(1/30)🧵

LSD TVL is over Lending TVL now, you want some protocol to hedge/ gamble?

This thread provides you with a deep understanding of @y2kfinance, let's dive in🔮

Likes/ Comments/ RT are welcomed🫡

LSD TVL is over Lending TVL now, you want some protocol to hedge/ gamble?

This thread provides you with a deep understanding of @y2kfinance, let's dive in🔮

Likes/ Comments/ RT are welcomed🫡

(2/30)👹Background Info

Launch on @arbitrum

Launch date: 2022/10

Founder: @Crypwalk_240 , @0xdrej

Incubation & Investor: @neworderDAO , which is the incubation of @redactedcartel

Launch on @arbitrum

Launch date: 2022/10

Founder: @Crypwalk_240 , @0xdrej

Incubation & Investor: @neworderDAO , which is the incubation of @redactedcartel

(3/30)Y2K has two products

💥Earthquake is where people participate in a depeg insurance.

🔥Wildfire is the secondary market of Earthquake and it’s coming soon.

This mindmap can help you understand @y2kfinance

💥Earthquake is where people participate in a depeg insurance.

🔥Wildfire is the secondary market of Earthquake and it’s coming soon.

This mindmap can help you understand @y2kfinance

(4/30)

💥Earthquake

Positions in Earthquake are defined as an $ETH deposit in one of two types of vaults

🟡Hedge vaults

🔴Risk vaults

💥Earthquake

Positions in Earthquake are defined as an $ETH deposit in one of two types of vaults

🟡Hedge vaults

🔴Risk vaults

(5/30)

🟡Hedge vaults -Depeg insurance buyer

Users' $ETH deposit acts as an insurance premium

🔴Risk vaults -Depeg insurance seller

Depositors collect premiums from the Hedge vault while creating a market for depeg protection for the Hedge vault.

🟡Hedge vaults -Depeg insurance buyer

Users' $ETH deposit acts as an insurance premium

🔴Risk vaults -Depeg insurance seller

Depositors collect premiums from the Hedge vault while creating a market for depeg protection for the Hedge vault.

(6/30)

There are two parameters in every vault

⏰Epoch: Time of coverage, which is weekly or monthly.

📉Strike Price: Price where a depeg event is triggered.

Both parameters are pre-determined by the Y2K team.

There are two parameters in every vault

⏰Epoch: Time of coverage, which is weekly or monthly.

📉Strike Price: Price where a depeg event is triggered.

Both parameters are pre-determined by the Y2K team.

(7/30)

🔮Oracle

@chainlink is used to monitor underlying asset prices.

When the Chainlink oracle indicates that the strike price for a given vault has been hit, the vault will be closed.

This will initiate a transfer of Risk vault deposits to the Hedge vault.

🔮Oracle

@chainlink is used to monitor underlying asset prices.

When the Chainlink oracle indicates that the strike price for a given vault has been hit, the vault will be closed.

This will initiate a transfer of Risk vault deposits to the Hedge vault.

(8/30)

🎭Scenarios

🔺Vault does not depeg

$ETH in the Hedge vault is prorated to the Risk vault as an insurance premium.

🔻Vault depeg

$ETH in the Risk vault is prorated to the Hedge vault as an insurance payout

$ETH in the Hedge vault is prorated to the Risk vault

🎭Scenarios

🔺Vault does not depeg

$ETH in the Hedge vault is prorated to the Risk vault as an insurance premium.

🔻Vault depeg

$ETH in the Risk vault is prorated to the Hedge vault as an insurance payout

$ETH in the Hedge vault is prorated to the Risk vault

(9/30)

Y2K charges a 5% fee from insurance buyers regardless of the depeg event occurs.

If the depeg event occurs, Y2K takes an additional 5% fee from the insurance payout, which is the sweetest part🍬

Y2K charges a 5% fee from insurance buyers regardless of the depeg event occurs.

If the depeg event occurs, Y2K takes an additional 5% fee from the insurance payout, which is the sweetest part🍬

(10/30)

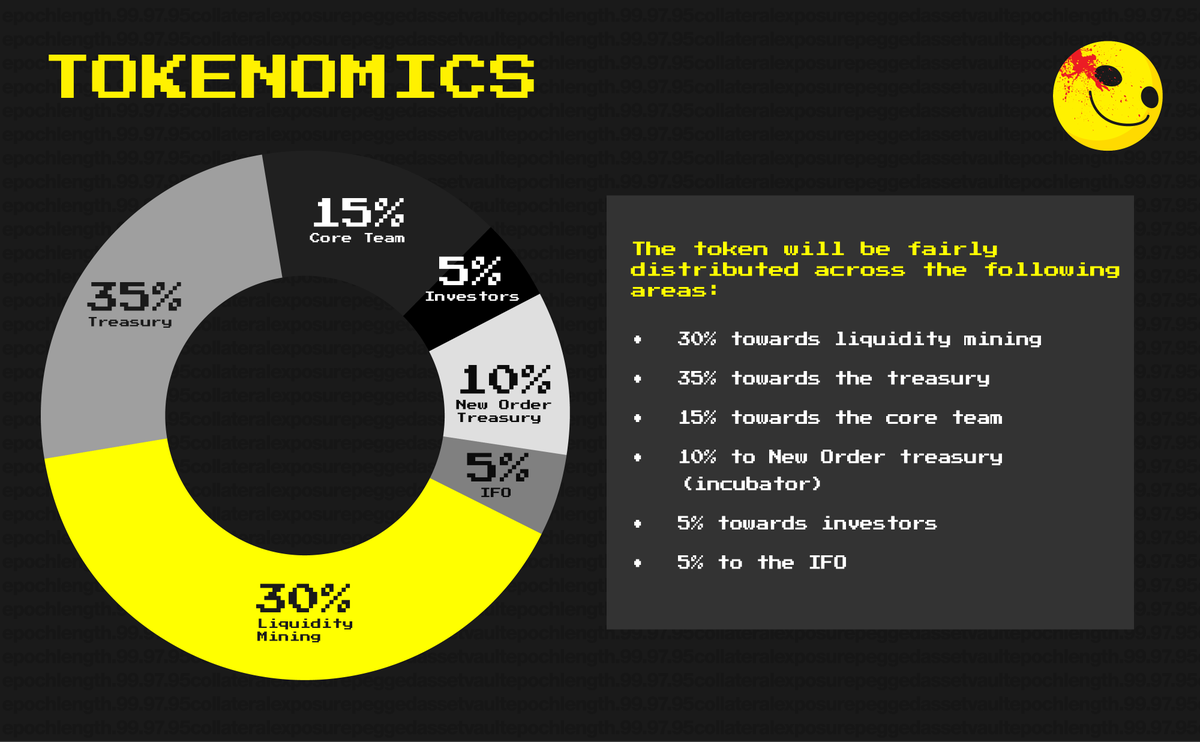

🪙Tokenomic

Their tokenomic is similar to @CurveFinance

🔸Users provide LP and lock the LP token for a long period and get $vlY2K.

🔸$vlY2K holders vote to decide the direction of emissions.(Bribery economic)

🔸$vlY2K holders share 50% of revenue of Y2K

Further dig🔨👇

🪙Tokenomic

Their tokenomic is similar to @CurveFinance

🔸Users provide LP and lock the LP token for a long period and get $vlY2K.

🔸$vlY2K holders vote to decide the direction of emissions.(Bribery economic)

🔸$vlY2K holders share 50% of revenue of Y2K

Further dig🔨👇

(11/30)

