Credit Suisse is in crisis.

What went wrong? So, so much.

🧵 Let’s take a look

What went wrong? So, so much.

🧵 Let’s take a look

We *just* learned that #SVB’s downfall was announcing it was raising equity without having buyers lined up, says @matt_levine.

So why would Credit Suisse’s biggest shareholder announce they would “absolutely not” put more money into the embattled bank? trib.al/aS9oy3I

So why would Credit Suisse’s biggest shareholder announce they would “absolutely not” put more money into the embattled bank? trib.al/aS9oy3I

After Saudi National Bank ruled out providing more assistance, #CreditSuisse closed down 24% at 1.697 Swiss francs per share, its lowest closing price on record trib.al/nnFD2F8

Credit Suisse can withstand a lot more deposit outflows and serious interest rate stress — if clients and investors see it through, says @PaulJDavies bloomberg.com/opinion/articl…

Market chaos is spreading from Europe to the US.

⬇️ Follow along for all the latest news, market reaction and analysis bloomberg.com/news/live-blog…

⬇️ Follow along for all the latest news, market reaction and analysis bloomberg.com/news/live-blog…

Credit Suisse dropped as much as 30% today — a record low.

But the bank’s previous mishaps had already caused many clients to flee, says @jkarl26 bloomberg.com/opinion/articl…

But the bank’s previous mishaps had already caused many clients to flee, says @jkarl26 bloomberg.com/opinion/articl…

POV: Your largest shareholder tells the world they’re not going to support you anymore 🙃

Imagine the utter betrayal Credit Suisse is feeling right now…

🎥 @jkarl26 breaks it down

Imagine the utter betrayal Credit Suisse is feeling right now…

🎥 @jkarl26 breaks it down

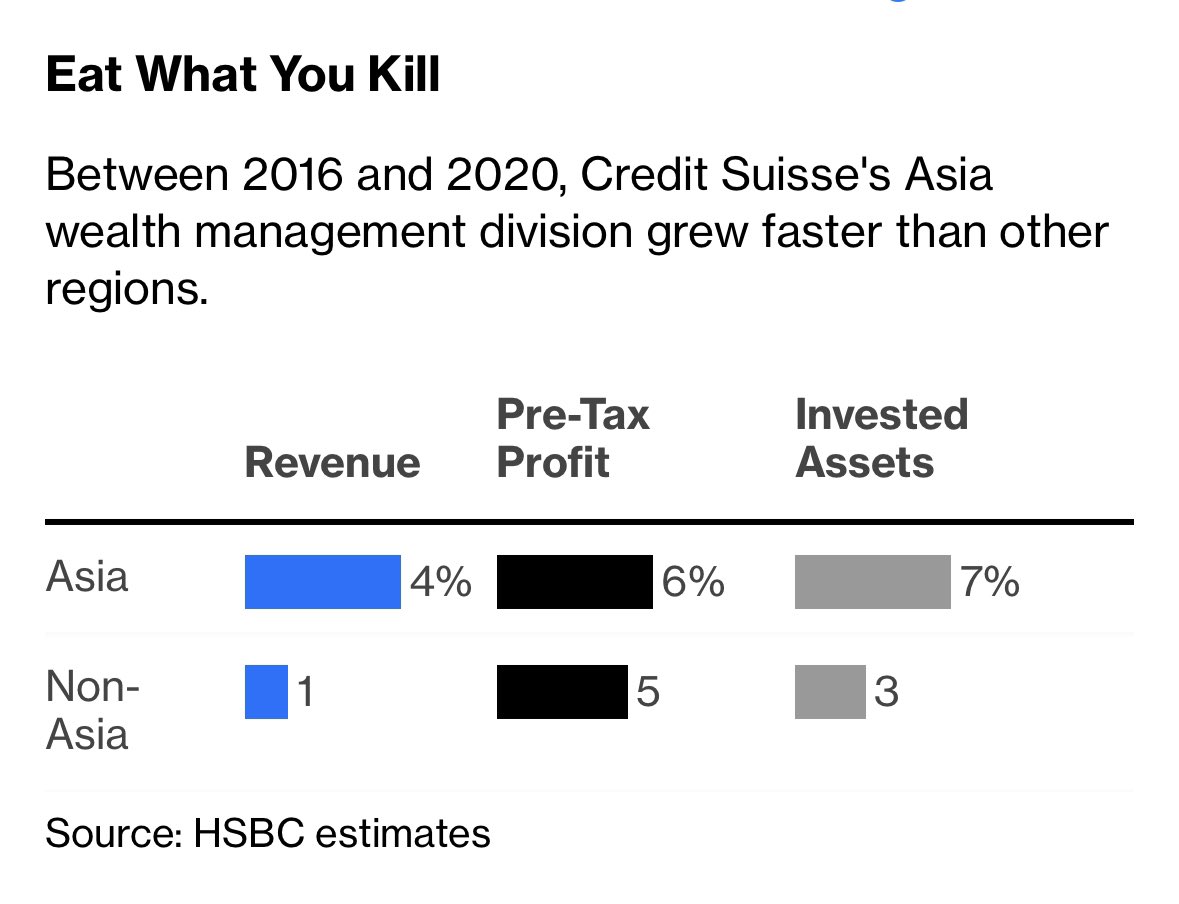

Credit Suisse can no longer brand itself as a global wealth manager without its rich Asians, says @shuli_ren bloomberg.com/opinion/articl…

Credit Suisse has been thrown a $54 billion lifeline.

So can the bank stay independent?

🎥 @PaulJDavies explores bloomberg.com/opinion/articl…

So can the bank stay independent?

🎥 @PaulJDavies explores bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh