Tech company @mifielfirma has initiated the issuance of more than $200M in digitized promissory notes on the #LiquidNetwork to facilitate debt financing between Mexican lenders and global investment banks.

blog.liquid.net/mifiel-initiat…

blog.liquid.net/mifiel-initiat…

Over 2,000 promissory notes have already been issued worth an average of $23,000 for more than $43M, with potentially more worth billions over the next few years.

Promissory notes are considered high-value financial assets in emerging economies like Mexico due to their strong legal protections. Because of this benefit, most of the credit issued by non-banks in Mexico (B2B and B2C) is in the form of promissory notes.

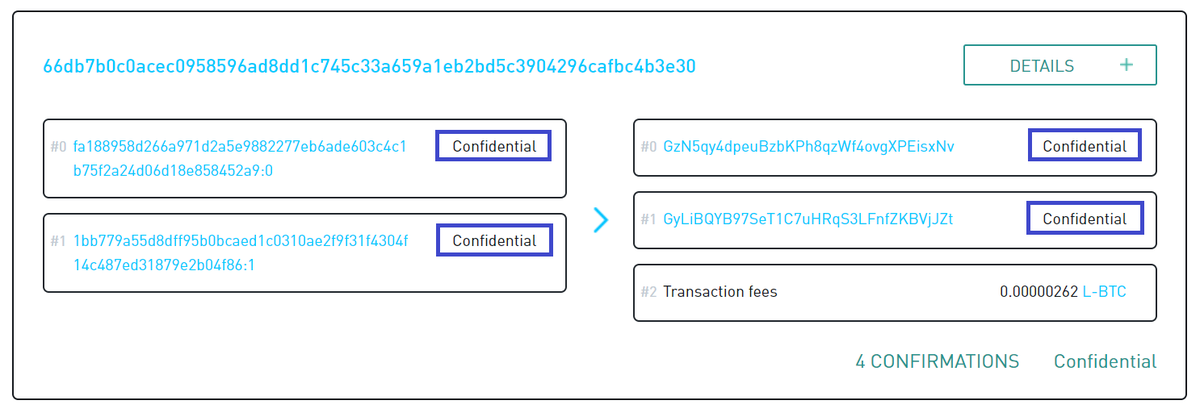

Historically, digitizing promissory notes has been challenging because there is no fail-safe way to guarantee that only one copy of the note is being endorsed and not rehypothecated. Liquid solves this problem by verifying each note and its ownership on the blockchain.

Issuing the promissory note on Liquid removes intermediaries (highlighted in blue), and each note no longer needs to be physically sent one by one from FI to DC, providing significant savings in cost and time.

As more promissory notes and other financial products become digitized, issuing on Liquid provides a compliant and secure way for homegrown financial institutions to diversify and access international lending markets with greater flexibility and freedom of use.

“After building on a ColoredCoins protocol, we decided to migrate to a more suitable solution. We evaluated most public blockchains and concluded that Liquid offered the best balance between security, decentralization, regulatory risks and transaction costs,” - @mifielfirma

You can learn more about @mifielfirma and its plans for issuing on Liquid by connecting with them on #BuildOnL2. The Capital Markets page is an excellent resource for those interested in discussing financial products and markets.

community.liquid.net/c/capital-mark…

community.liquid.net/c/capital-mark…

• • •

Missing some Tweet in this thread? You can try to

force a refresh