Pendle can let you weaponize assets like #LSD to get an outsized return.

With the right moves and some Pendle magic, you can potentially earn ~6x profit vs. the old hold and wait 🪄

With the right moves and some Pendle magic, you can potentially earn ~6x profit vs. the old hold and wait 🪄

Before we get into the juicy 🫐 details, we need to first understand YT.

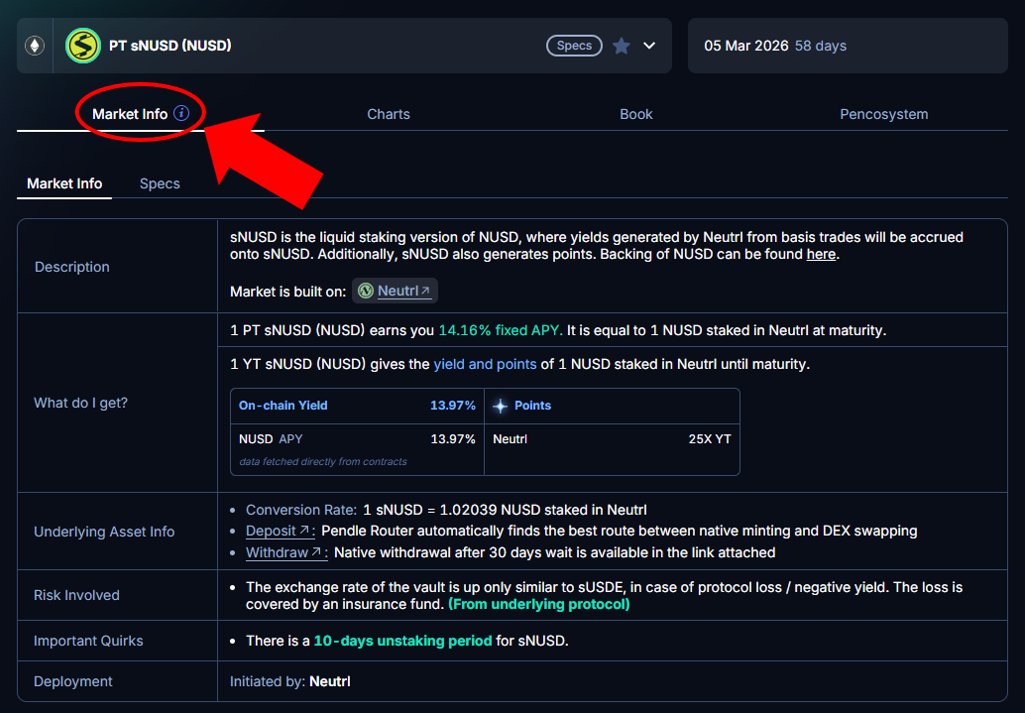

Holding a Yield Token (YT) gives you the right to receive all the yield generated by the underlying asset up to maturity.

Holding 1 YT-rETH-WETH for instance lets you receive yield from 1 rETH-WETH.

Holding a Yield Token (YT) gives you the right to receive all the yield generated by the underlying asset up to maturity.

Holding 1 YT-rETH-WETH for instance lets you receive yield from 1 rETH-WETH.

As of now, the Long Yield APY of YT-rETH-WETH is at ~46.5% APY.

This number estimates the amount of yield generated from your YT purchase, assuming the Average Future APY of rETH-WETH stays at the current level (8.47%) up until maturity.

This number estimates the amount of yield generated from your YT purchase, assuming the Average Future APY of rETH-WETH stays at the current level (8.47%) up until maturity.

Since Implied APY (6.3%) is less than the Underlying APY (8.47%), it seems that YT might be potentially undervalued here, again this is assuming that the Average Future Underlying APY will stay at this level.

Let's see what the Pendle Calculator has to say about this...

Let's see what the Pendle Calculator has to say about this...

With a capital of 3 $ETH, buying YT can potentially net you a profit of 1.11 $ETH at the current price.

In contrast, holding rETH-WETH itself will only earn you 0.209 $ETH within the same time period.

Once again, this is assuming the Average Future APY of rETH-WETH is 8.47%.

In contrast, holding rETH-WETH itself will only earn you 0.209 $ETH within the same time period.

Once again, this is assuming the Average Future APY of rETH-WETH is 8.47%.

As long as it stays well above the Implied APY of 6.3%, the Average Future APY can stay at the current level, increase or even decrease slightly and you will STILL be in profit.

Below are examples of when the Average Future APY:

⬆️ Increases to 9.5%

⬇️ Decreases to 7%

Below are examples of when the Average Future APY:

⬆️ Increases to 9.5%

⬇️ Decreases to 7%

If you think that the Average Future APY will drop way below the current level to near or below the Implied APY of 6.3%, then just holding would be a better strategy.

So what's the right move? It all comes down to whether you're Team Bull or Team Bear for #LSD yield.

To be sure, always make use of the Pendle Calculator to help you estimate the potential returns.

To be sure, always make use of the Pendle Calculator to help you estimate the potential returns.

Yield trading has always been the backbone of institutional hedging. In the right hands, it can be a very powerful tool that can help supercharge returns.

So anon, what's your #LSD play going to be?

trckr.com/rp0zace

So anon, what's your #LSD play going to be?

trckr.com/rp0zace

• • •

Missing some Tweet in this thread? You can try to

force a refresh