Where are we now? 4 propositions:

1. Need less demand

2. Need to avoid nonlinearily massively less demand due to a banking crisis

3. Fed should make only limited use of interest rates for financial stability

4. Fed should take into account tightened financial conditions.

A🧵

1. Need less demand

2. Need to avoid nonlinearily massively less demand due to a banking crisis

3. Fed should make only limited use of interest rates for financial stability

4. Fed should take into account tightened financial conditions.

A🧵

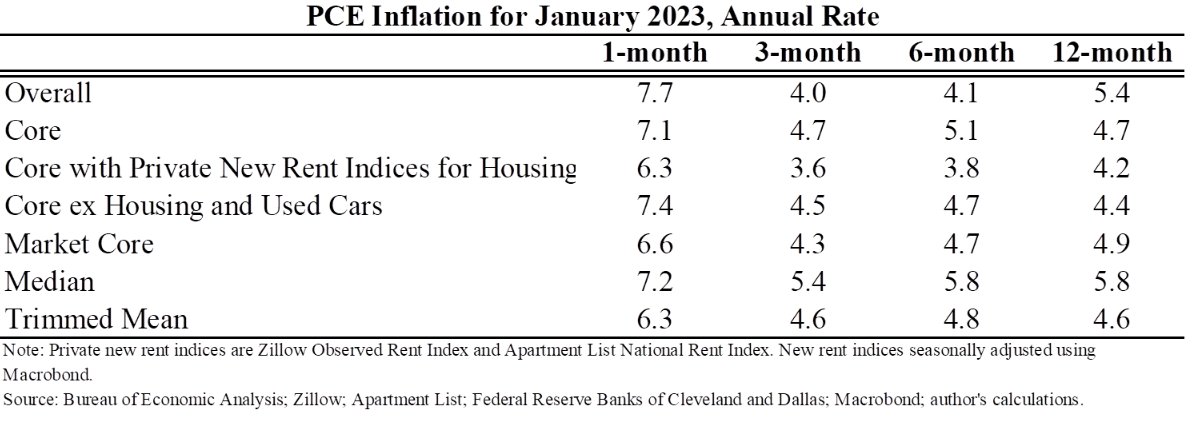

1. There are lots of measures of underlying inflation but most of them have a 4 in front of them. You have to be very confident in your models and predictions to think that will change a lot--especially in an economy where GDP for Q1 is tracking at a 3.2% annual rate.

So I continue to think the economy will need less demand over time to bring inflation back to something within range of the target, whether that is the Fed's current 2% target or a de facto or de jure range that includes 3%.

2. A banking crisis is a bad way to lower demand. It's nonlinear, could spiral in uncontrollable and long-lasting ways & result in high costs--some of which we've already seen w/ the ex post deposit insurance expansions being passed on to depositors & govt funds at risk.

3. In past episodes of financial turmoil the Fed cut rates. But in most of those cases inflation was fine & the rate cuts were justifiable based on the employment side of the mandate. In some cases those rate cuts may have been a mistake, spuriously derisking financial markets.

The Fed already has a hard enough job using one tool (interest rates) to achieve two goals (inflation and employment). Adding a third goal makes it even harder, especially when the Fed has other tools to advance that goal.

Most importantly, using interest rates aggressively for financial stability at a time like this could be counterproductive. Higher inflation/expected inflation would raise nominal bond yields and lower prices. And even more importantly...

...If the financial system gets a false sense of security about how much the FFR needs to rise to contain inflation that could cause even more accidents down the road. The FFR at the end of 2024 could be anywhere from 0% to 8%, financial system needs to be ready for any of those.

4. The Fed SHOULD take into account that the banking turmoil will tighten financial conditions, especially by reducing bank lending.This event should count as X bp of tightening--so the terminal rate should be whatever you thought before (in my case ~6%) - X.

The tricky thing is assessing what the X is. Most of the timely measures of financial conditions that we have are based on market prices. Those measures show that financial conditions have *loosened* slightly since the turmoil began, because yields & the dollar are both down.

Of course, those market-based measures are a poor guide to what is happening now, especially the widespread reports of credit pullbacks by banks, especially small and medium-sized banks. These are almost certainly large but really, really hard to quantify in real-time or at all.

I had been operating w/ a working assumption that when the dust settles this will all amount to the equivalent of 50bp of tightening. But that is a completely made up number and, so far, the dust is not coming close to settling. I've seen others (e.g., Torsten Slok) saying 150bp.

The Fed generally has better information than we do. When the most important info is in the CPI, employment report, etc., they have some advantage but not huge. When it is non-quantifiably spread throughout the banking system they may have an even larger informational advantage.

So where does that leave me? I lean towards 25bp, mostly because I still worry about demand & also about sending a falsely reassuring signal to financial markets about the future path. But I don't feel strongly & if the Fed's info leads them to 0bp I'll likely update my views.

• • •

Missing some Tweet in this thread? You can try to

force a refresh