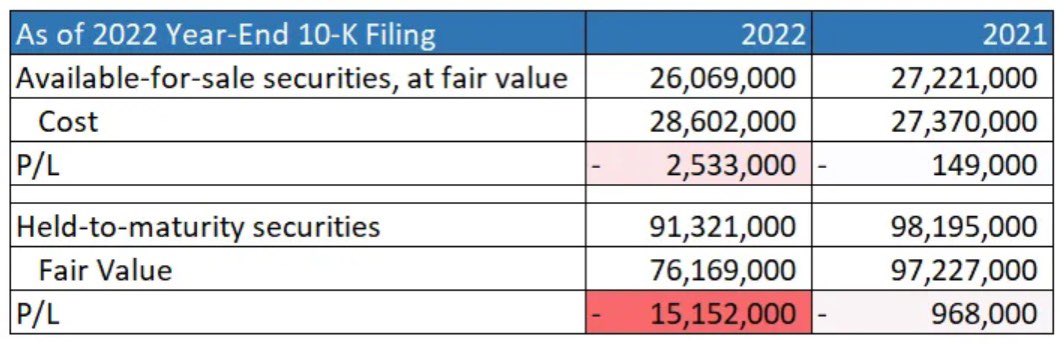

Silicon Valley Bank took a $1.8B loss on its available-for-sale (AFS) bond portfolio.

But it’s the held-to-maturity (HTM) bond portfolio that is the real problem.

Short 🧵

But it’s the held-to-maturity (HTM) bond portfolio that is the real problem.

Short 🧵

Wednesday afternoon, SVB announced that they had sold $21B of their Available For Sale (AFS) securities at a $1.8bn loss, and were raising $2.25bn in equity and debt.

This came as a surprise to investors, who were under the impression that SVB had enough liquidity to avoid selling their AFS portfolio.

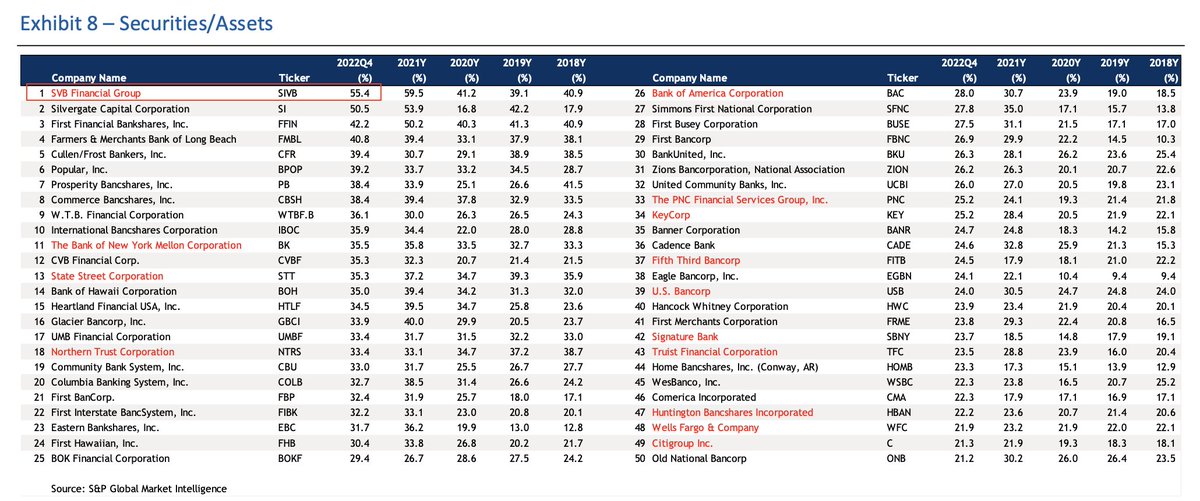

When you get a massive "bank run" you have to sell off AFS. Then when you're worked through that cushion (and the cushion was $28B) you have to sell off HTM.

As soon as the perception hit that they had to sell off AFS, bank run happens, AFS gets sold off, and then HTM gets fire-sold next.

And that’s why they couldn’t raise the equity.

Bank runs hammer asset/liability mismatch.

Bank runs hammer asset/liability mismatch.

Why doesn’t another bank want to buy them? Because it would be dangerous to assume the deposits would stay. Further exasperating the asset/liability mismatch.

It’s toxic.

It’s toxic.

Should the government take it over?

Bill Ackman thinks so.

And maybe they should given the crisis we are now in.

Bill Ackman thinks so.

And maybe they should given the crisis we are now in.

• • •

Missing some Tweet in this thread? You can try to

force a refresh