How to get URL link on X (Twitter) App

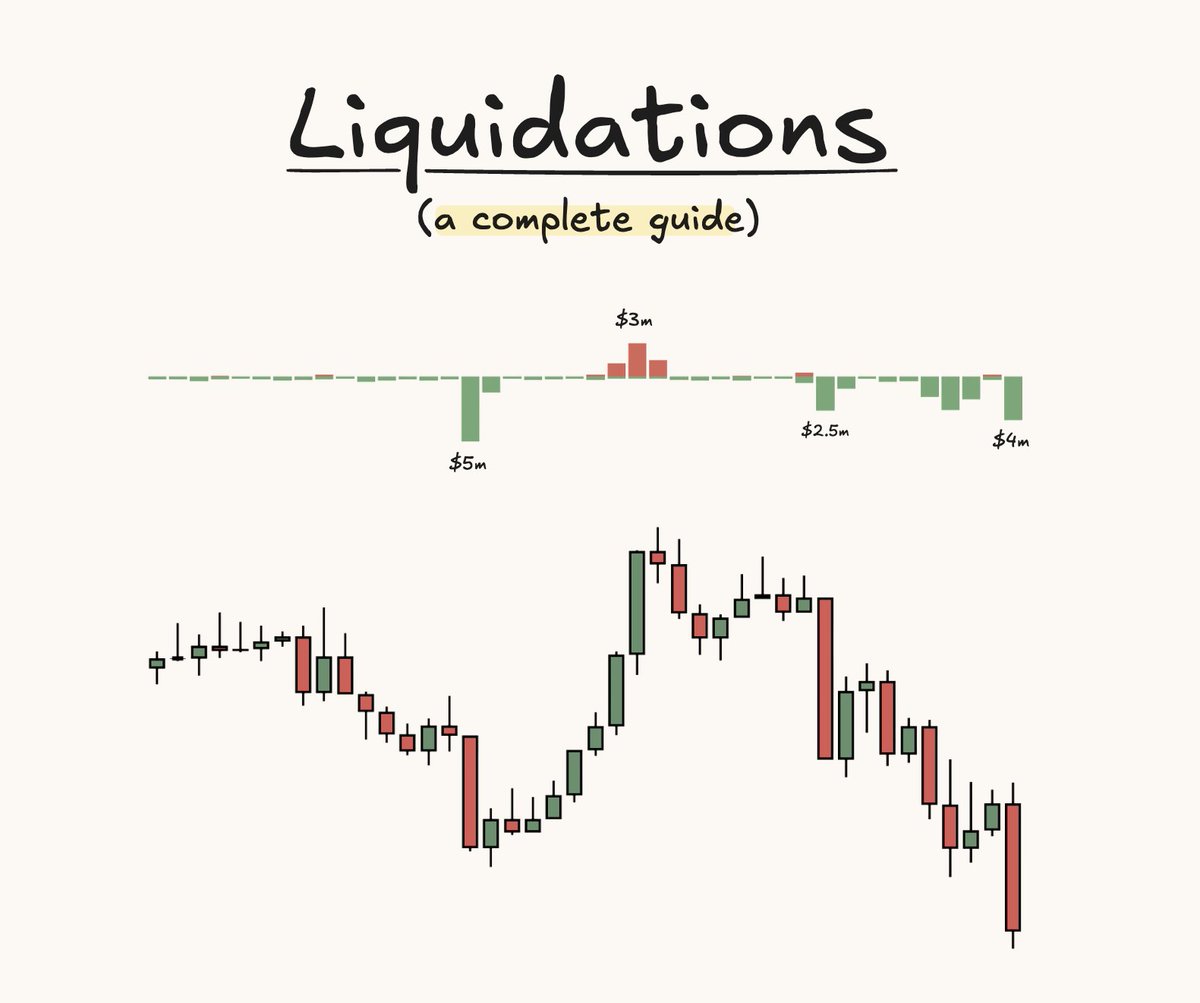

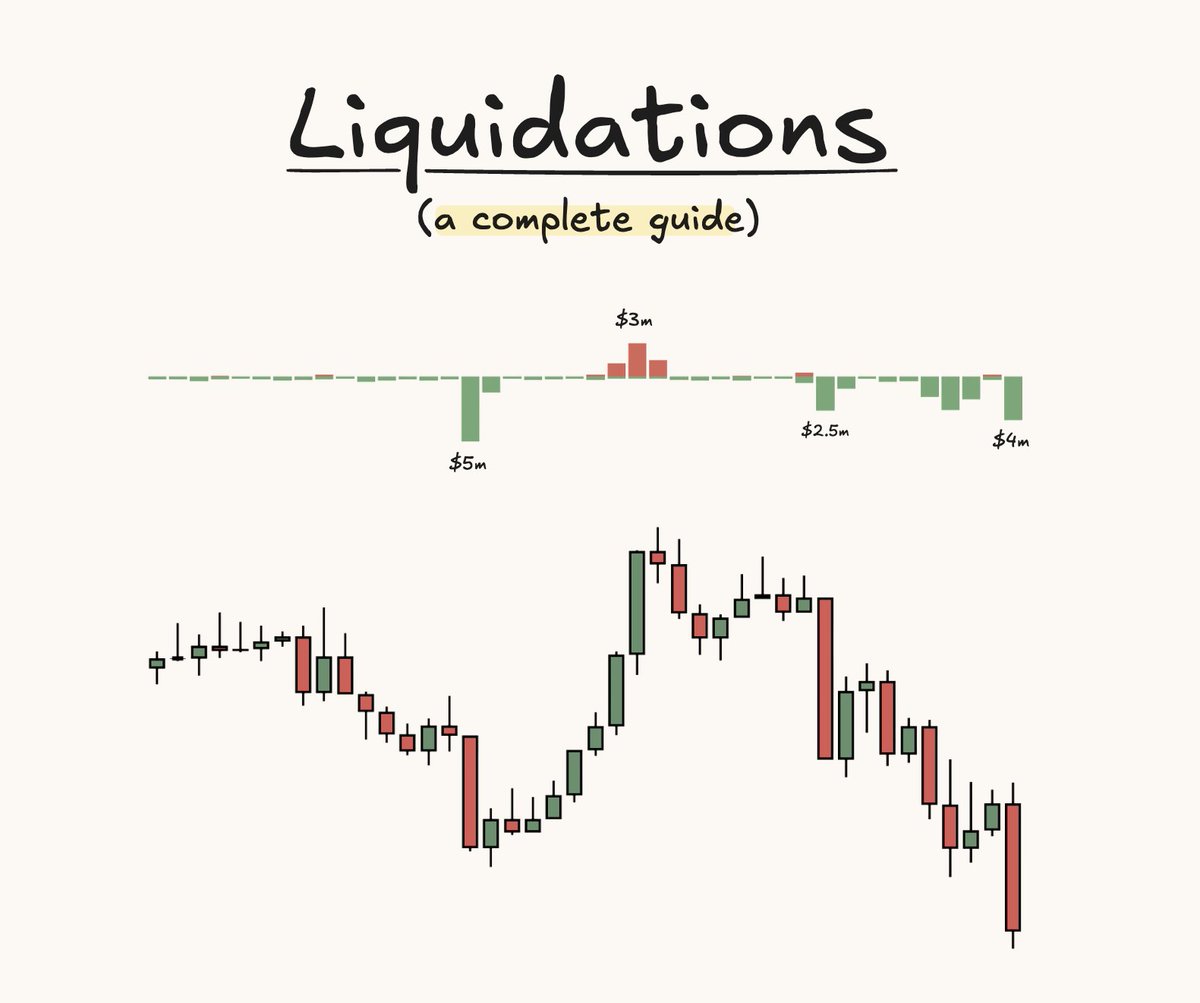

What are liquidations?

What are liquidations?

fading breakout traders:

fading breakout traders:

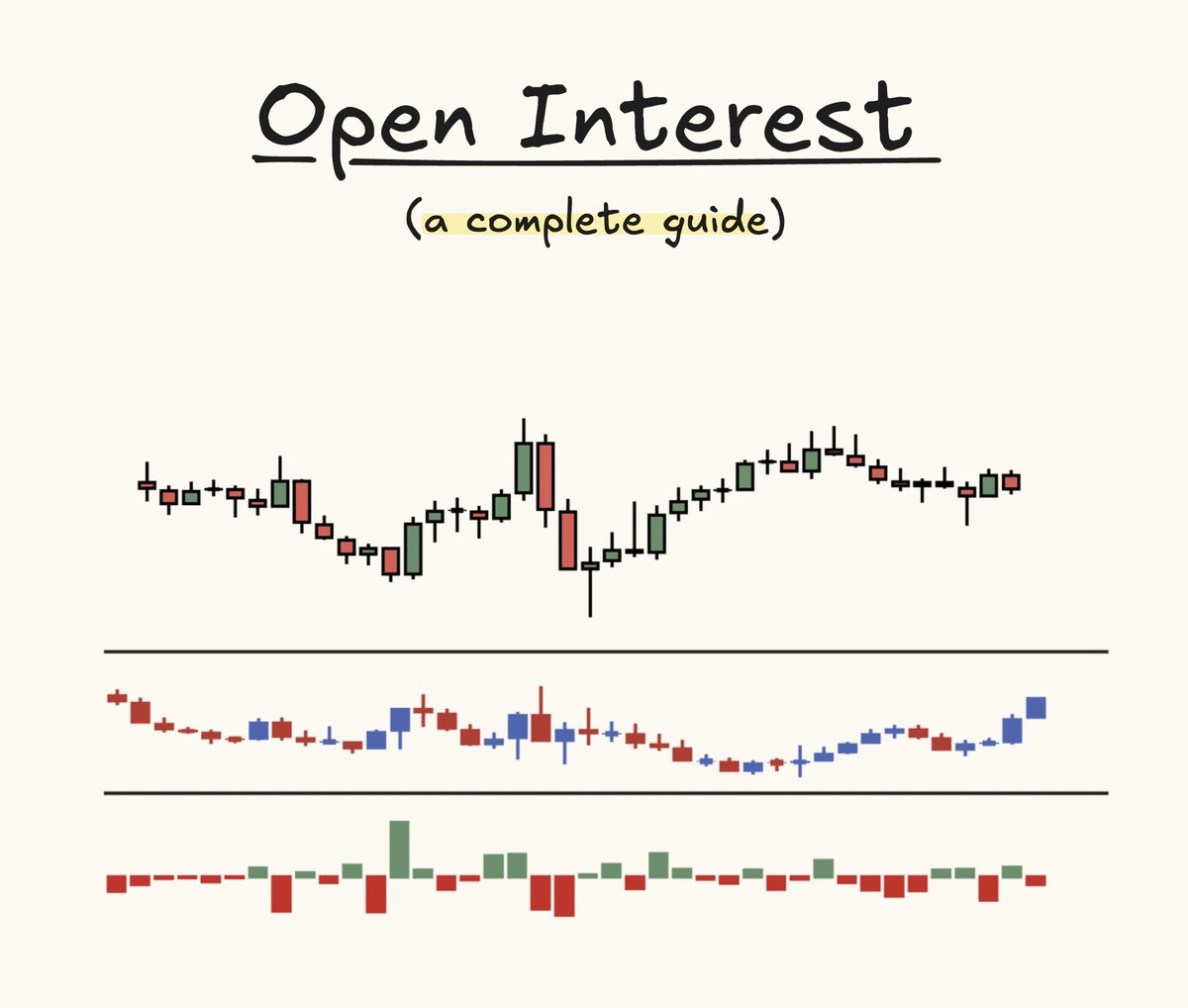

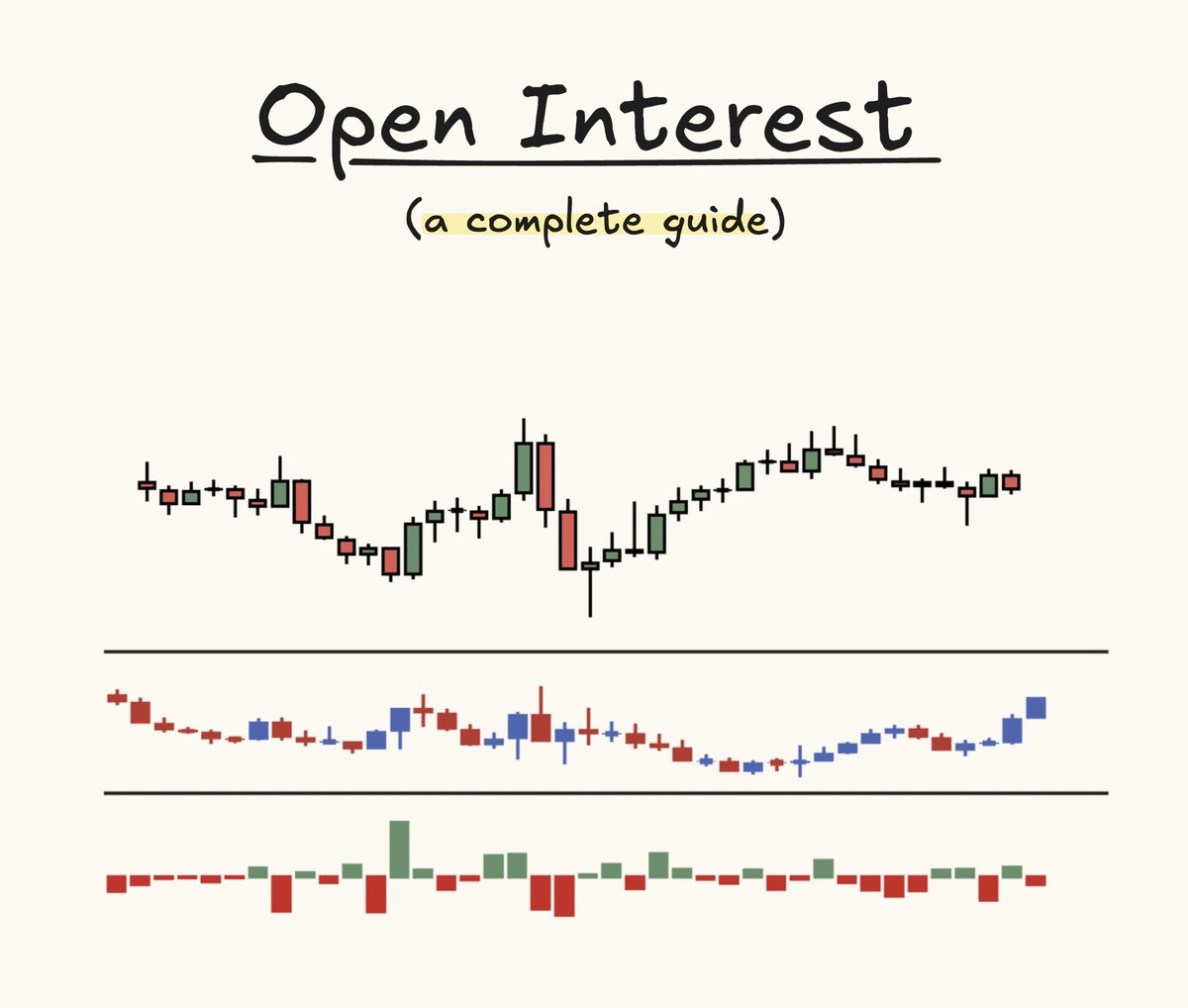

what is open interest?

what is open interest?

market/limit orders:

market/limit orders:

footprint vs regular charts:

footprint vs regular charts:

Asia (00-06)

Asia (00-06)

what are npocs:

what are npocs:

what is monday range?

what is monday range?

what is vwap:

what is vwap:

open interest vs price:

open interest vs price:

what is auction market theory:

what is auction market theory:

what is delta:

what is delta:

what are trapped traders?

what are trapped traders?

candle formations:

candle formations:

1. Market Structure

1. Market Structure