I've spent countless hours trying to perfect my daily & weekend routines in the market.

I've also been able to improve my performance while spending way less time at the desk...

Here's how you can build YOUR perfect trading routine (to simply perform better & win time back):

I've also been able to improve my performance while spending way less time at the desk...

Here's how you can build YOUR perfect trading routine (to simply perform better & win time back):

Over the course of this thread, you’ll master two things:

1. The optimal daily routine structure

2. The optimal weekend routine structure

Buckle up - it’s going to be a valuable ride. Let’s dive in:

1. The optimal daily routine structure

2. The optimal weekend routine structure

Buckle up - it’s going to be a valuable ride. Let’s dive in:

Here’s a simple daily routine that you can implement TODAY:

Overall Structure:

• Premarket routine (30 min)

· Trade the first 1-2 hours

· Check back every 30 min after

· Trade the last 1 hour

· Scanning / Journalling / Tomorrow Prep

Let’s break down each part ↓

Overall Structure:

• Premarket routine (30 min)

· Trade the first 1-2 hours

· Check back every 30 min after

· Trade the last 1 hour

· Scanning / Journalling / Tomorrow Prep

Let’s break down each part ↓

· Premarket routine (30 min)

You don’t have to have a crazy complex premarket routine. The only 2 things you need to do are:

1. Check-in with yourself

What could hold you back? (answer & then avoid doing!)

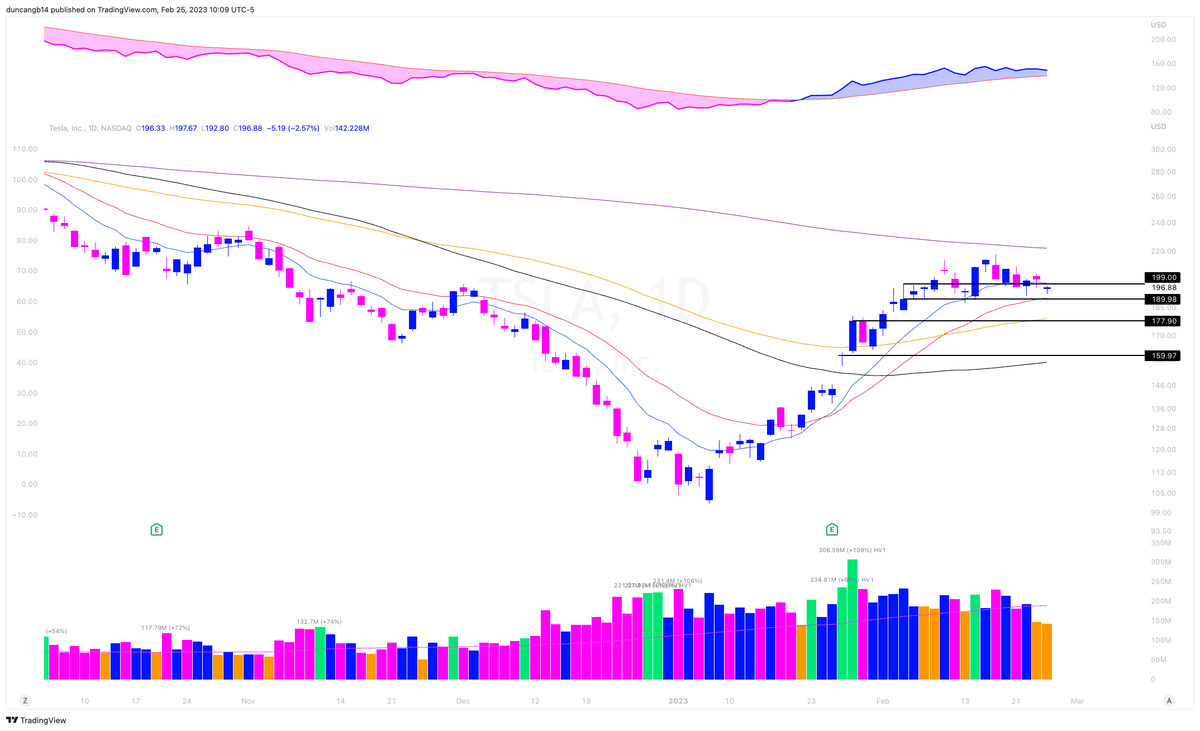

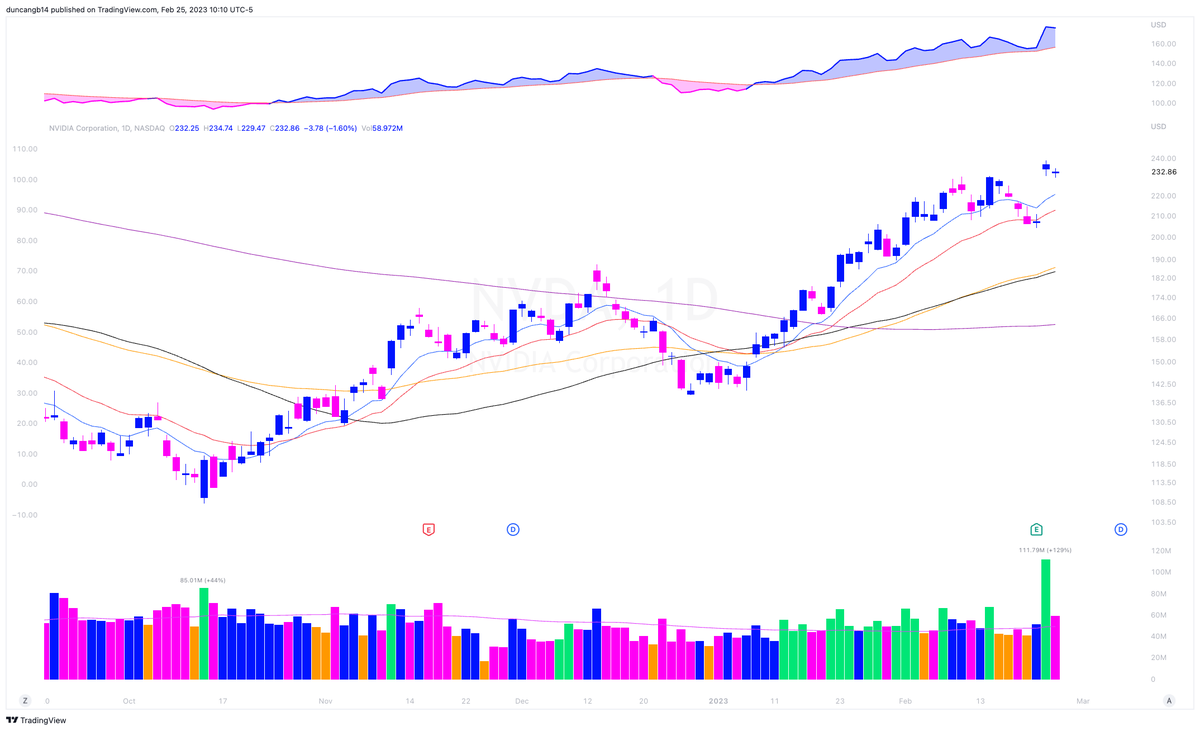

2. Review your focus list stocks & premarket action

That’s it.

You don’t have to have a crazy complex premarket routine. The only 2 things you need to do are:

1. Check-in with yourself

What could hold you back? (answer & then avoid doing!)

2. Review your focus list stocks & premarket action

That’s it.

· Trade the first 1-2 hours

One of the biggest realizations I’ve had over the past couple of years is that you only have to trade the first two hours to make significant progress in the market.

Watching all day will burn you out, quickly.

One of the biggest realizations I’ve had over the past couple of years is that you only have to trade the first two hours to make significant progress in the market.

Watching all day will burn you out, quickly.

· Check back every 30min - 1 hour later.

Once you’ve traded the first hour or so, you can set alerts and then check back periodically throughout the rest of the session.

This will keep you in tune with the action but not burn you out in the process.

Once you’ve traded the first hour or so, you can set alerts and then check back periodically throughout the rest of the session.

This will keep you in tune with the action but not burn you out in the process.

· Trade for the last hour

Major market participants will come back to the market and put the finishing touches on their positions into the close.

Volume will be higher and moves should be more prominent - giving better trading opportunities when compared to midday.

Major market participants will come back to the market and put the finishing touches on their positions into the close.

Volume will be higher and moves should be more prominent - giving better trading opportunities when compared to midday.

· Scanning / Journalling / Tomorrow’s Prep

Let’s split each piece into its own parts:

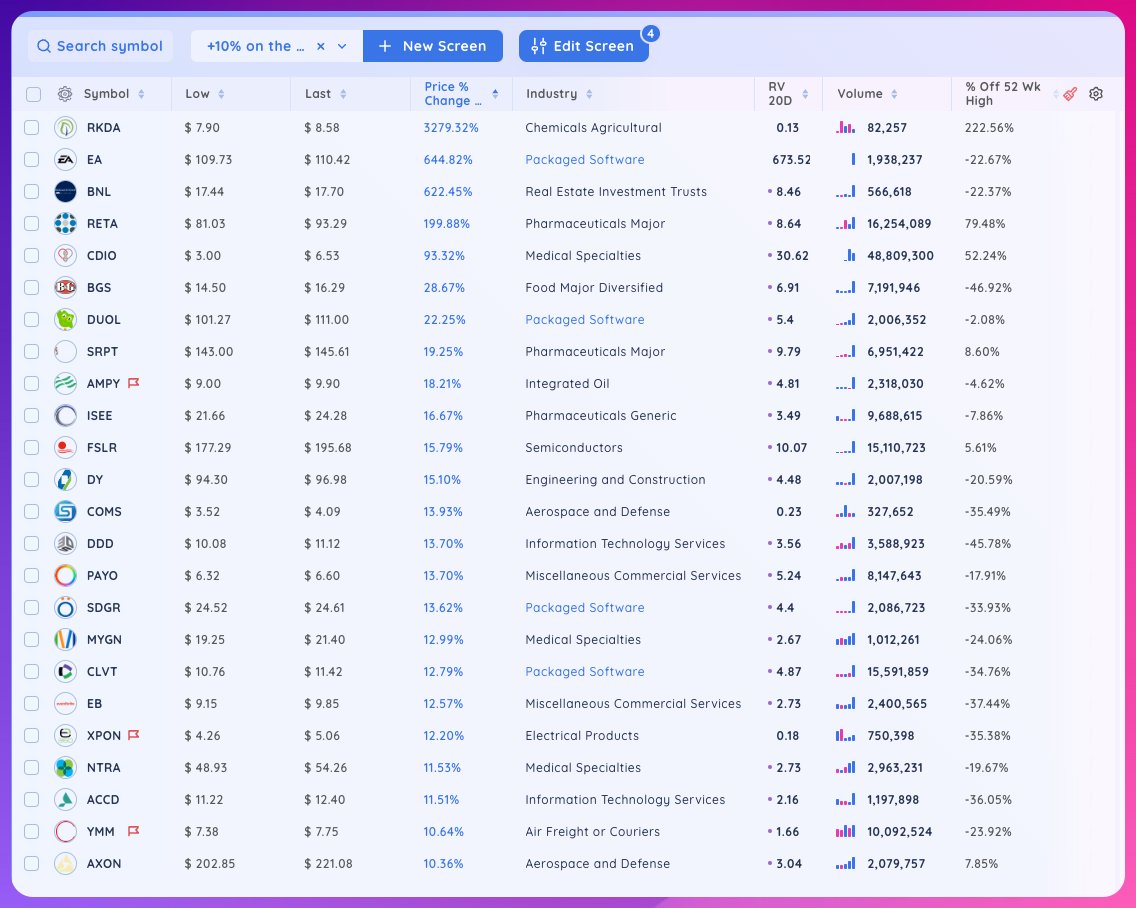

1) Sample Scanning Routine via @deepvue (30 minutes)

• High Volume Scans (HVE, HV1, HVLE, HVIPO)

• 10% or greater on the session

• Pure Liquidity / Volume Scan

Let’s split each piece into its own parts:

1) Sample Scanning Routine via @deepvue (30 minutes)

• High Volume Scans (HVE, HV1, HVLE, HVIPO)

• 10% or greater on the session

• Pure Liquidity / Volume Scan

@Deepvue 2) Journalling

There are so many ways you can journal your thoughts, but I’ve found the following two to be the most effective:

1. 3-2-3 Journalling Method

2. What Would Webby Do #WWWD

Here’s a quick breakdown of both:

There are so many ways you can journal your thoughts, but I’ve found the following two to be the most effective:

1. 3-2-3 Journalling Method

2. What Would Webby Do #WWWD

Here’s a quick breakdown of both:

@Deepvue The 3-2-3 Journalling Method is my go-to (and it’s simple!)

· 3 questions to answer premarket

· 2 questions to answer during market hours

· 3 questions to answer post market

You can download this template here: gregduncan.gumroad.com/l/323-journal

· 3 questions to answer premarket

· 2 questions to answer during market hours

· 3 questions to answer post market

You can download this template here: gregduncan.gumroad.com/l/323-journal

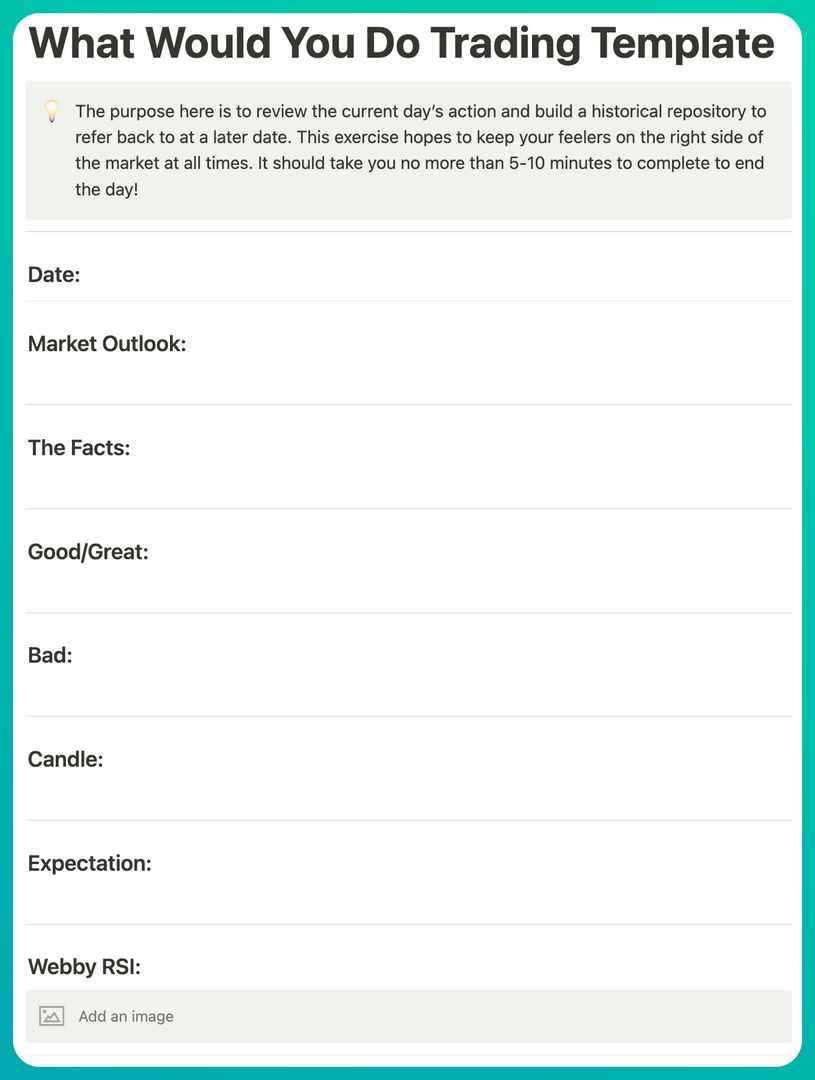

@Deepvue The What Would Webby Do #WWWD Journalling Method:

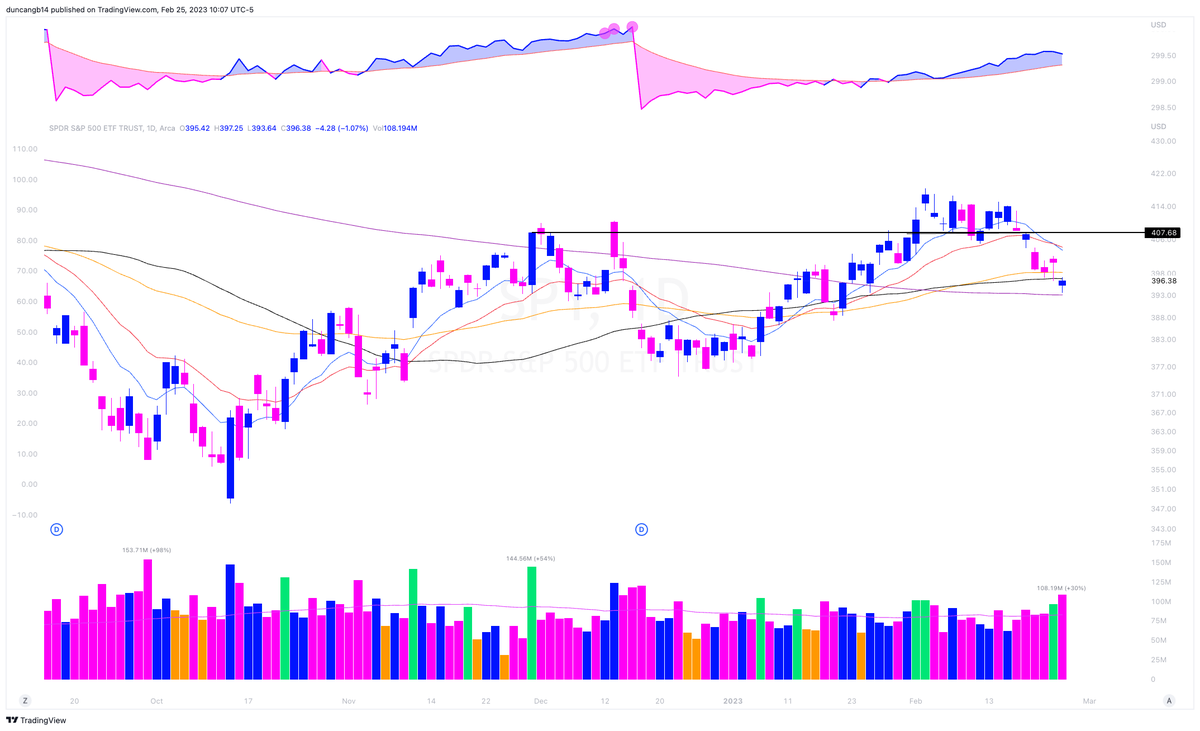

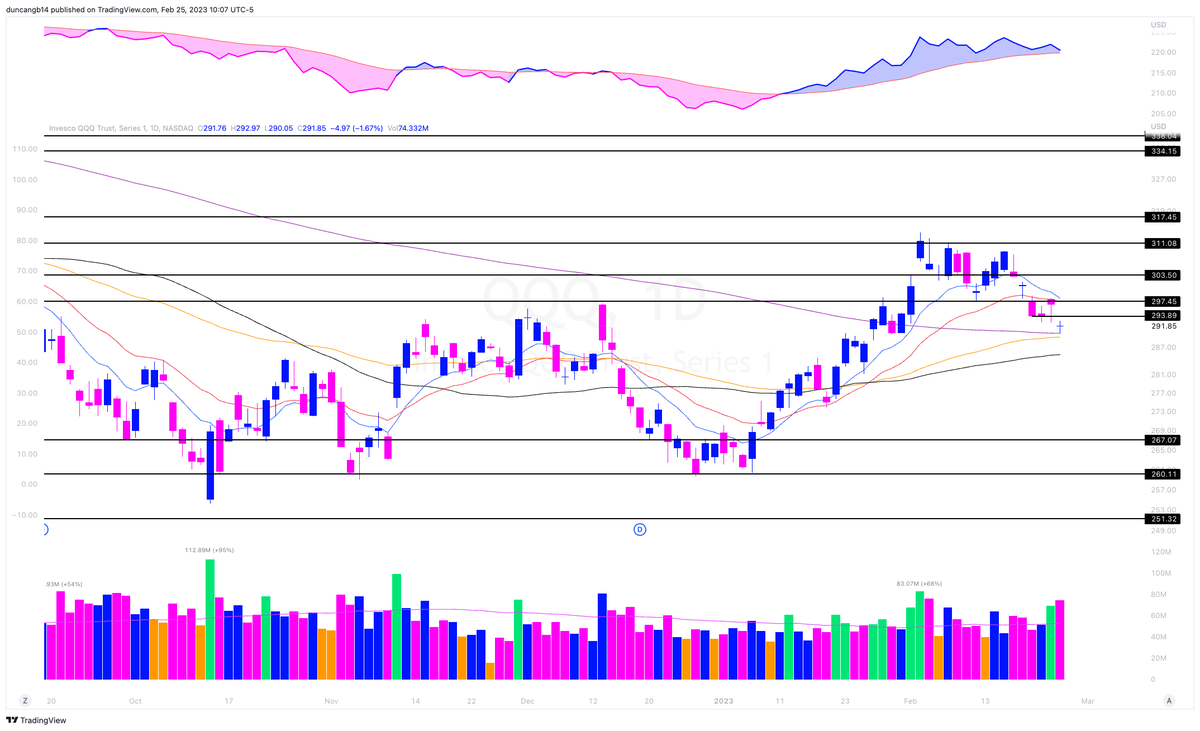

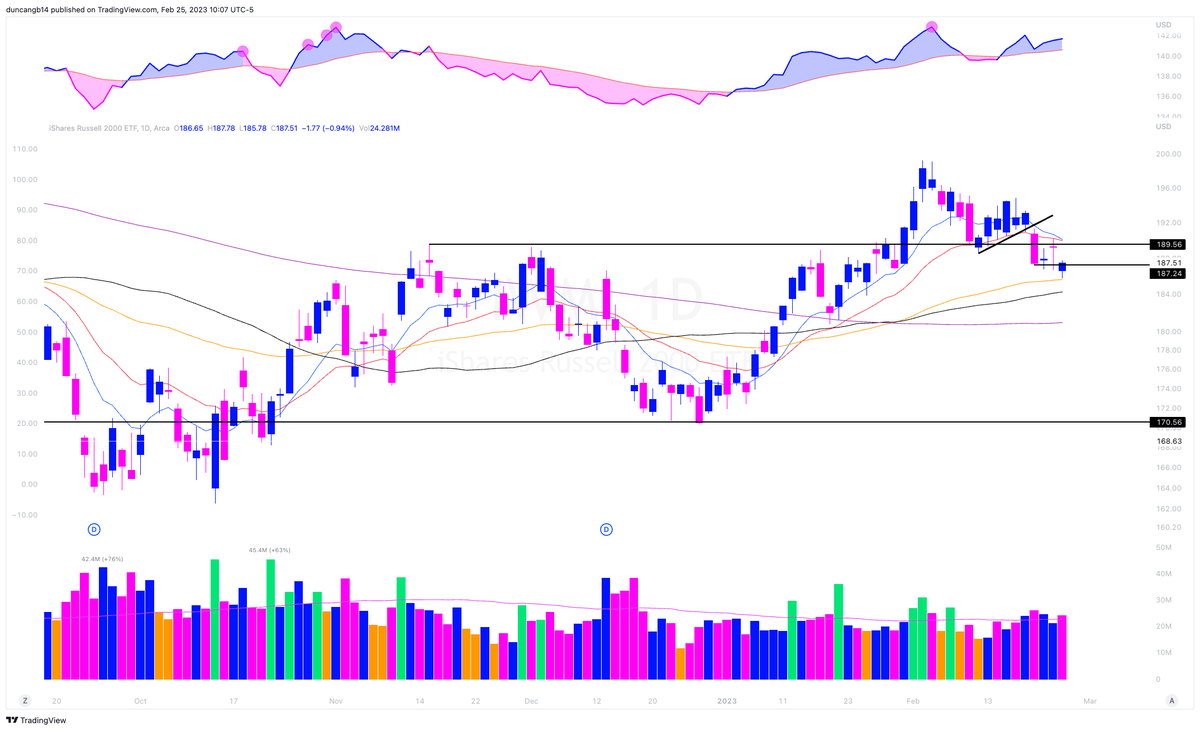

@mwebster1971 used to post a What Would Webby Do article to the IBD site each day, reviewing the general market action.

Doing so helped him stay in touch w/ the market & build out a ‘feel’ for what the market was going to do.

@mwebster1971 used to post a What Would Webby Do article to the IBD site each day, reviewing the general market action.

Doing so helped him stay in touch w/ the market & build out a ‘feel’ for what the market was going to do.

@Deepvue @mwebster1971 At the end of the day, you can come back to answer these questions the same way he did to stay in tune with the market.

If you want to download this free notion template, you can do so here: gregduncan.gumroad.com/l/WWYD

If you want to download this free notion template, you can do so here: gregduncan.gumroad.com/l/WWYD

@Deepvue @mwebster1971 Here’s an example I posted last week (and try to upload to twitter daily)

https://twitter.com/GregDuncan_/status/1635810081416572930

@Deepvue @mwebster1971 Okay! We’ve gotten through the daily routine. You now can see where you need to spend your time and where you can win time back.

Let’s jump into the weekend routine:

Let’s jump into the weekend routine:

@Deepvue @mwebster1971 Simple Weekend Routine Structure:

· Weekly post-trade analysis (1 hr MAX)

· Specific scanning routine (1 hour MAX)

· Clean up watchlists (30min)

· Review journal from week (30 min)

· Prep focus list after scans / review (30 min)

Again, let’s break down each:

· Weekly post-trade analysis (1 hr MAX)

· Specific scanning routine (1 hour MAX)

· Clean up watchlists (30min)

· Review journal from week (30 min)

· Prep focus list after scans / review (30 min)

Again, let’s break down each:

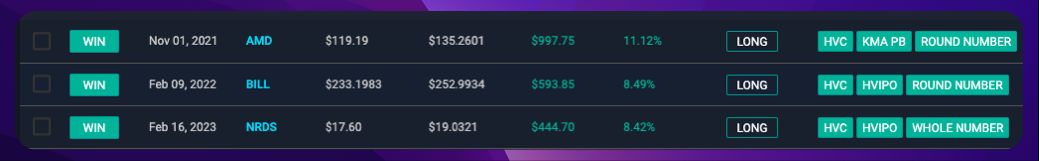

@Deepvue @mwebster1971 1. Weekly Post-Trade Analysis

I use @tradersync

• Import trades from the week from your broker

• Go over wins/losses

• Jot down mistakes to avoid/areas to double down on

That’s it. Keep it simple.

I use @tradersync

• Import trades from the week from your broker

• Go over wins/losses

• Jot down mistakes to avoid/areas to double down on

That’s it. Keep it simple.

@Deepvue @mwebster1971 @tradersync I like to import my trades, label them by setup/edge, and then jot down the mistakes of each and study from there.

If you want to try Tradersync, you can do so here:

tradersync.com/?ref=gregdunca…

If you want to try Tradersync, you can do so here:

tradersync.com/?ref=gregdunca…

@Deepvue @mwebster1971 @tradersync 2. Specific Scanning Routine

On the weekends, here is my scanning routine:

• Short Stroke

• IPO’s over the past 3 years

• High Tight Flags

• +90’s Scan

That’s it. Keep it simple!

On the weekends, here is my scanning routine:

• Short Stroke

• IPO’s over the past 3 years

• High Tight Flags

• +90’s Scan

That’s it. Keep it simple!

https://twitter.com/GregDuncan_/status/1621482387824693248

@Deepvue @mwebster1971 @tradersync 3. Cleaning up watchlists

Once you’ve done your PTA and scanned, you can start to clean up your watchlists.

• Add names that are showing up in scans

• Remove names that have broken down / are lagging

Boom. On to the final two pieces…

Once you’ve done your PTA and scanned, you can start to clean up your watchlists.

• Add names that are showing up in scans

• Remove names that have broken down / are lagging

Boom. On to the final two pieces…

@Deepvue @mwebster1971 @tradersync 1. Review journal from week (30 min)

This is when you can review each day’s 3-2-3 or #WWWD.

Try to see how you were thinking each day and go from there.

2. Prep focus list after scans / review (30 min)

It’s now time to review your WL’s and create a Focus List.

This is when you can review each day’s 3-2-3 or #WWWD.

Try to see how you were thinking each day and go from there.

2. Prep focus list after scans / review (30 min)

It’s now time to review your WL’s and create a Focus List.

@Deepvue @mwebster1971 @tradersync Your focus list should be stocks that meet your criteria for the highest level of confidence.

I wrote more about how to use The Confidence System here:

gduncan.substack.com/p/the-confiden…

I wrote more about how to use The Confidence System here:

gduncan.substack.com/p/the-confiden…

@Deepvue @mwebster1971 @tradersync TL;DR To perform better & win back time, structure your routines like:

Daily:

• Premarket

· Trade first 1-2 hrs, last 1hr

· Periodic check back

· Scan, Journal, Tomorrow Prep

Weekend:

· Weekly PTA

· Specific scanning routine

· Review journal/watchlists

· Build focus list

Daily:

• Premarket

· Trade first 1-2 hrs, last 1hr

· Periodic check back

· Scan, Journal, Tomorrow Prep

Weekend:

· Weekly PTA

· Specific scanning routine

· Review journal/watchlists

· Build focus list

@Deepvue @mwebster1971 @tradersync That’s it… I just wrote 950+ words on everything I know about routines and how optimizing them will change the way you trade.

If you enjoyed:

1. Follow me @gregduncan_ for more valuable content on the market

2. Like/retweet the first tweet below to share with another trader:

If you enjoyed:

1. Follow me @gregduncan_ for more valuable content on the market

2. Like/retweet the first tweet below to share with another trader:

https://twitter.com/GregDuncan_/status/1637773559010320386

If you enjoyed posts like these, you'll probably find value in my 2020's Best Charts book.

· 90+ annotated charts, highlighting key winning characteristics

· Learn to spot the common characteristics market's best stocks

Join 850+ others here:

gregduncan.gumroad.com/l/wmfsd

· 90+ annotated charts, highlighting key winning characteristics

· Learn to spot the common characteristics market's best stocks

Join 850+ others here:

gregduncan.gumroad.com/l/wmfsd

• • •

Missing some Tweet in this thread? You can try to

force a refresh