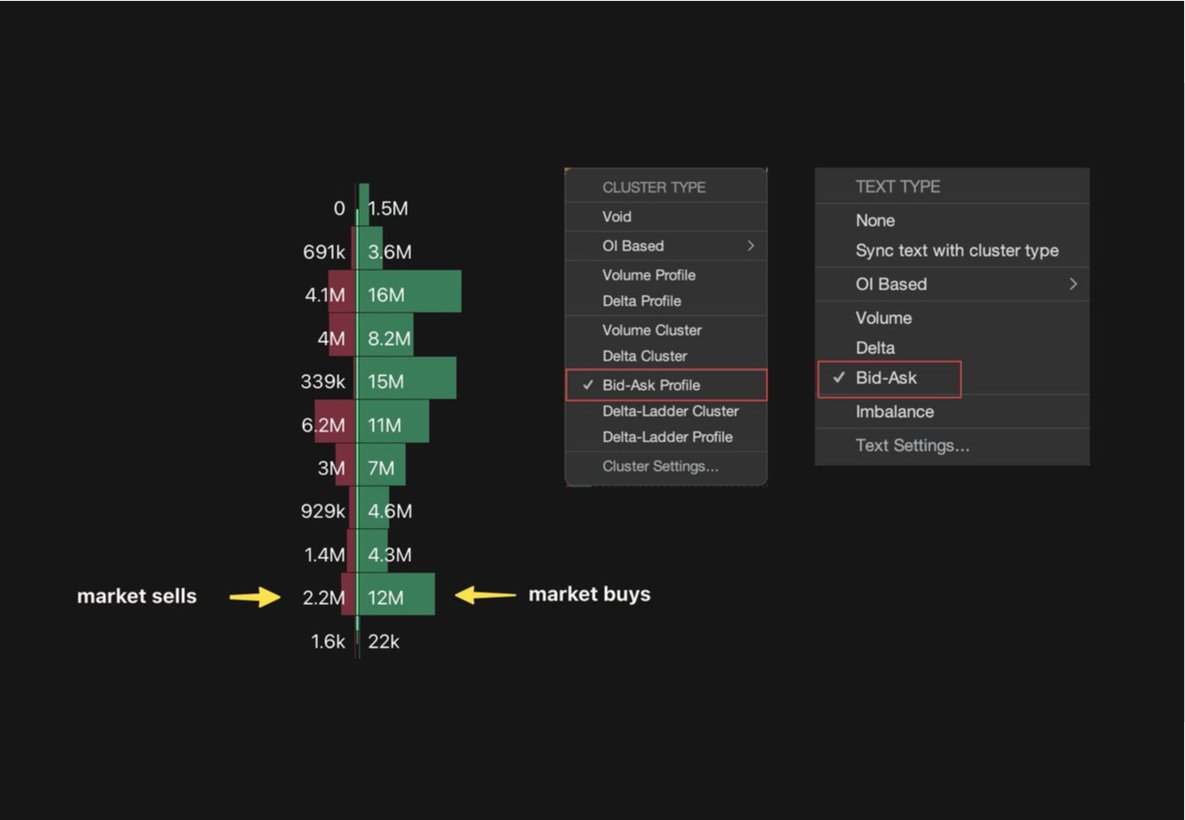

@ExochartsC 7️⃣ Volume profile & Delta overlay

I prefer to see larger blue bars at the top of a profile or large red bars at the bottom of a profile if we are to see a pivot at either point.

This could signify trapped traders.

Then would check OI at those levels within a different tpl.

I prefer to see larger blue bars at the top of a profile or large red bars at the bottom of a profile if we are to see a pivot at either point.

This could signify trapped traders.

Then would check OI at those levels within a different tpl.

@ExochartsC If you enjoyed remember - RT the 1st Tweet of this thread to receive the templates discussed

thanks.

thanks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh