Most people don't realize how crucial Silicon Valley Bank is.

Billions of dollars in venture debt. Untold amounts of warrants and convertible notes in early-stage firms.

If SVB fails, this could be the Lehman moment for the startup world.

Billions of dollars in venture debt. Untold amounts of warrants and convertible notes in early-stage firms.

If SVB fails, this could be the Lehman moment for the startup world.

Bank run on SVB might be kicking off.

The one thing you DON'T DO as a bank CEO is telling everyone,

"We'll be fine, just don't pull out your money"

The one thing you DON'T DO as a bank CEO is telling everyone,

"We'll be fine, just don't pull out your money"

I've worked with SVB through my job. they fund a huge amount of startups in the United States- and have their tentacles in basically every large VC and PE fund out there.

Most of you have never heard of them, but in the startup world, they are huge.

Most of you have never heard of them, but in the startup world, they are huge.

The real risk is SVB is essentially a commercial bank- thousands of startups hold cash reserves at Silicon Valley Bank.

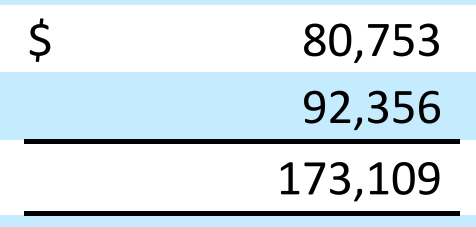

Looks like $173B as of last December.

Looks like $173B as of last December.

Gonna dig through their financials some more- feel free to join in:

d18rn0p25nwr6d.cloudfront.net/CIK-0000719739…

d18rn0p25nwr6d.cloudfront.net/CIK-0000719739…

Provisions for Credit losses in 2022 were 3x as high as prior years. Management was getting worried.

looks like mostly fixed income- they were holding a ton of Treasury and MBS paper going into 2022

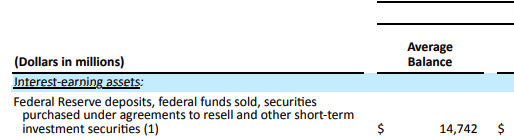

they held $14B in Fed deposits and government debt as of YE 2022... Losing $1.8-$1.9B is a huge chunk of that

average yield achieved on these securities was 1.44%- likely they acquired most before or during covid when rates were extremely low

They have 2.3B in cash while total liabilities are 195B and customer deposits are 173B... putting reserve ratio at 0.01329479769

wow they have $13B of cash and cash equivalents, but as we can see on page 49 the only actual interest-bearing cash they have at the Fed and other commercial banks is 2.3B.

Like most banks, they call Treasury securities "cash equivalents"

Like most banks, they call Treasury securities "cash equivalents"

looks like even though provisions for credit losses increased dramatically they still INCREASED net loans in 2022 from $65B to $73B

looks like this was likely due to greed. they made more in interest income in 2022 due to higher rates they were charging on venture debt

Statement of cash flows shows despite the bond market bloodbath in 2022 they continued investing MORE into AFS and HTM securities

for reference, AFS means Available for Sale and HTM is Held to Maturity...

these are all debt instruments, they appear to differentiate them based on what their intent is. Likely the Treasuries were held to maturity and mortgage backed securities, ABS, CMBS, and other types of… twitter.com/i/web/status/1…

these are all debt instruments, they appear to differentiate them based on what their intent is. Likely the Treasuries were held to maturity and mortgage backed securities, ABS, CMBS, and other types of… twitter.com/i/web/status/1…

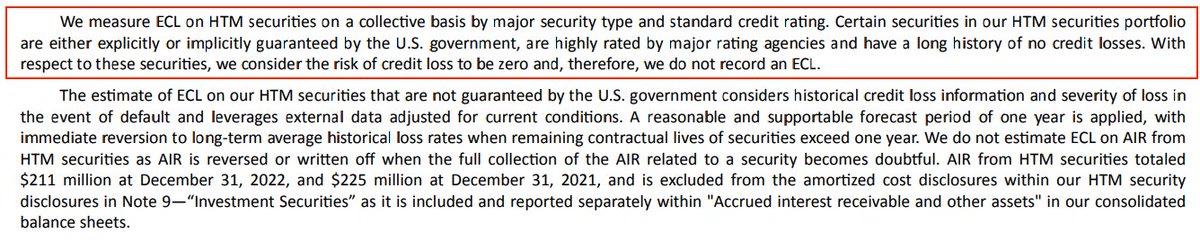

WAIT THEY ASSUME THE CREDIT RISK FOR SOME OF THEIR HTM SECURITIES TO BE 0??

so all the MBS they bought they had no risk management or buffers in case this lost value? Are you fucking kidding me?

so all the MBS they bought they had no risk management or buffers in case this lost value? Are you fucking kidding me?

they are deep in MBS and CMBS across the spectrum. they even hold variable-rate collateralized mortgage obligations

fucking hell- they barely even invest in startups. looks like only $605M in private equity from startups and $14B in Agency issued CMBS

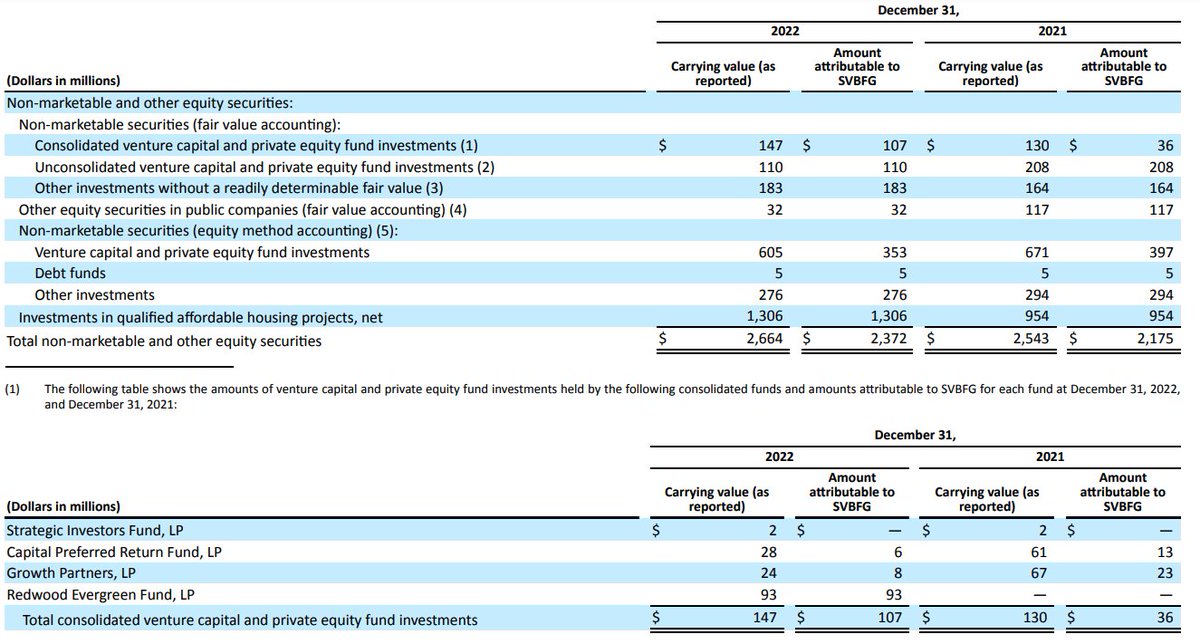

jesus. they hold $117.39 Billion in MBS, CMBS, Treasuries, ABS, CMO, Corporate bonds, Muni Bonds- and only $2.664B in equity valued securities (actual shares in startups, this is very illiquid)....

they're essentially plowing everything they have into debt instruments.

they're essentially plowing everything they have into debt instruments.

only 0.02219001449 , or 2% of all investment assets is in startups

$57 BILLION in residential MBS

more info: rb.gy/najpow

here's their breakdown of private equity investments, compared to their MBS portfolio they barely do any.

i'll have to leave it here. gotta run to dinner with a friend. Feel free to dig more on your own: d18rn0p25nwr6d.cloudfront.net/CIK-0000719739…

• • •

Missing some Tweet in this thread? You can try to

force a refresh