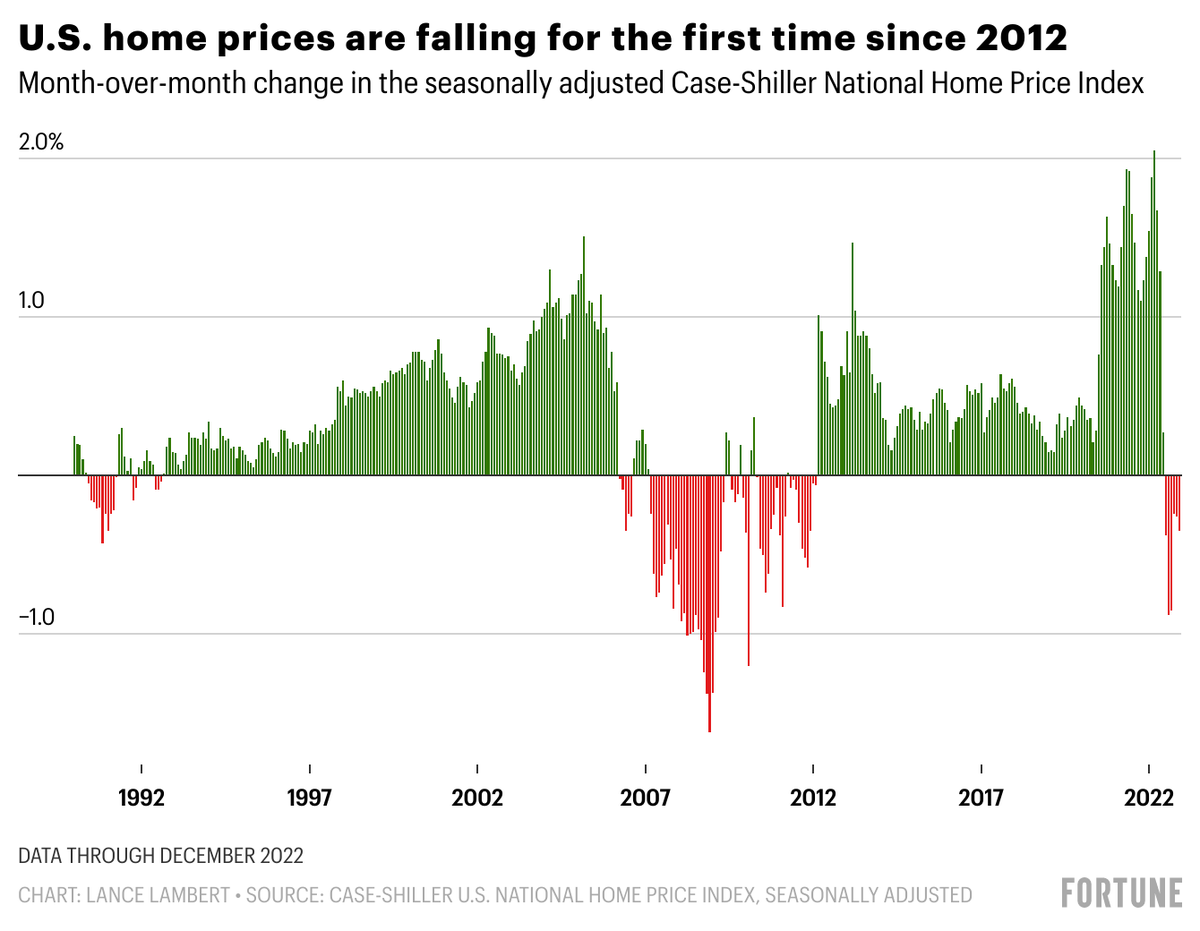

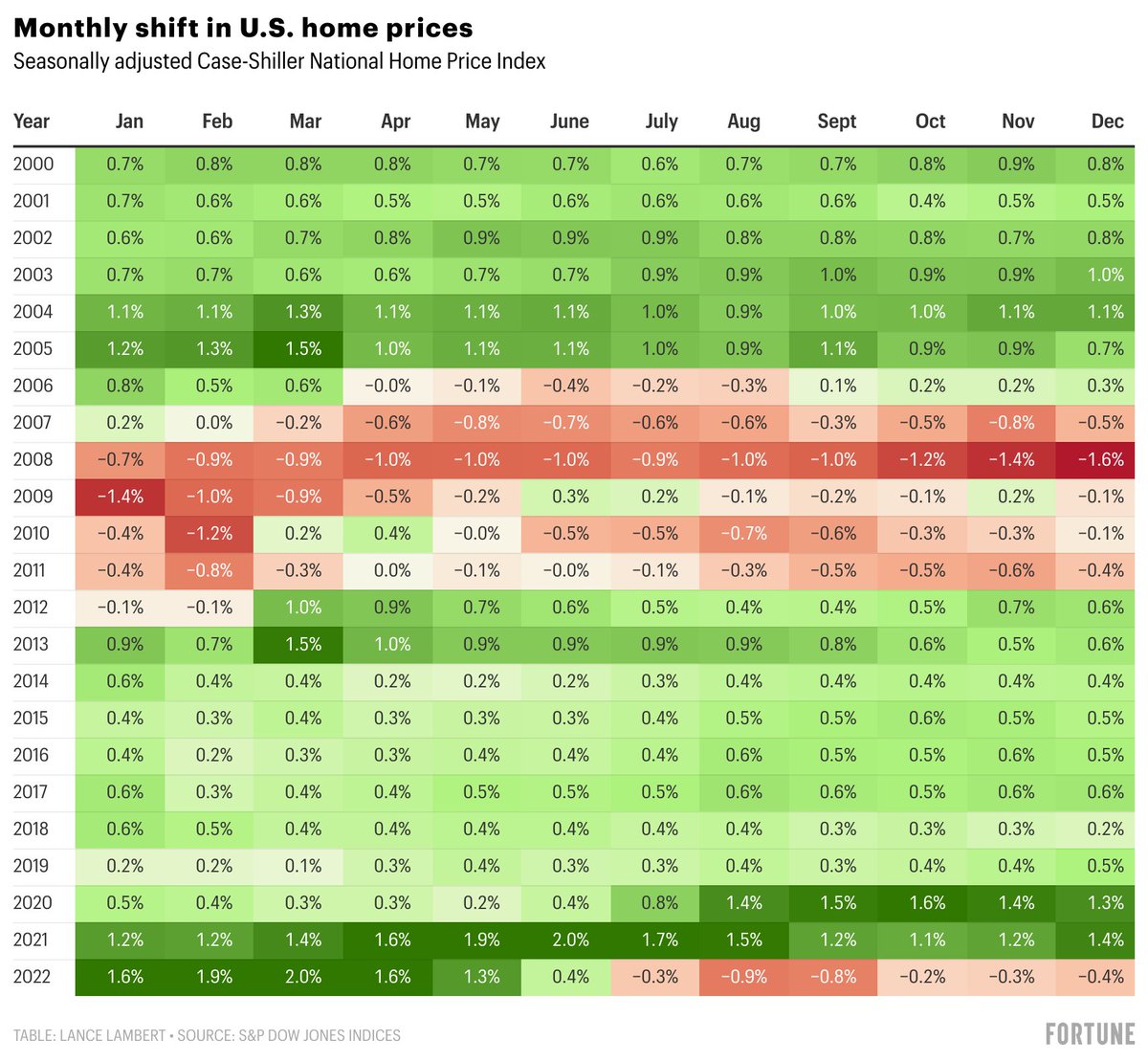

U.S. home prices, as measured by the seasonally adjusted Case-Shiller National Home Price Index, fell for the sixth straight month in December.

Since peaking in June 2022, U.S. home prices have fallen -2.7%.

Without seasonal adjustment, U.S. home prices are down -4.4%

Since peaking in June 2022, U.S. home prices have fallen -2.7%.

Without seasonal adjustment, U.S. home prices are down -4.4%

The U.S. housing market slipped into a home price correction in the second half of 2022.

The six monthly declines are the most in a year since 2011.

The six monthly declines are the most in a year since 2011.

Through June 2022, U.S. home prices had climbed +8.7% on the year.

By the end of December, 2022 home price growth was reduced to +5.8%.

By the end of December, 2022 home price growth was reduced to +5.8%.

The Pandemic Housing Boom saw U.S. home prices rise 41.2% between March 2020 and June 2022.

As of December, those total Pandemic Housing Boom gains have been reduced to 37.3%.

As of December, those total Pandemic Housing Boom gains have been reduced to 37.3%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh