1/ Arguably, the most important issue facing Chicago is the pension deficit. There's no way to tax our way out of this. We need growth plans. Vallas gets this. Johnson believes in "trickle down pension-omics." More tax $ for his CTU pals at the expense of a functioning city.

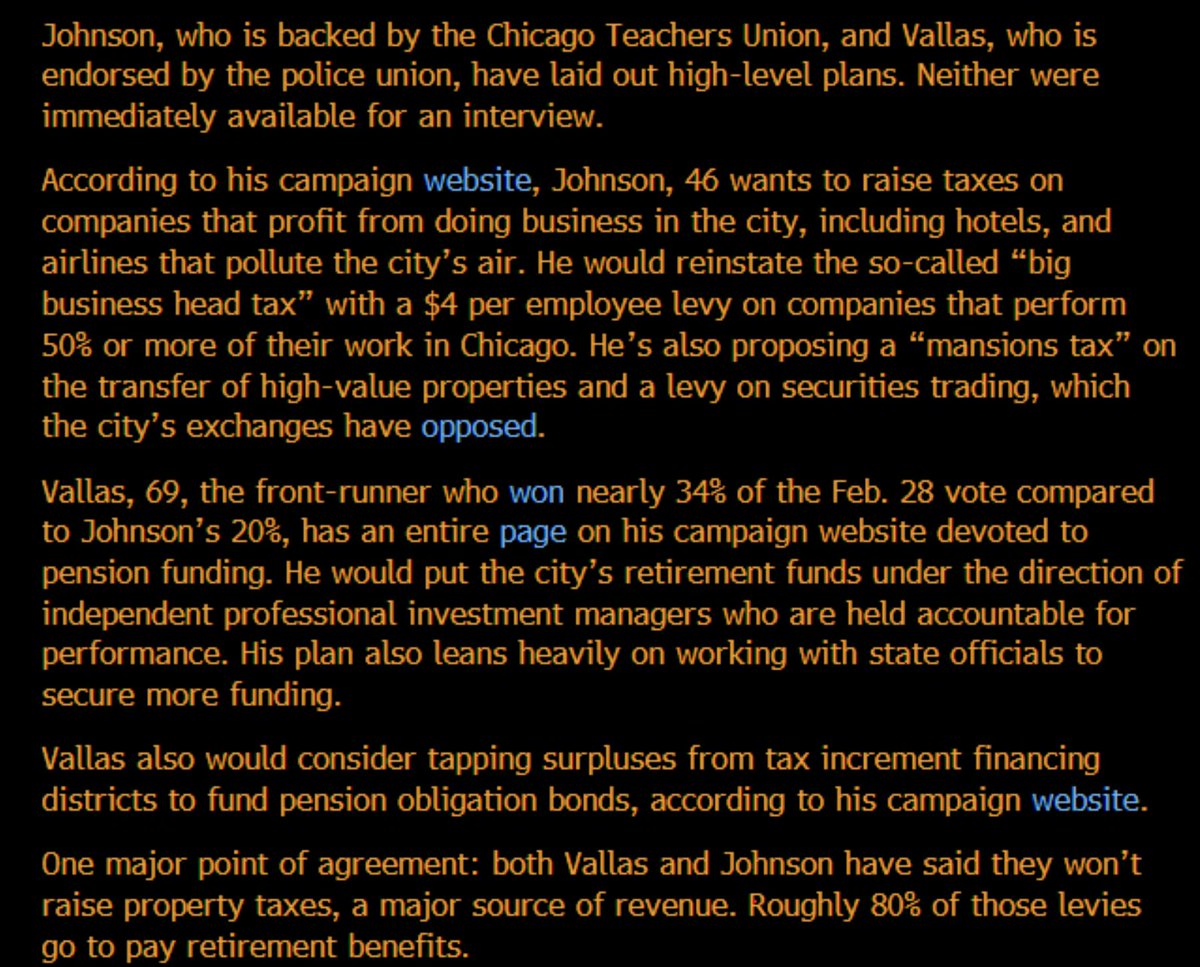

2/ Here's the summary of each candidate's plan. Johnson's tax ideas are indicative of zero understanding of how the economy works. Last time I checked, there's no wall around Chicago preventing anyone from leaving. Under Johson, we'll have higher tax rates and lower revenue.

3/ Like I've said many times, we already have some of the highest local taxes in the country. And our 9.5% corporate tax ranks #3. But I'm sure ramping taxes even more will make people and businesses flock to Chicago and everyone will soon be pockets deep in free money...

4/ Seriously, though, Johnson's tax ideas indicate he doesn't have a grip on reality. Chicago is in the bottom half of cities when it comes to economic growth. A robust 0.9% for 2022. You think higher taxes will improve that and bring in more revenue? kenaninstitute.unc.edu/american-growt…

5/ And our unemployment statistics are abysmal compared to the rest of the country. But I'm sure businesses will definitely invest more here and hire all the workers knowing that they will face higher taxes for doing so. Right?...

bls.gov/regions/midwes…

bls.gov/regions/midwes…

6/ Also, raising taxes on people making over $100k? Sorry, this isn't 1960 where that makes you in the financial elite. People in that tax bracket aren't exactly thriving at the moment. Ironically, higher taxes will hurt his CTU comrades as enrollment plummets as people move out.

7/ And this is great - straight from his plan. My guy, not a single non-resident will step foot in this city.

brandonforchicago.com/issues/city-bu…

brandonforchicago.com/issues/city-bu…

8/ Here are a few more summary details from his plans if interested...

https://twitter.com/StuLoren/status/1617767828052144128?s=20

9/ Anyways, the issue with Johnson and his far-left supporters - including our good friends in the democratic socialist community - is that they think taxes and revenue have a linear relationship. Ever hear of the Laffer Curve my man? en.wikipedia.org/wiki/Laffer_cu…

10/ Ok, back to Chicago's pension deficit. We're drowning in debt here - and it's constitutionally protected under state law - so no hope of reform. The only way out is to grow revenue by improving our economic performance. Johnson's plans would just make our finances much worse.

11/ Vallas seems to get that taxing our way out of this is impossible and we need to get our economy growing again (which also means we need to focus on public safety as that's a MAJOR impediment to business investment here).

https://twitter.com/StuLoren/status/1570261514556407808?s=20

12/ Our pension problems are so much worse than most appreciate. Want to know why city services are in such bad shape? Because a third of our revenue has to go to pension payments (and 80% of our property taxes). Again, we need to GROW revenue.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

13/ Here's a much more detailed discussion of our city and state pension woes if interested - which will likely deteriorate given the current economic and inflationary environment.

https://twitter.com/StuLoren/status/1600592511877226496?s=20

14/ I've been talking about this stuff consistently for almost two years now. Here's a good recap from last year.

https://twitter.com/StuLoren/status/1570096409059397632?s=20

15/ And here's my original commentary from 2021. Not much has changed. Johnson would make most of the trends I've discussed in the last two years worse, leaving our city finances and economy in shambles. And our pension problems exponentially worse off.

https://twitter.com/StuLoren/status/1455045477284687883?s=20

16/ But like his ideas sound cool and hip. Everything will be solved if we just "Tax the rich". Make non-residents pay. Stick it to "Big Corporations." Democratic socialism is a hell of a drug...

https://twitter.com/StuLoren/status/1481843816483143682?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh