🚨🚨Absence rate & Lost Worktime rate analysis

Conclusion: Taken in conjunction with the increase in disability rates since early 2021, which we’ve shown previously, we believe that the most likely cause for the rise in both was due to the Covid 19 vaccines

Conclusion: Taken in conjunction with the increase in disability rates since early 2021, which we’ve shown previously, we believe that the most likely cause for the rise in both was due to the Covid 19 vaccines

In 2022 the absence rate was 11 sigma above trend & the worktime lost rate in 2022 was 13 sigma from trend.

This is a very strong signal.

This is a very strong signal.

Lost worktime rates have grown substantially since 2019. In 2022, lost worktime rates were 50% higher, an extraordinary change representing a large economic loss of productivity.

We have chronicled the dead, the disabled & now the chronically sick. The vaccines are devastating our economy. Next week we will tie all this together and put an annual $ Dollar figure on this damage and tragedy.

It’s not a stretch to conclude from this data that the vaccines are causing death, disabilities & injuries due to a degradation of individuals immune system.

The rate of change is not explained by the long Covid trope. Ask yourself where is funding for such studies? Cover up!

The rate of change is not explained by the long Covid trope. Ask yourself where is funding for such studies? Cover up!

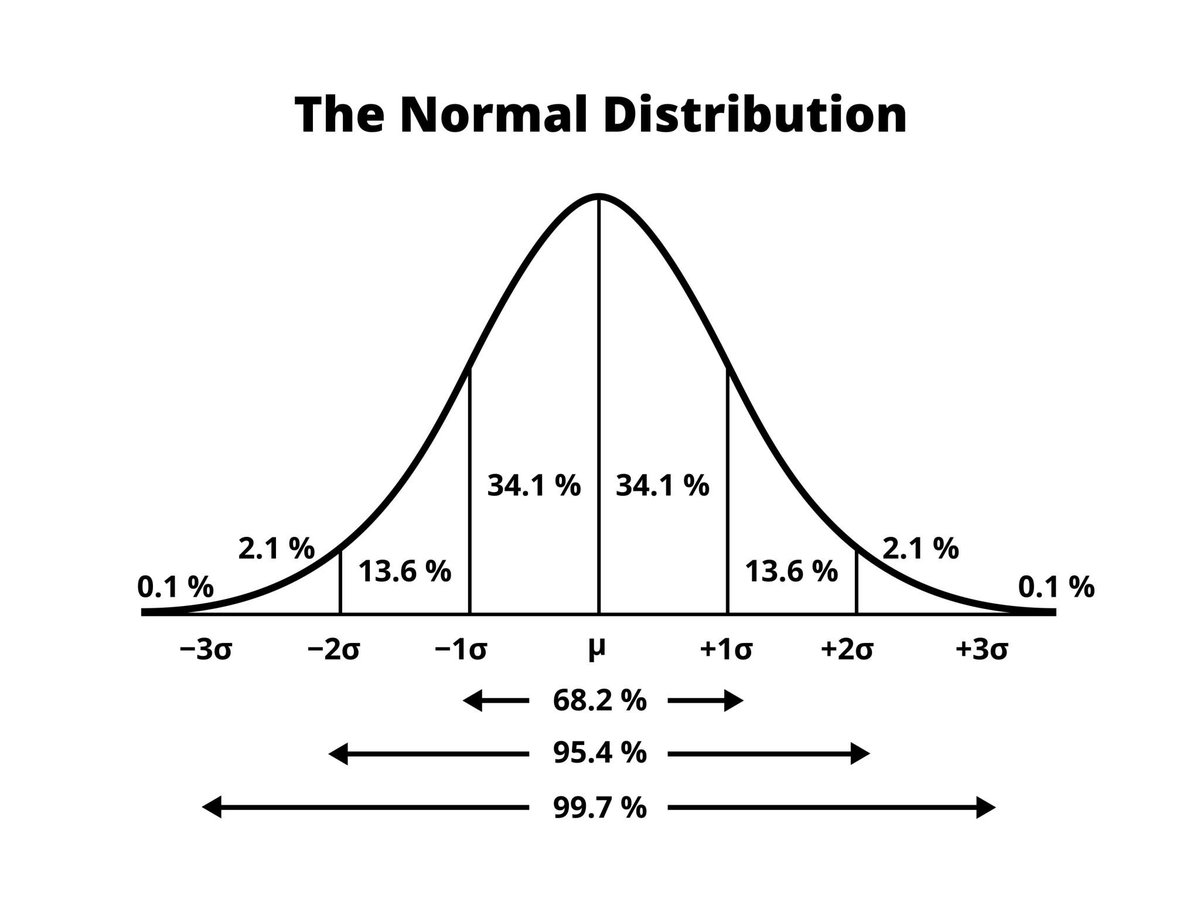

For those who don’t understand sigma or standard deviation this normal distribution can tell you how rare 11 and 13 sigma events are. The right and left tails of the distribution are 3 sigma.

• • •

Missing some Tweet in this thread? You can try to

force a refresh