Knowing how to analyze a balance sheet is a must to make good investment decisions.

You want to invest in companies that are in good financial health.

Here's everything you need to know:

You want to invest in companies that are in good financial health.

Here's everything you need to know:

1️⃣ What is a balance sheet?

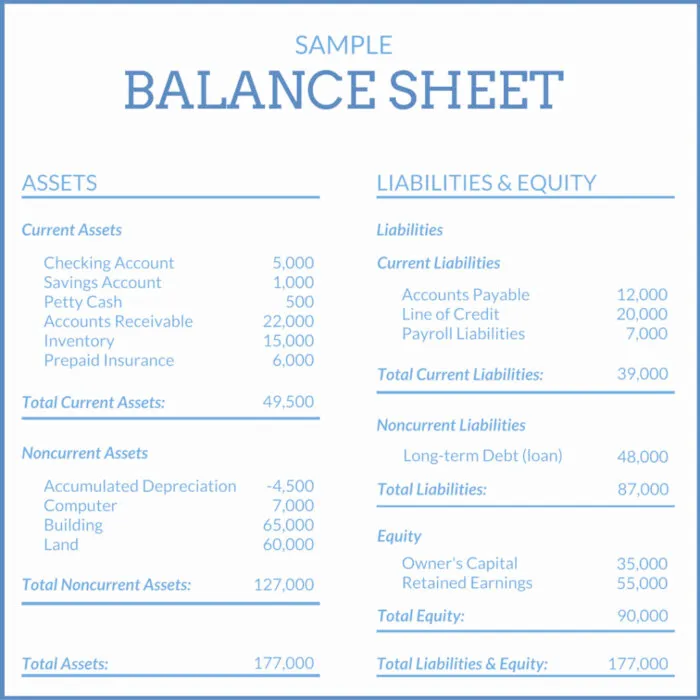

A balance sheet is a financial statement that shows you 3 things of a company at a specific point in time:

1. Assets

2. Liabilities

3. Shareholders equity

In child language, a balance sheet shows you what a company owns and owes.

A balance sheet is a financial statement that shows you 3 things of a company at a specific point in time:

1. Assets

2. Liabilities

3. Shareholders equity

In child language, a balance sheet shows you what a company owns and owes.

2️⃣ Balance sheet = snapshot

It is very important to understand that a balance sheet is a SNAPSHOT of a company’s financial health at a certain point in time.

It is very important to understand that a balance sheet is a SNAPSHOT of a company’s financial health at a certain point in time.

This is a fundamental difference compared to an income statement and cash flow statement as these statements are measured OVER a period of time.

This also means that when management has bad intentions it could try to fine tune their balance sheet to look more healthy.

That’s why I prefer to invest in companies with an integer management and skin in the game.

That’s why I prefer to invest in companies with an integer management and skin in the game.

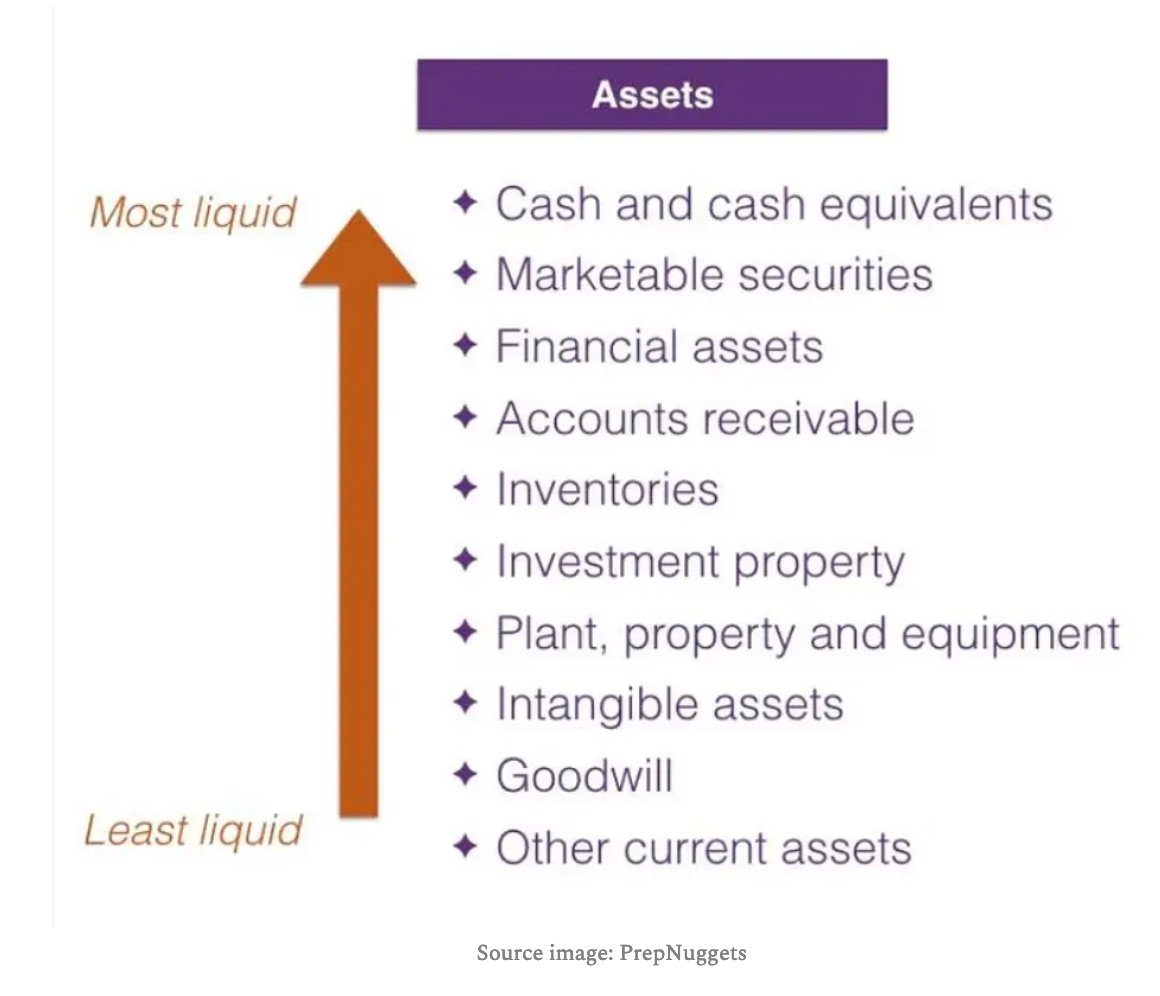

3️⃣ Assets

The assets of a company show you everything the company owns.

A distinction can be made between current assets and non-current assets.

The assets of a company show you everything the company owns.

A distinction can be made between current assets and non-current assets.

Current assets: assets that can be converted into cash within 1 year

Examples of current assets: cash and cash equivalents, short-term investments, accounts receivable and inventories.

Examples of current assets: cash and cash equivalents, short-term investments, accounts receivable and inventories.

Non-current assets: assets that are harder to convert into cash

Examples of non-current assets: buildings, stores, goodwill (premium paid to make an acquisition) and patents.

Examples of non-current assets: buildings, stores, goodwill (premium paid to make an acquisition) and patents.

Questions to ask yourself about a company’s assets

▪️How much cash and cash equivalents does the company have?

▪️ How much goodwill does the company have?

▪️ Does the company have a lot of intangible assets?

▪️How much cash and cash equivalents does the company have?

▪️ How much goodwill does the company have?

▪️ Does the company have a lot of intangible assets?

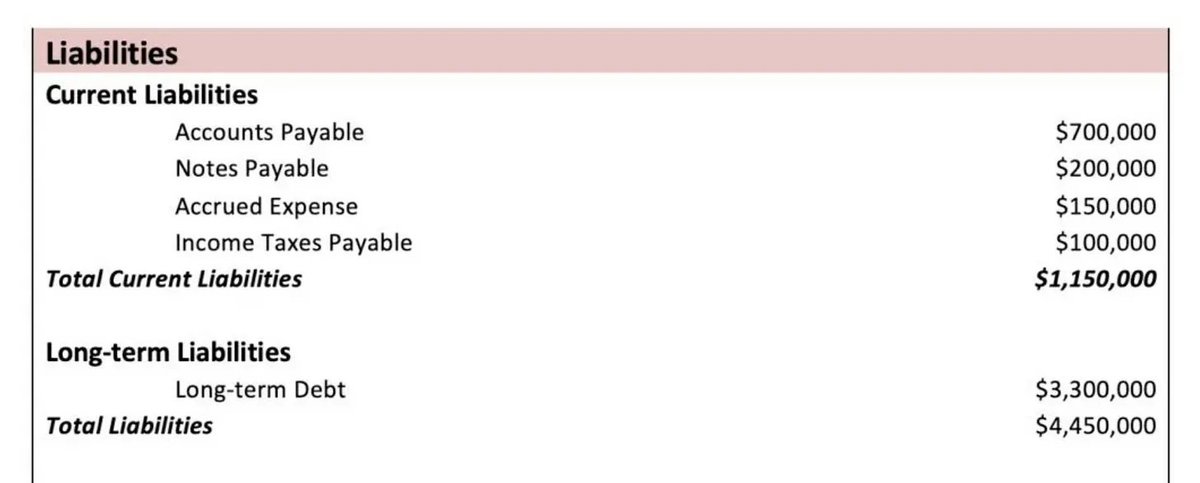

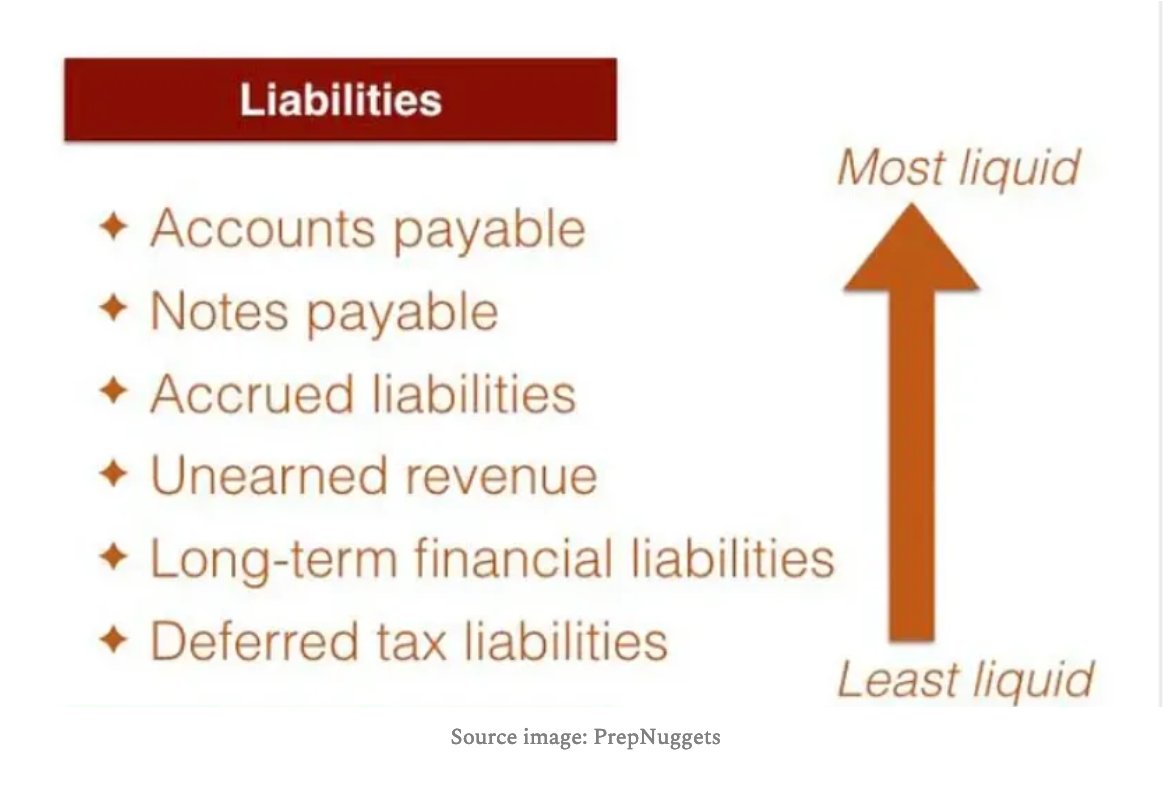

4️⃣ Liabilities

The liabilities of a company show you how much the company owes.

A distinction can be made between short-term liabilities and long-term liabilities.

The liabilities of a company show you how much the company owes.

A distinction can be made between short-term liabilities and long-term liabilities.

Short-term liabilities: a financial obligation that has to be paid within 1 year

Examples of short-term liabilities: short-term debt and accounts payable

Examples of short-term liabilities: short-term debt and accounts payable

Long-term liabilities: debt that has to be paid > 1 year

Examples of long-term liabilities: long-term debt and pension plans

Examples of long-term liabilities: long-term debt and pension plans

Questions to ask yourself about the company's liabilities:

▪️Does the company have more ST than LT liabilities (bad sign)?

▪️Does the company have more cash than ST debt (good sign)?

▪️Are total liabilities increasing or decreasing? And why?

▪️Does the company have more ST than LT liabilities (bad sign)?

▪️Does the company have more cash than ST debt (good sign)?

▪️Are total liabilities increasing or decreasing? And why?

5️⃣ Shareholders equity

The shareholders equity shows you how much money the owners (shareholders) have invested in the company.

The shareholders equity shows you how much money the owners (shareholders) have invested in the company.

You can calculate the shareholders equity of a company yourself very easily:

Shareholders equity = Total assets - Total liabilities

Shareholders equity = Total assets - Total liabilities

There are 3 categories of shareholders equity:

▪️Contributed capital: what shareholders have invested to buy their stake

▪️ Retained earnings: profits a company has reserved to reinvest in the business

▪️ Treasury sock: cash the company uses to buy back its own shares

▪️Contributed capital: what shareholders have invested to buy their stake

▪️ Retained earnings: profits a company has reserved to reinvest in the business

▪️ Treasury sock: cash the company uses to buy back its own shares

Questions to ask yourself about the company's shareholders equity:

▪️Does the company have a lot of retained earnings (good sign)?

▪️Are there a lot of preferred stocks (bad sign)?

▪️Does the company buy back shares (good sign)?

▪️Does the company have a lot of retained earnings (good sign)?

▪️Are there a lot of preferred stocks (bad sign)?

▪️Does the company buy back shares (good sign)?

6️⃣ Great ratios to analyze a company’s balance sheet

You’ve now learned that you should invest in companies which are in good financial share.

You’ve now learned that you should invest in companies which are in good financial share.

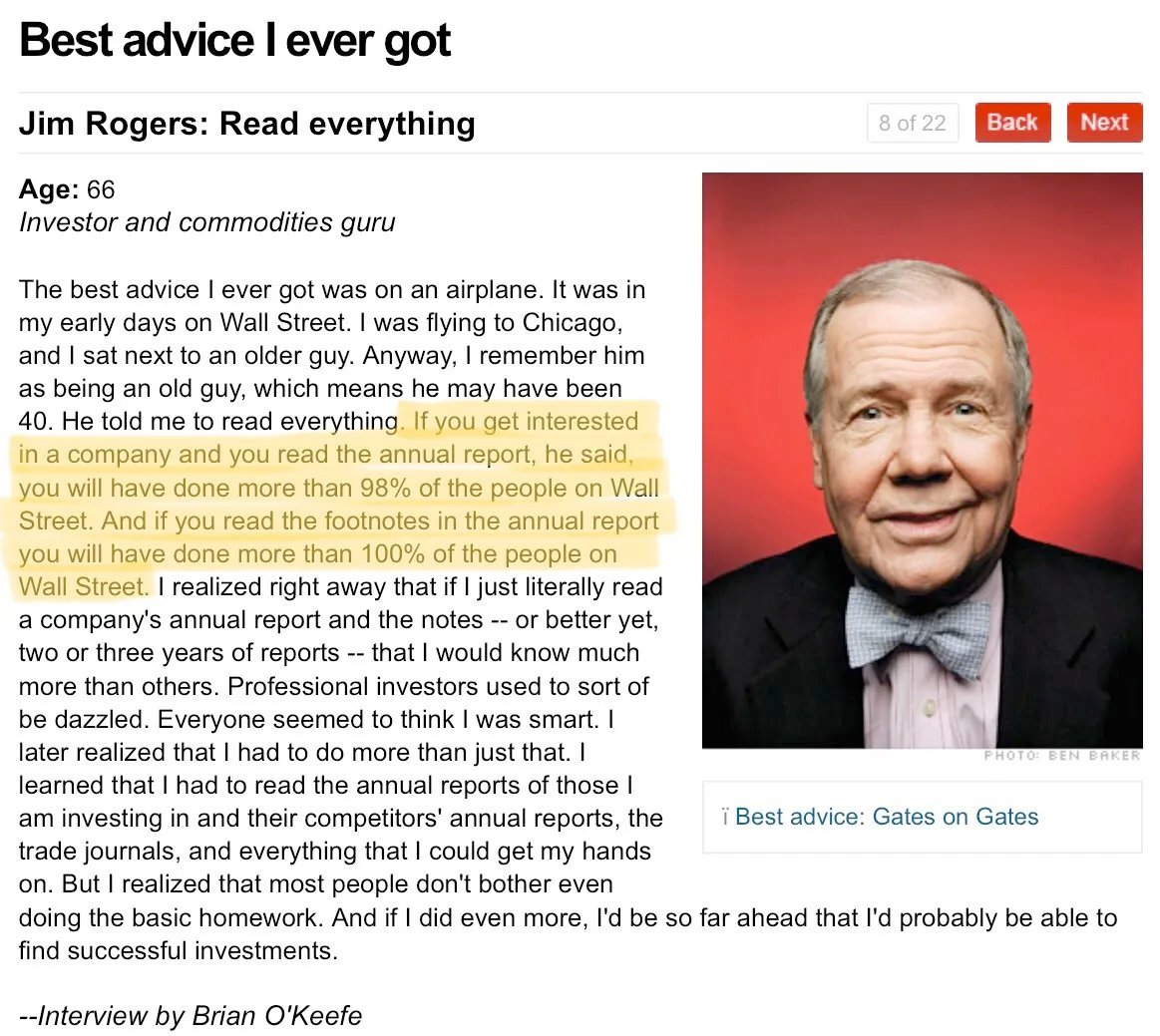

Just like Terry Smith, I like to look at 2 ratios to determine the healthiness of a balance sheet:

1. Interest coverage

2. Net debt / free cash flow

1. Interest coverage

2. Net debt / free cash flow

Interest coverage

This ratio shows you how easily a company can pay back the interests on its outstanding debt.

This ratio shows you how easily a company can pay back the interests on its outstanding debt.

You can calculate it as follows:

Interest coverage = (EBIT / Interest payments)

The higher this ratio, the better. I prefer to invest in company’s with an interest coverage of at least 10x.

Interest coverage = (EBIT / Interest payments)

The higher this ratio, the better. I prefer to invest in company’s with an interest coverage of at least 10x.

Net Debt / Free Cash Flow

This ratio shows you how many years it would take the company to pay down all its debt when it would use all available free cash flow.

This ratio shows you how many years it would take the company to pay down all its debt when it would use all available free cash flow.

The formula for this ratio is very obvious:

Net Debt / Free Cash Flow = (Net Debt / Free Cash Flow)

The lower this ratio, the better. Personally I prefer companies with a Net Debt / Free Cash Flow lower than 4.

Net Debt / Free Cash Flow = (Net Debt / Free Cash Flow)

The lower this ratio, the better. Personally I prefer companies with a Net Debt / Free Cash Flow lower than 4.

The end!

If you want to learn more, you can read the full article on our website.

Next week we'll publish an article about to analyze an income statement.

qualitycompounding.substack.com/p/how-to-analy…

If you want to learn more, you can read the full article on our website.

Next week we'll publish an article about to analyze an income statement.

qualitycompounding.substack.com/p/how-to-analy…

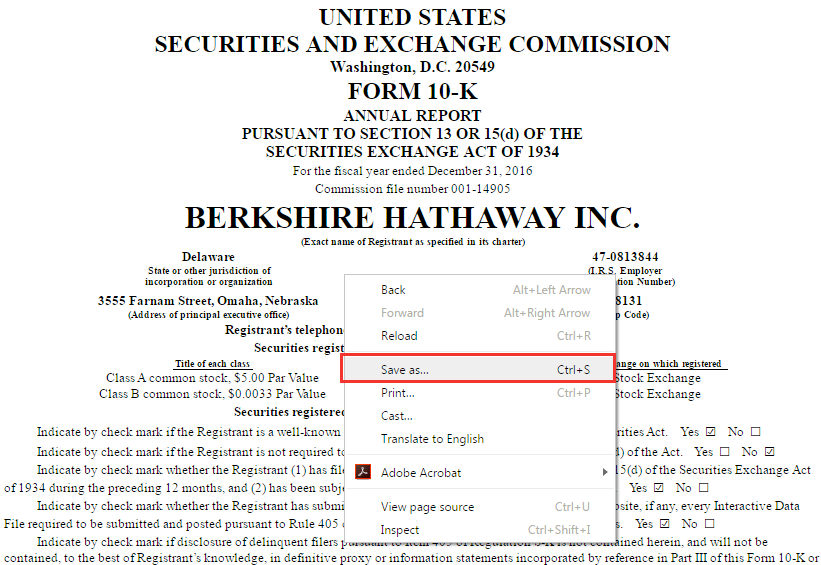

For those who want to learn more, here you can learn how to read a 10-K:

https://twitter.com/QCompounding/status/1632376727623049218?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh