Uncovering India’s Wealth Story 🇮🇳 Celebrate India's rise through market trends & visual stories. No buy/sell tips. No stock advice. 🚀📈

8 subscribers

How to get URL link on X (Twitter) App

🎖️ABOUT THE COMPANY:-

🎖️ABOUT THE COMPANY:-

I've looked to analyse, ‘#BHARATSEATS’ Business, Fundamentals, Technicals, Financials, Product Mix, CAPEX, Valuation Gap, Clients, Business Divisions etc. Tried to compile each and every small detail and informations about this company.

I've looked to analyse, ‘#BHARATSEATS’ Business, Fundamentals, Technicals, Financials, Product Mix, CAPEX, Valuation Gap, Clients, Business Divisions etc. Tried to compile each and every small detail and informations about this company.

⭐️ABOUT THE COMPANY

⭐️ABOUT THE COMPANY

Management, to its Chart Pattern analysis 📉📈, to its valuation gap ⚖️♎ and at last I'll give my final commentary👨💻 about this stock.

Management, to its Chart Pattern analysis 📉📈, to its valuation gap ⚖️♎ and at last I'll give my final commentary👨💻 about this stock.

⭐ABOUT THE COMPANY

⭐ABOUT THE COMPANY

🏅Fundamental Analysis

🏅Fundamental Analysis

Each and every neeche details about HPL Electric ⚡⚡ will be covered in this Detailed Thread

Each and every neeche details about HPL Electric ⚡⚡ will be covered in this Detailed Thread

Management, to its Chart Pattern analysis📉📈, to its valuation gap⚖️♎ and at last I'll give my final commentary👨💻 about this stock.

Management, to its Chart Pattern analysis📉📈, to its valuation gap⚖️♎ and at last I'll give my final commentary👨💻 about this stock.

Each and every neeche details about this company will be covered in this thread 🧵

Each and every neeche details about this company will be covered in this thread 🧵

In this detailed thread 🧵 I've look and analyse TALBROS AUTOMATIVE COMPONENTS Business, Fundamentals, Technicals, Financials, Product Mix, Management, CAPEX, Order Book, Valuation Gap, Clients, Business Divisions etc. I'll compile each and every small detail about this company

In this detailed thread 🧵 I've look and analyse TALBROS AUTOMATIVE COMPONENTS Business, Fundamentals, Technicals, Financials, Product Mix, Management, CAPEX, Order Book, Valuation Gap, Clients, Business Divisions etc. I'll compile each and every small detail about this company

Giants like Abbott Ltd, Alembic Pharmaceutical, Cipla India, Deys Medical Stores, Meyer organics Ltd, Phizer India etc are its Clients

Giants like Abbott Ltd, Alembic Pharmaceutical, Cipla India, Deys Medical Stores, Meyer organics Ltd, Phizer India etc are its Clients

Patience to the utmost level💯💯

Patience to the utmost level💯💯

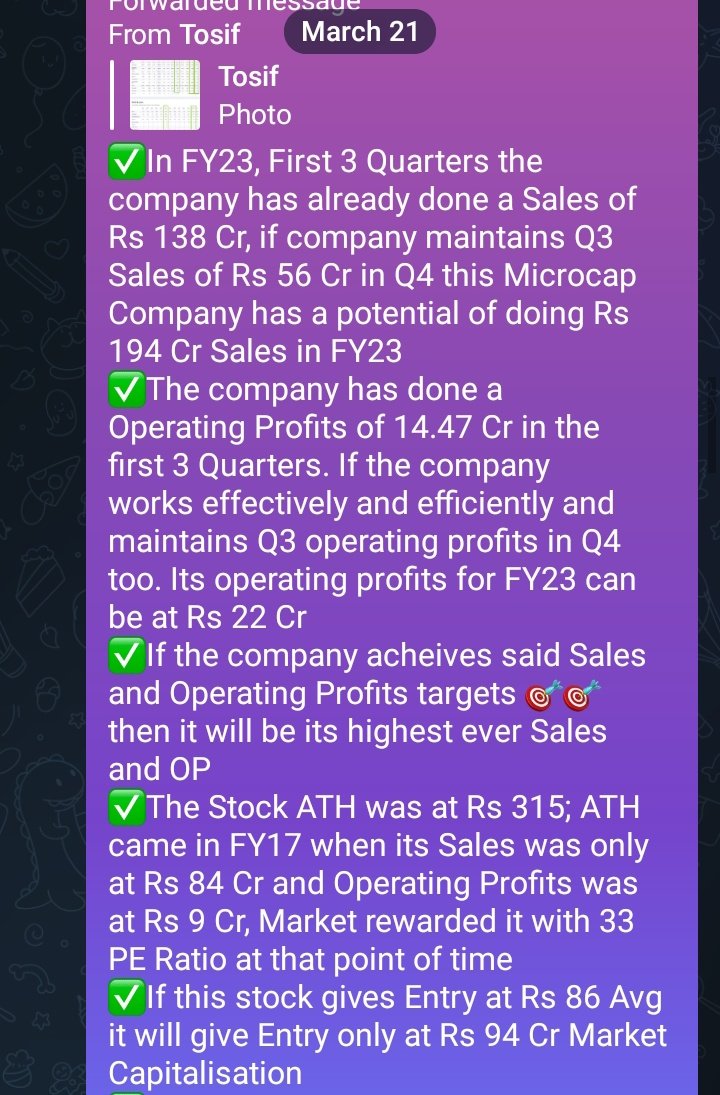

✅Prima Plastics was a 21st March set-up from the Microcap Space🧢🌌

✅Prima Plastics was a 21st March set-up from the Microcap Space🧢🌌

✅In its Second Cycle:- From Oct-2013 to October-2017. Chennai Petroleum went from Rs 51 to Rs 480(9 Baggers)

✅In its Second Cycle:- From Oct-2013 to October-2017. Chennai Petroleum went from Rs 51 to Rs 480(9 Baggers)

🎖️About The Company

🎖️About The Company

✅Shared Management Commentry about Cigniti Technologies on 28th October 2022.

✅Shared Management Commentry about Cigniti Technologies on 28th October 2022.

Individual stocks cracked 10-15%

Individual stocks cracked 10-15%

Last not the least I'll give my overall thesis about this stock.

Last not the least I'll give my overall thesis about this stock.