There were 10.8 million job openings at the end of January, down slightly from an upwardly-revised 11.2 million in December.

Layoffs up slightly. Quits down slightly. All consistent with a gradually cooling (but still hot) labor market. #JOLTS

bls.gov/news.release/j…

Layoffs up slightly. Quits down slightly. All consistent with a gradually cooling (but still hot) labor market. #JOLTS

bls.gov/news.release/j…

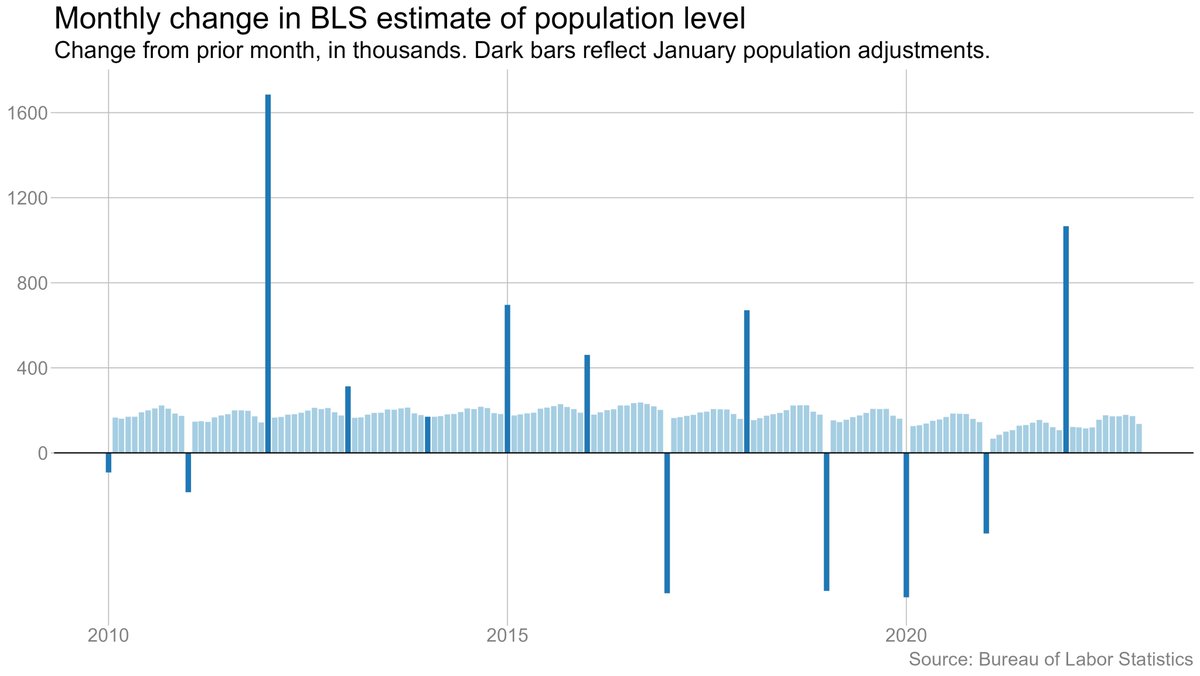

The exception, of course, is hiring -- way up in January, to 6.1 million from 4.6 million in December. (Remember, these are gross figures, not net like in the monthly jobs report.) Consistent with the big gain we we saw in the jobs report last month.

Job openings *are* trending down. It's just a very slow process, and not a smooth one. Openings are still far above any prepandemic level.

There are still close to twice as many job openings as unemployed workers. Hard to say anything about the trend on this one -- maybe it's easing a bit, but if so only very gradually.

Quits fell by more than 200,000 in January, the biggest one-month decline since May. It had looked for a bit like the decline in quits might have stalled out, but this suggests it's continuing.

The comparison between quits and openings continues to be interesting. Both remain elevated, but openings much more so -- quits are starting to return to something more in line with historical norms.

Layoffs rose in January. They're still low by historical standards, but the pickup is starting to look a bit more real.

@melbournecoal and I wrote about the low level of layoffs last month:

nytimes.com/2023/02/26/bus…

@melbournecoal and I wrote about the low level of layoffs last month:

nytimes.com/2023/02/26/bus…

Gross hiring picked up in January, consistent with what we saw in the jobs report. But I wouldn't read too much into the monthly ups and downs -- the bigger picture there still seems to be one of gradual cooling.

• • •

Missing some Tweet in this thread? You can try to

force a refresh