#Metallicus/#Proton🤡

"unsafe or unsound banking practices

and violations"..."attempted to conceal excessive bonus payments" - FDIC

🔴Metallicus forms FBBT Holdings

🔴FBBT Holdings intends to acquire the State Bank of Nauvoo (SBN)

Short🧵...

businesswire.com/news/home/2023…

"unsafe or unsound banking practices

and violations"..."attempted to conceal excessive bonus payments" - FDIC

🔴Metallicus forms FBBT Holdings

🔴FBBT Holdings intends to acquire the State Bank of Nauvoo (SBN)

Short🧵...

businesswire.com/news/home/2023…

In 2020, the FDIC issued a Consent order on the State Bank of Nauvoo.

"NOTICE OF CHARGES AND OF HEARING detailing the unsafe or unsound banking practices

and violations of law or regulation alleged to have been committed by the Bank"

1/7

idfpr.illinois.gov/banks/cbt/Enfo…

"NOTICE OF CHARGES AND OF HEARING detailing the unsafe or unsound banking practices

and violations of law or regulation alleged to have been committed by the Bank"

1/7

idfpr.illinois.gov/banks/cbt/Enfo…

As per the FDIC... "The public is also notified when a bank’s Consent Order is terminated"

I could not find a termination order so I assume that SBN is still under the Consent Order of 2020.

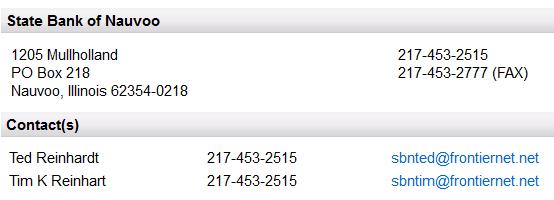

It looks like a family business with Tim and Ted Reinhardt taking the lead.

2/7

I could not find a termination order so I assume that SBN is still under the Consent Order of 2020.

It looks like a family business with Tim and Ted Reinhardt taking the lead.

2/7

The article from Businesswire mentions that Ted is the President of SBN. But oddly, his brother Tim was also the president only a few years ago. What happened???

3/7

3/7

In 2018 the FDIC filed "ORDER OF PROHIBITION FROM FURTHER PARTICIPATION AND

FOR RESTITUTION" against TIMOTHY K. REINHARDT.

5/7

orders.fdic.gov/sfc/servlet.sh…

FOR RESTITUTION" against TIMOTHY K. REINHARDT.

5/7

orders.fdic.gov/sfc/servlet.sh…

"unsafe or unsound banking practices and breaches of fiduciary duty"... "attempted to conceal excessive bonus payments to himself"... "prohibited from... participating in any... affairs of any financial

institution or agency"

6/7

institution or agency"

6/7

I don't know how much Metallicus/FBBT is paying for the SBN acquisition, but I'd be willing to bet that a single-branch bank, in the middle of nowhere Illinois, with a dodgy management history and still under an FDIC Consent Order, would likely be in my budget too.🤣

7/7

7/7

I was honestly looking into the Nauvoo acquisition hoping to find something to be excited about. But alas, I was unsuccessful. ⚛️🚀🤡

• • •

Missing some Tweet in this thread? You can try to

force a refresh