How to find new investments?

Microcap-focused investment blogs can be really fertile hunting grounds.

Sharing my list of freely accessible and active blogs.

I scan these regularly and have made a handful of lucrative picks already.

👇

Microcap-focused investment blogs can be really fertile hunting grounds.

Sharing my list of freely accessible and active blogs.

I scan these regularly and have made a handful of lucrative picks already.

👇

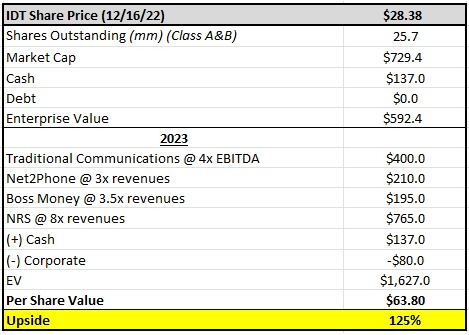

1/ Clark Street Value blog is one of the best hunting grounds for event-driven ideas.

The posts are frequent, clear, and always to the point.

A very active community is full of insights on each name covered on the blog.

The posts are frequent, clear, and always to the point.

A very active community is full of insights on each name covered on the blog.

2/ Recent posts on Clark Street Value.

$MGTA potential liquidation of biopharma at 43% discount to net cash:

clarkstreetvalue.blogspot.com/2023/02/magent…

$SCU potential sale of an asset management firm due to infighting between the founder and the current CEO:

clarkstreetvalue.blogspot.com/2023/02/sculpt…

$MGTA potential liquidation of biopharma at 43% discount to net cash:

clarkstreetvalue.blogspot.com/2023/02/magent…

$SCU potential sale of an asset management firm due to infighting between the founder and the current CEO:

clarkstreetvalue.blogspot.com/2023/02/sculpt…

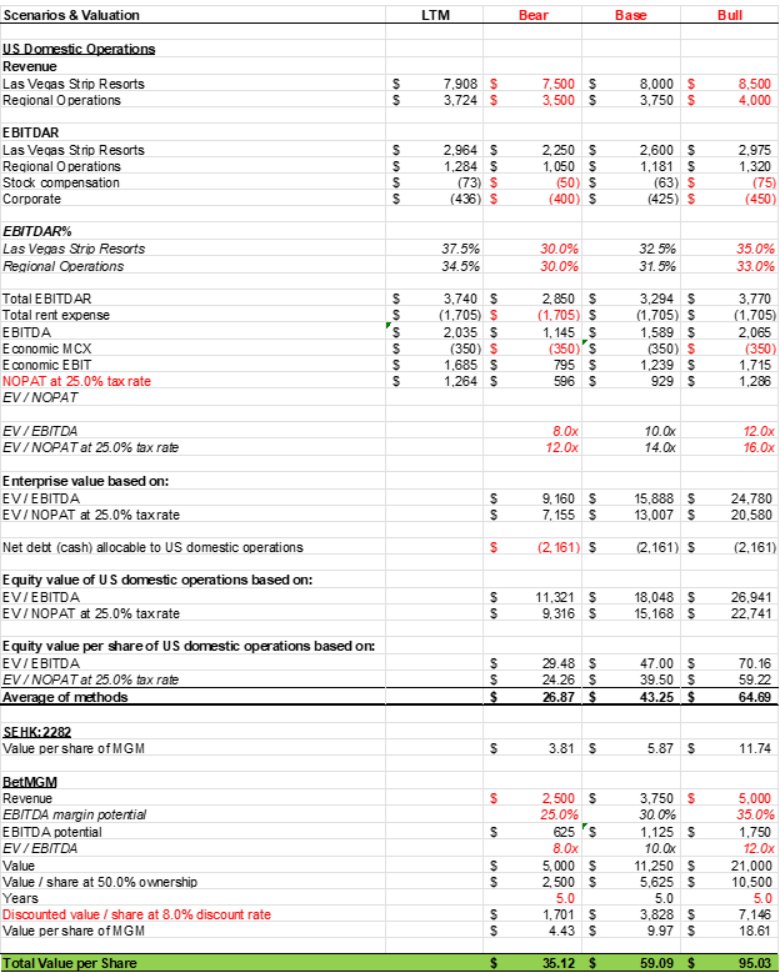

3/ @alluvialcapital blog and investor letters are equally impressive.

Mostly focused on illiquid, deep-value names with an occasional shift into event-driven space.

Writes up are balanced and easy to read, no matter the size of the pitch itself.

Mostly focused on illiquid, deep-value names with an occasional shift into event-driven space.

Writes up are balanced and easy to read, no matter the size of the pitch itself.

4/ Recent posts on Alluvial Capital.

$CBAV high-quality business with inflecting operating leverage trading at single digit multiples:

alluvial.substack.com/p/clinica-bavi…

$LGT-A small-cap owner-operator of irreplaceable infrastructure assets trading at just 10x PE:

alluvial.substack.com/p/looking-ahead

$CBAV high-quality business with inflecting operating leverage trading at single digit multiples:

alluvial.substack.com/p/clinica-bavi…

$LGT-A small-cap owner-operator of irreplaceable infrastructure assets trading at just 10x PE:

alluvial.substack.com/p/looking-ahead

5/ Value and Opportunity blog by @memyselfandi006.

Blogging on investments for 12 years already.

Focused on undervalued compounders as well as the special situation plays in Europe.

Blogging on investments for 12 years already.

Focused on undervalued compounders as well as the special situation plays in Europe.

6/ Recent posts on Value and Opportunity.

$RBREW.CO fairly valued regionally dominant beverage company in Nordics:

valueandopportunity.com/2022/11/01/roy…

$SFSN.SW High-quality Swiss manufacturing business trading at 12x PE despite growing EPS at 15% CAGR for a decade:

valueandopportunity.com/2023/02/06/sfs…

$RBREW.CO fairly valued regionally dominant beverage company in Nordics:

valueandopportunity.com/2022/11/01/roy…

$SFSN.SW High-quality Swiss manufacturing business trading at 12x PE despite growing EPS at 15% CAGR for a decade:

valueandopportunity.com/2023/02/06/sfs…

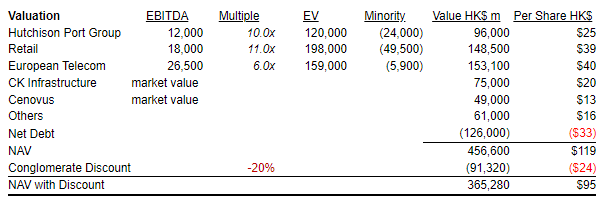

7/ Blog by @ToffCap1 is well worth your time if you look for some deeply undervalued picks.

You can expect in-depth research on a multitude of stocks across various countries and industries.

Mostly focused on overlooked and obscure micro/nano-cap stocks.

You can expect in-depth research on a multitude of stocks across various countries and industries.

Mostly focused on overlooked and obscure micro/nano-cap stocks.

8/ Recent posts on ToffCap.

$UMDK.DE German nano-cap with a negative EV and roughly 80% FCFE yield:

toffcap.com/united-mobilit…

$FTK.DE one of the largest pan-European online brokers at 15x fwd PE with 25% p.a growth vs peer group at 19x:

toffcap.com/flatexdegiro/

$UMDK.DE German nano-cap with a negative EV and roughly 80% FCFE yield:

toffcap.com/united-mobilit…

$FTK.DE one of the largest pan-European online brokers at 15x fwd PE with 25% p.a growth vs peer group at 19x:

toffcap.com/flatexdegiro/

9/ NoNameStocks blog takes the concept of obscure, off-the-beaten-path investments to the extreme.

The blog solely covers dark or OTC-only nanocap stocks with limited visibility.

Writes up are short and focused on the key inflection drivers.

The blog solely covers dark or OTC-only nanocap stocks with limited visibility.

Writes up are short and focused on the key inflection drivers.

10/ Recent posts on NoNameStocks.

$IVTO profitable, debt-free non-animal-based testing company trading slightly below its $1.2m in net cash:

nonamestocks.com/2022/11/ivro-y…

$BDRL left for a dead firm with 30-year public mkt history at $2m Mcap and $16m sales:

nonamestocks.com/2022/08/keepin…

$IVTO profitable, debt-free non-animal-based testing company trading slightly below its $1.2m in net cash:

nonamestocks.com/2022/11/ivro-y…

$BDRL left for a dead firm with 30-year public mkt history at $2m Mcap and $16m sales:

nonamestocks.com/2022/08/keepin…

11/ @tinystockninja mainly covers profitable US-listed microcaps with significant insider ownership.

Well-structured write-ups with a clearly defined thesis and well-thought-out background on a business.

Tiny Stock Ninja insights from mgmt conversations are especially helpful.

Well-structured write-ups with a clearly defined thesis and well-thought-out background on a business.

Tiny Stock Ninja insights from mgmt conversations are especially helpful.

12/ Recent posts on Tiny Stock Ninja.

$CRU.L high quality, niche plastics producer led by experienced mgmt and trading at less than 5x FCF:

tinystockninja.substack.com/p/coral-produc…

$KTEL countercyclical company nearing growth inflection and led by mgmt with a 55% stake:

tinystockninja.substack.com/p/konatel-inc-…

$CRU.L high quality, niche plastics producer led by experienced mgmt and trading at less than 5x FCF:

tinystockninja.substack.com/p/coral-produc…

$KTEL countercyclical company nearing growth inflection and led by mgmt with a 55% stake:

tinystockninja.substack.com/p/konatel-inc-…

13/ The Superinvestors of Augustusville by @augustusville.

The blog focuses on illiquid, undercovered names with an occasional shift to special situations as well as quality compounders.

Industry and largely geographically agnostic with a slight skew towards European names.

The blog focuses on illiquid, undercovered names with an occasional shift to special situations as well as quality compounders.

Industry and largely geographically agnostic with a slight skew towards European names.

14/ Recent posts on @augustusville's blog.

$FEW.F Illiquid hidden champion with ROIC of 40%+ in recent years (up from 18% in 2016):

augustusville.substack.com/p/funkwerk-ag-…

$OTOEL.AT Family-owned quality business with a LT orientation trading at less than 5x EV/EBITDA:

augustusville.substack.com/p/car-rental-c…

$FEW.F Illiquid hidden champion with ROIC of 40%+ in recent years (up from 18% in 2016):

augustusville.substack.com/p/funkwerk-ag-…

$OTOEL.AT Family-owned quality business with a LT orientation trading at less than 5x EV/EBITDA:

augustusville.substack.com/p/car-rental-c…

15/ Finally my own blog Special Situation Investments.

So far I did not have much free content as all of my currently active investment picks are behind the paywall.

But that is going to change shortly.

Sign up for free SSI newsletter on SSI home page: specialsituationinvestments.com

So far I did not have much free content as all of my currently active investment picks are behind the paywall.

But that is going to change shortly.

Sign up for free SSI newsletter on SSI home page: specialsituationinvestments.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh