It's probably time to write a requiem for the stock-'net liquidity' correlation.

Why? He dying, if not dead.

1/

Why? He dying, if not dead.

1/

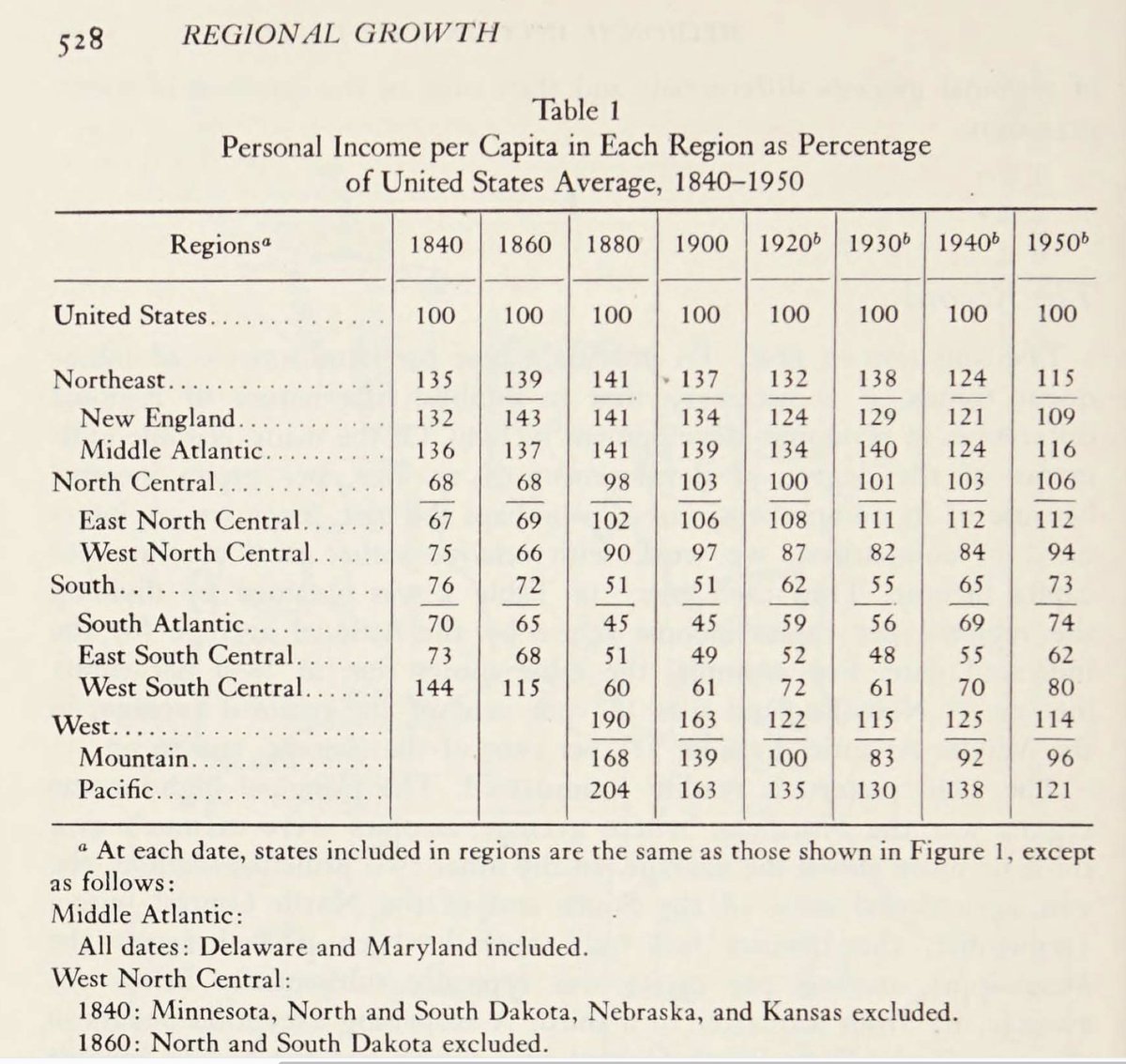

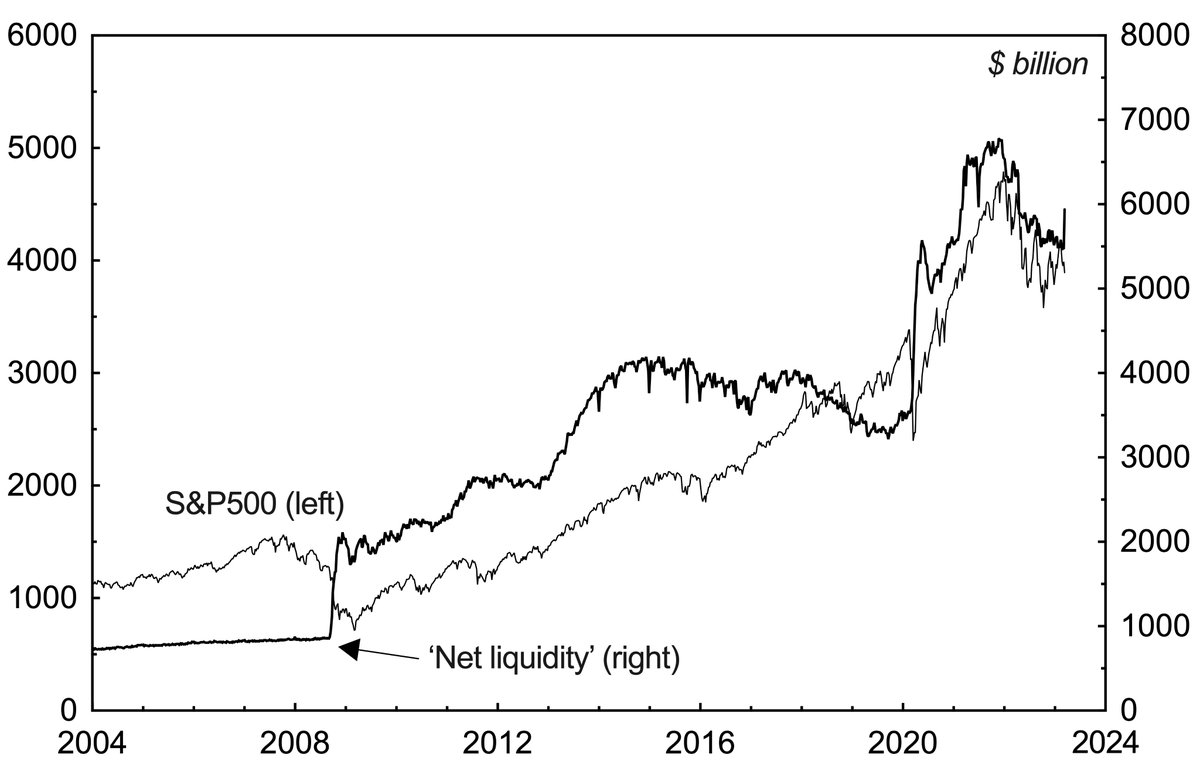

To clarify, I'm referring to the Fed's total assets, minus the Treasury General Account and the Reverse Repo Agreements.

It's supposed to have been driving stock market prices since the Covid Crash. You can see the correlation using weekly data here.

2/

It's supposed to have been driving stock market prices since the Covid Crash. You can see the correlation using weekly data here.

2/

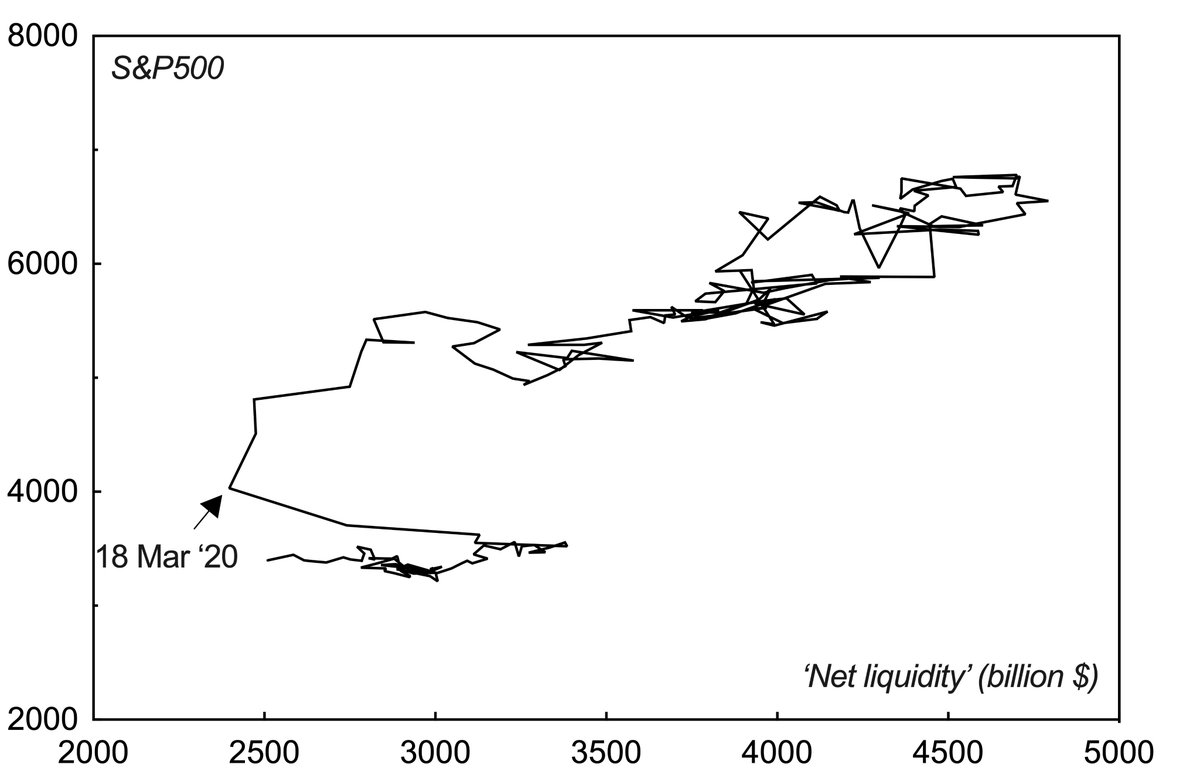

However, the correlation between the two hasn't been perfect.

It held from the second half of 2020 through the first half of 2021, but then faltered, before reestablishing itself in 2022.

Recently it has been faltering again.

3/

It held from the second half of 2020 through the first half of 2021, but then faltered, before reestablishing itself in 2022.

Recently it has been faltering again.

3/

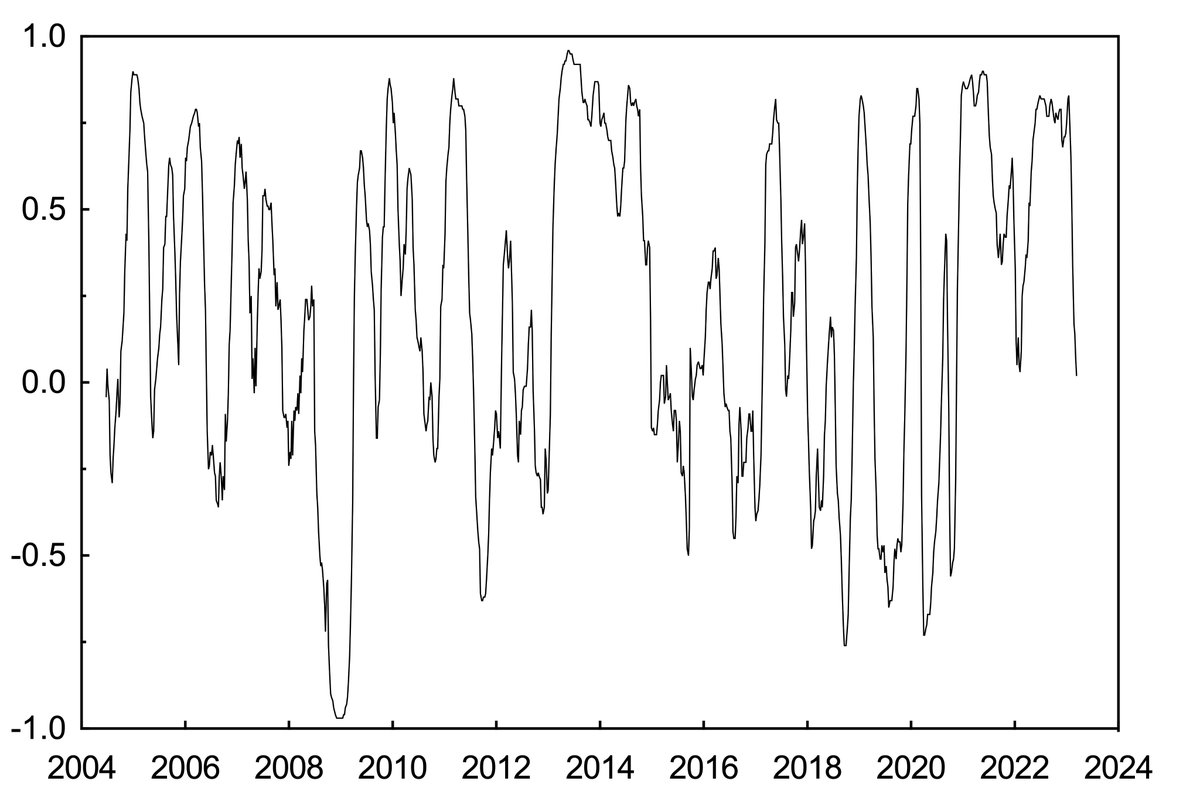

You can see this pattern here by looking at the 26-week Pearson correlation coefficient between the S&P500 and 'net liquidity'. It has fallen rapidly and is now almost negative.

4/

4/

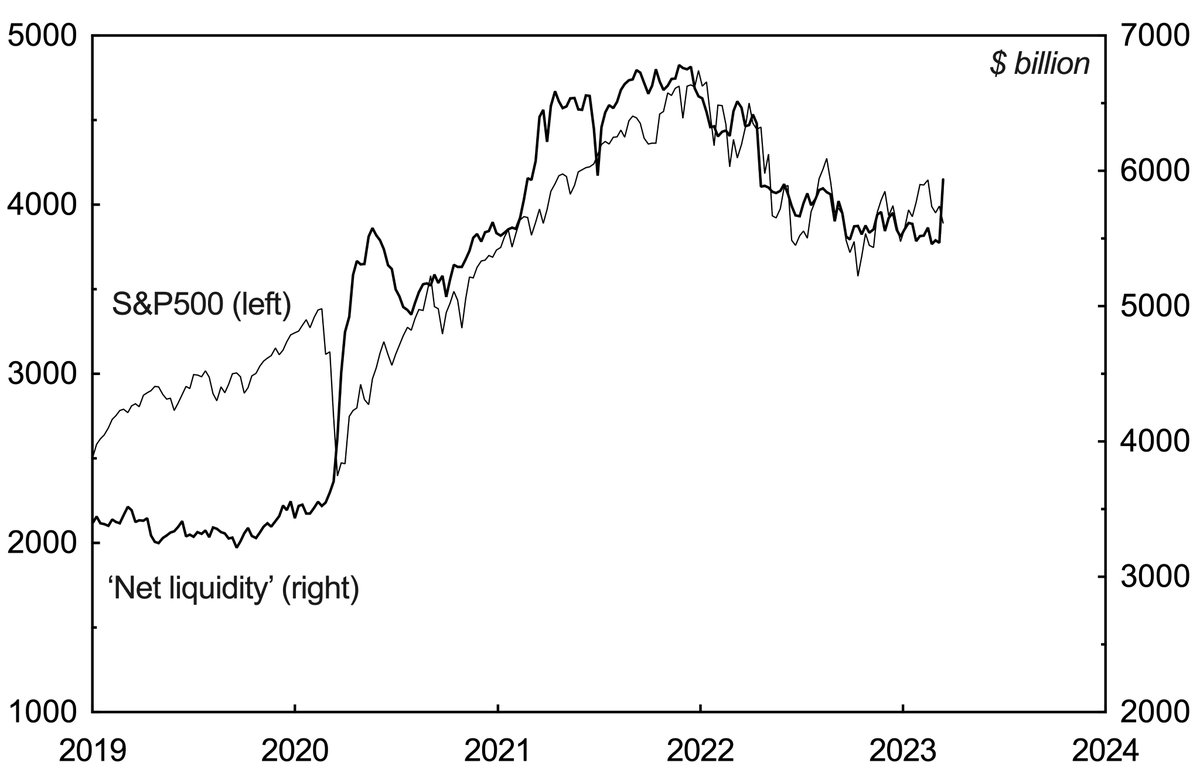

If you zoom out, moreover, the correlation looks shaky in the longer term.

Both have tended to go up over time, but their fluctuations haven't exactly been in sink.

5/

Both have tended to go up over time, but their fluctuations haven't exactly been in sink.

5/

There has also been a surprising increase in the number of black-footed ferrets in the Northern Great Plains over the past 20 years, but they probably didn't inflate the stock market.

aza.org/connect-storie…

6/

aza.org/connect-storie…

6/

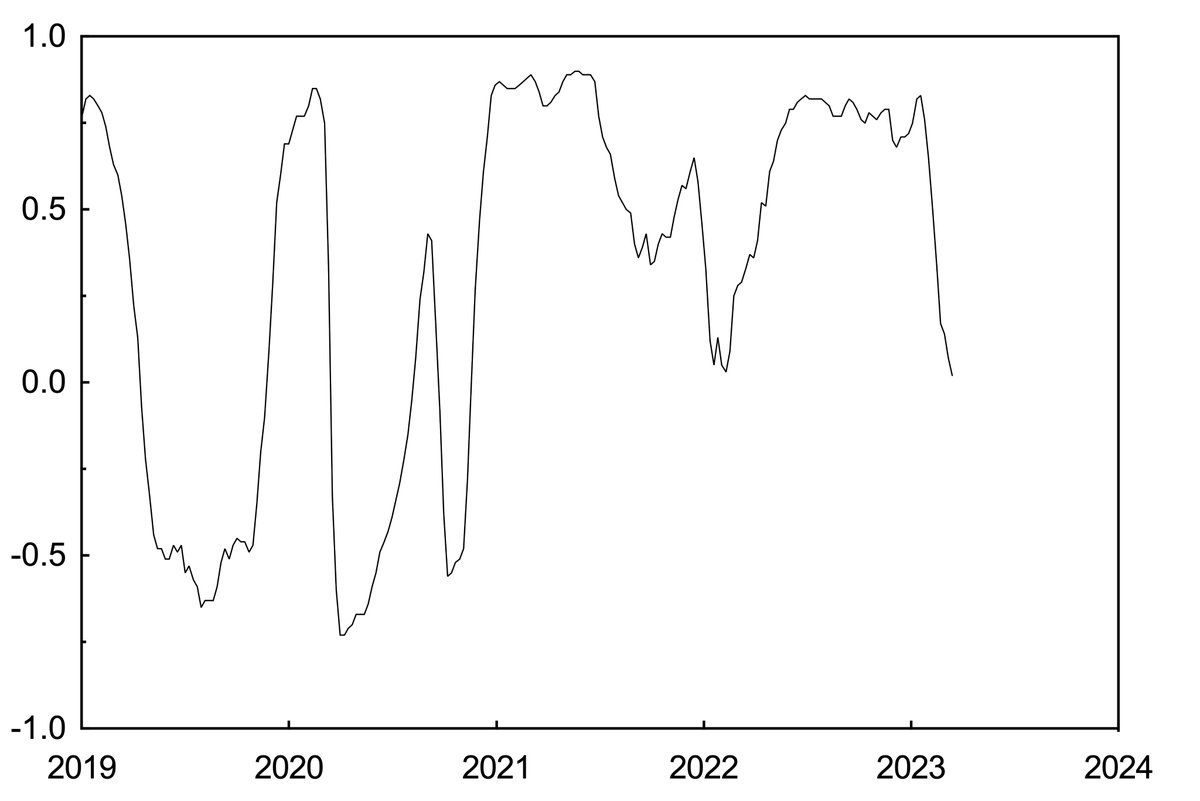

If you look at the 26-week Pearson correlation coefficient since 2004, you can see the problem more clearly.

There have been periods in which the 'net liquidity'-S&P500 correlation has been negative, and others in which it was non-existent. Overall, it looks fairly random.

7/

There have been periods in which the 'net liquidity'-S&P500 correlation has been negative, and others in which it was non-existent. Overall, it looks fairly random.

7/

I'm not saying that liquidity isn't important. But perhaps this isn't the best way to measure it.

8/

8/

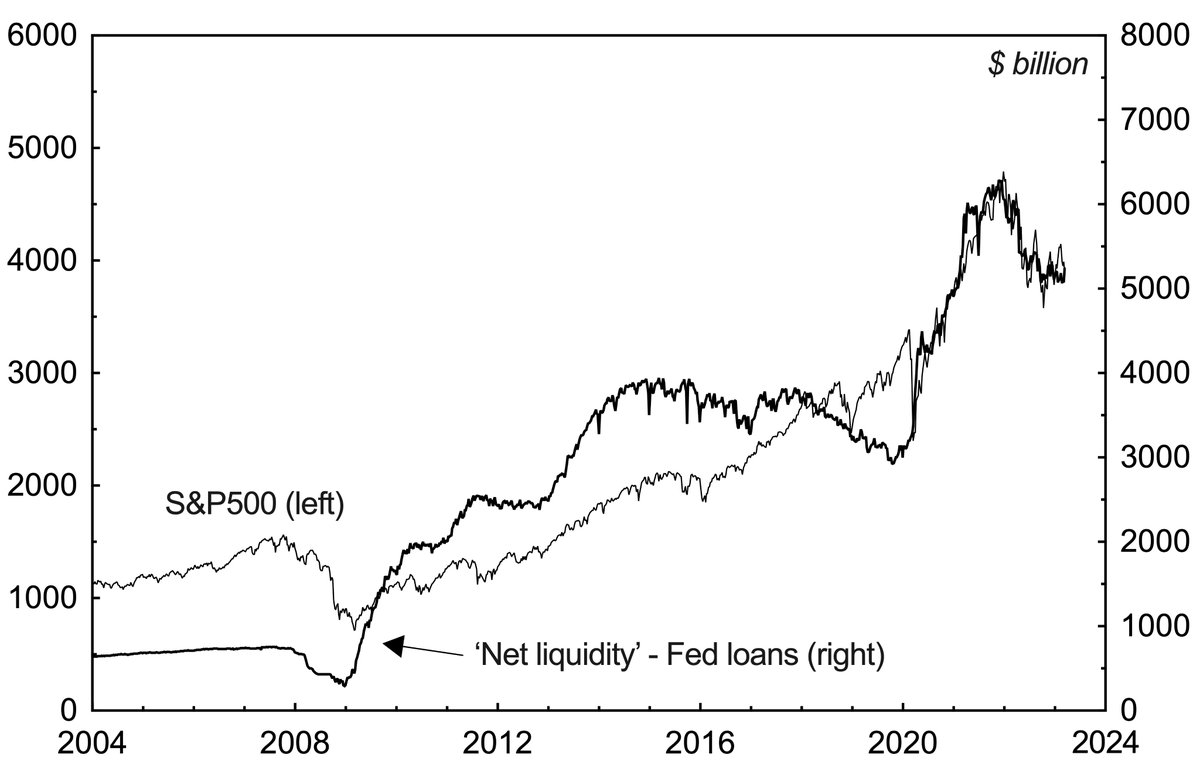

One way to get a better correlation is to look at 'net liquidity' but also subtract the Fed's loans from its balance sheet.

The correlation still isn't perfect, and flips negative from around 2018 up to the Covid Crash. Nonetheless, it is better.

9/

The correlation still isn't perfect, and flips negative from around 2018 up to the Covid Crash. Nonetheless, it is better.

9/

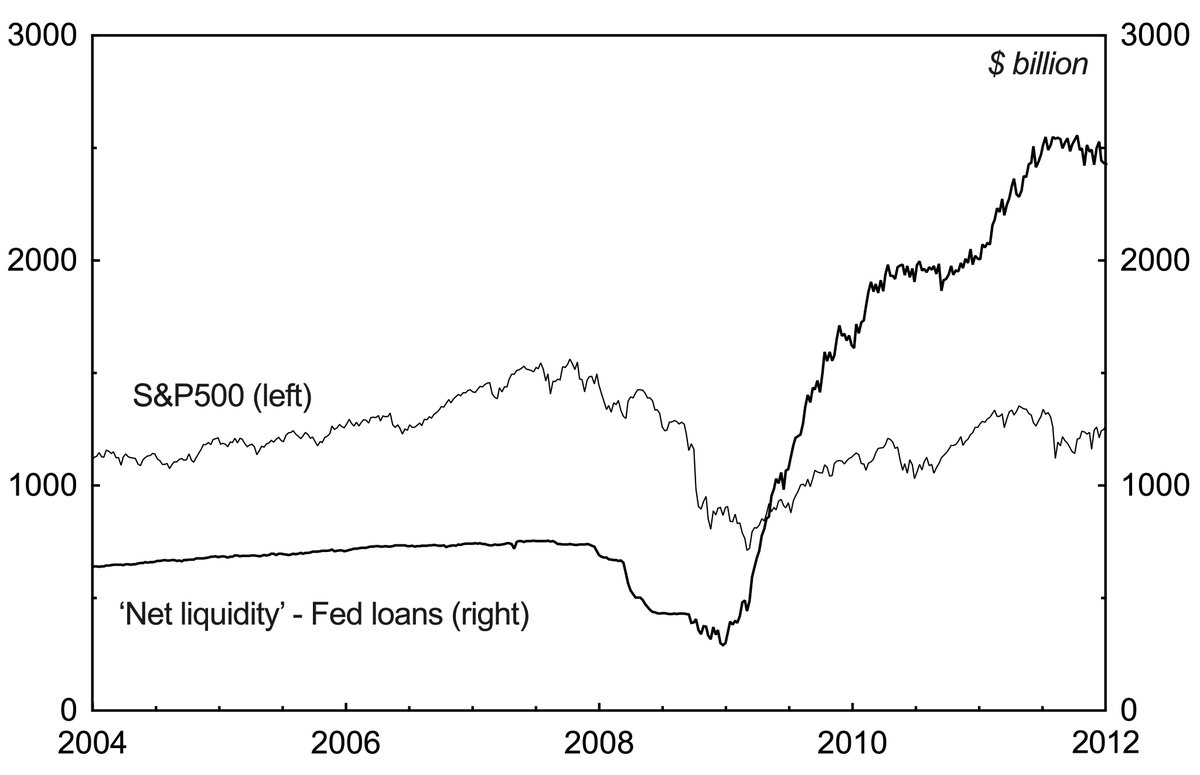

Notably, with loans subtracted, the positive correlation can be seen for the 2007-09 bear market.

Two things strike me.

10/

Two things strike me.

10/

First, there was a withdrawal of liquidity during the 2007-08 crash phase, which you don't see in the 'net liquidity' measure.

Second, the Fed had to provide A LOT of liquidity to get even a moderate recovery in stocks (assuming there was causality).

11/

Second, the Fed had to provide A LOT of liquidity to get even a moderate recovery in stocks (assuming there was causality).

11/

These are just observations from historical statistics, of course, and you might be better off counting ferrets to predict what will happen next in the stock market.

12/

12/

• • •

Missing some Tweet in this thread? You can try to

force a refresh