Anyone claiming the "market is rigged" or blames "naked shorts," "synthetics" or "counterfeit shares" genuinely has no clue what they're talking about.

At no time in history has the stock market ever been freer and fairer to retail investors.

1/13

At no time in history has the stock market ever been freer and fairer to retail investors.

1/13

Thanks to competition & PFOF, virtually all online brokerages have done away with commission fees (sans options contracts) and minimum deposit requirements. Anyone has the opportunity to put any amount of money to work on Wall Street.

2/13

2/13

"But PFOF is hurting retail"

No it's not. Instead of giving up $10-$20 on a round-trip trade, you're potentially losing fractions of a cent. You don't have to be a math genius to realize saving $10 or $20 is greater than a fraction of a penny.

3/13

No it's not. Instead of giving up $10-$20 on a round-trip trade, you're potentially losing fractions of a cent. You don't have to be a math genius to realize saving $10 or $20 is greater than a fraction of a penny.

3/13

Decades ago, fractional-share purchases weren't a thing. If you wanted to buy a share of a stock trading at $1,000, you needed to save a lot. Now you can buy fractions of shares with select brokerages at minimal/no cost.

4/13

4/13

30 years ago you received one annual report packet from the company's you invested in. Today, you can access 10Qs, 8-Ks, 10-Ks, management commentary, fundamental metrics/ratios, all SEC filings, and so on, at the click of a button.

5/13

5/13

To add, you also have instant access to the financial regulations and framework that govern online brokers, market makers, & any entity involved the securities business. There's no excuse to make asinine claims about market structure when it's free & publicly available.

6/13

6/13

The market isn't "rigged" or "controlled" by short-sellers. In fact, short interest remains historically low as the factual data shows.

7/13

7/13

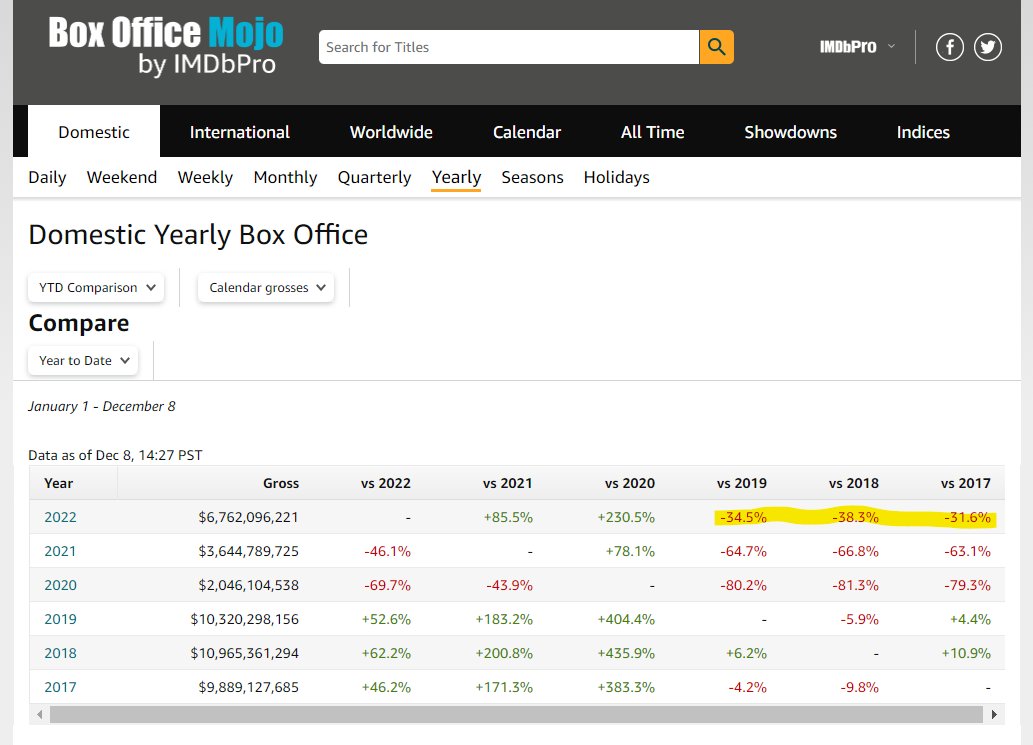

A fantasy "rigged market" & nonexistent "naked shorts" didn't cause $AMC/ $APE to lose money for 14 consecutive Qs. It didn't cause box office gross to fall by 28% & 43% to 2019 & 2018. It didn't cause AMC to take on a mountain of debt pre-COVID that it now can't repay.

8/13

8/13

A fantasy "rigged market" & nonexistent "naked shorts" didn't cause $BBBY to lose $1.116B over the past 9 months. It didn't force management to waste $12B+ on share buybacks. It didn't cause the company to default on bonds or become structurally insolvent.

9/13

9/13

A fantasy "rigged market" & nonexistent "naked shorts" didn't cause $MMTLP FOMOers to pile into a security that MMAT loftily valued at $70M (i.e., < $0.50/sh). It didn't force them to hold a security that filings clearly stated would transfer rights on 12/8 & stop trading.

10/13

10/13

A fantasy "rigged market" & nonexistent "naked shorts" didn't cause con artist $GNS CEO @rogerhamilton to grossly overpay for multiple acquisitions using his IPO cash raise, or to nearly 3X the company's loss through 9 months of 2022 (while missing issued EBITDA guidance)

11/13

11/13

A fantasy "rigged market" & nonexistent "naked shorts" didn't cause the 2-employee, no revenue, shell company $GTII to balloon its outstanding share count, lose $238M since its inception, or receive an ongoing concern warning from its auditors.

12/13

12/13

Anyone making the childish excuse of a "rigged market" or blaming "naked shorts" clearly:

- Doesn't understand market structure

- Hasn't done the real homework on the company's they own

- Is incapable of taking responsibility for their own actions. #FactsMatter

13/13

- Doesn't understand market structure

- Hasn't done the real homework on the company's they own

- Is incapable of taking responsibility for their own actions. #FactsMatter

13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh