Director of https://t.co/mXtyIGOiSm. Honorary Research Fellow @unibirmingham. Work: https://t.co/hd6On6Wtwx. Agent: https://t.co/p5h3kCMVNY.

3 subscribers

How to get URL link on X (Twitter) App

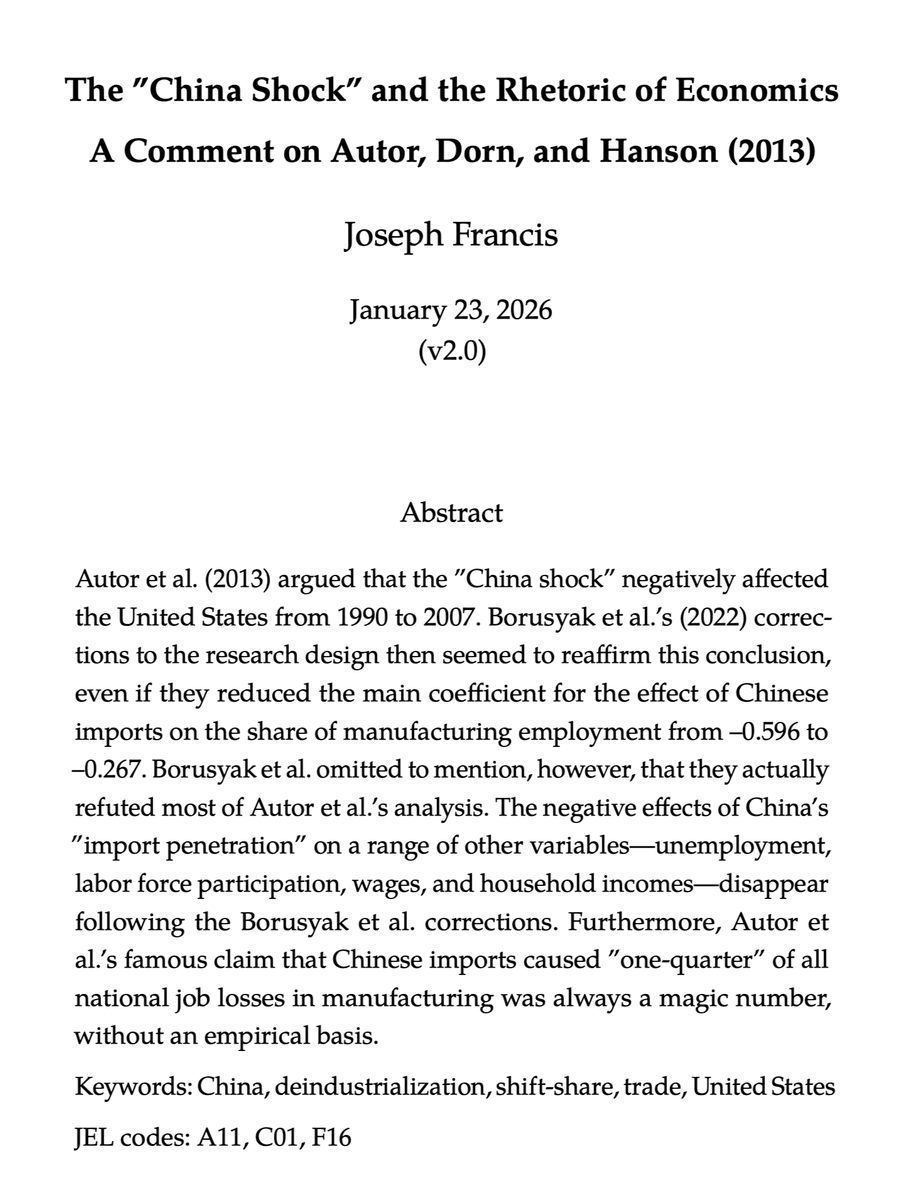

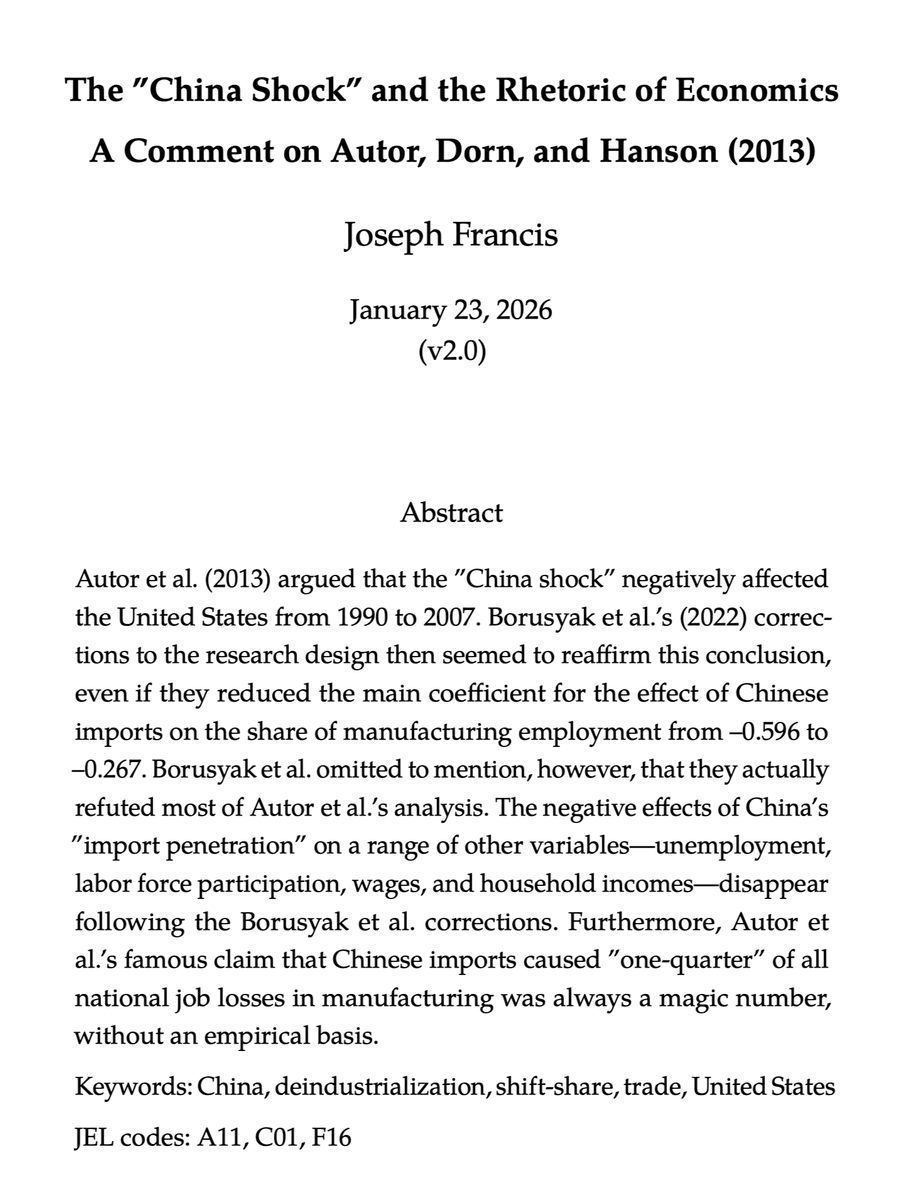

I think that previous critiques of Autor, Dorn, and Hanson (ADH) have tended to concede a key piece of ground: they assume that manufacturing employment's share of the working population is the key dependent variable. 2/11

I think that previous critiques of Autor, Dorn, and Hanson (ADH) have tended to concede a key piece of ground: they assume that manufacturing employment's share of the working population is the key dependent variable. 2/11

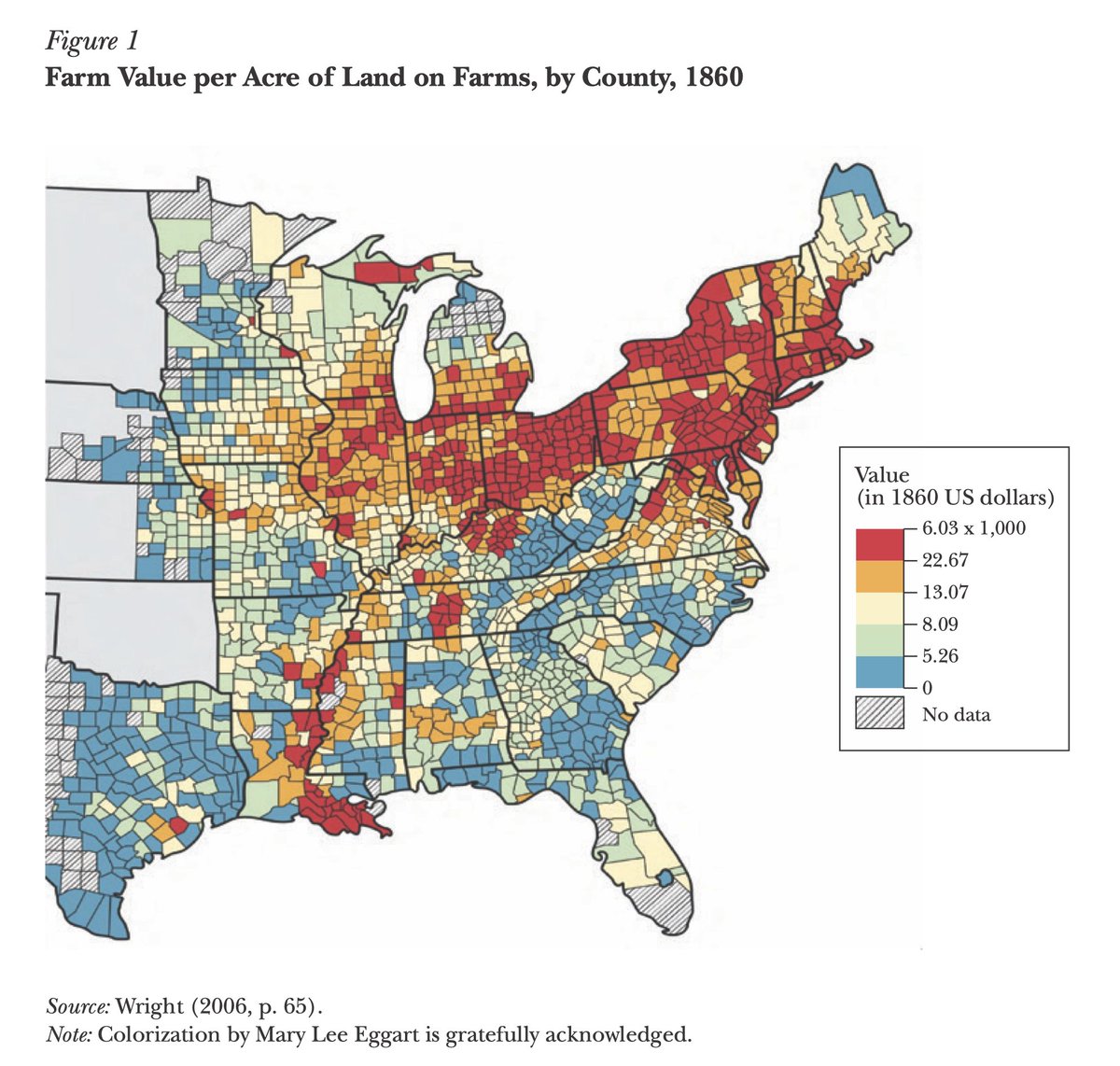

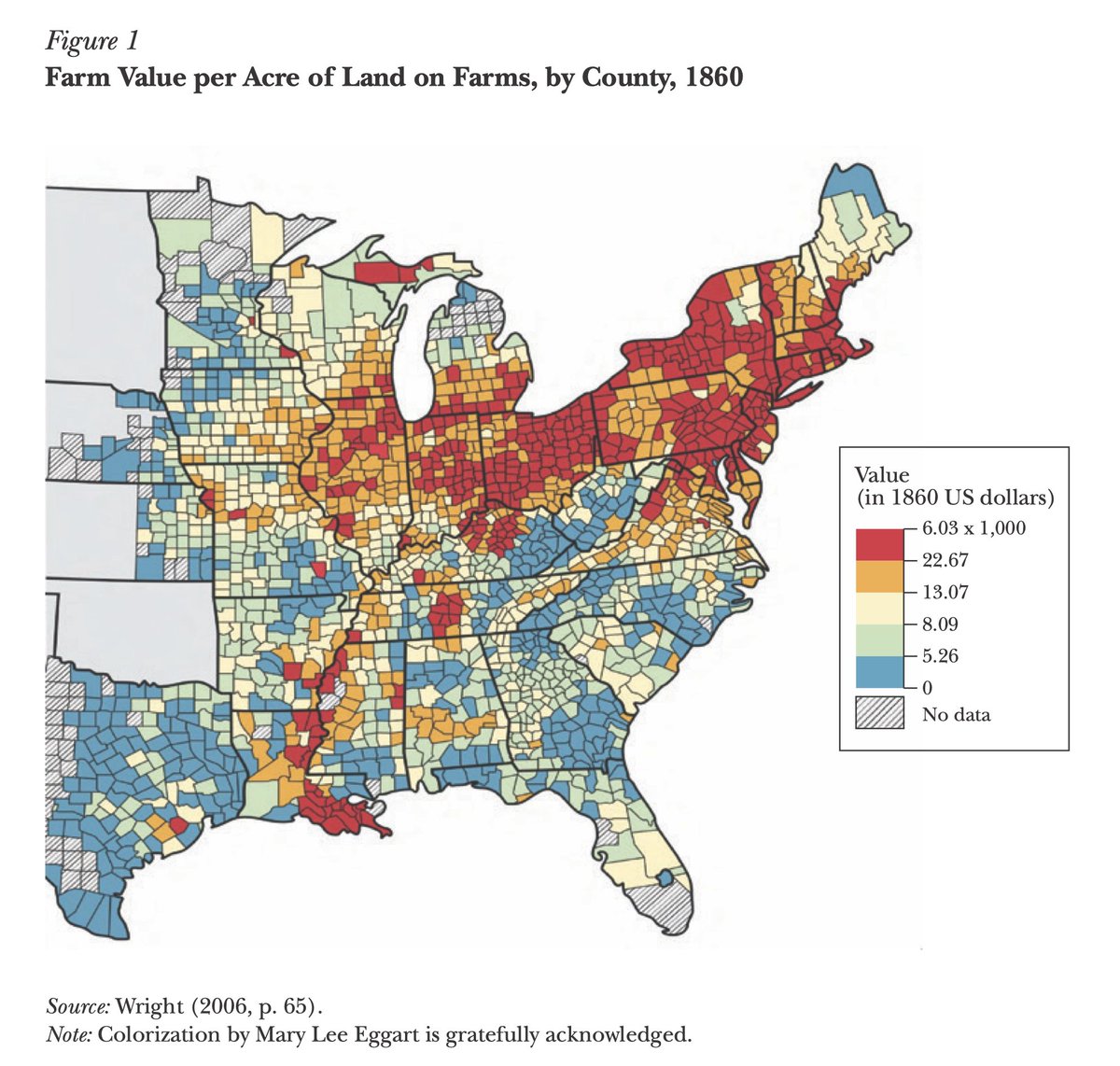

https://twitter.com/besttrousers/status/1957494016003789166Consider the evidence that Wright presents to make his case. Figure 1 shows that farm values per acre were higher in the North compared to the South in 1860. 2/14

To put this in perspective:

To put this in perspective:

Magness and Makovi’s article uses the Synthetic Control Method (SCM), an econometric technique designed to infer causality: .

Magness and Makovi’s article uses the Synthetic Control Method (SCM), an econometric technique designed to infer causality: .

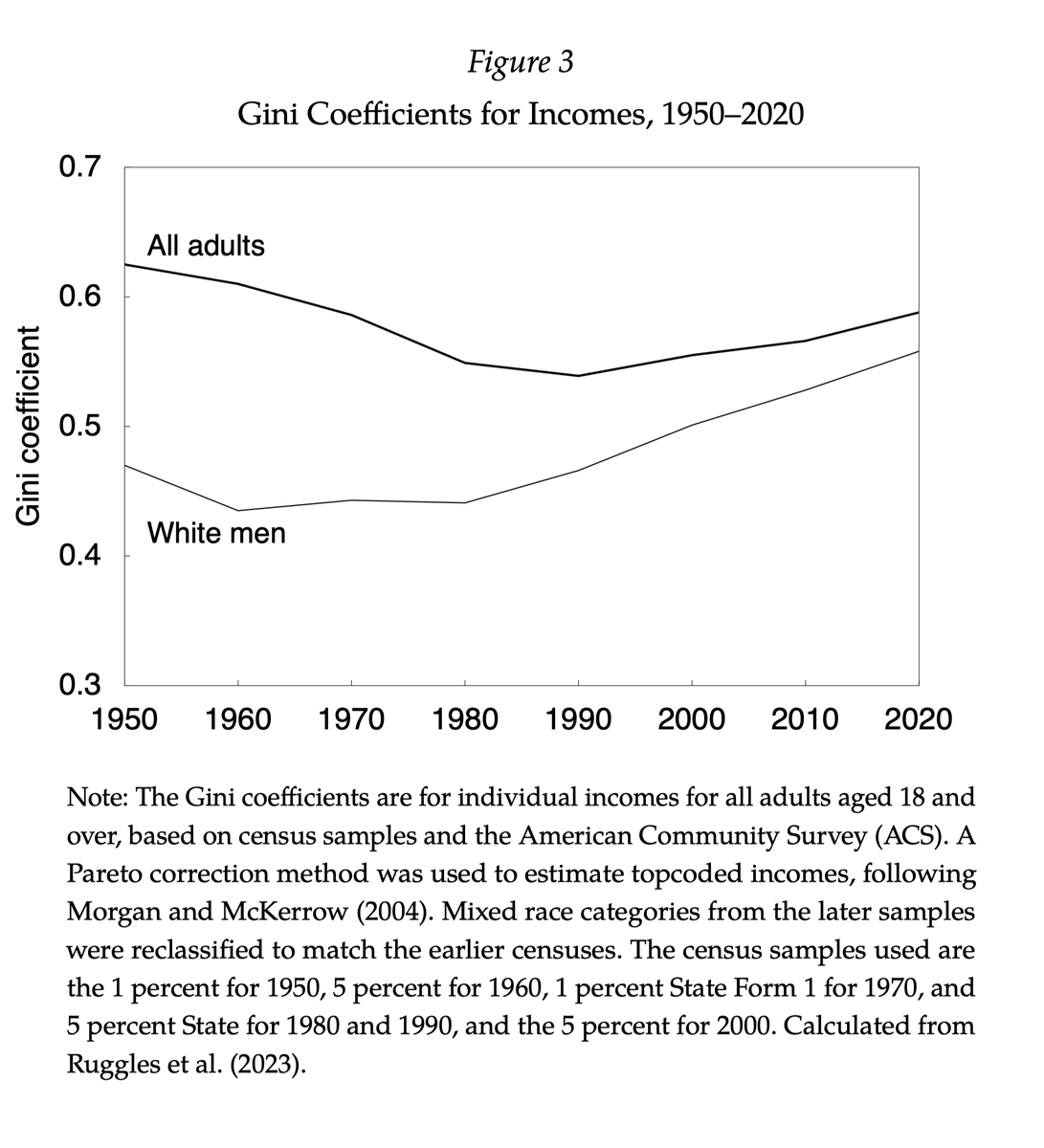

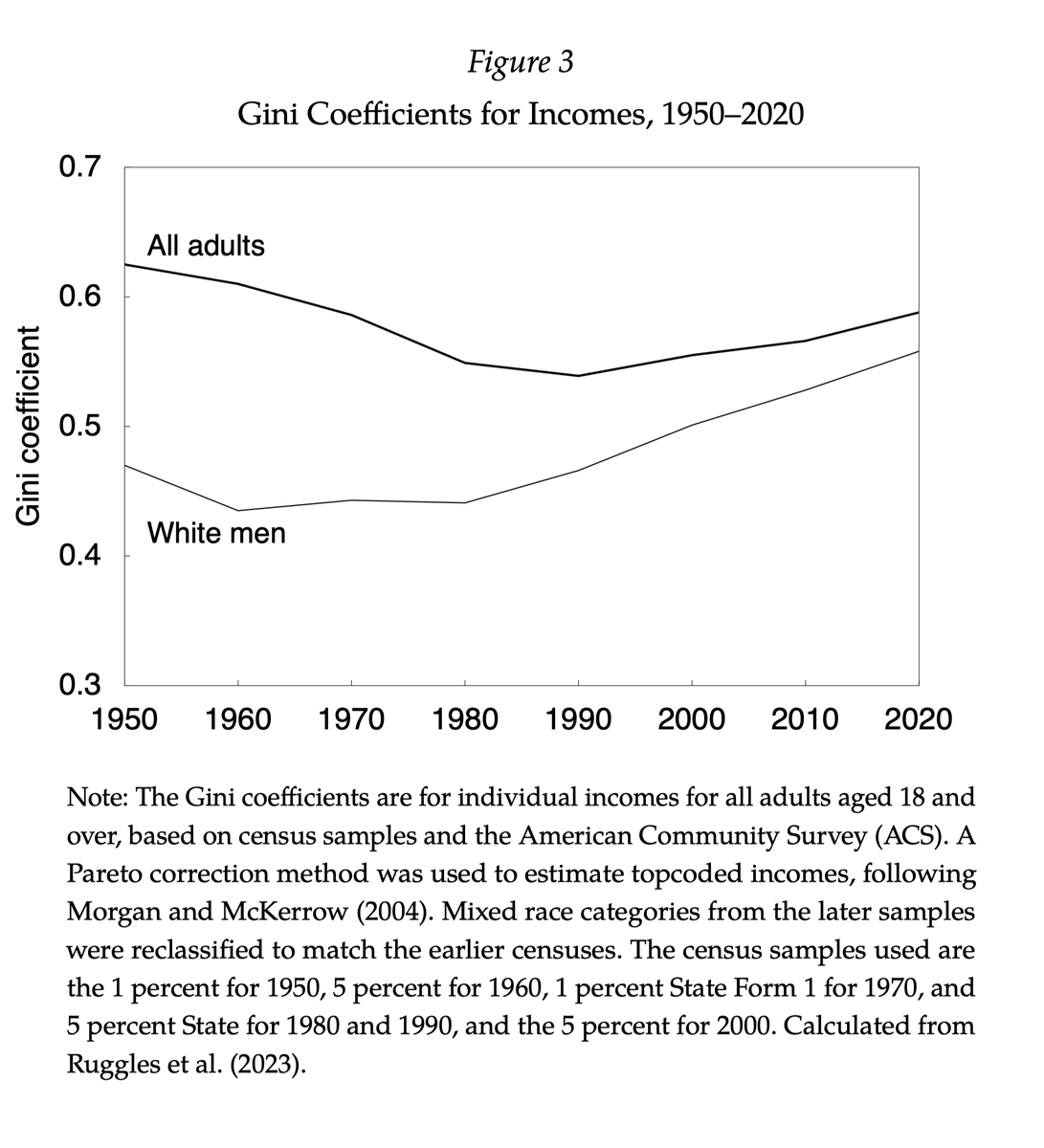

The paper tests my broader hypothesis is that American racism has proved so persistent because it has historically allowed one group to get ahead at the expense of another. 2/12

The paper tests my broader hypothesis is that American racism has proved so persistent because it has historically allowed one group to get ahead at the expense of another. 2/12

These data are more granular and frequent than anything economic historians have worked with before for the 19th century.

These data are more granular and frequent than anything economic historians have worked with before for the 19th century.

Fans of the “New Southern Economic History” may want to avoid this paper.

Fans of the “New Southern Economic History” may want to avoid this paper.

In Blanchet et al’s terms, “‘Predistribution,’ not ‘redistribution,’ explains why Europe is less unequal than the United States.”

In Blanchet et al’s terms, “‘Predistribution,’ not ‘redistribution,’ explains why Europe is less unequal than the United States.”

https://twitter.com/michaelxpettis/status/1903678722260996207Comparing Germany and the United States, for example, does not suggest that it is the former that has the inequality problem.

Now, of course, you might suggest that the PSZ article must be OK because it underwent a rigorous peer review process at a “Big Five” econ journal like the QJE. Nice one! 2/20

Now, of course, you might suggest that the PSZ article must be OK because it underwent a rigorous peer review process at a “Big Five” econ journal like the QJE. Nice one! 2/20

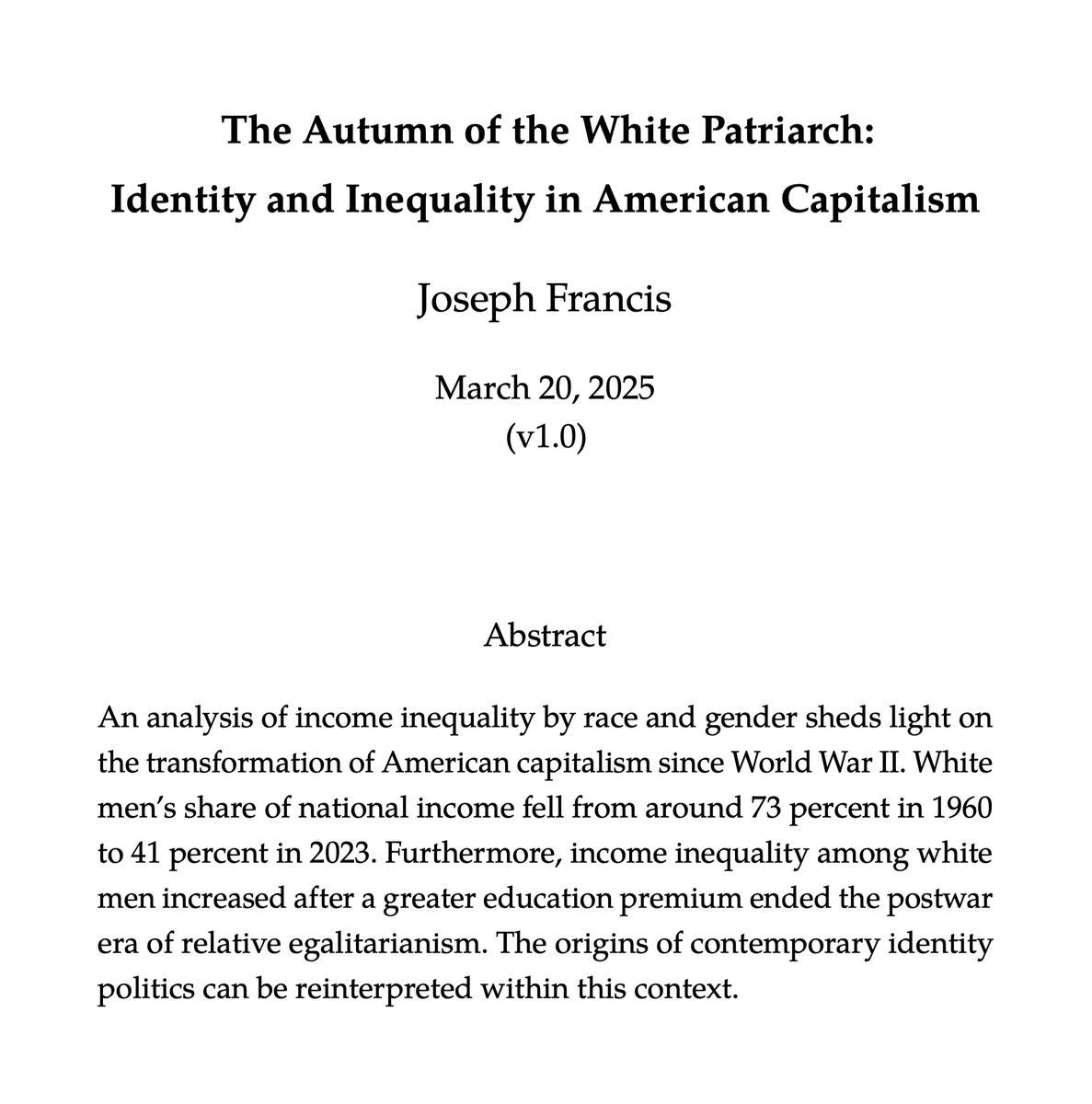

The paper is available here: .... In footnote 9, I explain how Piketty makes it methodologically impossible for feminism to have had any discernable impact on inequality since the 1960s. 2/5 raw.githubusercontent.com/joefrancis50

The paper is available here: .... In footnote 9, I explain how Piketty makes it methodologically impossible for feminism to have had any discernable impact on inequality since the 1960s. 2/5 raw.githubusercontent.com/joefrancis50

The paper is available here: .

The paper is available here: .

Schumpeter predicted that malcontented academics would demand socialism, and capitalism would be destroyed.

Schumpeter predicted that malcontented academics would demand socialism, and capitalism would be destroyed.

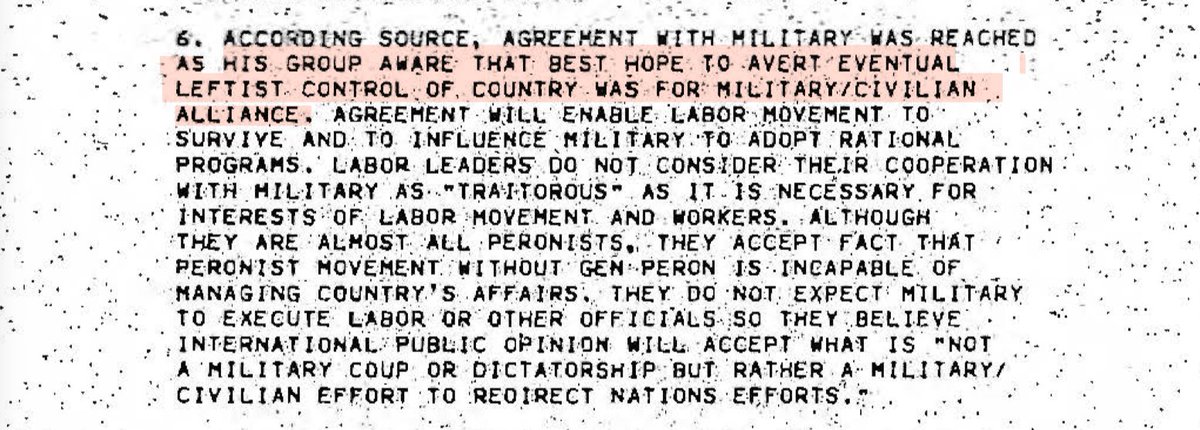

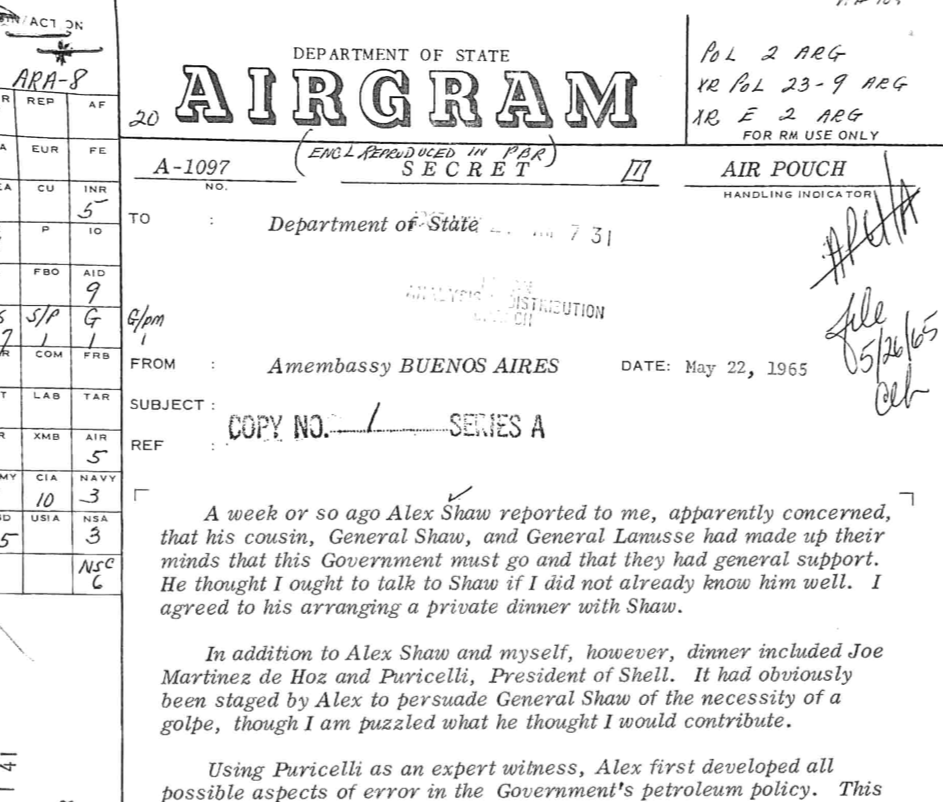

I had to go through a lengthy FOIA request to get this document, but it is now available here: .

I had to go through a lengthy FOIA request to get this document, but it is now available here: .

https://twitter.com/MkBlyth/status/1778427487782940808

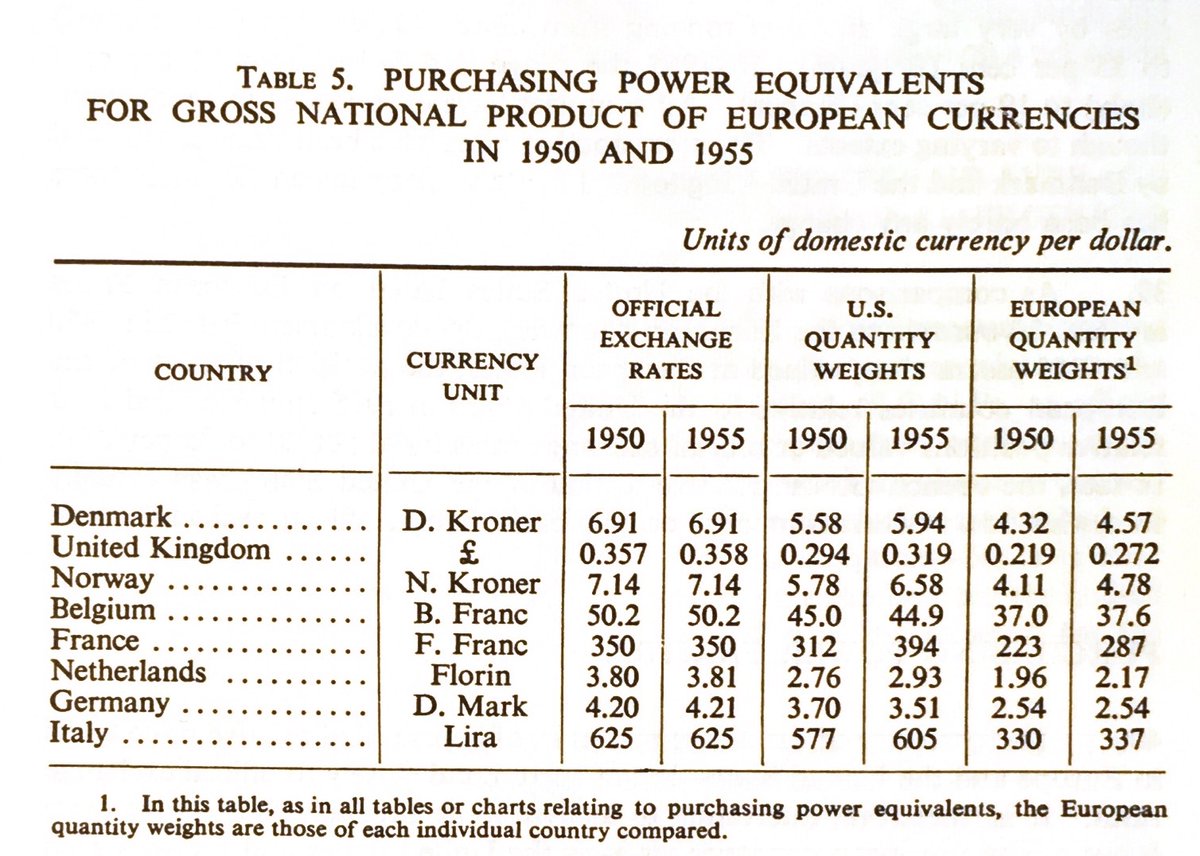

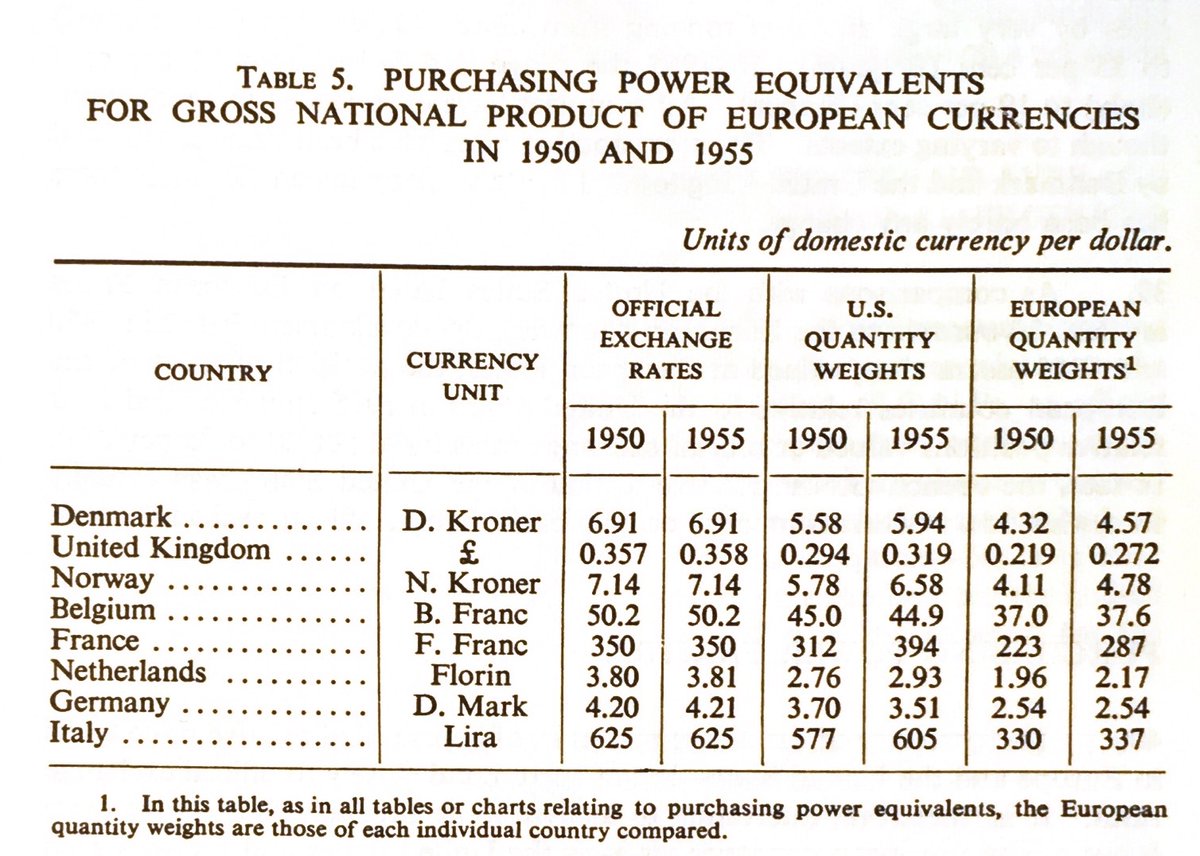

Above all, the Americans wanted to avoid a Communist takeover. The problem was that European currencies were massively overvalued: as you can see in the table, their official exchange rates were significantly above their PPP exchange rates. 2/

Above all, the Americans wanted to avoid a Communist takeover. The problem was that European currencies were massively overvalued: as you can see in the table, their official exchange rates were significantly above their PPP exchange rates. 2/

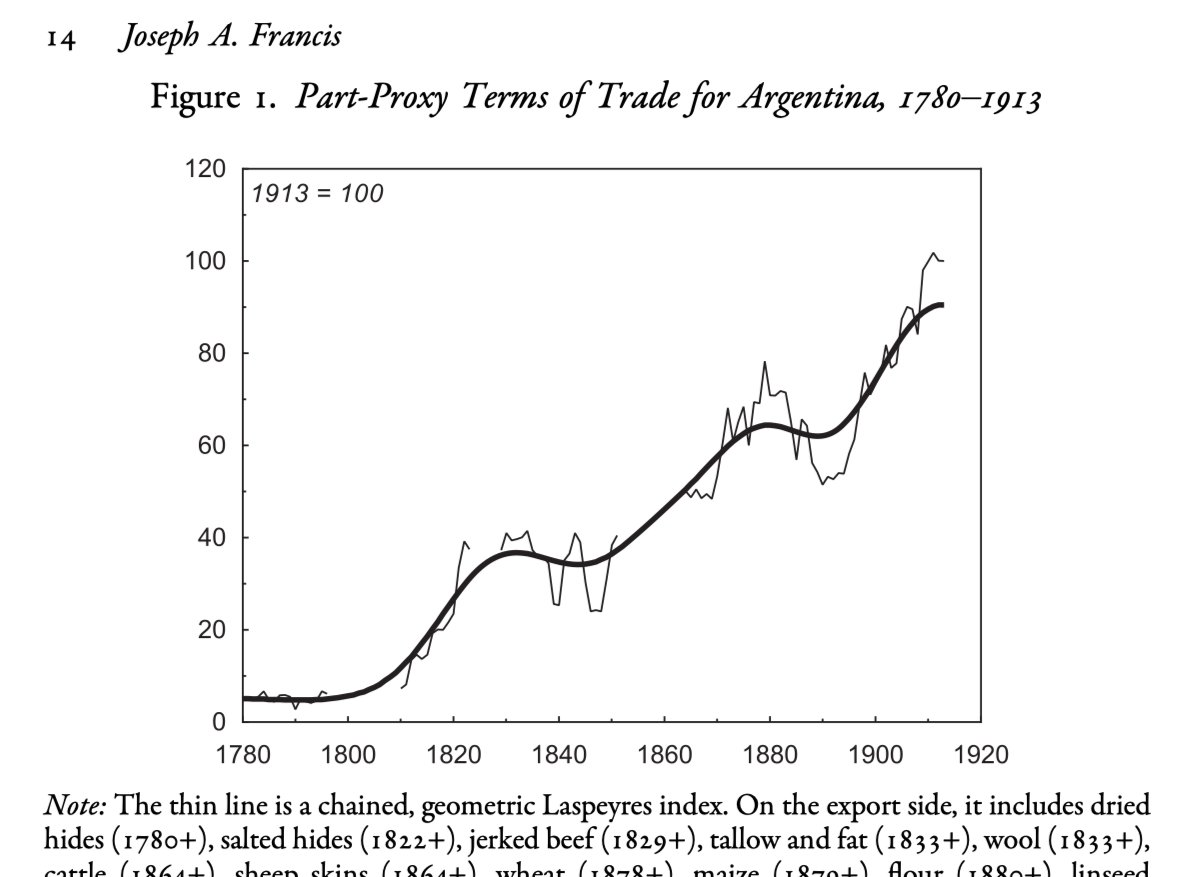

In the nineteenth century, there was an unprecedented boom in Argentina’s terms of trade due to (a) trade liberalisation, (b) the industrial revolution, and (c) cheaper transportation. They improved by roughly 2,000 percent from the 1780s to the First World War. 2/

In the nineteenth century, there was an unprecedented boom in Argentina’s terms of trade due to (a) trade liberalisation, (b) the industrial revolution, and (c) cheaper transportation. They improved by roughly 2,000 percent from the 1780s to the First World War. 2/

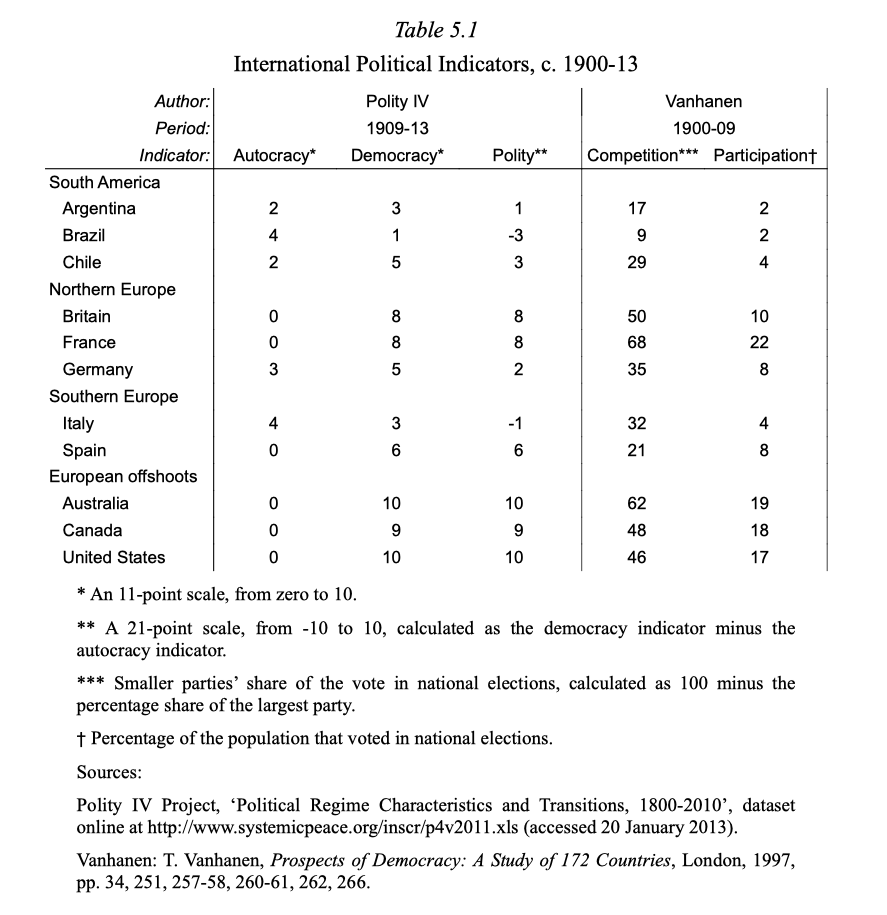

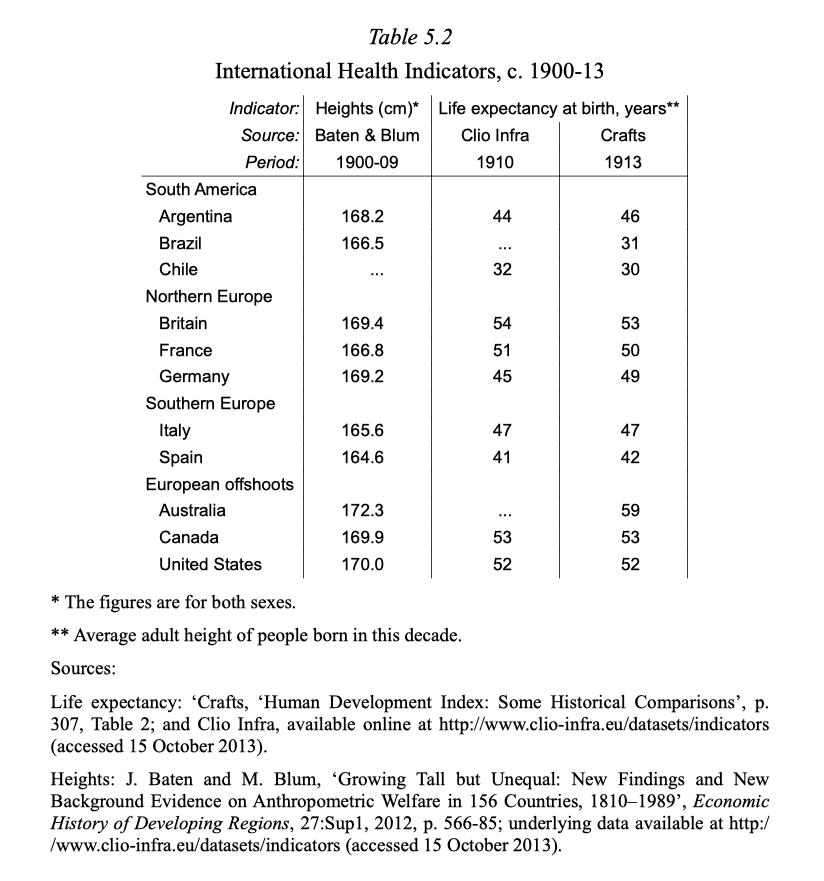

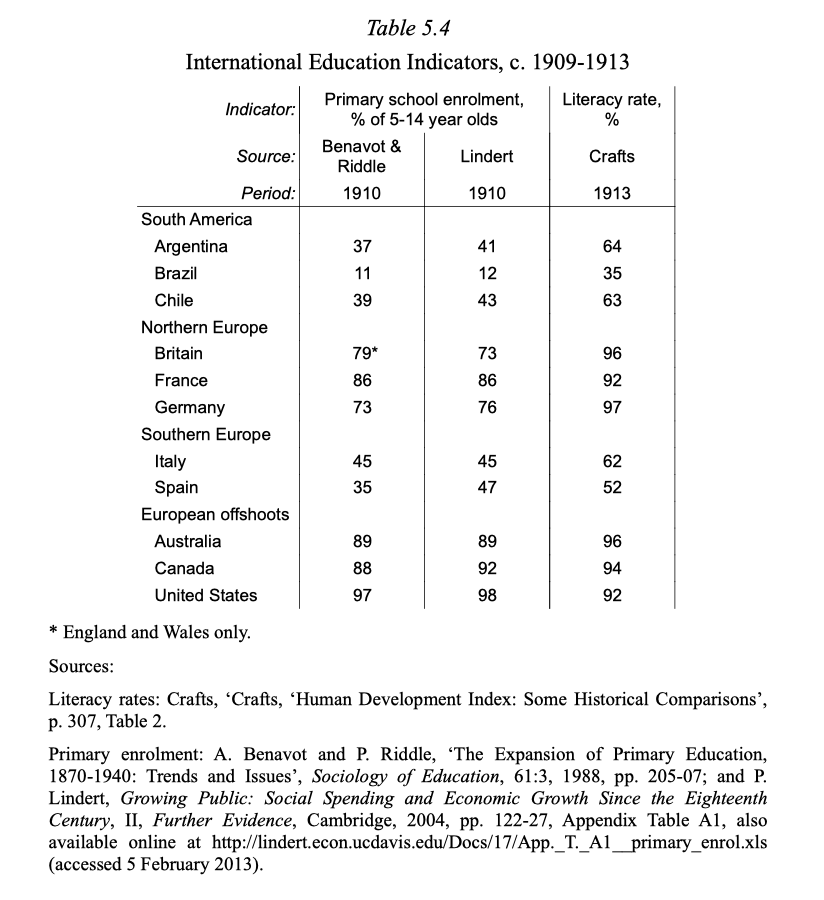

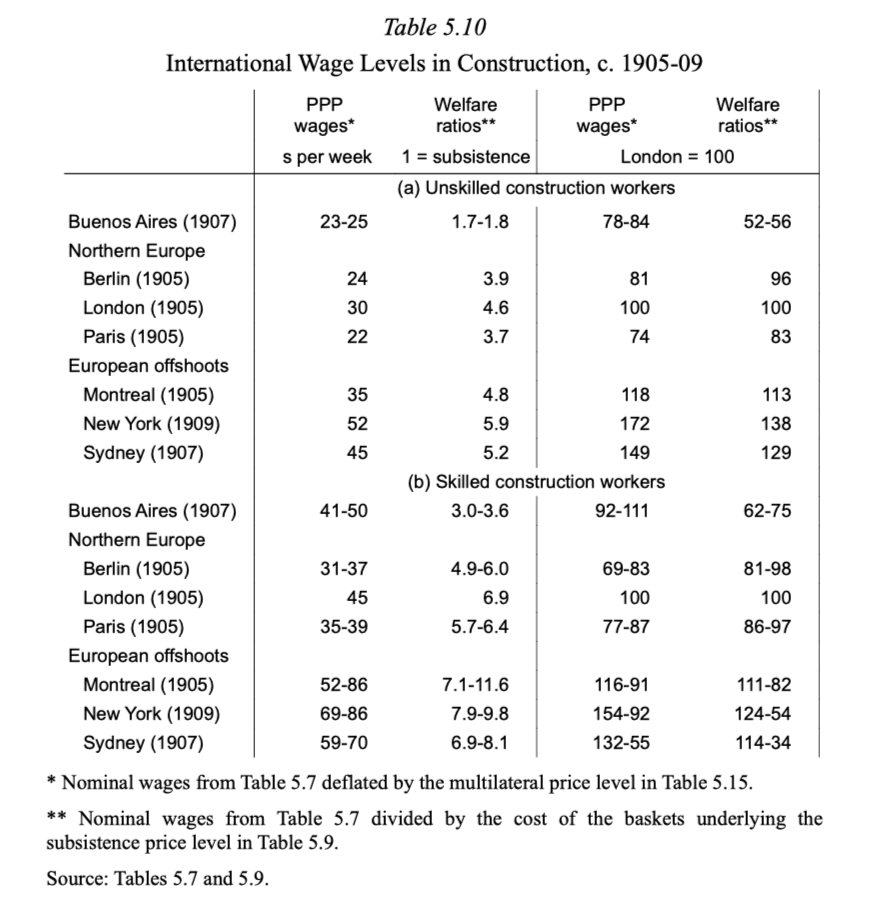

In Chapter 5, I showed that according to various variables – political institutions, health, education, purchasing power of wages – Argentina lagged behind the most developed countries circa 1913.

In Chapter 5, I showed that according to various variables – political institutions, health, education, purchasing power of wages – Argentina lagged behind the most developed countries circa 1913.

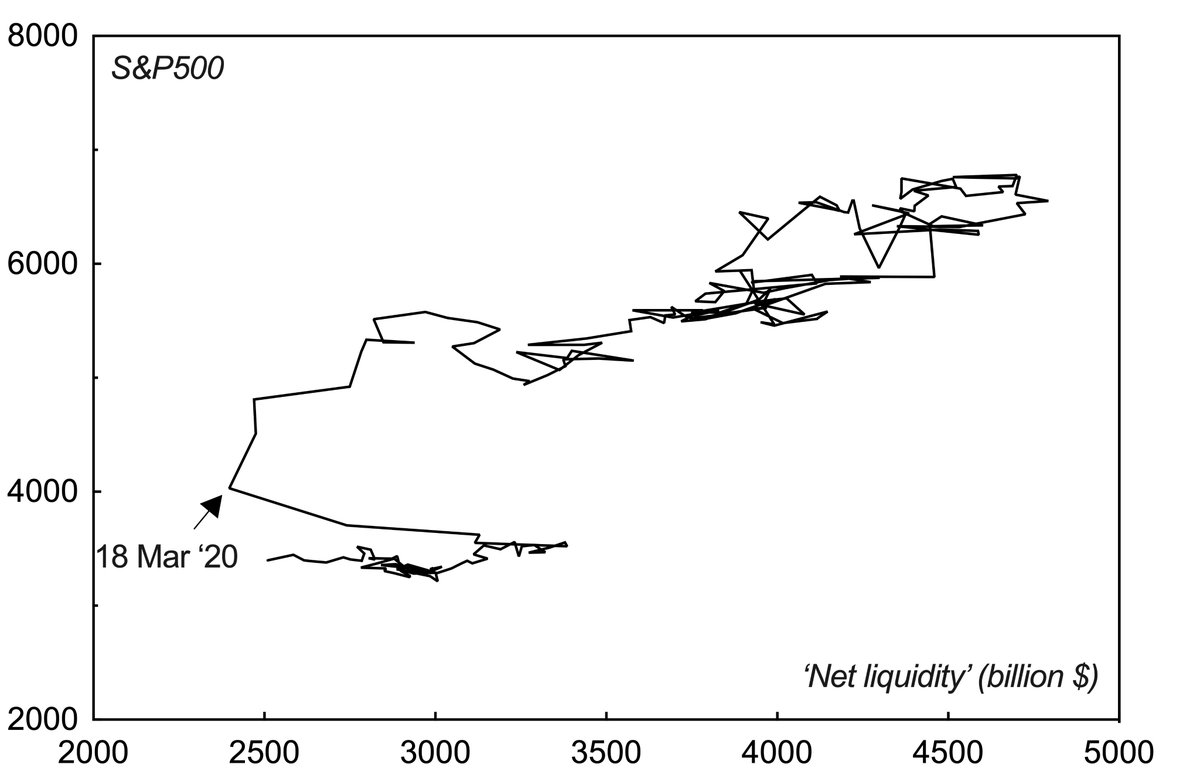

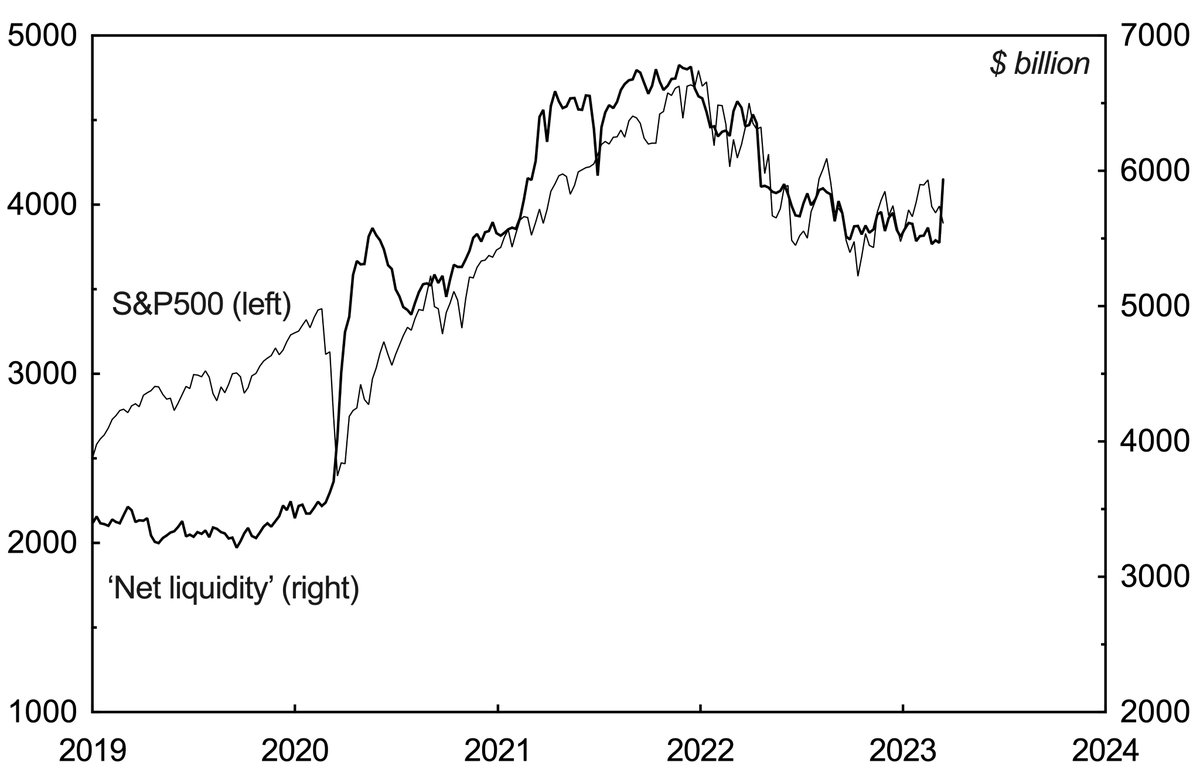

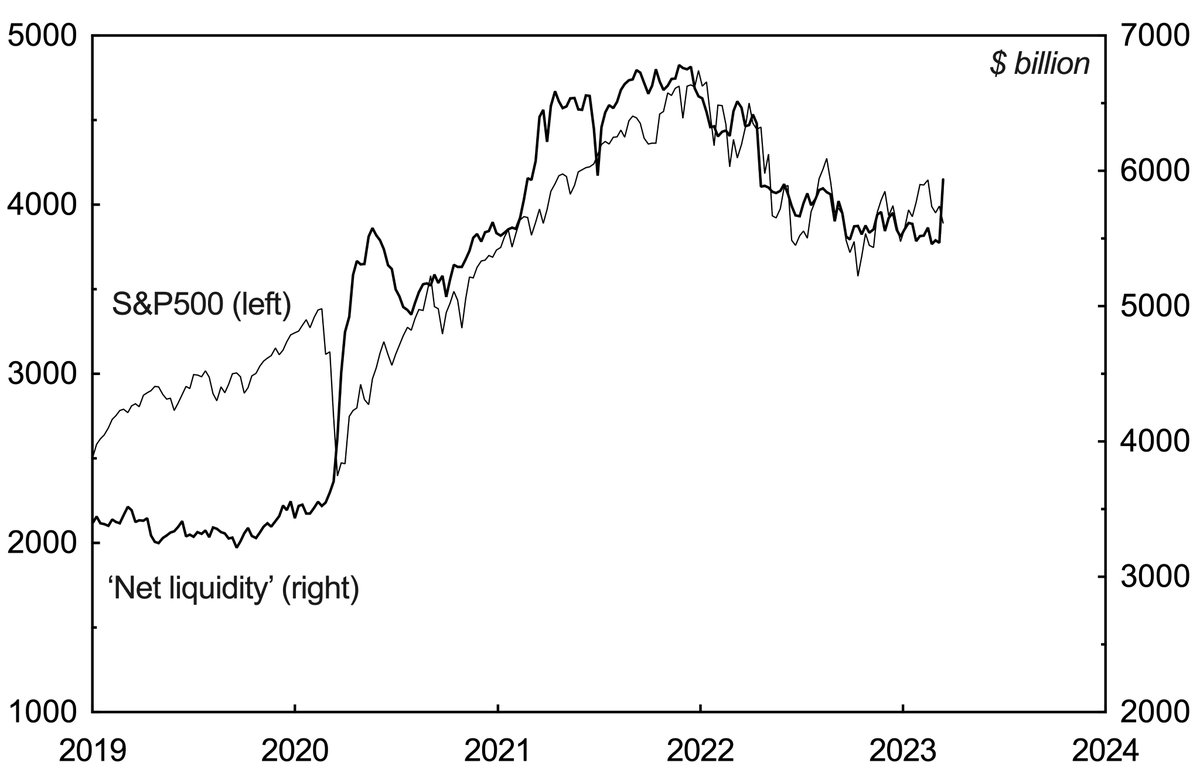

To clarify, I'm referring to the Fed's total assets, minus the Treasury General Account and the Reverse Repo Agreements.

To clarify, I'm referring to the Fed's total assets, minus the Treasury General Account and the Reverse Repo Agreements.