In this Thread 🧵 I'll look to give my Detailed analysis about Datamatics Global Services Ltd. I'll give complete details about its Business, Financial Results, Fundamentals, Management, Chart Pattern📈📉 Analysis and at last I'll give my Final Commentary👨💻

#Datamatics

#Datamatics

🎖️About The Company

☑️Datamatics is a global provider of Information Technology (IT), Business Process Management (BPM) and Consulting services.

☑️The Company provides business aligned next-generation solutions to a wide range of industry verticals that help enterprises

☑️Datamatics is a global provider of Information Technology (IT), Business Process Management (BPM) and Consulting services.

☑️The Company provides business aligned next-generation solutions to a wide range of industry verticals that help enterprises

across the world overcome their business challenges and achieve operational efficiencies.

🎖️Service Offerings

☑️The co. offers a wide range of services primarily categorized under information technology (IT) solutions, business process management (BPM), Big Data &

🎖️Service Offerings

☑️The co. offers a wide range of services primarily categorized under information technology (IT) solutions, business process management (BPM), Big Data &

Analytics & engineering services.

🥇IP Products

a. TruCap+:- It is an intelligent document-processing solution for businesses.

b. TruBot - It is RPA software, a digital workforce product enabling unattended and attended automation for a wide range of tasks and processes.

🥇IP Products

a. TruCap+:- It is an intelligent document-processing solution for businesses.

b. TruBot - It is RPA software, a digital workforce product enabling unattended and attended automation for a wide range of tasks and processes.

3. iPM - It is a web-based workflow system for accounts payable and accounts receivable processes.

4. TruBI - It is a visual analytics solution that offers an enterprise-ready business intelligence platform that provides a modern & responsive user interface

4. TruBI - It is a visual analytics solution that offers an enterprise-ready business intelligence platform that provides a modern & responsive user interface

5. TruFare - It is an automatic fare collection (AFC) solution built for digitally savvy urban transport systems such as metro rails, automated parking lots, rapid bus transport systems, etc.

6. TruAI - It is a comprehensive Artificial Intelligence and Cognitive

6. TruAI - It is a comprehensive Artificial Intelligence and Cognitive

Sciences solution that helps enterprises leverage use cases related to pattern detection, text & data mining, and computer vision.

Intelligent Automation Platform

The co. has developed its own intelligent automation platform that combines the capabilities of its various IP

Intelligent Automation Platform

The co. has developed its own intelligent automation platform that combines the capabilities of its various IP

products along with AI, ML, and NLP models developed by its datalabs. The market for the same is forecasted to grow at a CAGR of ~19% over 2020-25.

🎖️Revenue Breakup

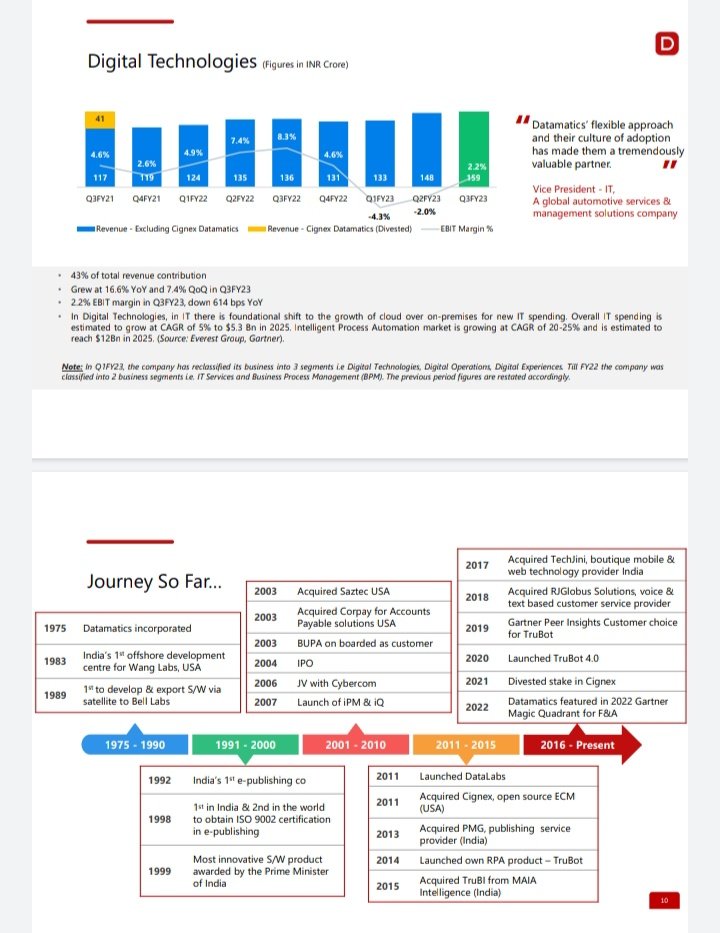

☑️As of Q3 FY23, The company reclassified its segments into 3 verticals,

🎖️Revenue Breakup

☑️As of Q3 FY23, The company reclassified its segments into 3 verticals,

☑️Digital Operations - 41% of revenue with ~20% margin

☑️Digital Experiences - 16% of revenue with ~26% margin

☑️Digital Technologies -43% of revenue with 2.2% margin

🎖️Industry-wise :-

As of Q3 FY23,

Banking & Financial Services - 24%

Education & Publishing - 22%

☑️Digital Experiences - 16% of revenue with ~26% margin

☑️Digital Technologies -43% of revenue with 2.2% margin

🎖️Industry-wise :-

As of Q3 FY23,

Banking & Financial Services - 24%

Education & Publishing - 22%

Tech & Consultancy - 16%

Non-profit, Non-government - 13%

Manufacturing, infra, logistics - 12%

Retail - 8%

Others - 4%

🎖️Geography-wise :-

USA - 54%

India - 29%

ROW - 17%

🎖️Client Profile

☑️The co. has 300+ clients.

☑️It added 1104 new clients in FY22. As of Q3 FY23,

Non-profit, Non-government - 13%

Manufacturing, infra, logistics - 12%

Retail - 8%

Others - 4%

🎖️Geography-wise :-

USA - 54%

India - 29%

ROW - 17%

🎖️Client Profile

☑️The co. has 300+ clients.

☑️It added 1104 new clients in FY22. As of Q3 FY23,

Top 5, 10 and 20 clients contributed 24%, 37% and 52% towards revenues respectively.

🎖️Office Locations

☑️The company’s international offices are located in the USA, UK, Mauritius, Philippines, and UAE.

☑️Offices within India are located in Mumbai, Bangalore, Puducherry, and

🎖️Office Locations

☑️The company’s international offices are located in the USA, UK, Mauritius, Philippines, and UAE.

☑️Offices within India are located in Mumbai, Bangalore, Puducherry, and

Nashik.

🎖️Divestment of Cignex

In FY21, the company sold its non-core business i.e. CIGNEX Datamatics Inc. It sold its entire 62.5% stake for ~183 crores INR.

🎖️Cash-Rich

As of Q3 FY23, The company's cash balance stood at ~Rs455cr

🎖️Divestment of Cignex

In FY21, the company sold its non-core business i.e. CIGNEX Datamatics Inc. It sold its entire 62.5% stake for ~183 crores INR.

🎖️Cash-Rich

As of Q3 FY23, The company's cash balance stood at ~Rs455cr

🎖️Promoter Selling

As per Concall, The Promoters as they age are providing for their grandchildren and have created separate trust in which they have transferred the shares

🎖️Order Pipeline

The company’s order pipeline remains strong with TCV2 of deal wins worth $126 million

As per Concall, The Promoters as they age are providing for their grandchildren and have created separate trust in which they have transferred the shares

🎖️Order Pipeline

The company’s order pipeline remains strong with TCV2 of deal wins worth $126 million

In FY2022 and $48.3 million in H1 FY2023, which provides revenue visibility over the medium term.

🎖️Strategic Focus

The strategic priority focuses on Products & Platforms, Automatic Fare Collection (AFC), Digital Solutions – Intelligent Automation, Digital Experiences, Could

🎖️Strategic Focus

The strategic priority focuses on Products & Platforms, Automatic Fare Collection (AFC), Digital Solutions – Intelligent Automation, Digital Experiences, Could

Account Penetration, and Branding and Marketing.

The Co.’s growth strategy includes focusing on the US market - Datamatics has extended the US sales force to focus on digital transformation opportunities including intelligent automation products, TruBot RPA and TruCap+ IDP.

The Co.’s growth strategy includes focusing on the US market - Datamatics has extended the US sales force to focus on digital transformation opportunities including intelligent automation products, TruBot RPA and TruCap+ IDP.

🎖️Fundamental Analysis

✅Market Capitalisation:- Rs 1792 Cr(Small Cap)

✅Stock PE:- 10.4(Undervalued)

✅Industry PE:- 30

✅Book Value:- Rs 158

✅Intrinsic Value:- Rs 303

✅Graham No:- Rs 324

✅ROE:- 18.3%

✅ROCE:- 22%

✅Dividend Yield:- 1.23%

✅Face Value:- 5

✅

✅Market Capitalisation:- Rs 1792 Cr(Small Cap)

✅Stock PE:- 10.4(Undervalued)

✅Industry PE:- 30

✅Book Value:- Rs 158

✅Intrinsic Value:- Rs 303

✅Graham No:- Rs 324

✅ROE:- 18.3%

✅ROCE:- 22%

✅Dividend Yield:- 1.23%

✅Face Value:- 5

✅

✅Profit Growth:- 31.6%

✅Sales Growth:- 15.8%

✅Promoters Holding:- 70.9%

✅FII Holdings:- 2.32%

✅Universal:- 3.39%

✅Debt to Equity:- 0.06

✅Reserves:- Rs 899 Cr(As Per Sept 22)

✅Debt:- Rs 52(As Per Sept 22)

✅Piotroksi Score:- 7

✅EPS:- 29.7

✅Fixed Assets:- Rs 197 Cr

✅Sales Growth:- 15.8%

✅Promoters Holding:- 70.9%

✅FII Holdings:- 2.32%

✅Universal:- 3.39%

✅Debt to Equity:- 0.06

✅Reserves:- Rs 899 Cr(As Per Sept 22)

✅Debt:- Rs 52(As Per Sept 22)

✅Piotroksi Score:- 7

✅EPS:- 29.7

✅Fixed Assets:- Rs 197 Cr

Datamatics

✅Last 3/5/10 Years Sales & Profits Growth🪴💹💹, CAGR, ROE

✅Accounting Ratios🧾🧾

✅Cash Flow⚖️♎

✅Concall Major points Details in the below pictures👇👇

As per latest Concall guidance Datamatics has become debt free with Rs 455 Cr Total Cash & Investment

✅Last 3/5/10 Years Sales & Profits Growth🪴💹💹, CAGR, ROE

✅Accounting Ratios🧾🧾

✅Cash Flow⚖️♎

✅Concall Major points Details in the below pictures👇👇

As per latest Concall guidance Datamatics has become debt free with Rs 455 Cr Total Cash & Investment

☑️One trigger point in Datamatics is that FII are continuously increasing their stake in this company since last 6 Quarters

☑️Promoters are ageing due to which they have created a trust by the name 'Universal Trustees Private Ltd' for transfer of shares for their grandchildren

☑️Promoters are ageing due to which they have created a trust by the name 'Universal Trustees Private Ltd' for transfer of shares for their grandchildren

🎖️Chart Pattern Analysis📉📈, Financial Results Analysis and My Commentry👨💻

Chart Pattern Analysis on Weekly Time Frame

☑️The Stock is trading at a Price Band of Rs 230 to Rs 383 since last 87-Weeks

☑️The Stock is trading above all the EMAs and DMAs

☑️A hammer is formed on

Chart Pattern Analysis on Weekly Time Frame

☑️The Stock is trading at a Price Band of Rs 230 to Rs 383 since last 87-Weeks

☑️The Stock is trading above all the EMAs and DMAs

☑️A hammer is formed on

The Chart Pattern

☑️The stock has a strong support placed at Rs 288. Below that the supports are placed at Rs 281/270

