Want to learn investing from scratch? 🤔

Here is the 2nd part of our series on Fundamental Analysis📈

Let’s learn about Revenue, Cost, Taxes, EPS and many more

Let's understand a Profit & Loss Account

A thread 🧵👇 #LearnwithICICIDirect

Here is the 2nd part of our series on Fundamental Analysis📈

Let’s learn about Revenue, Cost, Taxes, EPS and many more

Let's understand a Profit & Loss Account

A thread 🧵👇 #LearnwithICICIDirect

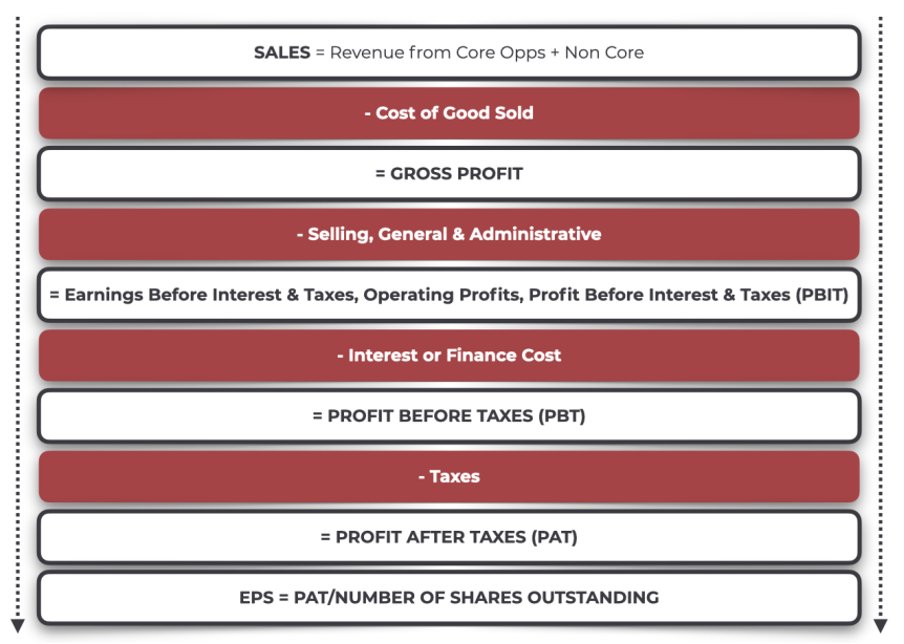

[A] What is Profit & Loss Account (P&L)?

🔶It is a statement of Company's Revenue, Cost & Profitability

🔶Simply, it's a snapshot of what Company earns and how it spends money

🔶It is prepared for the specific period

🔶Also known as Income Statement

Check out the image👇

🔶It is a statement of Company's Revenue, Cost & Profitability

🔶Simply, it's a snapshot of what Company earns and how it spends money

🔶It is prepared for the specific period

🔶Also known as Income Statement

Check out the image👇

[B] What are the Components of BS?

🔶Income: How much the company earns

🔶Expenses: How much the company spends

🔶Profit/Loss: Net earning of the Company

Mathematically,

Income - Expenses = Profit/Loss

Let's understand in detail

Contd.

Check out below image 👇

🔶Income: How much the company earns

🔶Expenses: How much the company spends

🔶Profit/Loss: Net earning of the Company

Mathematically,

Income - Expenses = Profit/Loss

Let's understand in detail

Contd.

Check out below image 👇

Shown in the image is the simplified form of P&L A/c

It flows from Top to Bottom.

That's why Net profit is known as the Bottom line of the Company.

P&L also discloses EPS i.e. Earnings per share (Calculated as Net Profit/Total No. of Shares)

It flows from Top to Bottom.

That's why Net profit is known as the Bottom line of the Company.

P&L also discloses EPS i.e. Earnings per share (Calculated as Net Profit/Total No. of Shares)

[B.1] - Income

Income includes:

🔶Revenue from Operations i.e., Sales from Core business [Can be bifurcated into Sale of Products and Sale of Services]

🔶Other Income i.e., Income from non-operating activities such as dividend, Interest, Forex Gain/loss, etc.

Check image 👇

Income includes:

🔶Revenue from Operations i.e., Sales from Core business [Can be bifurcated into Sale of Products and Sale of Services]

🔶Other Income i.e., Income from non-operating activities such as dividend, Interest, Forex Gain/loss, etc.

Check image 👇

[B.2] - Expenses

Expenses are the costs that a business incurs to run the business

It includes:

🔶Cost of Material Used

🔶Salary to employees

🔶Interest

🔶Depreciation

🔶Taxes

🔶Advertisement Expense

🔶Commission

🔶Repairing Cost

🔶Other expenses

Check image below👇

Expenses are the costs that a business incurs to run the business

It includes:

🔶Cost of Material Used

🔶Salary to employees

🔶Interest

🔶Depreciation

🔶Taxes

🔶Advertisement Expense

🔶Commission

🔶Repairing Cost

🔶Other expenses

Check image below👇

[C] How it is prepared?

🔶Based on accrual accounting

🔶Prepared for a specific period

🔶With comparative figures

🔶Prepared Quarterly for listed companies

🔶Based on accrual accounting

🔶Prepared for a specific period

🔶With comparative figures

🔶Prepared Quarterly for listed companies

[D] How it is Used?

🔶To evaluate growth in Business

🔶To assess whether Co. made money or lost during the period

🔶Helps in gaining insights into financial Position of Co.

🔶Used for Calculating several ratios

🔶Further, it's used by several stakeholders for different purposes

🔶To evaluate growth in Business

🔶To assess whether Co. made money or lost during the period

🔶Helps in gaining insights into financial Position of Co.

🔶Used for Calculating several ratios

🔶Further, it's used by several stakeholders for different purposes

[E] Limitations of P&L A/C

P&L doesn't capture the entire picture always

E.g. it doesn't consider

🔶Loss of Valuable Employees

🔶Cash Realization of Profits

🔶Window dressing could be possible through several means

Let's understand Window dressing in detail 👇

Contd.

P&L doesn't capture the entire picture always

E.g. it doesn't consider

🔶Loss of Valuable Employees

🔶Cash Realization of Profits

🔶Window dressing could be possible through several means

Let's understand Window dressing in detail 👇

Contd.

[F] Window Dressing

Simply, it is a superficial or misleading presentation of F St. to create favourable impression

It includes methods such as:

🔶Revaluation of assets

🔶Heavy discount or commission to boost sales

🔶Changing the method of depreciation

🔶Sale and leaseback txn.

Simply, it is a superficial or misleading presentation of F St. to create favourable impression

It includes methods such as:

🔶Revaluation of assets

🔶Heavy discount or commission to boost sales

🔶Changing the method of depreciation

🔶Sale and leaseback txn.

Want us to keep doing this?

1. Follow us (@ICICI_Direct) and hit the bell icon🔔

2. Retweet this tweet

1. Follow us (@ICICI_Direct) and hit the bell icon🔔

2. Retweet this tweet

https://twitter.com/ICICI_Direct/status/1635891094482296835

TL;DR

[1] What is P&L A/c

[2] Components of P&L A/c

[3] What is Income

[4] What is Expense

[5] How P&L A/c is prepared

[6] How P&L A/c is used

[7] Limitations of P&L A/c

[8] What is Window dressing

[1] What is P&L A/c

[2] Components of P&L A/c

[3] What is Income

[4] What is Expense

[5] How P&L A/c is prepared

[6] How P&L A/c is used

[7] Limitations of P&L A/c

[8] What is Window dressing

Disclaimer: bit.ly/fulldisclaimer

• • •

Missing some Tweet in this thread? You can try to

force a refresh