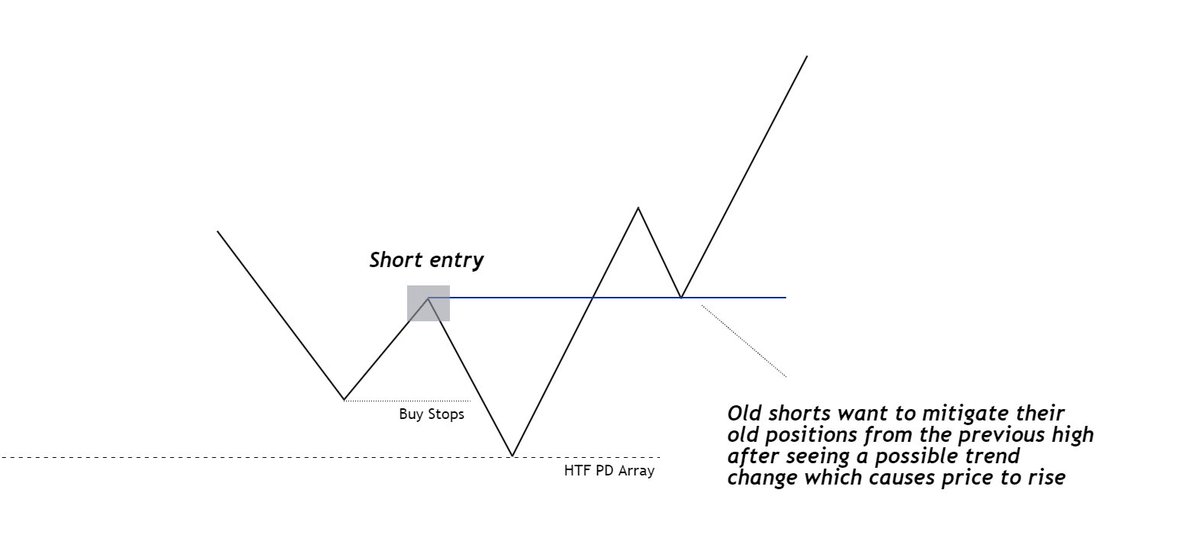

I suggest printing these out and putting them on your desk or something. It’s nice to see them side by side with the framework you are looking for live time

forgot to mention i do have a discord where you can ask me questions about these models discord.gg/sBkCXpwm

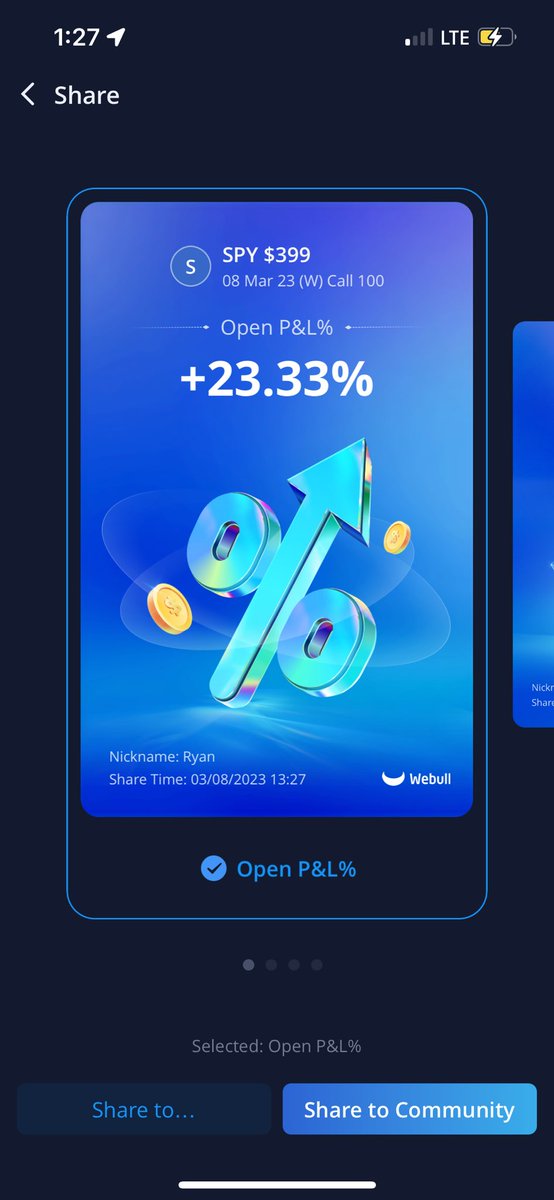

I do have a patreon as well where I live trade everyday in discord but the basic tier is closed for a few months, DM me if interested about the advanced tier

• • •

Missing some Tweet in this thread? You can try to

force a refresh