#SBI Mutual Fund has launched a Dividend Yield Fund.

While you must avoid new funds, we thought it’s a good time to look at the Dividend Yield category.

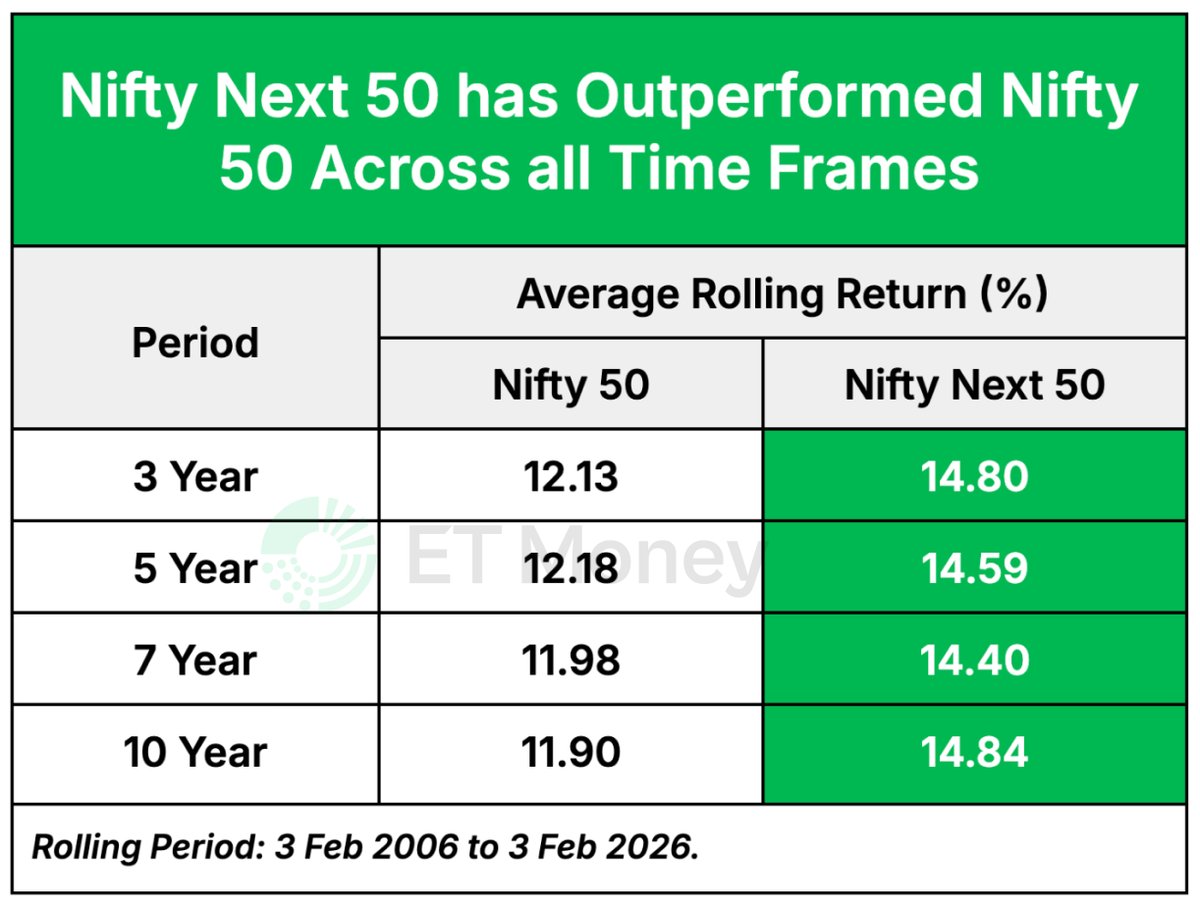

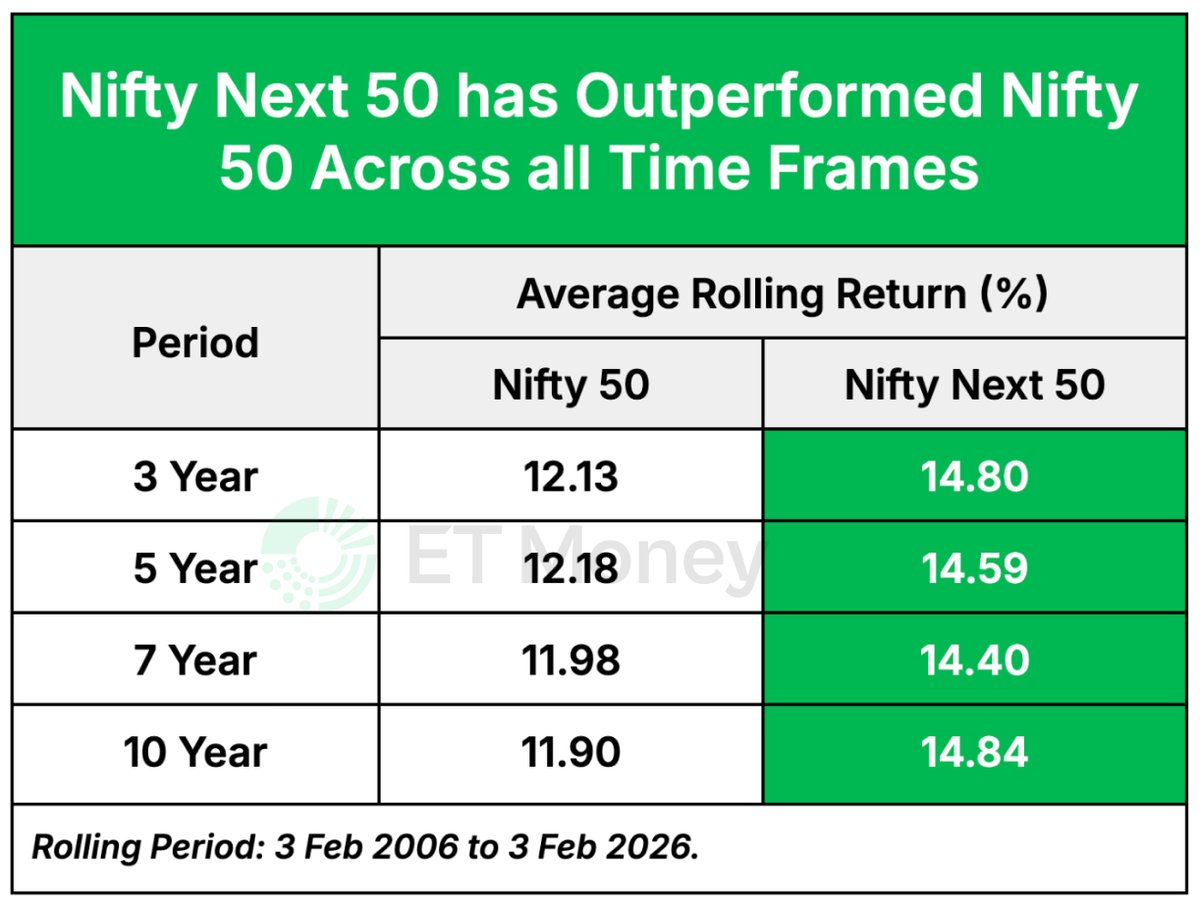

This category has outperformed many equity #schemes (See table)

But should you invest in these funds?

Let’s evaluate.

A 🧵

While you must avoid new funds, we thought it’s a good time to look at the Dividend Yield category.

This category has outperformed many equity #schemes (See table)

But should you invest in these funds?

Let’s evaluate.

A 🧵

First, some basics about these funds.

As per definition, Dividend Yield funds must invest at least 65% of their corpus in high dividend-paying companies.

Currently, there are eight funds in this category.

Together, they manage over Rs 10,200 crore.

As per definition, Dividend Yield funds must invest at least 65% of their corpus in high dividend-paying companies.

Currently, there are eight funds in this category.

Together, they manage over Rs 10,200 crore.

How do these funds define high dividend-paying stocks?

Different funds define it differently(see table)

Nonetheless, they don’t have any restrictions for picking stocks from different sectors or market caps.

Probably, that’s why #NIFTY 500 TRI is the benchmark for most funds.

Different funds define it differently(see table)

Nonetheless, they don’t have any restrictions for picking stocks from different sectors or market caps.

Probably, that’s why #NIFTY 500 TRI is the benchmark for most funds.

These funds are similar to Flexi Cap funds as their portfolio can be seen spread across stocks of different market caps.

This makes them comparable to Flexi Cap funds.

Check the allocation of 8 existing Dividend Yield Funds across market caps.

This makes them comparable to Flexi Cap funds.

Check the allocation of 8 existing Dividend Yield Funds across market caps.

What differentiates dividend Yield Funds and Flexi Cap Funds?

The choice of stocks in their portfolio.

Cash-rich companies dominate portfolios of Dividend Yield Funds, while banks are in top holdings of Flexi Cap funds. (See table)

The choice of stocks in their portfolio.

Cash-rich companies dominate portfolios of Dividend Yield Funds, while banks are in top holdings of Flexi Cap funds. (See table)

What do Dividend Yield Funds bring to the table?

They typically invest in cash-rich companies.

Stocks of such companies tend to do well during market downturns, and they are less volatile.

But have Dividend Yield Funds been able to weather the market storms?

They typically invest in cash-rich companies.

Stocks of such companies tend to do well during market downturns, and they are less volatile.

But have Dividend Yield Funds been able to weather the market storms?

Data shows that Dividend Yield funds have been able to provide better downside protection than Flexi Cap funds

Of the 7 Quarters (since 2018) when NIFTY 500 TRI was in the red, Dividend Yield funds did better in 4 of them (See Table)

Of the 7 Quarters (since 2018) when NIFTY 500 TRI was in the red, Dividend Yield funds did better in 4 of them (See Table)

What about the upside?

We checked the average 3-year returns of Dividend Yield Funds & Flexi Cap Funds on a rolling basis since January 2018.

Result - Dividend Yield Funds have underperformed Flexi Cap Funds on 58% of the occasions. (See graph)

We checked the average 3-year returns of Dividend Yield Funds & Flexi Cap Funds on a rolling basis since January 2018.

Result - Dividend Yield Funds have underperformed Flexi Cap Funds on 58% of the occasions. (See graph)

Here’s the summary.

During market rallies, Flexi Cap Funds have done better than Dividend Yield Funds.

And amid falling markets, Dividend Yield Funds have done better.

In the long-term, Dividend Yield Funds have delivered close to other diversified equity funds (See table)

During market rallies, Flexi Cap Funds have done better than Dividend Yield Funds.

And amid falling markets, Dividend Yield Funds have done better.

In the long-term, Dividend Yield Funds have delivered close to other diversified equity funds (See table)

Are Dividend Yield Funds worth investing?

These funds offer decent downside protection.

Their long-term returns are at par with other diversified equity funds.

So, you can make them part of your long-term equity portfolio.

These funds offer decent downside protection.

Their long-term returns are at par with other diversified equity funds.

So, you can make them part of your long-term equity portfolio.

There’s just one aspect that you must keep in mind.

Many Dividend Yield funds have high exposure to mid and small-cap stocks.

So, everything depends on the fund manager’s ability to balance the risks and maintain a low-risk portfolio of dividend-paying stocks.

Many Dividend Yield funds have high exposure to mid and small-cap stocks.

So, everything depends on the fund manager’s ability to balance the risks and maintain a low-risk portfolio of dividend-paying stocks.

Be selective when picking a Dividend Yield Fund.

Here are quick pointers to pick one:

- Preferably opt for a fund that has higher exposure to large-cap stocks

- Choose a scheme with a solid track record

- Avoid new funds

Here are quick pointers to pick one:

- Preferably opt for a fund that has higher exposure to large-cap stocks

- Choose a scheme with a solid track record

- Avoid new funds

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

For more threads, follow us.

Also, click on the bell icon in the profile section, so you don't miss any threads🔔

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

For more threads, follow us.

Also, click on the bell icon in the profile section, so you don't miss any threads🔔

• • •

Missing some Tweet in this thread? You can try to

force a refresh