STARTING NOW: Spring Budget 2023 IFS analysis

Watch our overnight analysis of yesterday's #Budget2023 here:

Watch our overnight analysis of yesterday's #Budget2023 here:

.@PJTheEconomist opens our event with his opening remarks, followed by four presentations on the public finances and public spending, tax changes, the changes to Universal Credit and disability benefits and childcare changes.

Watch live here:

Watch live here:

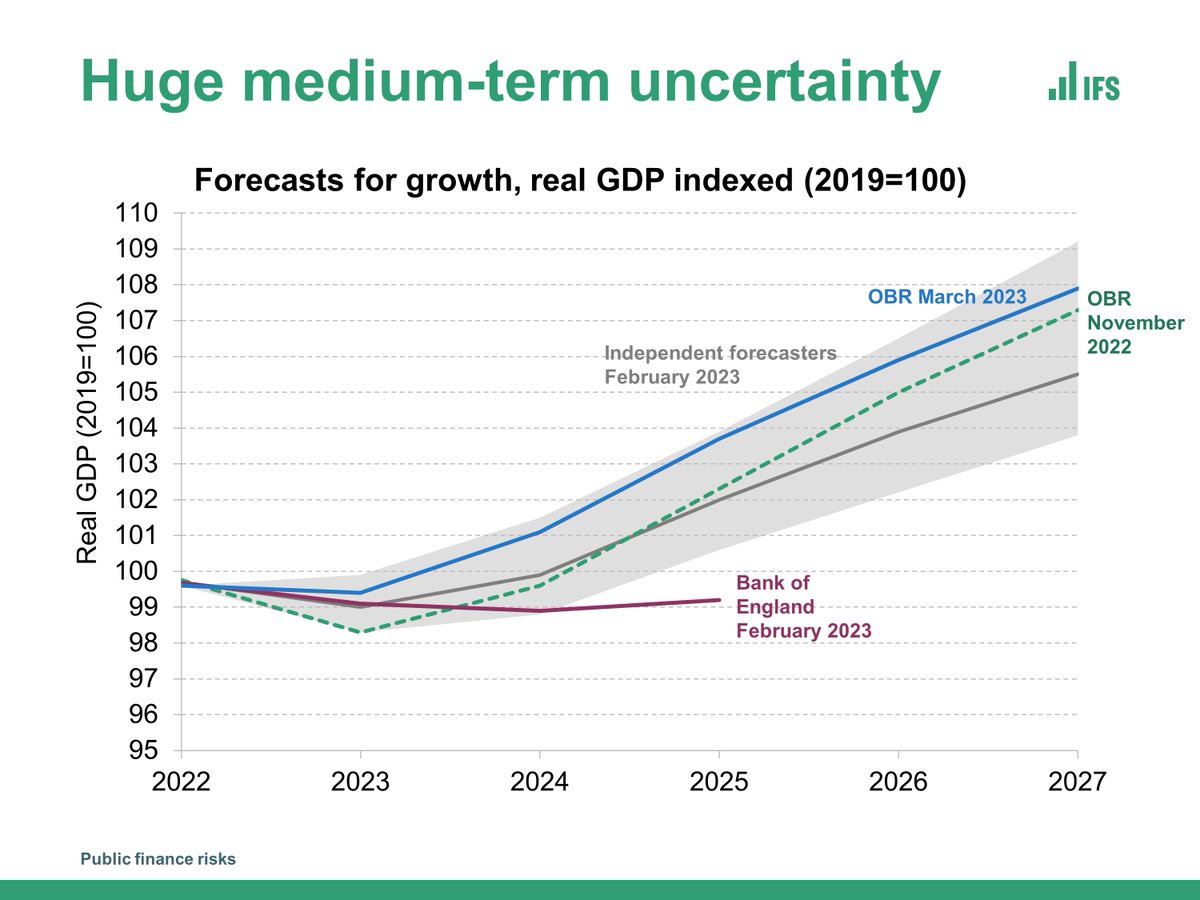

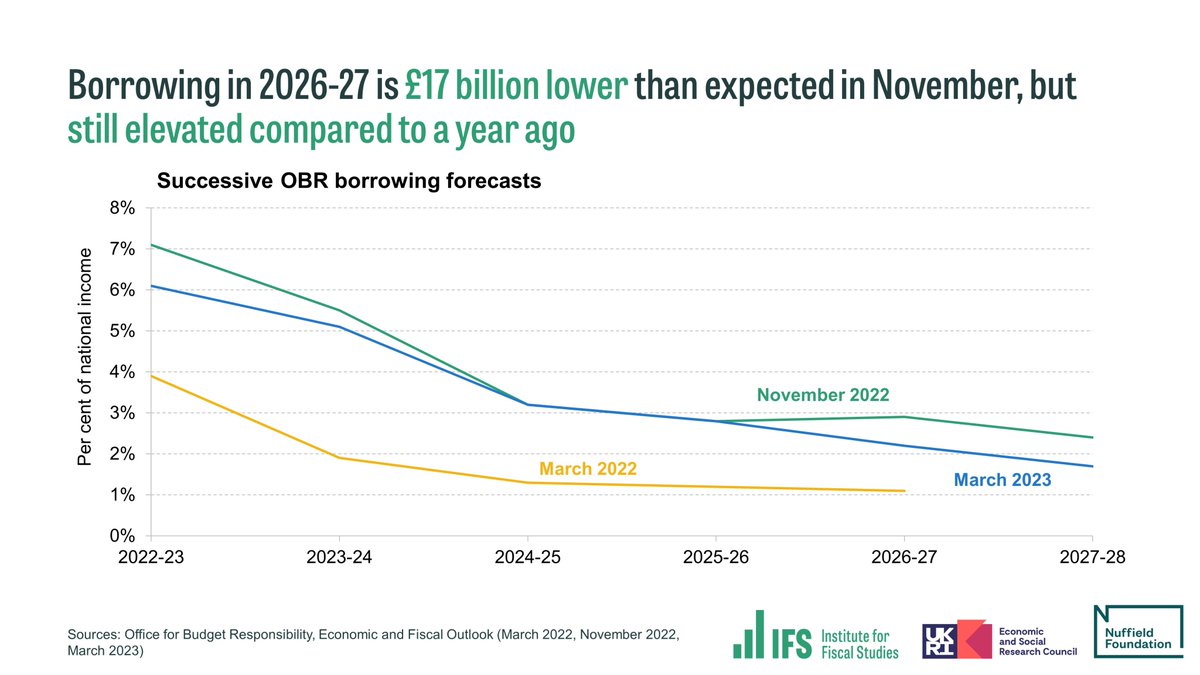

@PJTheEconomist: “The overall outlook for the public finances still looks difficult.”

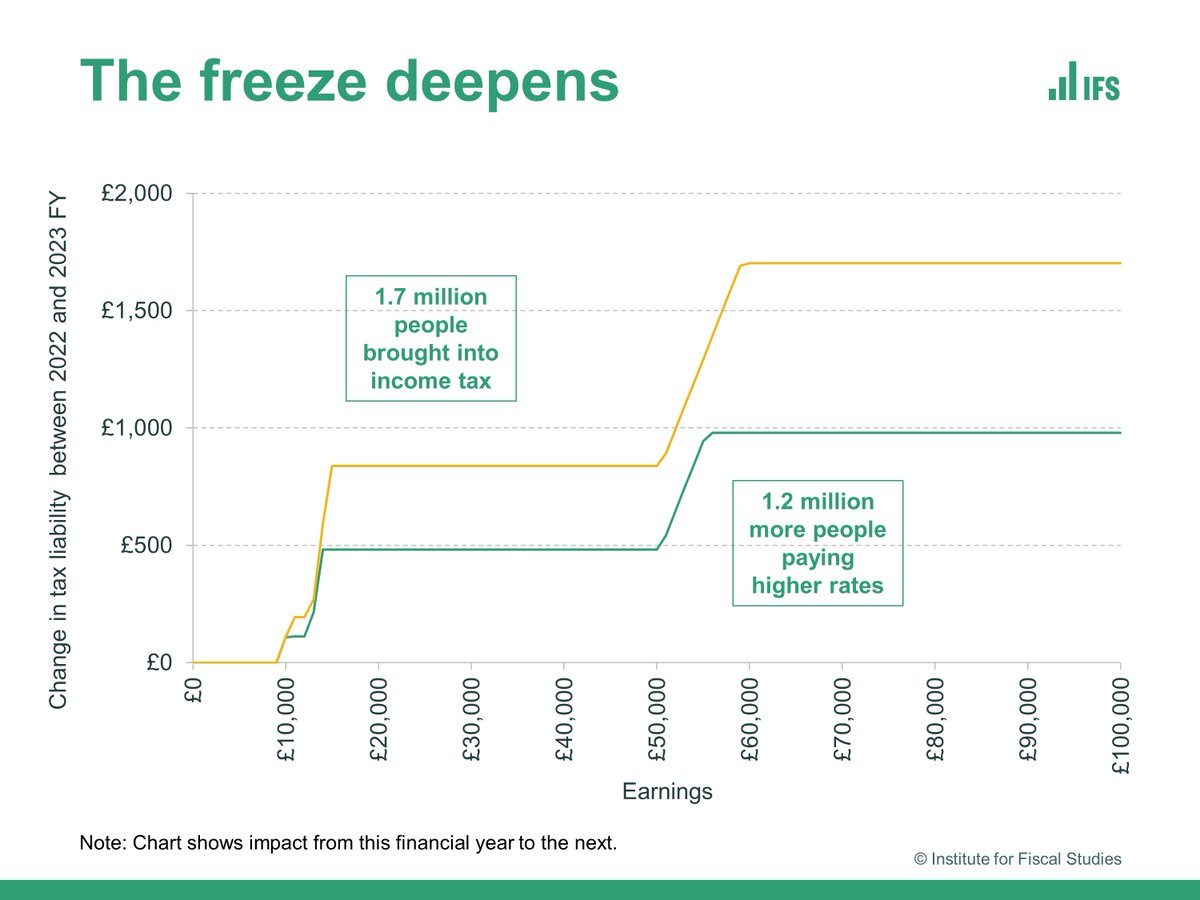

“Tax continues to rise to its highest ever level,” but “even with very tight spending pencilled in from 2024, debt is barely falling.”

#Budget2023

“Tax continues to rise to its highest ever level,” but “even with very tight spending pencilled in from 2024, debt is barely falling.”

#Budget2023

“Mr Hunt was hemmed in by his own fiscal target to get debt falling in the last year of the forecast period.”

“This is not a terribly sensible way of being guided by such [fiscal] rules.” @PJTheEconomist

“This is not a terribly sensible way of being guided by such [fiscal] rules.” @PJTheEconomist

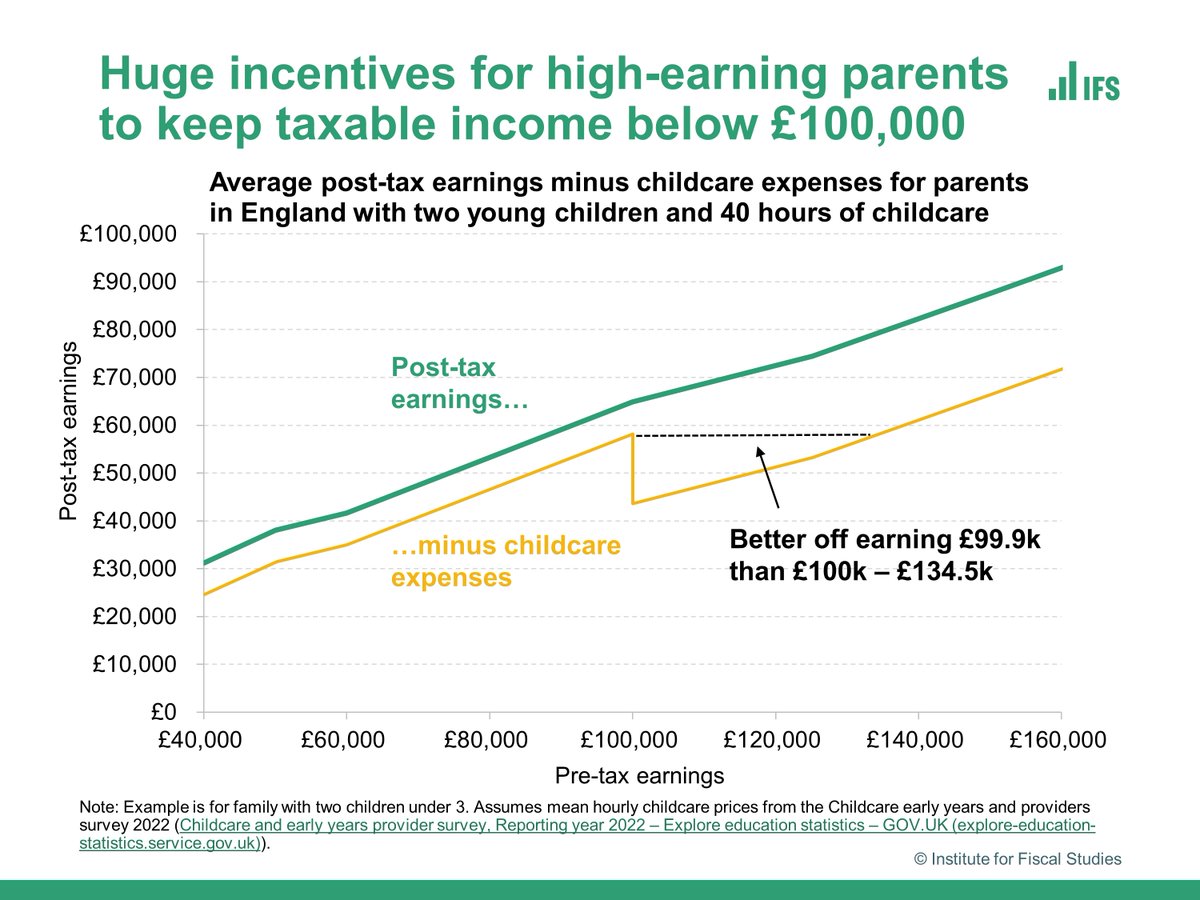

.@PJTheEconomist says that the changes to childcare announced yesterday will make this "one of the few budgets that will be remembered in ten years time."

There is an “overwhelming focus on providing childcare to working families to reduce their costs and allow more parents to work,” notes @PJTheEconomist.

A “big shift from spending on poor children to a universal offer for those with working parents.”

#Budget2023

A “big shift from spending on poor children to a universal offer for those with working parents.”

#Budget2023

The lack of coherent strategy on pension tax “remains deeply disappointing.”

"There is a case for allowing people to save more in a pension, even if those who gain will generally be on high incomes", but the overgenerous aspects of pension taxation weren't fixed –@PJTheEconomist

"There is a case for allowing people to save more in a pension, even if those who gain will generally be on high incomes", but the overgenerous aspects of pension taxation weren't fixed –@PJTheEconomist

@PJTheEconomist – "There has been a complete lack of apparent long-term strategy is corporation tax.”

“Government needs to learn that stability and consistent long-term strategy are vital for companies looking to invest and therefore for securing better living standards.”

“Government needs to learn that stability and consistent long-term strategy are vital for companies looking to invest and therefore for securing better living standards.”

“The pretence that fuel duties will always rise next year, when they never rise this year, is becoming increasingly wearisome," says @PJTheEconomist.

"It makes a bit of a nonsense of the fiscal forecasts if you can't even undo a supposedly temporary 5p a litre cut to duty.”

"It makes a bit of a nonsense of the fiscal forecasts if you can't even undo a supposedly temporary 5p a litre cut to duty.”

“There was no discussion of public spending.”

But we’re now going to spend more on childcare and defence, meaning “real spending plans are even tighter than announced in November.” @PJTheEconomist

#Budget2023

But we’re now going to spend more on childcare and defence, meaning “real spending plans are even tighter than announced in November.” @PJTheEconomist

#Budget2023

.@PJTheEconomist – "We can’t keep cutting the pay of teachers, nurses and civil servants, both in real terms and relative to the private sector, without consequences for recruitment, retention and service delivery."

"Money will have to be found from somewhere.”

#Budget2023

"Money will have to be found from somewhere.”

#Budget2023

"The argument that this is not affordable founders on the fact that Mr Hunt found £20 billion a year yesterday for other things," @PJTheEconomist says on public sector pay deals.

"This is a question of choices and priorities."

#Budget2023

"This is a question of choices and priorities."

#Budget2023

• • •

Missing some Tweet in this thread? You can try to

force a refresh