"in the land of the coins the man who makes it to dubai is king"

(often held in The Shadows of Bǟǟn by The Brothren, you may not see me tweet unless you 🔔)

How to get URL link on X (Twitter) App

🧵2/Ω

🧵2/Ωhttps://x.com/Timodc/status/1998387324833378744

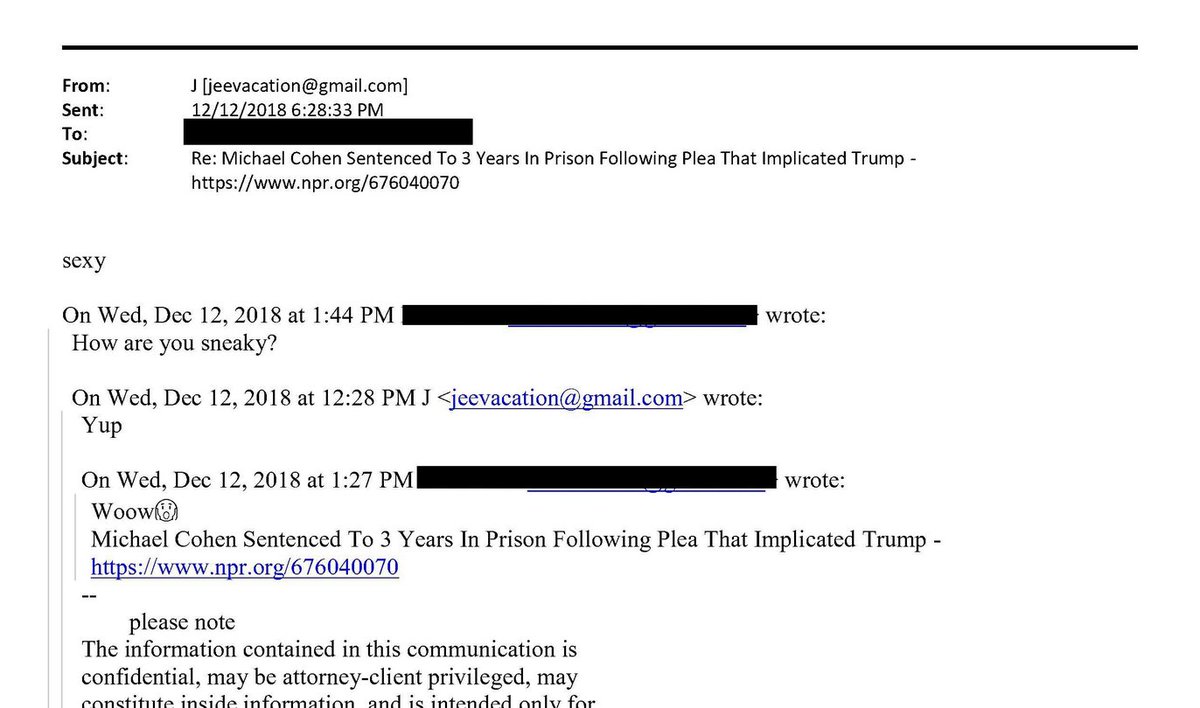

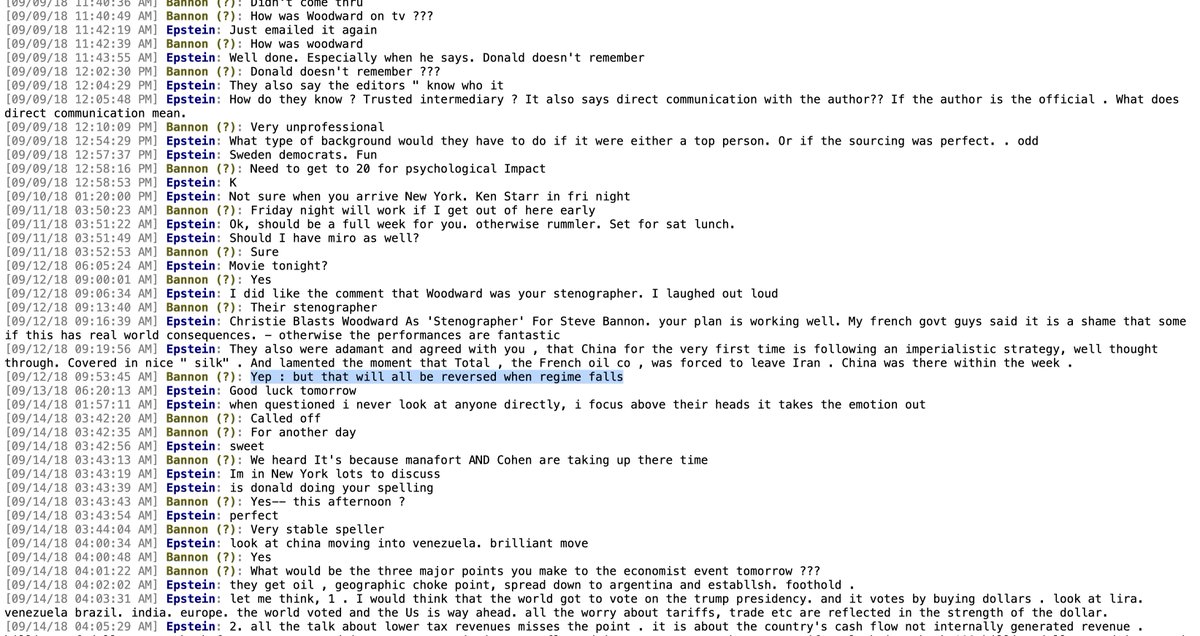

...to which epstein replies "sexy" #EpsteinFiles

...to which epstein replies "sexy" #EpsteinFiles

https://x.com/Cryptadamist/status/1989402347873997072

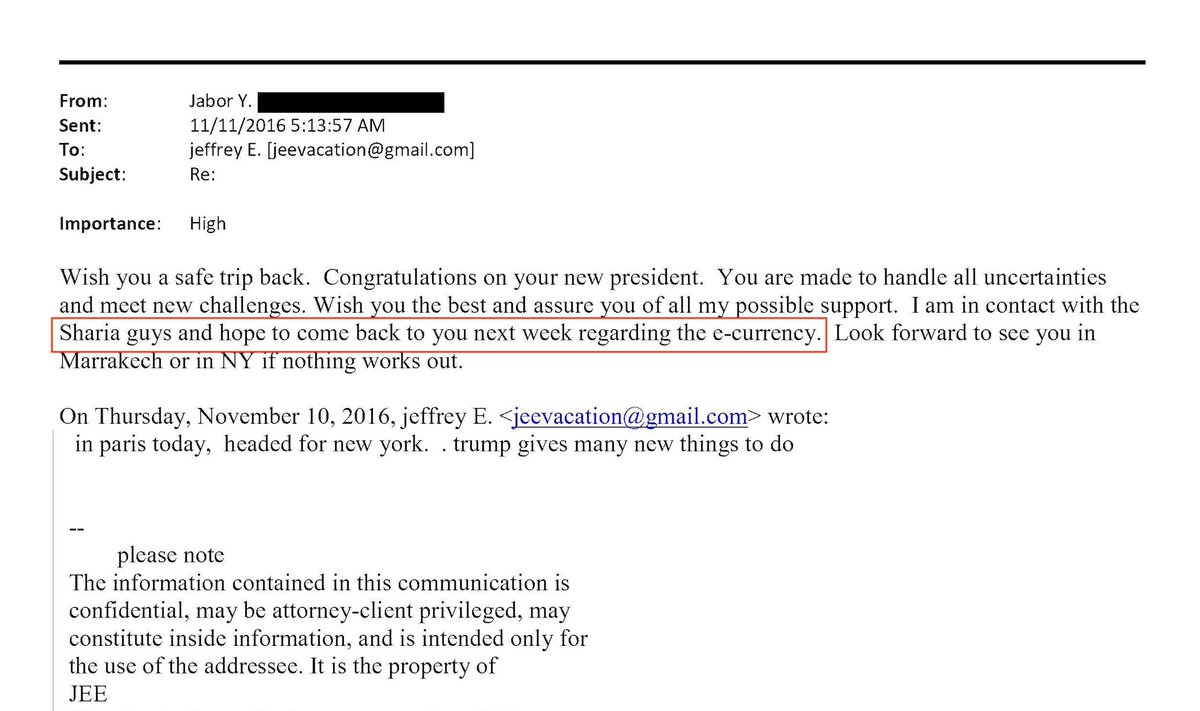

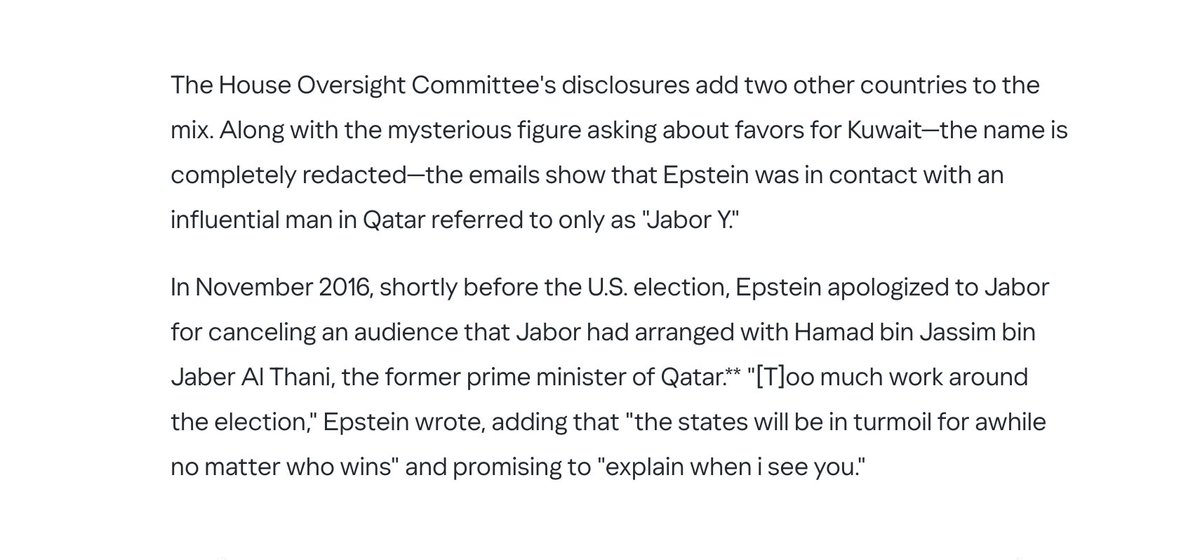

2/ maybe not actually a Qatari - @matthew_petti at @reason described the "Jabor Y" who was interested in "e-currency" as "an influential man in Qatar".

2/ maybe not actually a Qatari - @matthew_petti at @reason described the "Jabor Y" who was interested in "e-currency" as "an influential man in Qatar".

🧵2/Ω

🧵2/Ω

https://twitter.com/jbendery/status/1989362339360215440

🧵8/Ω

🧵8/Ω

🧵2/Ω

🧵2/Ωhttps://x.com/Cryptadamist/status/1948250031166722241

🧵2/Ω

🧵2/Ω

🧵2/Ω

🧵2/Ω

🧵2/Ω

🧵2/Ω

🧿2/Ω

🧿2/Ω https://twitter.com/WatcherGuru/status/1857091491341934972and if you think i'm exaggerating you haven't been paying attention. the taxpayer bailout of the crypto industry is already well underway.

🧵2/Ω

🧵2/Ωhttps://x.com/Cryptadamist/status/1851703115487248573🧵2/Ω

https://x.com/Cryptadamist/status/1851683989154861500

https://twitter.com/tier10k/status/1851716488157155501i find it at least curious that this announcement of such a massive capital raise came just a few days after we got confirmation that the Treasury Dept is considering freezing Tether's assets and the DOJ is investigating them...

https://x.com/WuBlockchain/status/1851089618604851515

https://twitter.com/lauramandaro/status/1765143052908429797

2/ Funds were in accounts labeled as "Deciens Chipper Cash SPV" 1-N. based on the total amount roughly matching the below tweet it seems like those funds somehow came from #Nigeria's government?

2/ Funds were in accounts labeled as "Deciens Chipper Cash SPV" 1-N. based on the total amount roughly matching the below tweet it seems like those funds somehow came from #Nigeria's government? https://x.com/TersectionMag/status/1636371890418905090

https://x.com/Cryptadamist/status/1839145478111293684🧵2/Ω

https://x.com/Cryptadamist/status/1839149431184093490

@Bitfinexed @myuzumaki_com @OccamiCrypto @tysgillies @BenFoldy @crypto1nfern0 @DesoGames @ParrotCapital 👆

@Bitfinexed @myuzumaki_com @OccamiCrypto @tysgillies @BenFoldy @crypto1nfern0 @DesoGames @ParrotCapital 👆

🧵2/Ω

🧵2/Ω

🧵2/Ω

🧵2/Ω

https://twitter.com/Cryptadamist/status/1717684442171379973🧵2/Ω