1/ BREAKING - #Budget2023 🧵 is now live

Chancellor @Jeremy_Hunt is on his feet and starting to give his speech. I'll be tweeting live on anything related to NHS pensions in particular (& lots of changes expected so pay attention!)

Read to the end, & RT once you have!

Chancellor @Jeremy_Hunt is on his feet and starting to give his speech. I'll be tweeting live on anything related to NHS pensions in particular (& lots of changes expected so pay attention!)

Read to the end, & RT once you have!

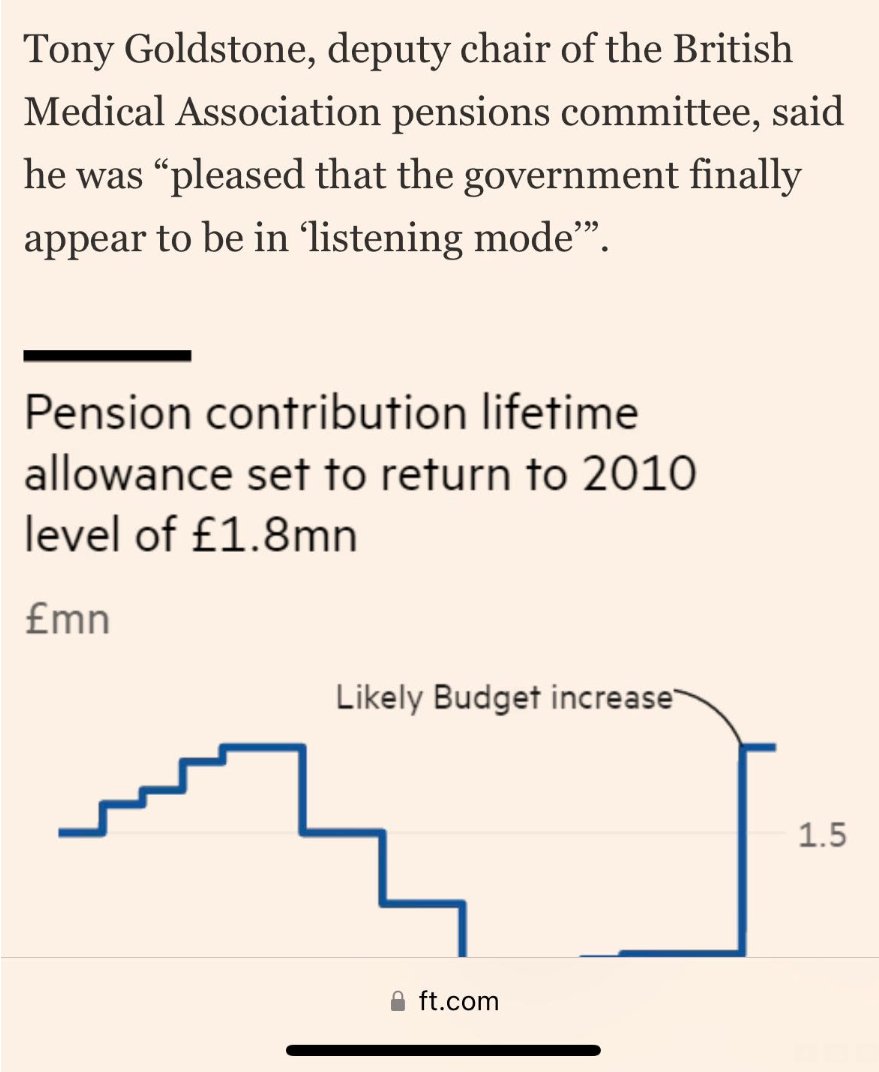

2/ There has been intense media speculation over the last week so we are expecting that will be movement on #pension taxation as per the headline of the @Telegraph yesterday.... so lets see what makes it to the FINAL budget 🍿

3/ Please make sure you read to the end

As with all of these things #TheDevilisInTheDetail, this 🧵 will expand during the chancellors speech, & finally detail will be added once the budget documents are added later this PM (including any required addenda as more detailed known)

As with all of these things #TheDevilisInTheDetail, this 🧵 will expand during the chancellors speech, & finally detail will be added once the budget documents are added later this PM (including any required addenda as more detailed known)

4/ 4/ States that the OBR now expects inflation to fall from 10.7% to to 2.9% by the end of 2023 (including measures to be announced). Clearly inflation has an important link to both pay and pensions (and pension taxation)

5/ References doctors retiring early [and makes excellent snipe at Matt Hancock]

6/ BREAKING:

✔️ The LIFETIME ALLOWANCE has been abolished

✔️ The LIFETIME ALLOWANCE has been abolished

7/ BREAKING🚨

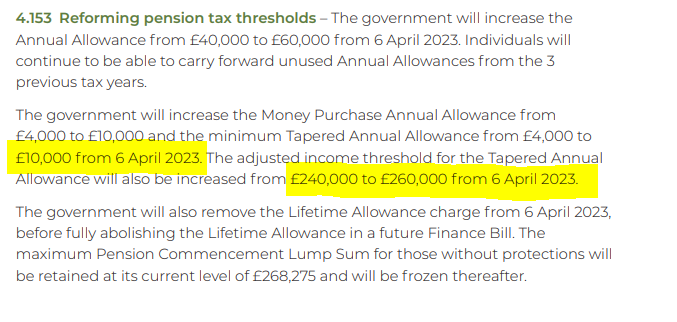

✔️ The (General) ANNUAL ALLOWANCE ⬆️ to £60k (previously £40k, peak £255k 10/11, excl. inflation, excl. tapering)

❓ Unknown [currently] whether INDEXATION will be restored (stopped 2011) to maintain the value of this (will update )

✔️ Good for NHS #Retention

✔️ The (General) ANNUAL ALLOWANCE ⬆️ to £60k (previously £40k, peak £255k 10/11, excl. inflation, excl. tapering)

❓ Unknown [currently] whether INDEXATION will be restored (stopped 2011) to maintain the value of this (will update )

✔️ Good for NHS #Retention

8/ BREAKING🚨

❌ Taper ANNUAL ALLOWANCE remains (still an issue for some medics)

❌ Threshold income remains at £200k

• Adjusted income assumed to increase to £260 (i.e. threshold plus general AA)

✔️ Minimum tapering RESTORED to prior level of £10k

❌ Still bad for #Retention

❌ Taper ANNUAL ALLOWANCE remains (still an issue for some medics)

❌ Threshold income remains at £200k

• Adjusted income assumed to increase to £260 (i.e. threshold plus general AA)

✔️ Minimum tapering RESTORED to prior level of £10k

❌ Still bad for #Retention

9/ BREAKING🚨:

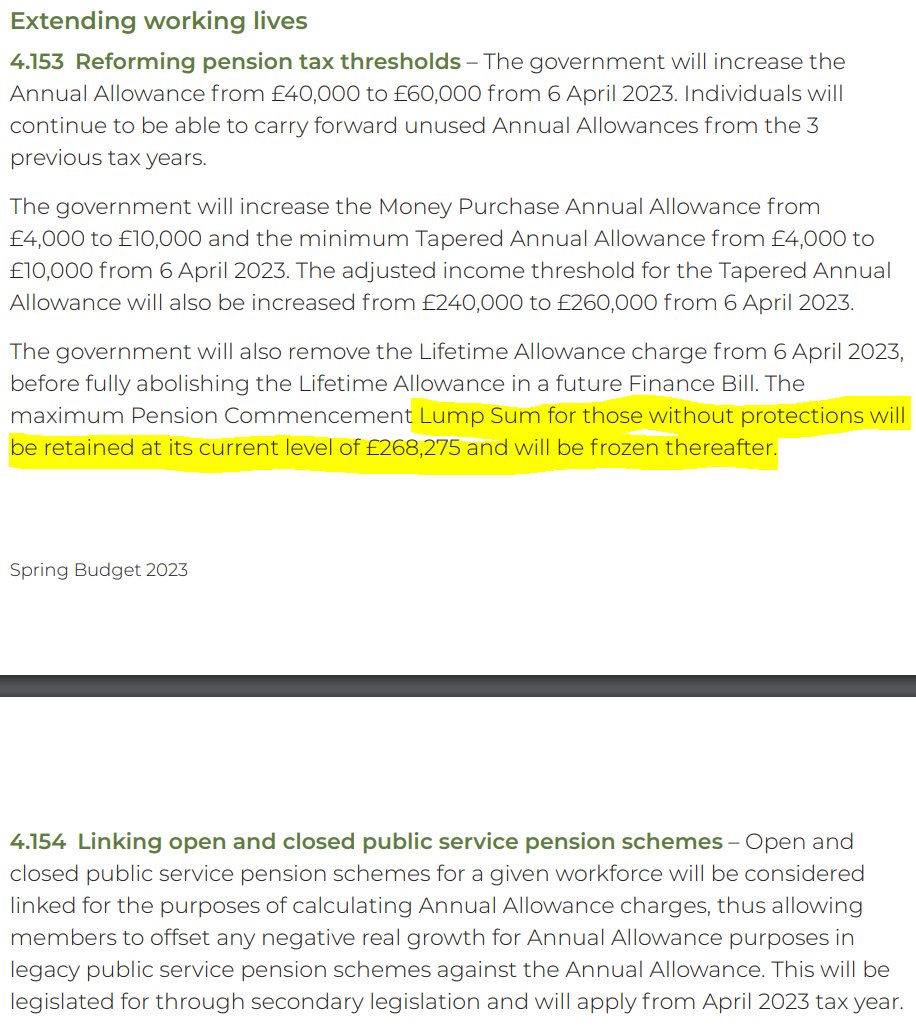

✔️ Government *finally* does something to #FixNegativePIAs

✔️ Negative growth in one scheme (i.e. 1995 benefits) can be combined with positive growth in 2015 so only *real* growth above inflation measured

✔️ Government *finally* does something to #FixNegativePIAs

✔️ Negative growth in one scheme (i.e. 1995 benefits) can be combined with positive growth in 2015 so only *real* growth above inflation measured

10/ ❌ Negative overall growth cannot be carried forwards / backwards which is disappointing

✔️ Overall big win for #Retention

❌ Will continue to campaign for a more substantive fix incl. Carry forward/back to help anomalies with salary sacrifice, temporary promotion etc

✔️ Overall big win for #Retention

❌ Will continue to campaign for a more substantive fix incl. Carry forward/back to help anomalies with salary sacrifice, temporary promotion etc

12/ SUMMARY so far

✔️AA⬆️to £60k (prior £40k)

❌? AA indexed to keep value

✔️LTA Abolished

✔️Good but partial fix to #FixNegativePIAs (no carry forward/back)

❌Taper remains but

✔️⬆️Adjusted £260k (prior £240k)

✔️⬆️Min £10k (prior £4k)

✔️AA⬆️to £60k (prior £40k)

❌? AA indexed to keep value

✔️LTA Abolished

✔️Good but partial fix to #FixNegativePIAs (no carry forward/back)

❌Taper remains but

✔️⬆️Adjusted £260k (prior £240k)

✔️⬆️Min £10k (prior £4k)

14/ Confirmation about changes to #taper

❌Taper remains but

✔️⬆️Adjusted £260k (prior £240k)

✔️⬆️Min £10k (prior £4k)

❌Taper remains but

✔️⬆️Adjusted £260k (prior £240k)

✔️⬆️Min £10k (prior £4k)

15/ Last but by no means least, today's significant progress is in no small part due to lots of work in the background- many people working v. hard on this especially staff & other elected members @BMA_Pensions & extensive engagement with @hmtreasury for which we are grateful

16/ And of course a huge thanks to many thousands of @The_BMA members have taken part in campaigns, consultations, written to MPS etc- which has been hugely influential, as well as numerous grass root campaigners who have been fighting this for many years. Thank you

17/ Today’s announcements are probably the most significant changes since I wrote this @FT letter in 2019. They will take many NHS staff out of AA, LTA is in the bin, but tapering still remains & so does AA. But definitely a lot to be thankful for, so thankyou @Jeremy_Hunt

18/ Addendum: Though lifetime allowance has been abolished from 6th April 2023, the tax free lump sum will be frozen at a limit based on the existing LTA and not indexed (which is a shame)

Anyone who is >LTA & retiring between today and 5th April 23 might want to review that

Anyone who is >LTA & retiring between today and 5th April 23 might want to review that

19/ Addendum 2 - More important technical details added today by government on LTA protections (this only applies to people who already hold valid LTA protections before 15th March 23), can accrue pension from 6th April 23 w/o losing it for TFLS

• • •

Missing some Tweet in this thread? You can try to

force a refresh