A dive into EigenLayer

@eigenlayer is building a set of smart contracts on Ethereum that allows ETH stakers to opt into validating other applications or networks, extending Ethereum’s cryptoeconomic security

A thread on what it is and whether it warrants the recent hype👇

1/21

@eigenlayer is building a set of smart contracts on Ethereum that allows ETH stakers to opt into validating other applications or networks, extending Ethereum’s cryptoeconomic security

A thread on what it is and whether it warrants the recent hype👇

1/21

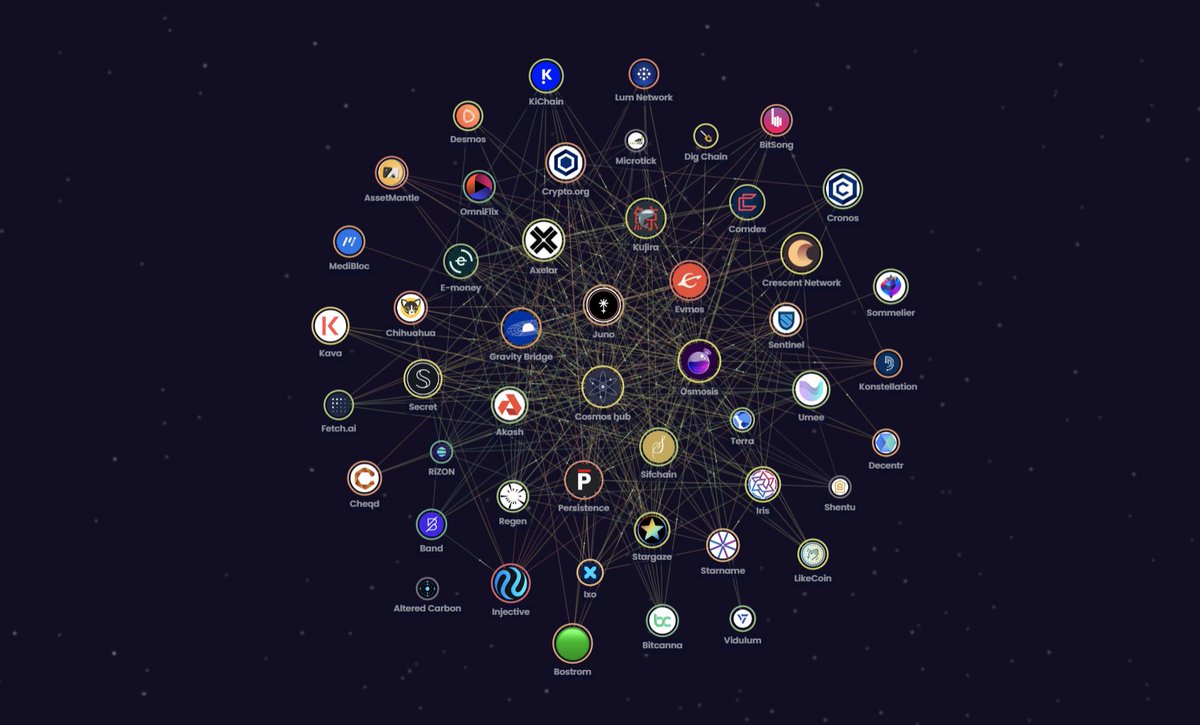

One way to think about EigenLayer is that it’s similar to Polkadot and Cosmos Interchain Security - extending the same validator set to secure standalone applications, or Actively Validated Services (AVS)

2/21

2/21

AVSs include other virtual machines, keeper networks, oracle networks, and bridges. Typically, these AVSs are secured by their own token, but with EigenLayer they’d be able to rely on Ethereum validators (a more trusted validator set)

3/21

3/21

EigenLayer has two main features

1) Pooled security via restaking - enables modules to be secured by restaked ETH rather than their own token. Modules provide additional revenue to ETH validators and can impose additional slashing conditions.

4/21

1) Pooled security via restaking - enables modules to be secured by restaked ETH rather than their own token. Modules provide additional revenue to ETH validators and can impose additional slashing conditions.

4/21

2) Free-market governance - open market mechanism where validators determine risk/reward trade-offs by opting in and out of modules built on EigenLayer.

5/21

5/21

EigenLayer will significantly increase the cost of corruption of modules. A 51% attack on a bridge, for example, will be significantly more expensive, while maintaining, or even improving its decentralization.

6/21

6/21

EigenLayer will allow several options for restaking (using staked ETH in EigenLayer)

1. Native restaking - validators point their withdrawal credentials to EigenLayer smart contracts, allowing for slashing

7/21

1. Native restaking - validators point their withdrawal credentials to EigenLayer smart contracts, allowing for slashing

7/21

2. LSD restaking - deposit Liquid Staking Derivatives (like Lido stETH) into EigenLayer smart contracts

3. ETH LP restaking - validators stake the LP token of an AMM pair which includes ETH

8/21

3. ETH LP restaking - validators stake the LP token of an AMM pair which includes ETH

8/21

4. LSD LP restaking - validators stake LP token of an AMM pair which includes an LSD ETH token (such as Curve’s stETH-ETH LP token)

9/21

9/21

Module developers will get to choose which tokens from the above they accept to secure their AVS

10/21

10/21

@eigenlayer allows for flexibility in the design of the AVS. For example, an AVS can have a dual staking model, where the quorum is achieved by both ETH restakers and $AVS stakers (native token of the AVS).

11/21

11/21

EigenLayer restakers will also be able to delegate their ETH or LSDs to other entities running EigenLayer operator nodes. The operators would be entitled to a portion of fees from both Ethereum and the modules they participate in with the delegated tokens.

12/21

12/21

This requires users to trust the operators they delegate to to perform their tasks diligently and not get slashed.

13/21

13/21

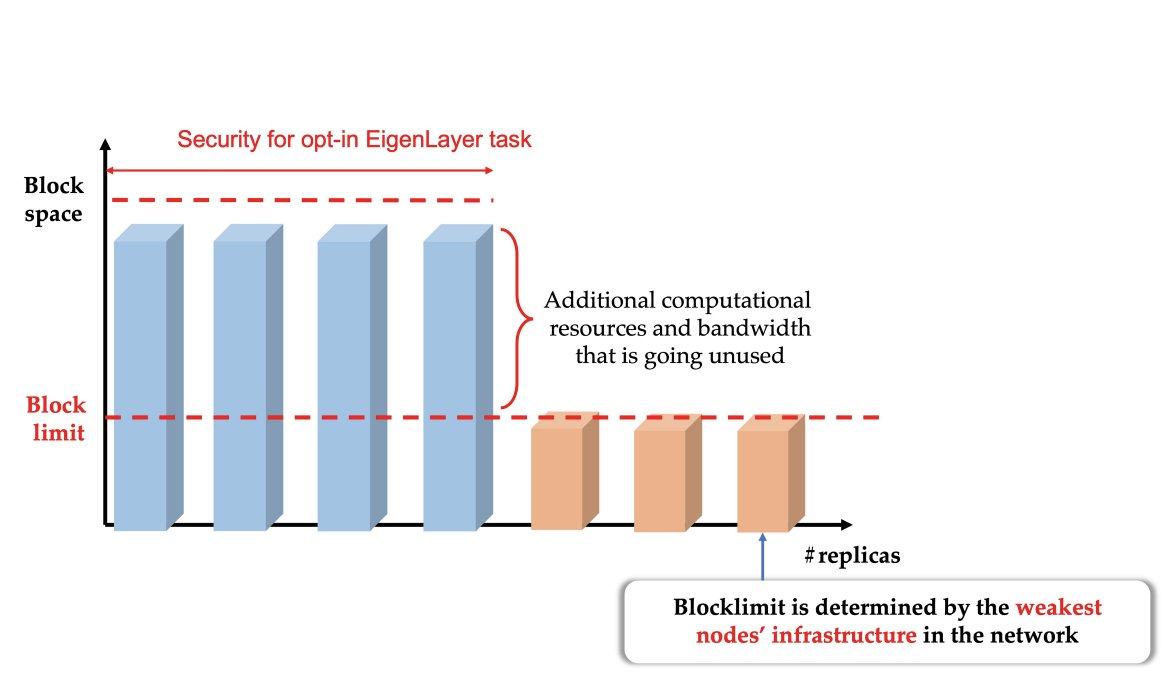

On a high level, EigenLayer allows for ETH validators to monetize the excess bandwidth that goes unused due to the block limit on Ethereum determined by the weakest nodes’ infrastructure (minimum determined by core developers).

14/21

14/21

EigenLayer is great infrastructure for applications like

- Hyperscale Data Availability Layer

- Decentralized sequencers

- Light-Node bridges

- Fast-mode bridges for rollups

- Oracles

- Opt-in Event-Driven Activation

15/21

- Hyperscale Data Availability Layer

- Decentralized sequencers

- Light-Node bridges

- Fast-mode bridges for rollups

- Oracles

- Opt-in Event-Driven Activation

15/21

- Opt-in MEV Management

- Settlement Chains with Ultra-Low Latency

- Single-Slot Finality

16/21

- Settlement Chains with Ultra-Low Latency

- Single-Slot Finality

16/21

EigenLayer can also act as a platform where competing ideas are tested before being integrated into Ethereum, allowing for rapid permissionless innovation while preserving the conservative governance of Ethereum

17/21

17/21

That being said, EigenLayer really is just a smart contract on Ethereum to which validators assign their withdrawal keys so that it can slash them for malicious activity on the AVSs they choose to validate for.

18/21

18/21

There have also been concerns about the security of EigenLayer. While the protocol will improve capital efficiency and allow for security extension, it will also allow malicious actors to multiply their potential number of attacks while keeping value at risk constant.

19/21

19/21

Effectively, one would be able to attack 20 networks at the same time and only be slashed for the full amount once.

20/21

20/21

Finally, many of the potential projects listed could still prefer to only have their own token that secures their network because it accrues value and allows the team to have a fat treasury instead of constantly paying Ethereum validators.

21/21

21/21

Follow these gigabrains that cover EigenLayer

@eigenlayer @sreeramkannan @siddsanyal @EigenlayrIntern @cjliu49 @apolynya @kachapah @dankrad @lemiscate @MaanavKhaitan @DeFi_Cheetah @CryptRillionair @bertran_yorro @DAdvisoor @Slappjakke @0xCrypto_doctor @cryptodetweiler

@eigenlayer @sreeramkannan @siddsanyal @EigenlayrIntern @cjliu49 @apolynya @kachapah @dankrad @lemiscate @MaanavKhaitan @DeFi_Cheetah @CryptRillionair @bertran_yorro @DAdvisoor @Slappjakke @0xCrypto_doctor @cryptodetweiler

• • •

Missing some Tweet in this thread? You can try to

force a refresh