ICT GEM💎

There are 6 Daily Index Templates👁️

Two Session Up Close

Two Session Down Close

AM Rally PM Reversal

AM Decline PM Reversal

Consolidation AM Rally PM decline

Consolidation AM Decline PM rally

Below you will find when to expect them + examples⬇️

🧵🧵

#TRADINGTIPS

There are 6 Daily Index Templates👁️

Two Session Up Close

Two Session Down Close

AM Rally PM Reversal

AM Decline PM Reversal

Consolidation AM Rally PM decline

Consolidation AM Decline PM rally

Below you will find when to expect them + examples⬇️

🧵🧵

#TRADINGTIPS

Two Session Up Close:

If we are in the middle of an intermediate or long term price swing based on what we would see on the HTF chart, this is the classic scenario

When we start approaching HTF opposing arrays, this profile is less likely to occur 🙅♂️

If we are in the middle of an intermediate or long term price swing based on what we would see on the HTF chart, this is the classic scenario

When we start approaching HTF opposing arrays, this profile is less likely to occur 🙅♂️

Two Session Down Close:

If we are in the middle of an intermediate or long term price swing based on what we would see on the HTF chart, this is the classic scenario.

When we start approaching HTF opposing arrays, this profile is less likely to occur 🙅♂️

If we are in the middle of an intermediate or long term price swing based on what we would see on the HTF chart, this is the classic scenario.

When we start approaching HTF opposing arrays, this profile is less likely to occur 🙅♂️

AM Rally PM Reversal:

Price is yet to fulfill a completion of a bullish run, but very close to where we are presently there is a higher time frame premium PD array 🧲

The session will start off bullish until it hits the HTF PD array which causes the intraday market reversal↗️↘️

Price is yet to fulfill a completion of a bullish run, but very close to where we are presently there is a higher time frame premium PD array 🧲

The session will start off bullish until it hits the HTF PD array which causes the intraday market reversal↗️↘️

AM Decline PM Reversal:

Price is yet to fulfill a completion of a bearish run, but very close to where we are presently there is a HTF premium PD array🧲

The session will start off bearish until it hits the HTF PD array which causes the intraday market reversal↘️↗️

Price is yet to fulfill a completion of a bearish run, but very close to where we are presently there is a HTF premium PD array🧲

The session will start off bearish until it hits the HTF PD array which causes the intraday market reversal↘️↗️

Consolidation AM Rally PM Decline:

If unsure of what the IOF of the current day is or where we are relative to Premium/Discount on Daily/4h, chances are we likely see this scenario

ESPECIALLY if there's no high/medium impact news expected during 10am or later in the day⛔️

If unsure of what the IOF of the current day is or where we are relative to Premium/Discount on Daily/4h, chances are we likely see this scenario

ESPECIALLY if there's no high/medium impact news expected during 10am or later in the day⛔️

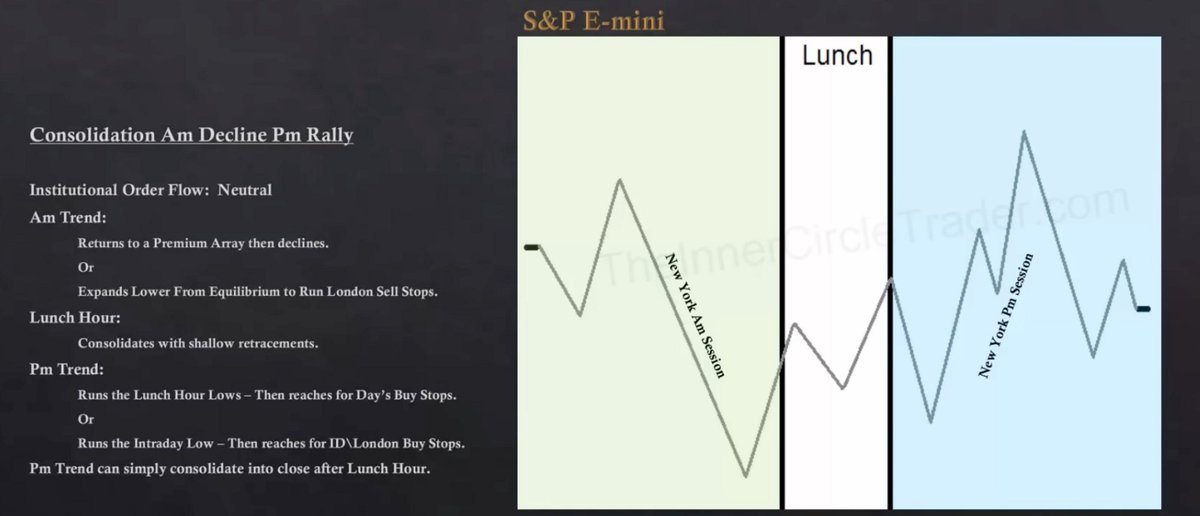

Consolidation AM Decline PM Rally:

If unsure of what the IOF of the current day is or where we are relative to Premium/Discount on Daily/4h, chances are we likely see this scenario

ESPECIALLY if there's no high/medium impact news expected during 10am or later in the day⛔️

If unsure of what the IOF of the current day is or where we are relative to Premium/Discount on Daily/4h, chances are we likely see this scenario

ESPECIALLY if there's no high/medium impact news expected during 10am or later in the day⛔️

EXTRA CONSOLIDATION TIPS💡:

How to know if the PM session will run lunch or Intraday highs?🤔

HTF PD array hit in AM session = Lunch highs likely to be ran

HTF PD array NOT hit in AM session= PM session could run the intraday high, hit the HTF Premium array, and then reverse

How to know if the PM session will run lunch or Intraday highs?🤔

HTF PD array hit in AM session = Lunch highs likely to be ran

HTF PD array NOT hit in AM session= PM session could run the intraday high, hit the HTF Premium array, and then reverse

(Slides from ICT Core Content Month 10 "Index Futures - Projected Range & Objectives"

If you found this helpful I would really appreciate a like and retweet thank you!💚🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh