Connect the Financial dots unapologetically. Get your scouring dose of fin analysis, in big-data, w/ augmented web delivery ex hedgie 👇 get your free account

4 subscribers

How to get URL link on X (Twitter) App

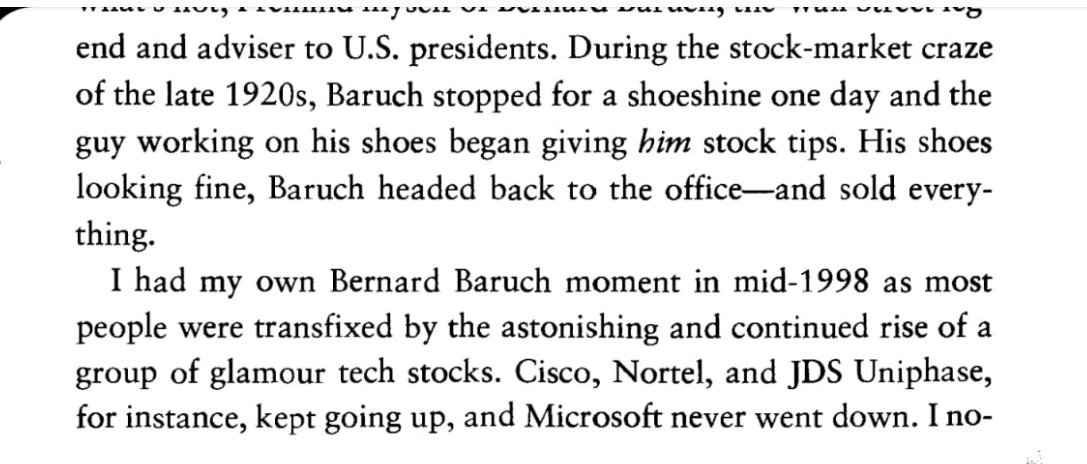

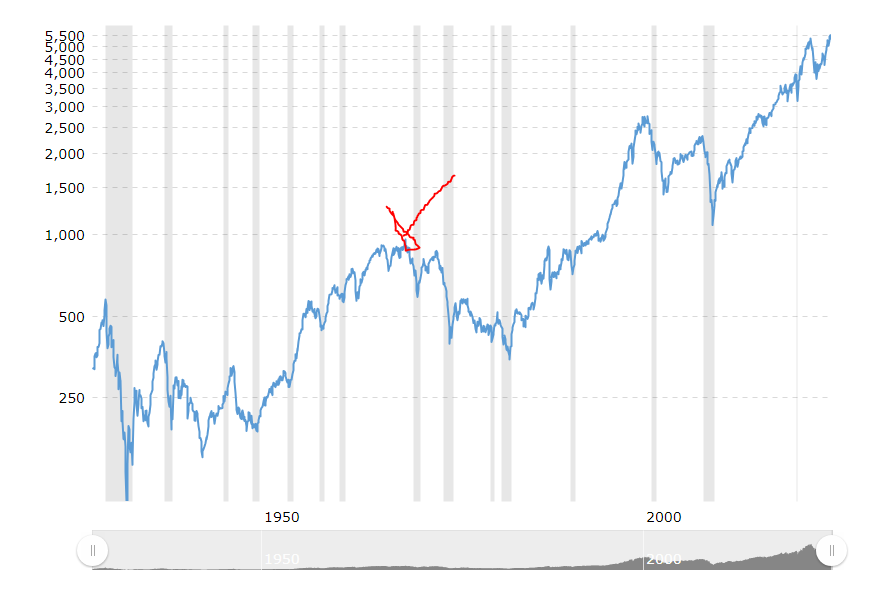

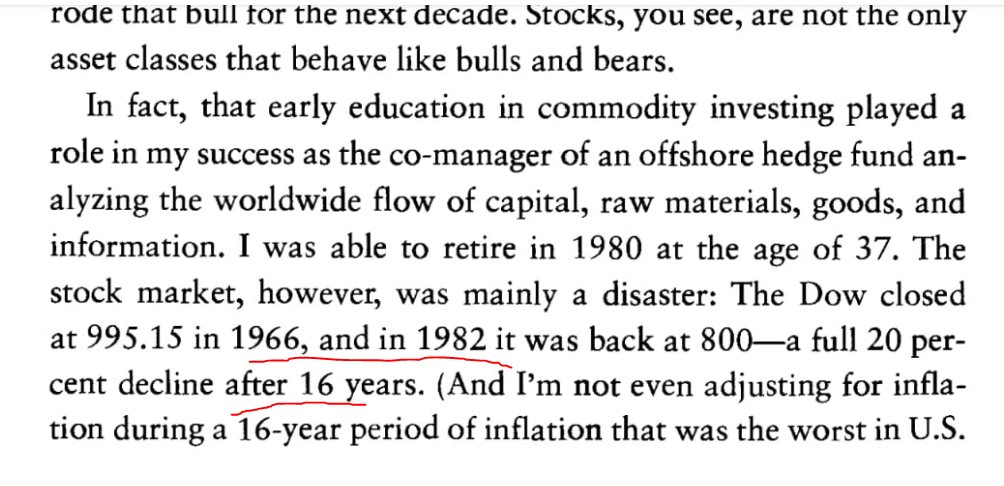

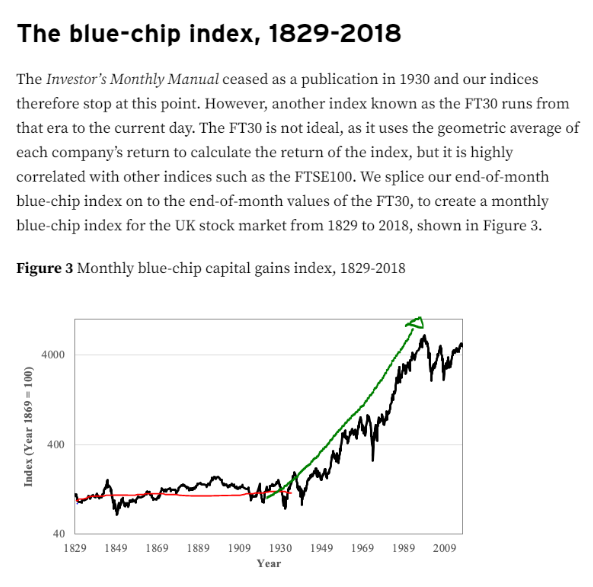

2/ Money market derangement is one type of abrupt bear market 1825-1873-1929-2008, none of the conditions for it are present today, but it does not mean you can't have a bear market. Inflationary bubble are a different beast.

2/ Money market derangement is one type of abrupt bear market 1825-1873-1929-2008, none of the conditions for it are present today, but it does not mean you can't have a bear market. Inflationary bubble are a different beast.

2/ Prior to 2007 you have a credit driven bubble in in Black in 1 Copper is getting more spec than Silver. There is no bullshit monetary premium because the Fed has not engaged in massive M0 expansion since 1933 more or less.

2/ Prior to 2007 you have a credit driven bubble in in Black in 1 Copper is getting more spec than Silver. There is no bullshit monetary premium because the Fed has not engaged in massive M0 expansion since 1933 more or less.

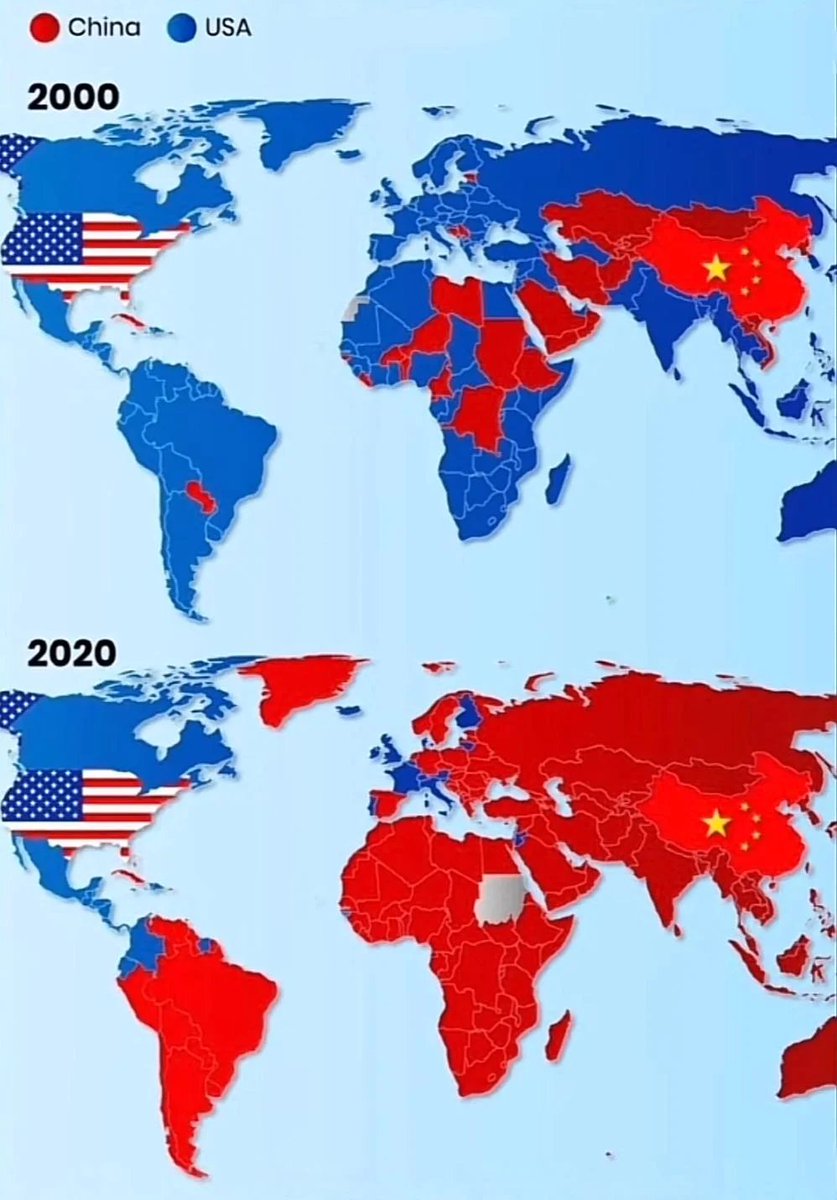

2/ This is well-explained by Rothbard (GraphFinancials are no Austrians, rather British Banking School, but Rothbard provided a detailed chronicle of the events). In 1925, GBP & USD were used as “FX as reserves” (reserve currency following the 1922 Genoa Convention's Article 9).

2/ This is well-explained by Rothbard (GraphFinancials are no Austrians, rather British Banking School, but Rothbard provided a detailed chronicle of the events). In 1925, GBP & USD were used as “FX as reserves” (reserve currency following the 1922 Genoa Convention's Article 9).

2/ The Fed pretends to have an inflation target but says it's too late if you wait for 2%.

2/ The Fed pretends to have an inflation target but says it's too late if you wait for 2%.

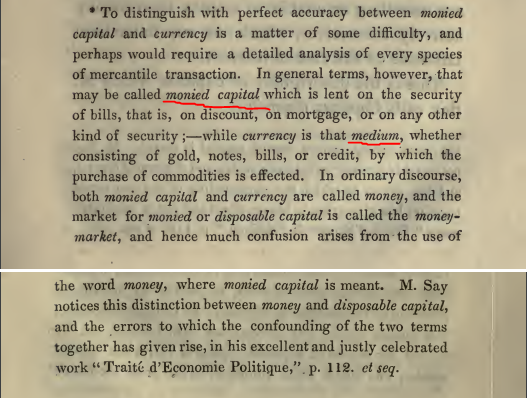

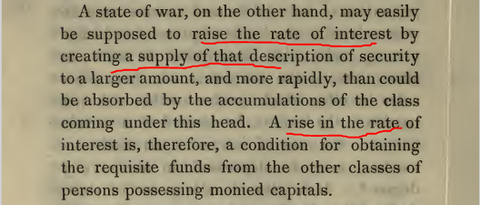

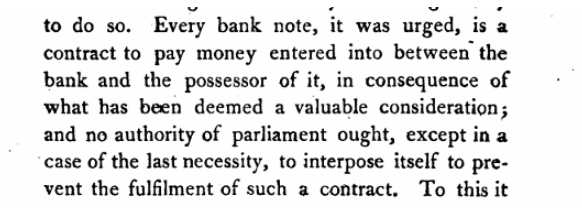

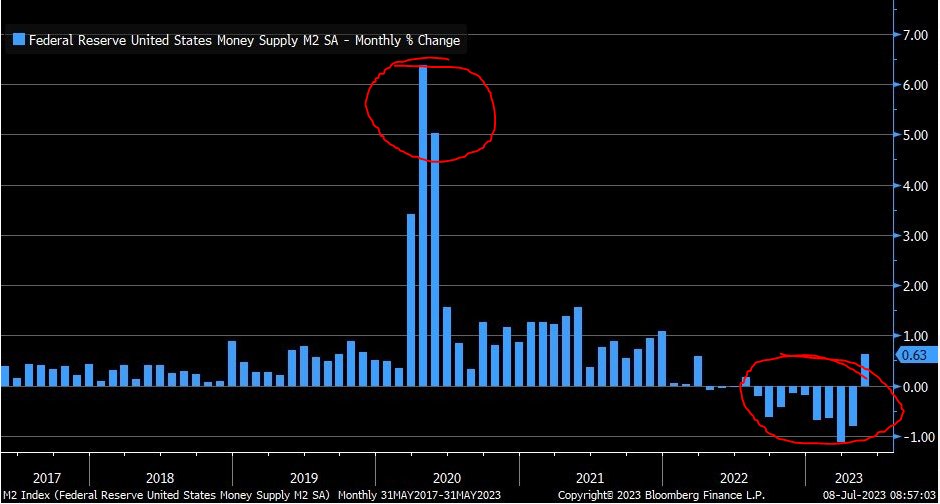

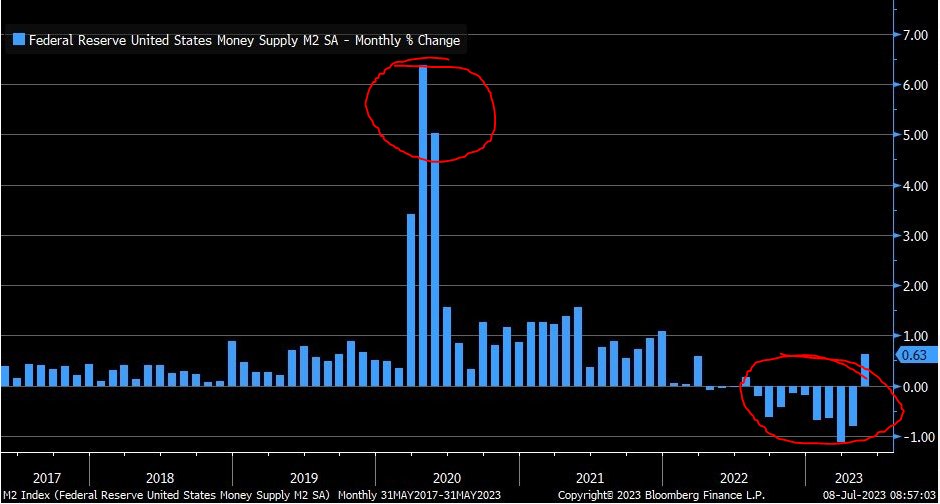

2/5 This is the difference between Monied Capital and Means of circulation both inside M2. Tooke definition.

2/5 This is the difference between Monied Capital and Means of circulation both inside M2. Tooke definition.