Biggest month ever!

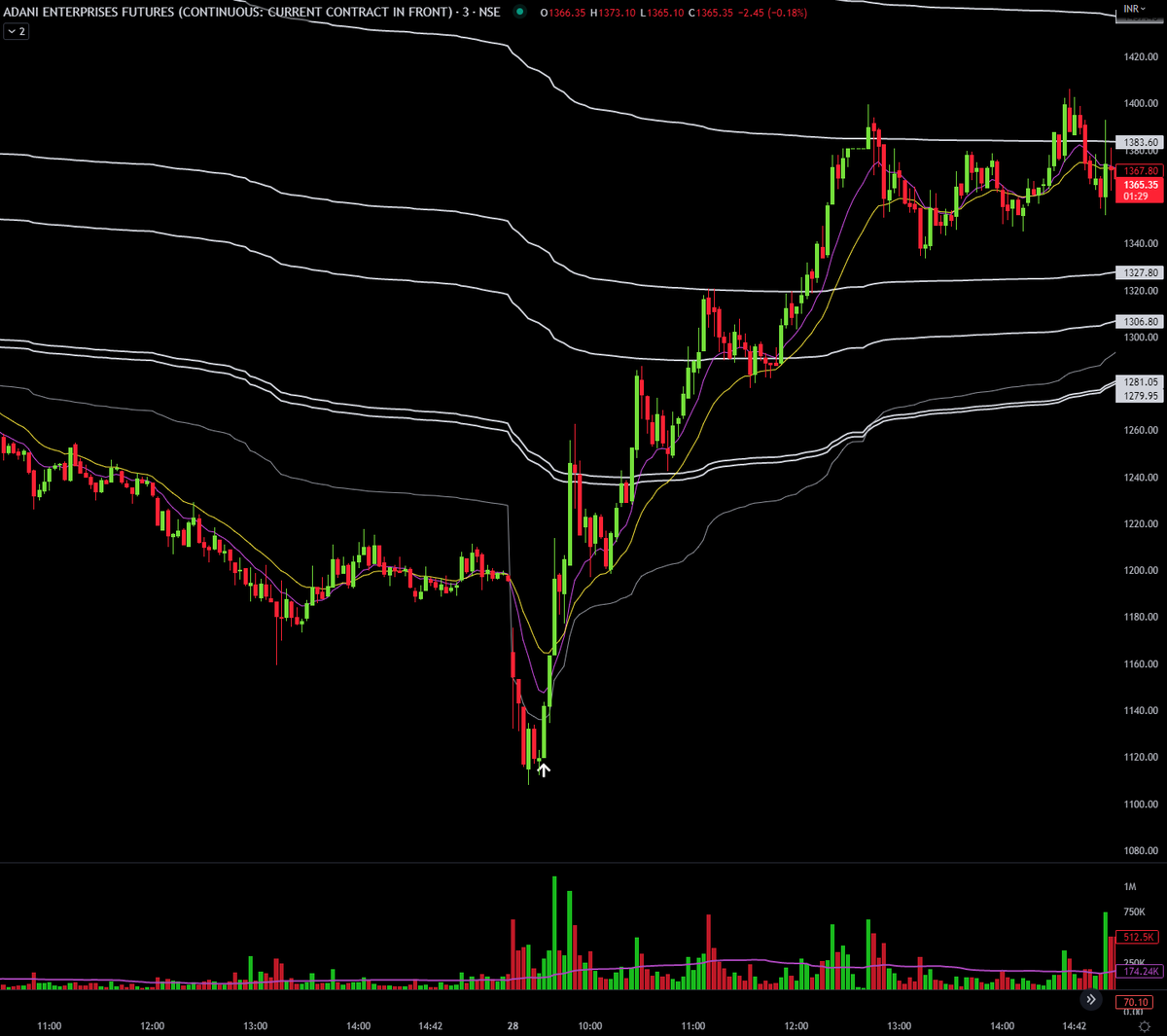

#ADANIENT - Trading this beast whole month. Both LONG & SHORT

Was way late to the party, should have been on this thing way earlier.

Gross return : 30%

Net return: 26.75% (excluding brokerage, taxes and losses from other trades)

// timeline of news events

#ADANIENT - Trading this beast whole month. Both LONG & SHORT

Was way late to the party, should have been on this thing way earlier.

Gross return : 30%

Net return: 26.75% (excluding brokerage, taxes and losses from other trades)

// timeline of news events

Why #ADANIENT

- Big news that had catastrophic effect on the prices

- Which led to upsurge in volatility

- Being in FnO made it free from circuit limits

- High liquidity, less slippage

Such instances are rare in Indian Markets, #YESBANK & #DHFL had similar characteristics.

- Big news that had catastrophic effect on the prices

- Which led to upsurge in volatility

- Being in FnO made it free from circuit limits

- High liquidity, less slippage

Such instances are rare in Indian Markets, #YESBANK & #DHFL had similar characteristics.

Such trades have high R:R and high win rate, like how often you buy something and it goes up 90% on the same day? Bonkers!

> Risk was much higher than my usual risk per trade (while trading cash stocks)

> Traded mostly futures

> Tools used: EMAs, A/VWAPs & intraday high and low

> Risk was much higher than my usual risk per trade (while trading cash stocks)

> Traded mostly futures

> Tools used: EMAs, A/VWAPs & intraday high and low

Other related tweets:

https://twitter.com/stonkssguy/status/1626585937777135617?s=20

https://twitter.com/stonkssguy/status/1626668257322348544?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh