As you may have heard recently, Credit Suisse is in trouble. Deep Trouble.

Question is, can they—*will they*—seize customer deposits to pay off creditors in a bankruptcy restructuring?

Time for a Bankruptcy 🧵👇

Question is, can they—*will they*—seize customer deposits to pay off creditors in a bankruptcy restructuring?

Time for a Bankruptcy 🧵👇

🤑 Bail-outs

If you’re in your 20’s or older, you likely remember the Great Financial Crisis

You know, that event in 2008 to 2010 that pushed major banks to the edge of catastrophic-level collapse because of poor—or non-existent—risk management policies?

If you’re in your 20’s or older, you likely remember the Great Financial Crisis

You know, that event in 2008 to 2010 that pushed major banks to the edge of catastrophic-level collapse because of poor—or non-existent—risk management policies?

As consequence for their gross negligence, most of these banks received the due punishment they deserved

The companies went bankrupt. The managers lost their bonuses, many were fired and many arrested, and they were all left to deal with a life of shame and poverty 🤡

Well, no.

The companies went bankrupt. The managers lost their bonuses, many were fired and many arrested, and they were all left to deal with a life of shame and poverty 🤡

Well, no.

If you remember correctly, none of that happened

The CEOs and managers received their fat bonuses. They kept their seats. They remain in power and are wealthy beyond imagination

How?

The CEOs and managers received their fat bonuses. They kept their seats. They remain in power and are wealthy beyond imagination

How?

Government led and government funded bail-outs

They screwed up. They lost money. They threatened to collapse the entire financial system with their sheer stupidity and arrogance

And they got bailed-out. With taxpayer-funded dollars.

They screwed up. They lost money. They threatened to collapse the entire financial system with their sheer stupidity and arrogance

And they got bailed-out. With taxpayer-funded dollars.

Actually, the Fed and Treasury printed money to do it, but we’re all paying for it, make no mistake

It’s just hidden from us through monetary manipulation and inflation

Items tucked nice and neatly away in a gnarled mess of Treasury and Fed balance sheet assets and liabilities.

It’s just hidden from us through monetary manipulation and inflation

Items tucked nice and neatly away in a gnarled mess of Treasury and Fed balance sheet assets and liabilities.

Flash forward to 2023, and we have a few messes creeping up again

UK pension funds over-levered with LDIs? On the verge of collapse?

The Bank of England bailed them out.

If you want to read about that, I wrote a newsletter all about it, here: jameslavish.substack.com/p/ldis-and-the…

UK pension funds over-levered with LDIs? On the verge of collapse?

The Bank of England bailed them out.

If you want to read about that, I wrote a newsletter all about it, here: jameslavish.substack.com/p/ldis-and-the…

Italy and Spain and Greece struggling with debt and in danger of systematic collapse of their banking systems?

The European Central Bank creates a manipulation called the Anti-Fragmentation Tool.

Wrote about that, too, you can find it here:

jameslavish.substack.com/p/-whats-an-an…

The European Central Bank creates a manipulation called the Anti-Fragmentation Tool.

Wrote about that, too, you can find it here:

jameslavish.substack.com/p/-whats-an-an…

TL;DR: Instead of austerity in those countries, the ECB buys their debt to prop them up, essentially handing Germany the mop and the bill

No consequences. For anyone, ever

Well, except for you and me.

No consequences. For anyone, ever

Well, except for you and me.

And soon, it could get even worse than the hidden money printing and government led bail-outs with the taxpayers footing the bill

You got it. This is where *bail-ins* come into play.

You got it. This is where *bail-ins* come into play.

🧐 Bail-Ins

In essence, a bail-in is when a bank’s creditors (yes, depositors, too) must forgive some of its debt to help save the bank from collapse

Is that even legal?

In essence, a bail-in is when a bank’s creditors (yes, depositors, too) must forgive some of its debt to help save the bank from collapse

Is that even legal?

Three hips and a hooray for the Dodd-Frank Wall Street Reform and Consumer Act of 2010 which makes bank bail-ins totally legal in the United States

In fact, the US has *declared* that the federal government will no longer inject taxpayer dollars to prevent big bank failure.

In fact, the US has *declared* that the federal government will no longer inject taxpayer dollars to prevent big bank failure.

Instead, banks have been granted the authority to use debt capital as equity to avoid insolvency

This includes: unsecured creditor capital, common and preferred equity shareholders, bondholders, and...depositors

Yay?

This includes: unsecured creditor capital, common and preferred equity shareholders, bondholders, and...depositors

Yay?

It means that the bank can use customer deposits to save its own risk-management deficient arse

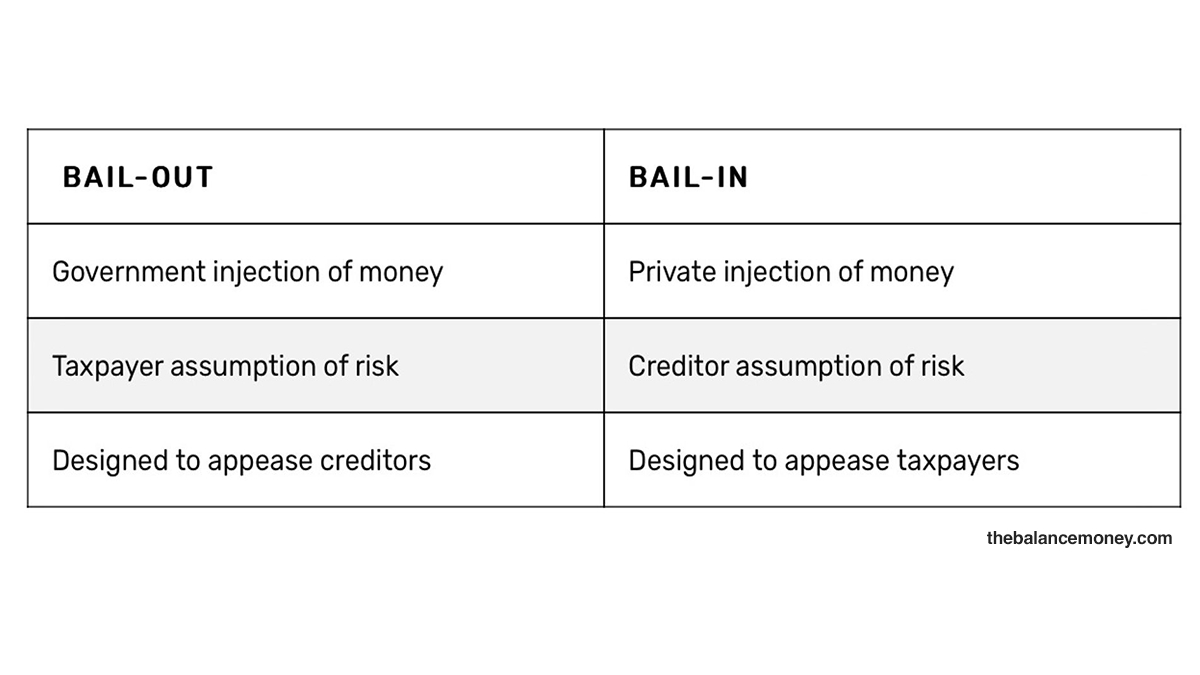

Here's the skinny on how bail-ins differ from bail-outs:

Here's the skinny on how bail-ins differ from bail-outs:

Wait, wait, wait, you say

That’s my money. They’re just holding it for me, but it is still mine

Well, not exactly.

That’s my money. They’re just holding it for me, but it is still mine

Well, not exactly.

In fact, when you deposit money in a bank—virtually any bank—you're in effect *loaning* the bank that money

And for the pleasure of allowing the bank to use your money any way they see fit, you receive interest on your deposit

A measly 0.5% annually, if you're lucky, today.

And for the pleasure of allowing the bank to use your money any way they see fit, you receive interest on your deposit

A measly 0.5% annually, if you're lucky, today.

The deposit becomes an asset on the books of the bank which is offset by a liability to you

Similar to if you bought a Certificate of Deposit (CD) or a Treasury bond (supposedly risk-less, but readers of 🧠The Informationist know better than that).

Similar to if you bought a Certificate of Deposit (CD) or a Treasury bond (supposedly risk-less, but readers of 🧠The Informationist know better than that).

But, you do have some protection. This protection comes in the form of FDIC insurance

In the United States, any deposits up to $250,000 are protected by the Federal Government. As long as the bank itself is federally insured.

In the United States, any deposits up to $250,000 are protected by the Federal Government. As long as the bank itself is federally insured.

So, if you have $300,000 in a savings account at Chase, $250,000 of that is insured and backstopped by the US Government. $50,000 of it is left unprotected

So, if you're someone who has $1 million on deposit, I'd consider spreading that around to be backstopped by FDIC insurance

So, if you're someone who has $1 million on deposit, I'd consider spreading that around to be backstopped by FDIC insurance

And yes, this includes your IRA

Sitting in cash during the current market uncertainty?

That’s right. If you're older or have been fortunate in saving for retirement, you need to know that only $250,000 of your cash equivalent or money market deposits are insured by FDIC.

Sitting in cash during the current market uncertainty?

That’s right. If you're older or have been fortunate in saving for retirement, you need to know that only $250,000 of your cash equivalent or money market deposits are insured by FDIC.

