🧵1/Ω

Let's talk about Metropolitan Community Bank (@MCBankNY, $MCB) one of the remaining publicly traded "crypto-friendly banks. Because the SEC filings look a lot like a mini-me version of our friend $SBNY.

Cash position down 90% YoY 👇

Let's talk about Metropolitan Community Bank (@MCBankNY, $MCB) one of the remaining publicly traded "crypto-friendly banks. Because the SEC filings look a lot like a mini-me version of our friend $SBNY.

Cash position down 90% YoY 👇

🧵2/Ω

$MCB has $2.2 billion - 42%! - in uninsured, non-interest bearing accounts.

In other words someone is willing to set $132 million a year on 🔥 because of inflation just to hold money in $MCB.

Why?

(note that $SIVB and $SBNY also had large non-interest bearing accounts)

$MCB has $2.2 billion - 42%! - in uninsured, non-interest bearing accounts.

In other words someone is willing to set $132 million a year on 🔥 because of inflation just to hold money in $MCB.

Why?

(note that $SIVB and $SBNY also had large non-interest bearing accounts)

🧵3/Ω

$MCB also of course has large unrecognized losses due to the "duration mismatch" problem that rekt $SI and $SIVB ¹.

¹ though other things rekt $SIVB even more...

$MCB also of course has large unrecognized losses due to the "duration mismatch" problem that rekt $SI and $SIVB ¹.

¹ though other things rekt $SIVB even more...

🧵4/Ω

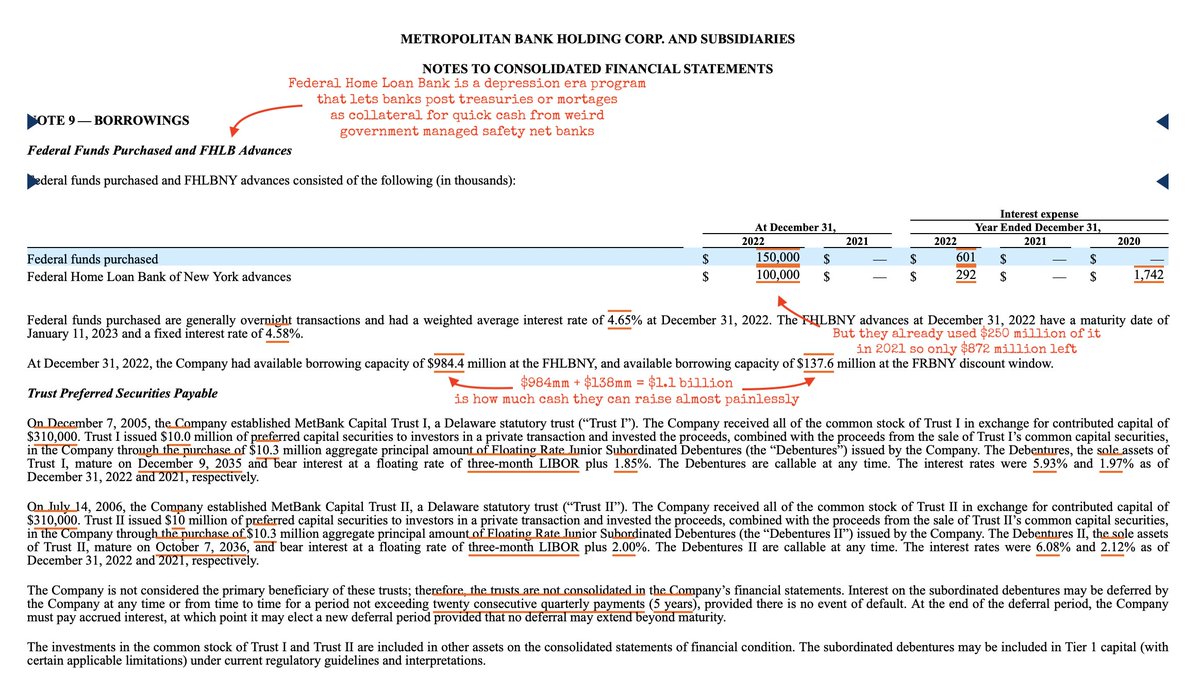

Also just like $SI and $SBNY, $MCB has started tapping its advances from the Federal Home Loan Bank system (#FHLB). However $MCB isn't primarily a residential lender and has less borrowing power.

Also just like $SI and $SBNY, $MCB has started tapping its advances from the Federal Home Loan Bank system (#FHLB). However $MCB isn't primarily a residential lender and has less borrowing power.

🧵5/Ω

The critical $MCB numbers that are Not Good:

➤ $5.3 bn in deposits

➤ $5.2 bn in high flight risk deposits (!)

➤ $2.2 bn in **extremely** high flight risk deposits

vs.

➤ $257 mm cash

➤ $872 mm advance available from #FHLB

You see the problem here?

The critical $MCB numbers that are Not Good:

➤ $5.3 bn in deposits

➤ $5.2 bn in high flight risk deposits (!)

➤ $2.2 bn in **extremely** high flight risk deposits

vs.

➤ $257 mm cash

➤ $872 mm advance available from #FHLB

You see the problem here?

@MCBankNY Oops typo - should say $250mm instead of $230mm in $MCB deposits. Doesn't make a huge diff.

$MCB

@beefwellingtoni @NotChaseColeman @DanielFCelsius @MikeBurgersburg @AlderLaneEggs @AureliusValue @schwab_clarence @leomschwartz @TheKeithLarsen @thebankerislaw @JohnCarreyrou @thebankerislaw @thebankzhar @bank_reg @otteroooo @CasPiancey @BennettTomlin @HiddenPivots

@beefwellingtoni @NotChaseColeman @DanielFCelsius @MikeBurgersburg @AlderLaneEggs @AureliusValue @schwab_clarence @leomschwartz @TheKeithLarsen @thebankerislaw @JohnCarreyrou @thebankerislaw @thebankzhar @bank_reg @otteroooo @CasPiancey @BennettTomlin @HiddenPivots

🧵6/Ω And this is **before** we even start talking about the fact that $MCB is the bank for #CryptoCom, which is a giant scam whose € bank accounts were already seized for money laundering.

https://mobile.twitter.com/Cryptadamist/status/1634250964914806798

🧵7/Ω Unfortunately for $MCB scam companies run by money launderers (#CryptoCom) have a habit of wiring all the money out as soon as feds start sniffing around.

We saw this with $SBNY... $17bn wired out at last minute. $1bn of $TUSD backing to #CapitalUnionBank in The Bahamas.

We saw this with $SBNY... $17bn wired out at last minute. $1bn of $TUSD backing to #CapitalUnionBank in The Bahamas.

🧵8/Ω One more $MCB thing I just noticed: as of Dec. 31th the bank had $257 million in cash and $250 million in advances from the #FHLB.

So 97% of cash $MCB has on hand is from a government program to support home loans for the middle class.

Remind you of anyone? (hint: $SI)

So 97% of cash $MCB has on hand is from a government program to support home loans for the middle class.

Remind you of anyone? (hint: $SI)

• • •

Missing some Tweet in this thread? You can try to

force a refresh