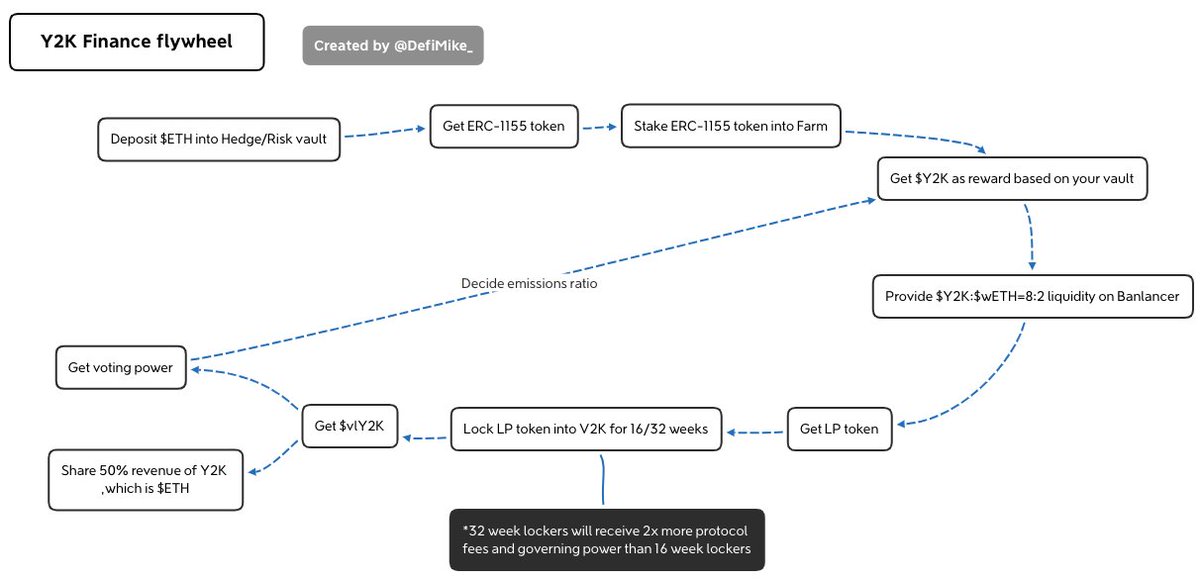

When you deposit $ETH into the Y2K vault, you will receive an ERC-1155 token that can be staked in the Farm to earn $Y2K emissions.

However, unlike Curve, you must provide liquidity on @Balancer with $Y2K:$ETH=80:20, which will result in a significant impermanent loss.

When you deposit $ETH into the Y2K vault, you will receive an ERC-1155 token that can be staked in the Farm to earn $Y2K emissions.

However, unlike Curve, you must provide liquidity on @Balancer with $Y2K:$ETH=80:20, which will result in a significant impermanent loss.

(12/30)

Afterward, you lock yr LP token into Y2K for 16/32 weeks to get $vlY2K.

The longer the locked period, the greater the benefit.

Then, you will have voting power to decide the emissions ratio of the Farm vault.

Being a loyal user will keep the Y2K flywheel in operation.

Afterward, you lock yr LP token into Y2K for 16/32 weeks to get $vlY2K.

The longer the locked period, the greater the benefit.

Then, you will have voting power to decide the emissions ratio of the Farm vault.

Being a loyal user will keep the Y2K flywheel in operation.

(14/30)

The incentive period is around 2 years, it’s too short in my opinion🤡

It’s 7.18% circulating right now, so it’s obviously #super #early #stage

The incentive period is around 2 years, it’s too short in my opinion🤡

It’s 7.18% circulating right now, so it’s obviously #super #early #stage

(16/30)

Y2K was launched on 2022/10 and has been operational for 5 months

Earned $544,203

😎61% of that coming from depeg events

🥸39% coming from premiums

Y2K was launched on 2022/10 and has been operational for 5 months

Earned $544,203

😎61% of that coming from depeg events

🥸39% coming from premiums

(17/30)

There have been four depeg events occurred.

🔸2022-11-08 MIM depeg

🔸2022-11-10 USDT depeg

🔸2023-01-28 wBTC depeg

🔸2023-02-15 stETH depeg

Only four times depeg event occurs, it brings 61% of the revenue of all time🤑

There have been four depeg events occurred.

🔸2022-11-08 MIM depeg

🔸2022-11-10 USDT depeg

🔸2023-01-28 wBTC depeg

🔸2023-02-15 stETH depeg

Only four times depeg event occurs, it brings 61% of the revenue of all time🤑

(18/30)

2022-11-08 MIM depeg

Hedger gains 1751.85/192.42=9.104, which is a #810.43% realized return.

@DigitsDao earned 99.52 ETH in this event

2022-11-10 USDT depeg

Hedger gains 2123.95/155.31=13.67, which is a #1267.55% realized return.

@DigitsDao earned 113.6 ETH in this event

2022-11-08 MIM depeg

Hedger gains 1751.85/192.42=9.104, which is a #810.43% realized return.

@DigitsDao earned 99.52 ETH in this event

2022-11-10 USDT depeg

Hedger gains 2123.95/155.31=13.67, which is a #1267.55% realized return.

@DigitsDao earned 113.6 ETH in this event

(19/30)

2023-01-28 wBTC depeg

Hedger gains 18.11/5.2=3.48, which is a #348.26% realized return.

2023-02-15 stETH depeg

Hedger gains1751.85/192.42=9.10, which is a #810.43% realized return.

However, it seems Y2K didn't use TWAP to avoid oracle manipulation

2023-01-28 wBTC depeg

Hedger gains 18.11/5.2=3.48, which is a #348.26% realized return.

2023-02-15 stETH depeg

Hedger gains1751.85/192.42=9.10, which is a #810.43% realized return.

However, it seems Y2K didn't use TWAP to avoid oracle manipulation

(20/30)

You can also refer to toubi dune to check every vault's details.

Something interesting you might see👀, like people put more bets on $BUSD will depeg

You can also refer to toubi dune to check every vault's details.

Something interesting you might see👀, like people put more bets on $BUSD will depeg

(21/30)

🔮Y2K is a super niche, super early-stage protocol.

🔸In 2023, regulators are cracking down on stablecoins.

🔸Shanghai update is expected to occur in 2023 Q2, some people believe that LSD will depeg.

👉Users are more likely to use Y2K for speculation.

🔮Y2K is a super niche, super early-stage protocol.

🔸In 2023, regulators are cracking down on stablecoins.

🔸Shanghai update is expected to occur in 2023 Q2, some people believe that LSD will depeg.

👉Users are more likely to use Y2K for speculation.

(22/30)

Although I believe this is a potential 50x protocol, the $Y2K price is too crazy right now.

Below is the FDV/TVL, you can see the ratio of Y2K is insane😬

Although I believe this is a potential 50x protocol, the $Y2K price is too crazy right now.

Below is the FDV/TVL, you can see the ratio of Y2K is insane😬

(23/30)

Some Q&A

1. How did Y2K solve the chicken and egg problem?

2. How did they bootstrap initial liquidity?

3. Other prediction markets have failed. What's Y2K's strategy?

Some Q&A

1. How did Y2K solve the chicken and egg problem?

2. How did they bootstrap initial liquidity?

3. Other prediction markets have failed. What's Y2K's strategy?

(24/30)

A1: Y2K try to use tokenomic to solve the chicken and egg problem.

Y2K creates a tokenomic that attracts users to LOCK their $Y2K back into their vault.

Once you lock your $Y2K into the vault, you become the chicken mama to ensure the flywheel run.

A1: Y2K try to use tokenomic to solve the chicken and egg problem.

Y2K creates a tokenomic that attracts users to LOCK their $Y2K back into their vault.

Once you lock your $Y2K into the vault, you become the chicken mama to ensure the flywheel run.

(25/30)

A2: In my opinion, they cooperate with DAO to gain initial liquidity.

My guess is based on their incubation is a famous DAO, and Digits DAO participated in Epoch 1 👀🔨

A2: In my opinion, they cooperate with DAO to gain initial liquidity.

My guess is based on their incubation is a famous DAO, and Digits DAO participated in Epoch 1 👀🔨

(26/30)

A3: Y2K's strategy to maintain the flywheel effect is to attract more users to their protocol, which is uncertain and resembles a Ponzi scheme. 👇

A3: Y2K's strategy to maintain the flywheel effect is to attract more users to their protocol, which is uncertain and resembles a Ponzi scheme. 👇

(27/30)

However, their real strength lies in offering a real yield to users.

Unlike other prediction markets where users pay a fee to gamble, users win/lose money and they walk away, they don’t have any loyalty to the casino.👇

However, their real strength lies in offering a real yield to users.

Unlike other prediction markets where users pay a fee to gamble, users win/lose money and they walk away, they don’t have any loyalty to the casino.👇

(28/30)

In Y2K, users gain $Y2K tokens and become owners of the casino, sharing 50% of the casino revenue.

This incentivizes users to remain loyal to the platform, making it a degen crypto way of ensuring user retention.

In Y2K, users gain $Y2K tokens and become owners of the casino, sharing 50% of the casino revenue.

This incentivizes users to remain loyal to the platform, making it a degen crypto way of ensuring user retention.

(29/30)

Okay, that's it for now, welcome to follow me, and discuss with me.

Keep learning in the bear market😇

Tell me your opinions:

@DeFiMinty

@thedefiedge

@DefiIgnas

@defi_mochi

@DeFi_Made_Here

@DeFi_Cheetah

@DeFi_Dad

@rektdiomedes

@WinterSoldierxz

Okay, that's it for now, welcome to follow me, and discuss with me.

Keep learning in the bear market😇

Tell me your opinions:

@DeFiMinty

@thedefiedge

@DefiIgnas

@defi_mochi

@DeFi_Made_Here

@DeFi_Cheetah

@DeFi_Dad

@rektdiomedes

@WinterSoldierxz

• • •

Missing some Tweet in this thread? You can try to

force a refresh