Event-driven trades and special situation investments.

All my picks are posted on https://t.co/YyZdX4ZhPY.

Tracking portfolio: +770% since 2017.

6 subscribers

How to get URL link on X (Twitter) App

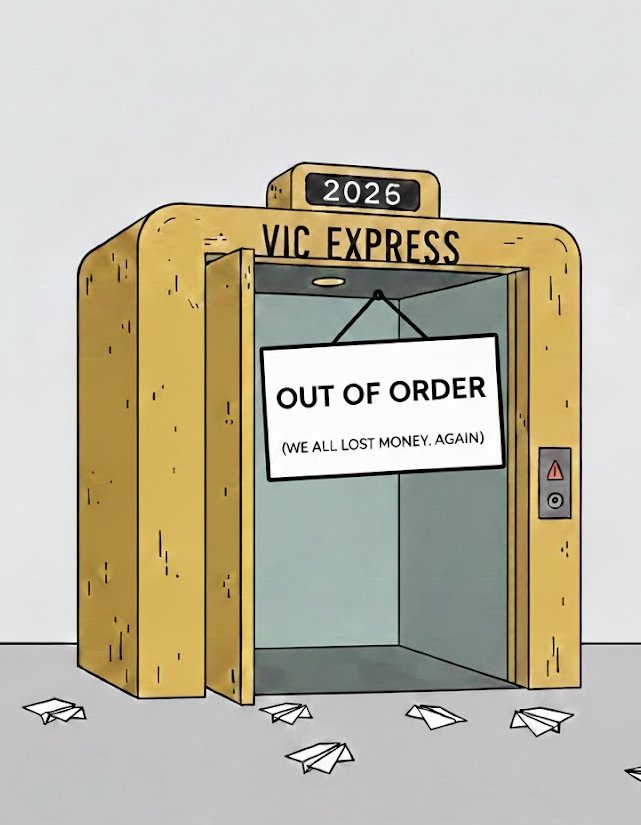

#1: $BFIT Long

#1: $BFIT Long

1/ $TIC pitch by @_Tourlite

1/ $TIC pitch by @_Tourlite

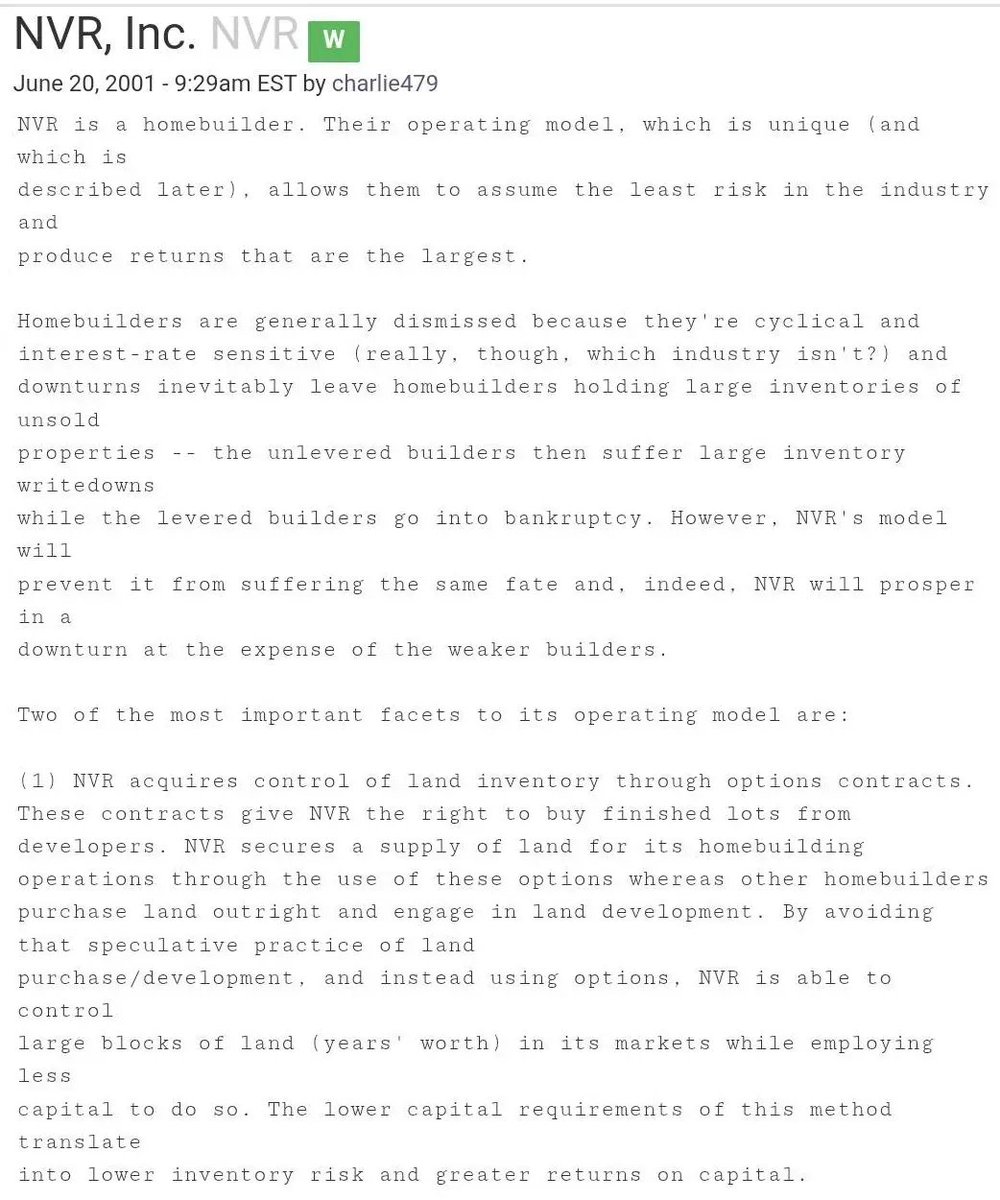

1/ charlie479 (active 2001-2009)

1/ charlie479 (active 2001-2009)

1/ $UCTT pitch by Rewey

1/ $UCTT pitch by Rewey

1/ @finance_schmidt isn’t the newest blog on the block, but I somehow haven’t mentioned him before.

1/ @finance_schmidt isn’t the newest blog on the block, but I somehow haven’t mentioned him before.

1/ @TenvaCapital's blog is a great source of deep-dive writeups on small & mid-cap Australian names.

1/ @TenvaCapital's blog is a great source of deep-dive writeups on small & mid-cap Australian names.

1/ $HAYPP pitch by Liberty Park

1/ $HAYPP pitch by Liberty Park

1/ $KITS pitch by @GreystoneCap

1/ $KITS pitch by @GreystoneCap

1/ $NRP pitch by @GreystoneCap

1/ $NRP pitch by @GreystoneCap

1/ $MCB.L pitch by @alluvialcapital

1/ $MCB.L pitch by @alluvialcapital

1/ @CapitalVoss

1/ @CapitalVoss

1/ $HAI.TO pitch by @AtaiCapital

1/ $HAI.TO pitch by @AtaiCapital

1) Yellowbrick Investing @joinyellowbrick

1) Yellowbrick Investing @joinyellowbrick

1) $KITW.L pitch from @JonCukierwar

1) $KITW.L pitch from @JonCukierwar

1) $CLMB pitch by @Headwaters_Cap

1) $CLMB pitch by @Headwaters_Cap

1/ One of the best sources on energy markets "The Palgrave Handbook of International Energy Economics".

1/ One of the best sources on energy markets "The Palgrave Handbook of International Energy Economics".

In November 2023, the company failed a phase 2 trial of its lead drug candidate, prompting a 46% workforce reduction a month later. In mid-January, the CEO stepped down, and a strategic review was initiated.

In November 2023, the company failed a phase 2 trial of its lead drug candidate, prompting a 46% workforce reduction a month later. In mid-January, the CEO stepped down, and a strategic review was initiated.

1/ @david_katunaric mostly focuses on small-cap, off-the-beaten-path value plays.

1/ @david_katunaric mostly focuses on small-cap, off-the-beaten-path value plays.https://twitter.com/david_katunaric/status/1765449290325832049