Financial Results Analysis

☑️Datamatics Sales, Operating Profits and EPS is increasing since last 6 Quarters

☑️The company is maintaining a Margin of 16-17%

☑️The stock has a strong support placed at Rs 288. Below that the supports are placed at Rs 281/270

Financial Results Analysis

☑️Datamatics Sales, Operating Profits and EPS is increasing since last 6 Quarters

☑️The company is maintaining a Margin of 16-17%

☑️In the FY23, First 3 Quarters Datamatics has done a Sales of Rs 1043 Cr if on topline company adds Rs 370 Cr Sales in Q4 then Datamatics Sales for FY23 can be at Rs 1413 Cr mentioning that its Sales of FY22 was only at Rs 1201 Cr

☑️If the Company acheives Rs 1400 Cr its Sales

☑️If the Company acheives Rs 1400 Cr its Sales

Will increase by about 15%💹💹 on YOY Basis

☑️In the FY23, First 3 Quarter Datamatics Operating Profits has been at Rs 159 Cr if on topline company manages to add Rs 59 Cr Net Profits in Q4 it means its Operating Profits can be at Rs 218 Cr

☑️If Datamatics acheives 218 Cr

☑️In the FY23, First 3 Quarter Datamatics Operating Profits has been at Rs 159 Cr if on topline company manages to add Rs 59 Cr Net Profits in Q4 it means its Operating Profits can be at Rs 218 Cr

☑️If Datamatics acheives 218 Cr

Operating profits it will be about 11%💹💹 on YOY Basis

☑️The Company at 10.4 PE Ratio looks very cheap when the Industry PE Ratio is at 30. Peers are trading at 15-20-30-40-50 PE Ratio

My Commentary Section

If I had to accumulate Datamatics I'll accumulate in this manner

☑️The Company at 10.4 PE Ratio looks very cheap when the Industry PE Ratio is at 30. Peers are trading at 15-20-30-40-50 PE Ratio

My Commentary Section

If I had to accumulate Datamatics I'll accumulate in this manner

☑️15% Quanties @295

☑️15% Quanties @288

☑️30% Quanties @281

☑️40% Quantities @272

Buying in this way will make my average at Rs 281. Since this is a smallcap company allocation will be only 4-5% of capital.

Targets 🎯🎯 for Datamatics will be at Rs 340/350/360/370/380+

☑️15% Quanties @288

☑️30% Quanties @281

☑️40% Quantities @272

Buying in this way will make my average at Rs 281. Since this is a smallcap company allocation will be only 4-5% of capital.

Targets 🎯🎯 for Datamatics will be at Rs 340/350/360/370/380+

Long term Targets will be at Rs 400/450/500+

SL will be kept at Rs 269.90

R:R is favorable. If SL gets hunted there is a Risk of 4% Drawdowns or 0.2% evaporation of total capital but at the last Targets the rewards is of 78%💚💚💹💹

🎖️Buying a Debt 🆓 Company which

SL will be kept at Rs 269.90

R:R is favorable. If SL gets hunted there is a Risk of 4% Drawdowns or 0.2% evaporation of total capital but at the last Targets the rewards is of 78%💚💚💹💹

🎖️Buying a Debt 🆓 Company which

Can do Rs 1400+ Cr Sales and Rs 218 Cr operating profits at just Rs 1600 Cr Market Capitalisation and 9.46 PE Ratio will be a very much fair deal🤝🤝

So, Technically here is my detailed thread 🧵 ends about Datamatics. If you liked this thread please Retweet♻️♻️ it so that it

So, Technically here is my detailed thread 🧵 ends about Datamatics. If you liked this thread please Retweet♻️♻️ it so that it

Reaches the fellow Traders and investors. Retweet it because it took me 5 Hours to make this thread.

Note:- This thread was only for educational purposes it is not a Buying/Selling advice. Do your own research promptly. I'll not be responsible for the profits or loss.

Note:- This thread was only for educational purposes it is not a Buying/Selling advice. Do your own research promptly. I'll not be responsible for the profits or loss.

• • •

Missing some Tweet in this thread? You can try to

force a refresh