As I was saying recently, small cap oil and gas companies are the most compelling to me here. Canadian midcaps have large followings these days ...

https://twitter.com/Josh_Young_1/status/1629520185622142976?t=ClqTmPicSqnfPT1Bpjuhdw&s=19

I was bullish Canadian oil and gas stocks when they were very out of favor. Now I'm even more focused on company specifics. Small cap seems to be where it's at, not the specific Canadian geography / trading jurisdiction.

https://twitter.com/Josh_Young_1/status/1629519522800574477?t=lH_jHgBOMPuMQWHTg9vJmg&s=19

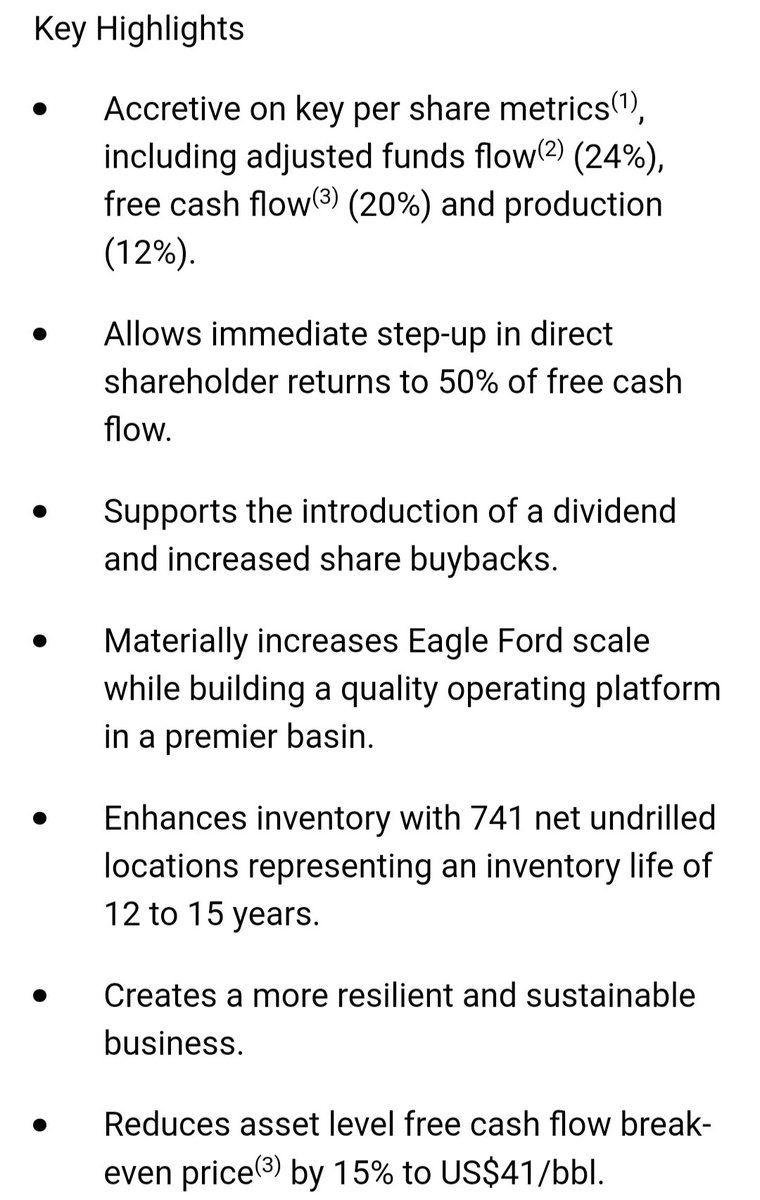

Baytex before and after this deal announcement? 🤔

https://twitter.com/INVESTMENTSHULK/status/1630320474931560448?t=Zdlq2iiIP6FCXWtIbQXRCQ&s=19

Harshest take on this deal that I've seen. #eft

https://twitter.com/FauxRight/status/1630387681564794882?t=KSFemaHrJl7rK9Y_YMNosQ&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh