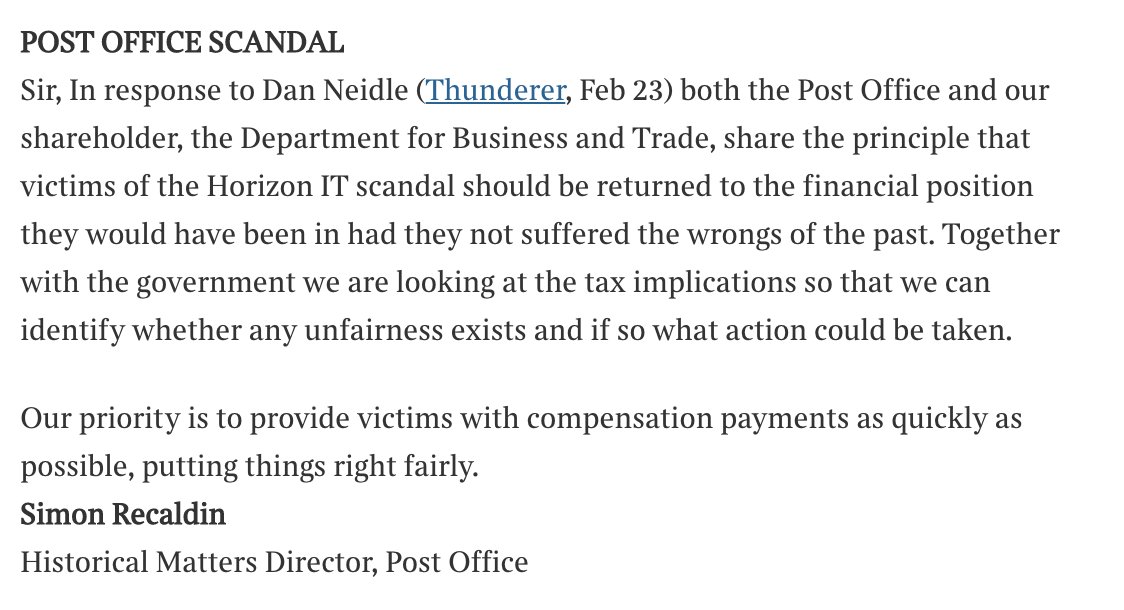

What have UK corporation tax rates and revenues been doing for the last fifty years? This:

#infographics #nerdery

#infographics #nerdery

And here's a full interactive version that lets you compare rates and revenues for any countries across the OECD: taxpolicy.org.uk/corp_tax_histo…

Comparing tax revenues as a % of GDP is imperfect, as clearly corporate profits are higher in some countries (eg Luxembourg) than others (eg Portugal). But unfortunately finding comparable data on corporate profits is hard.

So some caution is required when using the chart to… twitter.com/i/web/status/1…

So some caution is required when using the chart to… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh