One of the largest banks in the US completely shut down in the last 36 hours.

Here's what went wrong at Silicon Valley Bank and why it affects your money: 🧵

Here's what went wrong at Silicon Valley Bank and why it affects your money: 🧵

SVB isn't an ordinary bank – It was the go-to bank for Venture Capital and tech.

It became the "Startups bank".

From the beginning, they made concentrated bets. This is important to know...

It became the "Startups bank".

From the beginning, they made concentrated bets. This is important to know...

This worked out really well for them in the last decade.

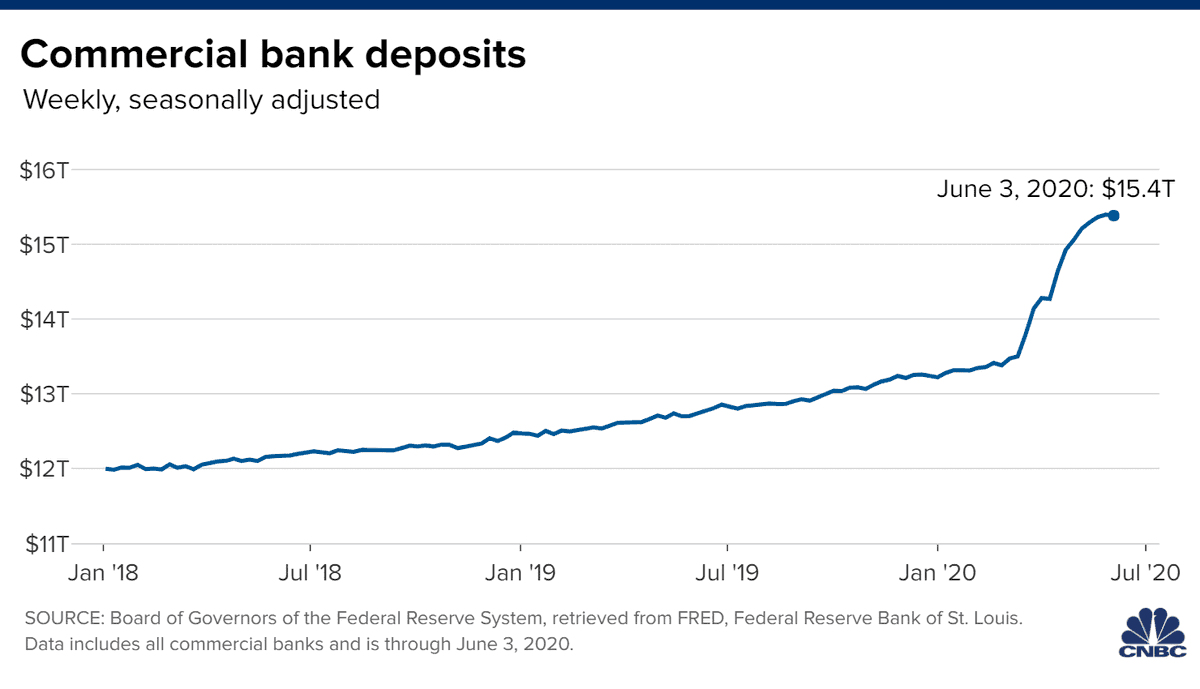

Especially in 2020 when the stimulus and rate cuts pumped cash into the banking system.

Especially in 2020 when the stimulus and rate cuts pumped cash into the banking system.

But that's where things went wrong.

Banks run on what is called a Fractional Reserve system. They hold a small portion of their deposits (>10%) for withdrawals and invest the rest.

This usually isn't a problem – because not everyone asks for their money back at the same time.

Banks run on what is called a Fractional Reserve system. They hold a small portion of their deposits (>10%) for withdrawals and invest the rest.

This usually isn't a problem – because not everyone asks for their money back at the same time.

On top of this, banks don't make risky investments with the bulk of their money.

Most of SVB's money was in safe assets like US Treasuries.

But even the safest bets become risky if you put all your eggs in one basket.

Most of SVB's money was in safe assets like US Treasuries.

But even the safest bets become risky if you put all your eggs in one basket.

