1/7 Few thoughts about the expansion of M0 that is not QE but seems like it could turn into it.

The #Fed has turned the spigots on BTFP. At first it looks like your traditional lender of last resort thing and backstop of credit.

The #Fed has turned the spigots on BTFP. At first it looks like your traditional lender of last resort thing and backstop of credit.

2/7 However, the nature of the "credit" to be backstopped is very unusual. #TSY. If this facility does not revert quickly, continues to grow beyond the panic, the conclusion? The Treasury and the Fed have fully merged. The #Fed is just another (North) LATAM central bank.

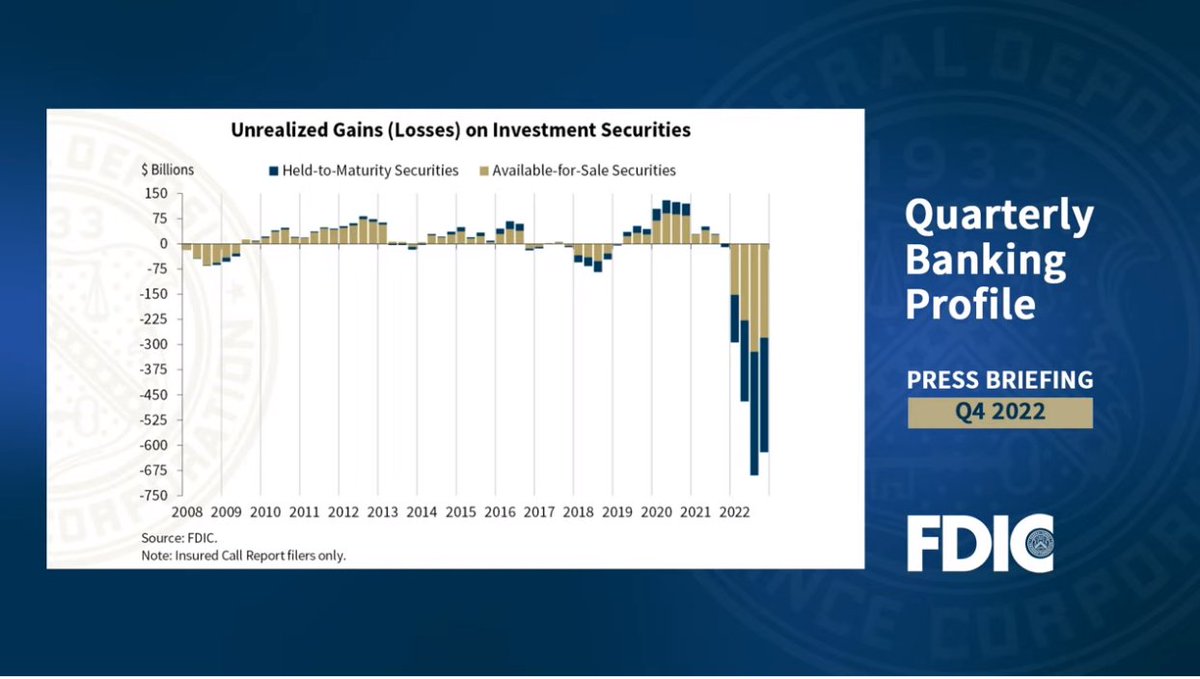

3/7 What is also means is the bond stuffing is starting to make the banking system wobble and TSY are puked by the banking system. Kemmerer mentioned in 1920 that TSY are unsuited to be in the banking system for various reasons.

4/7 It means the market wants to be compensated for the vagaries of the currency with higher rates, but it creates tension and a mismatch between the USD (M0 base at the Fed) with what is backing it, the #TSY.

5/7 If you can NOT afford to take losses from the left side of the balance sheet -#TSY by the price, you will take losses from the right side of the balance sheet, the value of USD M0. Hopefully this facility reverts post crisis, if not, we are in the full monetization path.

6/7 If the BTFP is extended post crisis, it would mean that the #Fed`s blurb for more than a decade of of ~fighting deflation- was just a blurb, monied capital does not create inflation, only means of circulation do. Just the a bond stuffing prelude to full blown monetization.

7/7 We are at a point where the market stops playing ball with the #Fed on absorption of gov bonds and narrative. We are moving close to revulsion. Not much time left for the Treasury and Congress to put their act together.

• • •

Missing some Tweet in this thread? You can try to

force a refresh