【Megathread on #ShanghaiUnlock & 🌈 LSDs】

⭐ Why $ETH won't dump

⭐ Why rotate from #alts

⭐ Why long $YFI and $GEAR ⚙️

⭐ Why $ETH won't dump

⭐ Why rotate from #alts

⭐ Why long $YFI and $GEAR ⚙️

1/ The knee-jerk reaction to the Shanghai Unlock schedule for March 2023 is of course: “Oh withdrawals! Eth will dump!” Indeed, A lot of reports seem to err on the side of downward price action for ETH.

https://twitter.com/kamikaz_ETH/status/1629958390846726144

2/ I don't see any solid reason for the selling pressure on ETH other than the expectation of selling. There are many reasons why ETH is unlikely to experience a severe drop, and even if it does, it won't be as significant.

3/ If anything, we might see alts, especially on @arbitrum to dive, as people rotate from alts into stables in anticipation of Eth dumping.

4/

• If stakers need liquidity, they could just sell the LSD - even if they're shutting down their fund or have to repay loans. It doesn’t take the Shanghai Unlock for them to sell.

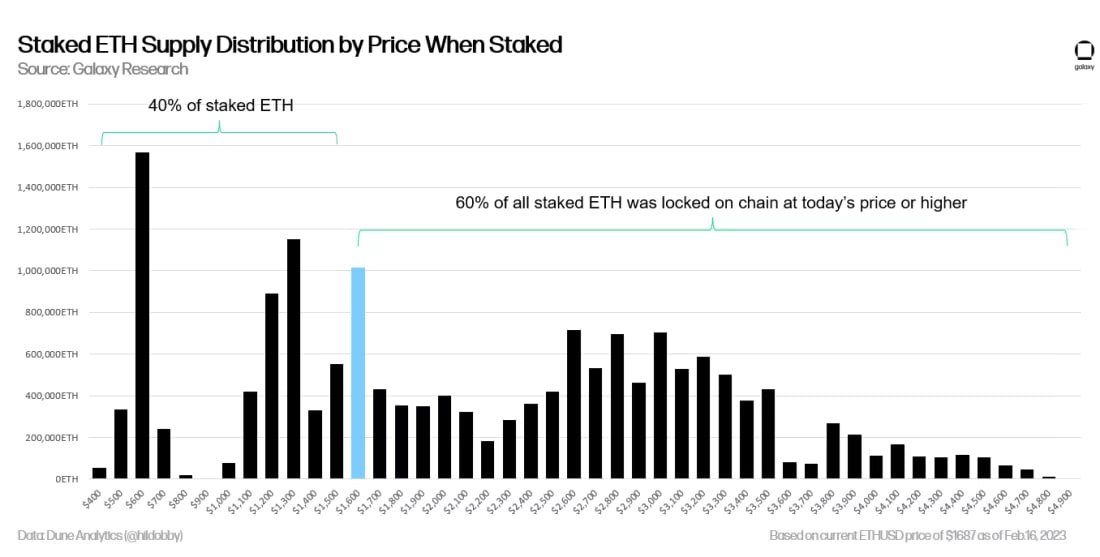

• Most stakers are underwater. Why will they sell now?

• If stakers need liquidity, they could just sell the LSD - even if they're shutting down their fund or have to repay loans. It doesn’t take the Shanghai Unlock for them to sell.

• Most stakers are underwater. Why will they sell now?

5/

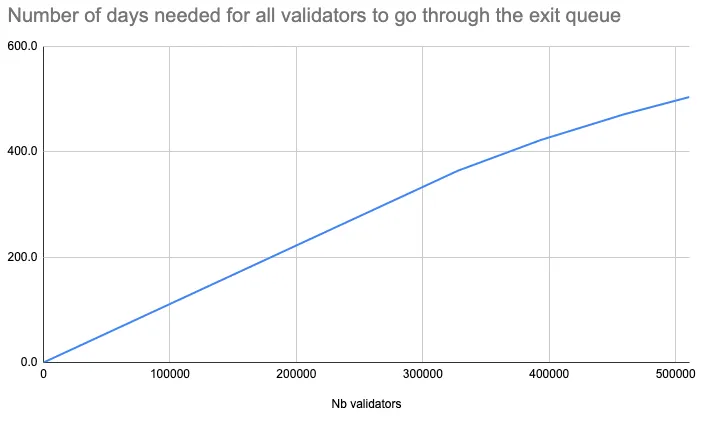

• Even if people rush to sell, the queuing mechanism will smoothen out the price chart.

• If hoards of people unstake and sell to USDC, staking APY is going to jack up across the board and folks will ape back in.

• Even if people rush to sell, the queuing mechanism will smoothen out the price chart.

• If hoards of people unstake and sell to USDC, staking APY is going to jack up across the board and folks will ape back in.

6/ Note that withdrawals come into 2 flavours: partial (withdrawals of only rewards) and full (withdrawals of rewards + principle, exiting from the validator set)

7/ Validators with credentials set to 0x01 will automatically partially withdraw, and @LidoFinance has 131,016 validators set to 0x01, on average Lido validators earned 1.23 ETH in rewards. So that’s 160k ETH (approx. 256m) of automatic partial withdrawals.

8/ This coupled with the likelihood of full validator withdrawals to rotate into @Rocket_Pool or @fraxfinance post v2 frxEth, is likely going to put some serious stress on the stEth-Eth peg.

9/ In light of that you might want to long $RPL, which actually has utility as the collateral against slashing. I suspect that $FXS will very likely be following similar tokenomics.

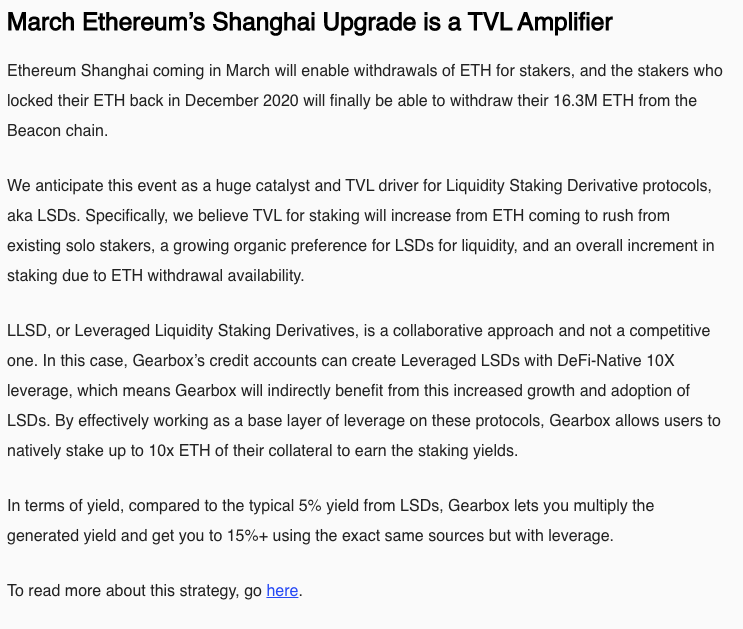

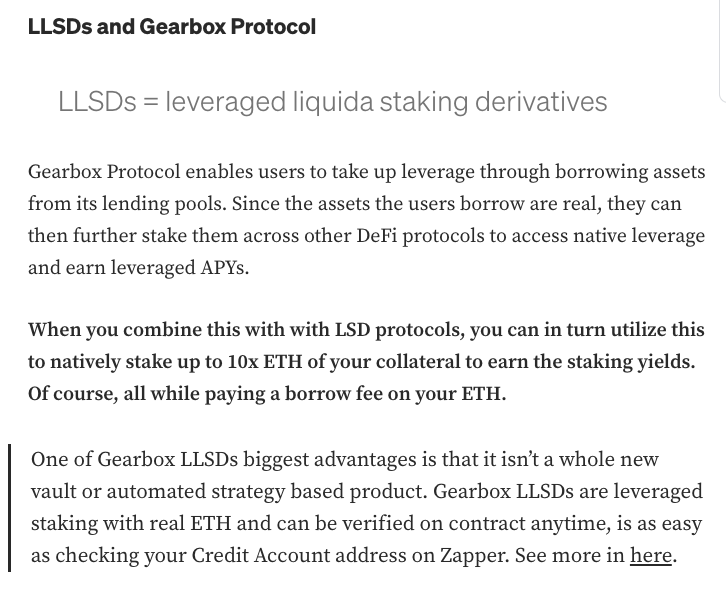

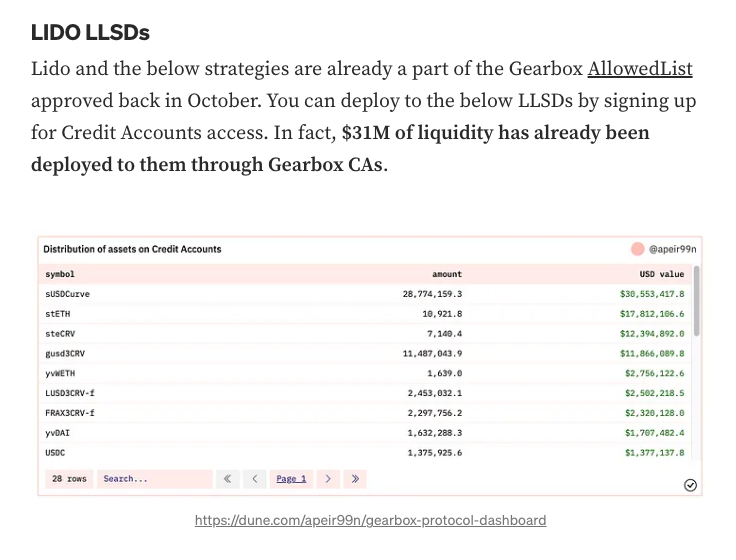

10/【⚙️$Gear & #LLSD】

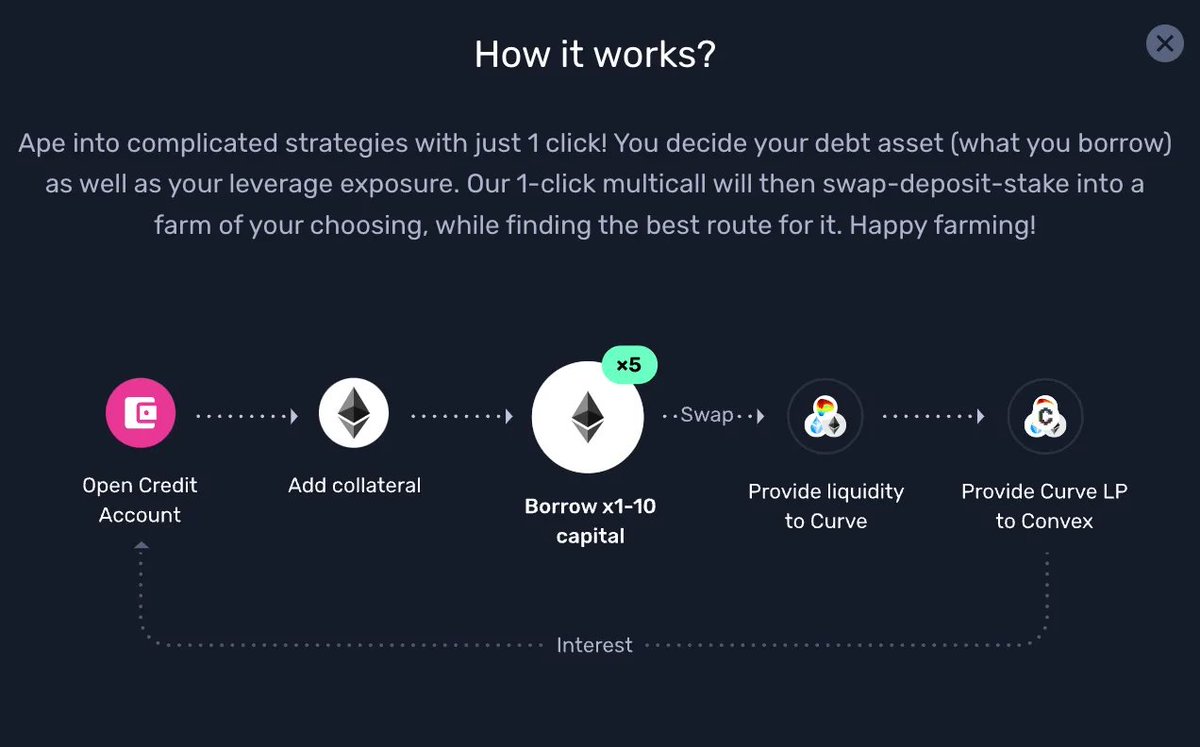

Now, @GearboxProtocol, which offers a closed system of margin trading, is also getting into the LSD game.

medium.com/gearbox-protoc…

Now, @GearboxProtocol, which offers a closed system of margin trading, is also getting into the LSD game.

medium.com/gearbox-protoc…

11/ Remember the $Steth-$Eth looping strategy that 3AC did? deposit stEth on Aave ->borrow Eth -> stake for stEth -> deposit it again on @AaveAave, now imagine it's a one-click strategy.

12/ Gearbox is offering this precise leveraging strategy on LSDs, and they’re calling it #LLSD. So far only $stEth and $cbEth are integrated for this strategy, and we would eventually see $rEth and $frxEth integrated as well.

13/ How about @eulerfinance? Hasn't euler been enabling this strategy for steth? And haven't they been terribly enthusiastic at pushing Frax to get the chainlink oracle necessary for listing sFrxEth as a collateral asset?

https://twitter.com/MacroMate8/status/1590699609881731080

14/ However, unlike Gearbox which offers one click implementation, deploying this strategy on Euler requires manual looping. $GEAR, which is now sitting on a market cap of just 15m, is therefore a superior exposure to the LSD trade than $EUL (130m)

15/ Furthermore, Gearbox’s strategic round tokens has 1-year cliff and 1-year linear vesting, so we won't be see dumping until 2023 Aug. Plenty of space and time to play the LSD narrative and TVL ballooning vis-a-vis Shanghai.

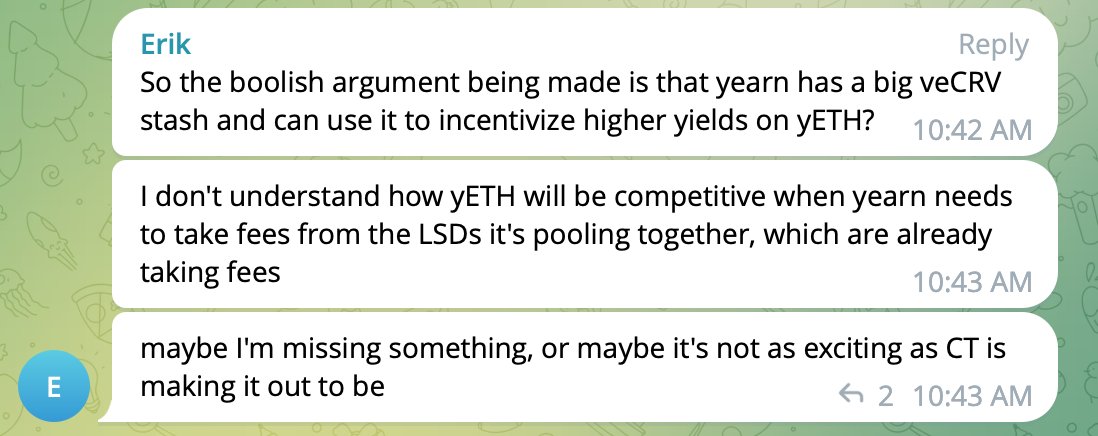

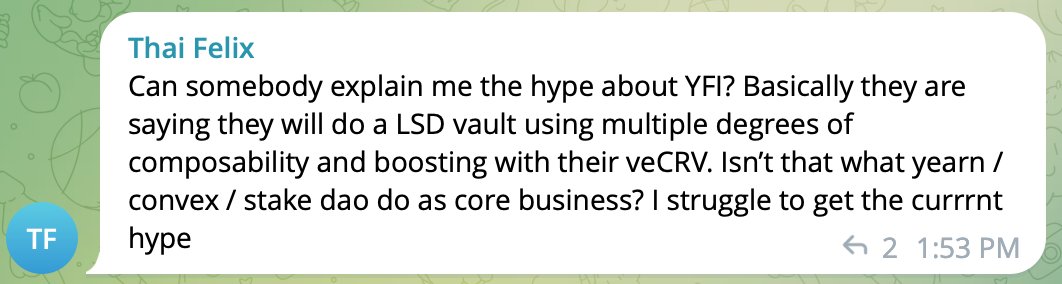

16/【Yearn and $yEth?】

@iearnfinance released a cryptic text that they’re getting into the 🌈 #LSD game.

@iearnfinance released a cryptic text that they’re getting into the 🌈 #LSD game.

https://twitter.com/iearnfinance/status/1628104719003418632

17/

If it were just another simple “stake with us and get a liquid token” it would have been very boring. But so far there hasn’t been any public release of information on what this thing even is.

If it were just another simple “stake with us and get a liquid token” it would have been very boring. But so far there hasn’t been any public release of information on what this thing even is.

18/ The only semblance of documentation on what yEth is is the following chart:

This picture is pretty cryptic, but basically I think it’s saying it will replicate frxEth’s structure on top of frxEth itself.

https://twitter.com/MStiive/status/1628273411087822849

This picture is pretty cryptic, but basically I think it’s saying it will replicate frxEth’s structure on top of frxEth itself.

19/ The $frxEth and $sFrxEth pair concentrates the right to access the underlying yield to $sFrxEth to push up the yield. The frxEth is Eth already staked, but the frxEth holders who do not stake their frxEth to obtain sFrxEth are forgoing their yield.

20/ The yield is then distributed only to sFrxEth holders, so yield is concentrated and pushed higher. Check out my piece Diving into FrxEth if you’re not familiar with FrxEth’s mechanism.

https://twitter.com/0xJamesBong/status/1589595520208551936

21/Now all this below is speculation, so read at your own risk - Not Financial Advice damn it.

22/ Assuming you have frxEth, you can stake it intosFrxEth for 7-9% yield, or you can shove it into for frxEth-LP for 10-13% yield. You can ofc mix the strategies together, depending on your risk appetite and your view on the risks of each strategy

23/

This yields the likely yEth vault architecture.

You stake Eth into a yEth vault.

The vault sends your Eth exactly into the strategy as outlined above: into a mixture of sFrxEth and frxEth-LP.

This yields the likely yEth vault architecture.

You stake Eth into a yEth vault.

The vault sends your Eth exactly into the strategy as outlined above: into a mixture of sFrxEth and frxEth-LP.

24/ The vault mints you a yEth, but like frxEth it doesn’t immediately entitle you to the underlying yield. Instead, you can pair that yEth with Eth on Curve for yield - just like the frxEth-Eth pair.

This strategy would make sense only if yEth is pegged to Eth.

This strategy would make sense only if yEth is pegged to Eth.

25/ Alternatively, you can also choose to stake your yEth such that you can the underlying sfrxEth + frxEth-Eth LP yield.

26/ So, this architecture enables st-yEth holders to (1) earn sFrxEth yield, (2) frxEth-Eth LP yield, and yEth holders can earn yEth-Eth CRV emissions.

27/ But why stop there ser? 😈 This structure is self-similar #套娃! One can replicate this very structure on top of yEth again - the only prerequisite is that whoever’s building it must have a large warchest of crv for directing guages. Maybe @ConvexFinance?

@ConvexFinance You can read more of my analysis here on the Reflexivity Engine!

reflexivityengine.substack.com/p/shanghai-unl…

reflexivityengine.substack.com/p/shanghai-unl…

@ConvexFinance @iamthetripoli's piece offers some good insights on the partial withdrawals situation

dataalways.substack.com/p/partial-with…

dataalways.substack.com/p/partial-with…

@ConvexFinance @iamthetripoli And ofc, @jon_charb's amazing Ethereum model

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

Thanks to @0xhopydoc and @DeFi_Cheetah for inspiration @0xminion and @dcfpascal for reality checking~ Tagging chads

@AlfaDAO_

@crypto_condom

@0xkyle__

@0xKofi

@CryptoMaestro

@rektdiomedes

@dapandaETH

@0xPrismatic

@GrantStenger

@AlfaDAO_

@crypto_condom

@0xkyle__

@0xKofi

@CryptoMaestro

@rektdiomedes

@dapandaETH

@0xPrismatic

@GrantStenger

• • •

Missing some Tweet in this thread? You can try to

force a refresh