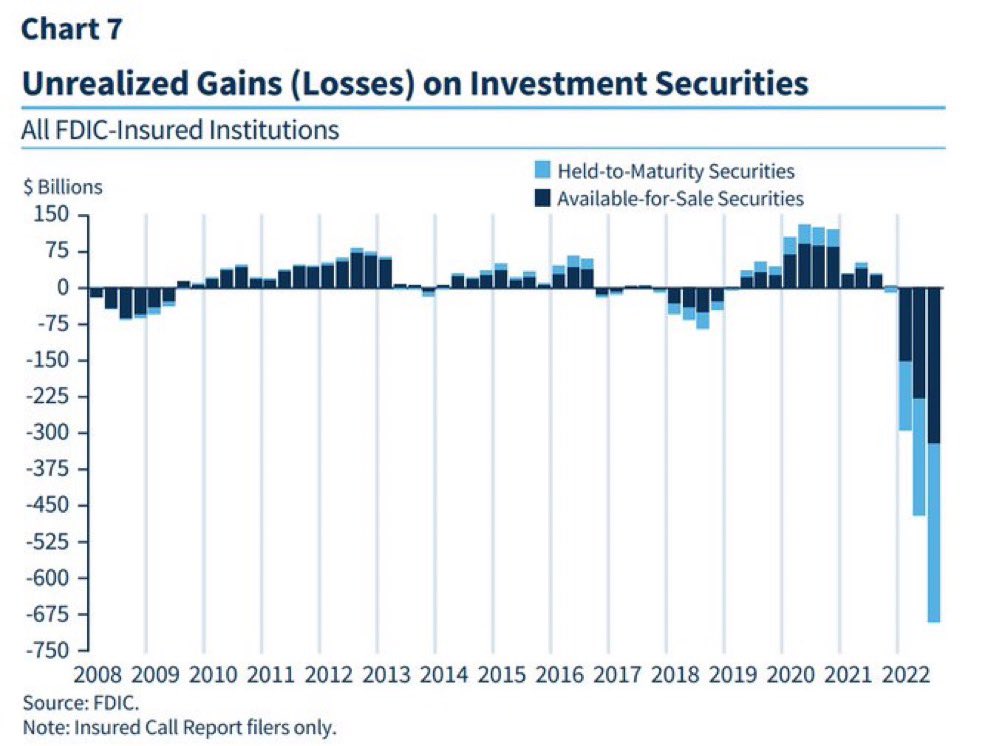

When the Fed started hiking rates last year, SVB made a risky bet – that the Fed's pace would be slower.

They invested $100 Billion into government backed bonds and locked it away for 3-4 years at an interest rate of 1.79%.

But the rate hikes accelerated fast.

They invested $100 Billion into government backed bonds and locked it away for 3-4 years at an interest rate of 1.79%.

But the rate hikes accelerated fast.

If SVB put $100 in bonds at 2% yield, they'd be paid back $108 in 4 years.

If rates suddenly hiked to 7%, they could make $131 instead.

But the bonds they hold would now be worth only $77 – and if they can't afford to wait it out, they'll have to sell at a loss for liquidity.

If rates suddenly hiked to 7%, they could make $131 instead.

But the bonds they hold would now be worth only $77 – and if they can't afford to wait it out, they'll have to sell at a loss for liquidity.

They could have handled a loss like this if they were diversified.

But SVB's clients were mostly startups, which were seeing less funding and withdrawing more money to pay for expenses.

SVB needed money to fund withdrawals but had to take a loss on bonds to do this.

But SVB's clients were mostly startups, which were seeing less funding and withdrawing more money to pay for expenses.

SVB needed money to fund withdrawals but had to take a loss on bonds to do this.

On March 8, the company announced they would sell a third of ownership to raise $2.25 Billion.

They did this because they were forced to take a loss of $1.5B on their bond positions – and needed enough money to process withdrawals.

They did this because they were forced to take a loss of $1.5B on their bond positions – and needed enough money to process withdrawals.

But the next day, the stock dropped by 60% when word got out that the bank was facing insolvency issues.

The CEO called clients to assure them their money was safe.

But on Mar 10, they announced that SVB had failed to raise capital.

The CEO called clients to assure them their money was safe.

But on Mar 10, they announced that SVB had failed to raise capital.

They were looking for someone to take over SVB, but it was too late – the govt stepped in and the FDIC seized the bank.

They assured that all accounts were insured and depositors would have access to their funds by Monday morning.

They assured that all accounts were insured and depositors would have access to their funds by Monday morning.

But there's a problem. FDIC insurance covers only up to $250k.

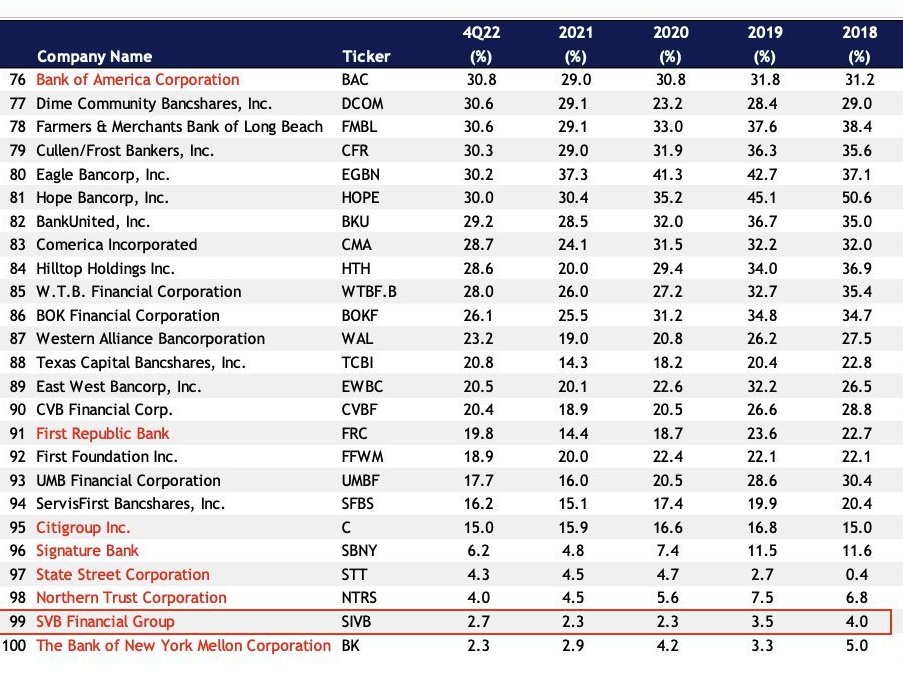

97.3% of accounts at SVB are bigger than that, because these are business accounts.

Though the companies might get some of their money back when assets are sold, it might take YEARS.

97.3% of accounts at SVB are bigger than that, because these are business accounts.

Though the companies might get some of their money back when assets are sold, it might take YEARS.

That's an emergency – because that money is needed for payroll, expenses, and just keeping companies running.

Companies that saved up cash diligently to prepare for a recession could now just die because they couldn't access their money.

Companies that saved up cash diligently to prepare for a recession could now just die because they couldn't access their money.

SVB holds $342 Billion in client funds. For all those companies, this is a crippling blow for no fault of theirs.

A startup will probably not lose all its money, but without access to working capital, can it stay afloat?

A startup will probably not lose all its money, but without access to working capital, can it stay afloat?

Two main problems led to this.

First, it's shocking that the 18th largest bank in America had this level of concentration and took bets on what the Fed would do.

No bank should be allowed to take this level of risk.

First, it's shocking that the 18th largest bank in America had this level of concentration and took bets on what the Fed would do.

No bank should be allowed to take this level of risk.

Second, an FDIC insurance of $250k makes no sense for businesses.

Businesses and individuals are not the same. A business has way higher working expenses.

If businesses fail, they affect 1000s. Their FDIC limit should be higher. Maybe a % of their deposit, not a number.

Businesses and individuals are not the same. A business has way higher working expenses.

If businesses fail, they affect 1000s. Their FDIC limit should be higher. Maybe a % of their deposit, not a number.

Could this happen to your bank?

What should you do with your money?

Will this damage the economy?

There is no reason to panic yet. But this is a situation that's continuously unfolding, and I'm on top of it.

What should you do with your money?

Will this damage the economy?

There is no reason to panic yet. But this is a situation that's continuously unfolding, and I'm on top of it.

For a detailed dive into the full story, with actionable tips on how you can protect your money, check the full post on my newsletter.

I will cover the situation as it keeps developing, so make sure to subscribe:

grahamstephan.substack.com/p/fall-of-a-gi…

I will cover the situation as it keeps developing, so make sure to subscribe:

grahamstephan.substack.com/p/fall-of-a-gi…

Everyone needs to know about this crisis and prepare for it. Like and retweet the first tweet to help out more people.

Follow @GrahamStephan for continuous updates on the situation.

Follow @GrahamStephan for continuous updates on the situation.

https://twitter.com/GrahamStephan/status/1634576301611687936

• • •

Missing some Tweet in this thread? You can try to

force a refresh