If your IRA custodian bank goes under, you may lose any or all of that cash above $250,000

Now you may be saying, OK, this all sounds like hypothetical conjecture. Question is, does this actually ever happen? If so, when and where?

I thought you’d never ask.

Now you may be saying, OK, this all sounds like hypothetical conjecture. Question is, does this actually ever happen? If so, when and where?

I thought you’d never ask.

☠️ History of Bail-Ins

Back to the Great Financial Crisis and its aftermath

A few years after the wipeout of massive financial institutions and its ongoing fallout, regions of Europe were still reeling.

Back to the Great Financial Crisis and its aftermath

A few years after the wipeout of massive financial institutions and its ongoing fallout, regions of Europe were still reeling.

One region in particular was Greece + neighboring island, Cyprus

In 2013, a concoction of events hit Cyprus banks like a financial tsunami:

Exposure to over-levered property co's, Greek debt crisis contagion, and Cyprus Treasuries downgraded to junk status by ratings agencies.

In 2013, a concoction of events hit Cyprus banks like a financial tsunami:

Exposure to over-levered property co's, Greek debt crisis contagion, and Cyprus Treasuries downgraded to junk status by ratings agencies.

The ongoing reluctance of the Cyprus government to restructure its banking sector led them to imminent collapse

Enter the ECB

Oh joy.

Enter the ECB

Oh joy.

In a €10 billion bail-out plan led by the European Commission, the ECB, and the International Monetary Fund (IMF), Cyprus agreed to close the country's second-largest bank, the Cyprus Popular Bank

A bail-out, you say...sounds familiar.

A bail-out, you say...sounds familiar.

Not exactly though, because the plan included an agreement for the bank to seize ~48% of all uninsured deposits: i.e., any deposit over €100,000

In return, they gave depositors shares of equity in the bank

Essentially worthless equity, of course

Yeah, thanks for nothing.

In return, they gave depositors shares of equity in the bank

Essentially worthless equity, of course

Yeah, thanks for nothing.

And the EU leaders loved it

So, in 2013, the EU introduced resolutions to make the bail-in a common principle, announcing it had transferred the responsibility of a failing banking system from taxpayers to unsecured creditors and bondholders, just like Dodd-Frank did in the US.

So, in 2013, the EU introduced resolutions to make the bail-in a common principle, announcing it had transferred the responsibility of a failing banking system from taxpayers to unsecured creditors and bondholders, just like Dodd-Frank did in the US.

So, though it is a short history, it’s an important one

Because the groundwork has been laid for, once again, the banks to avoid responsibility and just lay it off on you

Their creditor

On that, and on to Credit Suisse...

Because the groundwork has been laid for, once again, the banks to avoid responsibility and just lay it off on you

Their creditor

On that, and on to Credit Suisse...

😱 Credit Suisse and Can This Happen to You?

First, let’s check on the health of the Swiss bank—scratch that, let’s check for a pulse.

Because Credit Suisse just got hit by a run-on-the-bank bus

First, let’s check on the health of the Swiss bank—scratch that, let’s check for a pulse.

Because Credit Suisse just got hit by a run-on-the-bank bus

Whoa. Clients pulled 111 billion Swiss francs out of the bank in the last three months

And as we know, lower deposits = lower revenues = losses instead of earnings

To wit, Credit Suisse reported a loss of US$1.3 billion for the last quarter of 2022.

And as we know, lower deposits = lower revenues = losses instead of earnings

To wit, Credit Suisse reported a loss of US$1.3 billion for the last quarter of 2022.

Roughly translated: Credit Suisse is in deep 💩

And if it continues like this, they will go belly up

Bankrupt.

And if it continues like this, they will go belly up

Bankrupt.

But because the EU and ECB have declared no more bail-outs, guess who’s left holding the bill?

That’s right grasshopper,

In the event you still have deposits with Credit Suisse, I suggest you consider alternative banks

And I suggest you expedite the process.

That’s right grasshopper,

In the event you still have deposits with Credit Suisse, I suggest you consider alternative banks

And I suggest you expedite the process.

So, whether you live in the United States or Europe, I strongly encourage you to research and know your region and its rules

After all, these things seem to change with every crisis and set of politicians

Bail-in laws and federal deposit insurance is different for every country

After all, these things seem to change with every crisis and set of politicians

Bail-in laws and federal deposit insurance is different for every country

And then there’s the whole question about the FDIC being insolvent itself, and can they even bail out any bank at this point?

But that’s a whole newsletter in and of itself

One I can see in 🧠The Informationist’s near future. 😉

But that’s a whole newsletter in and of itself

One I can see in 🧠The Informationist’s near future. 😉

This thread is a summary of a recent Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

So, it seems $CS Credit Suisse was just the start.

Careful out there, kiddies.

Careful out there, kiddies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh