How to get URL link on X (Twitter) App

1. Acknowledge that you don't know everything

1. Acknowledge that you don't know everything

The story begins in late January of 2007, when FSLR breaks out above the $30 whole number on volume.

The story begins in late January of 2007, when FSLR breaks out above the $30 whole number on volume.

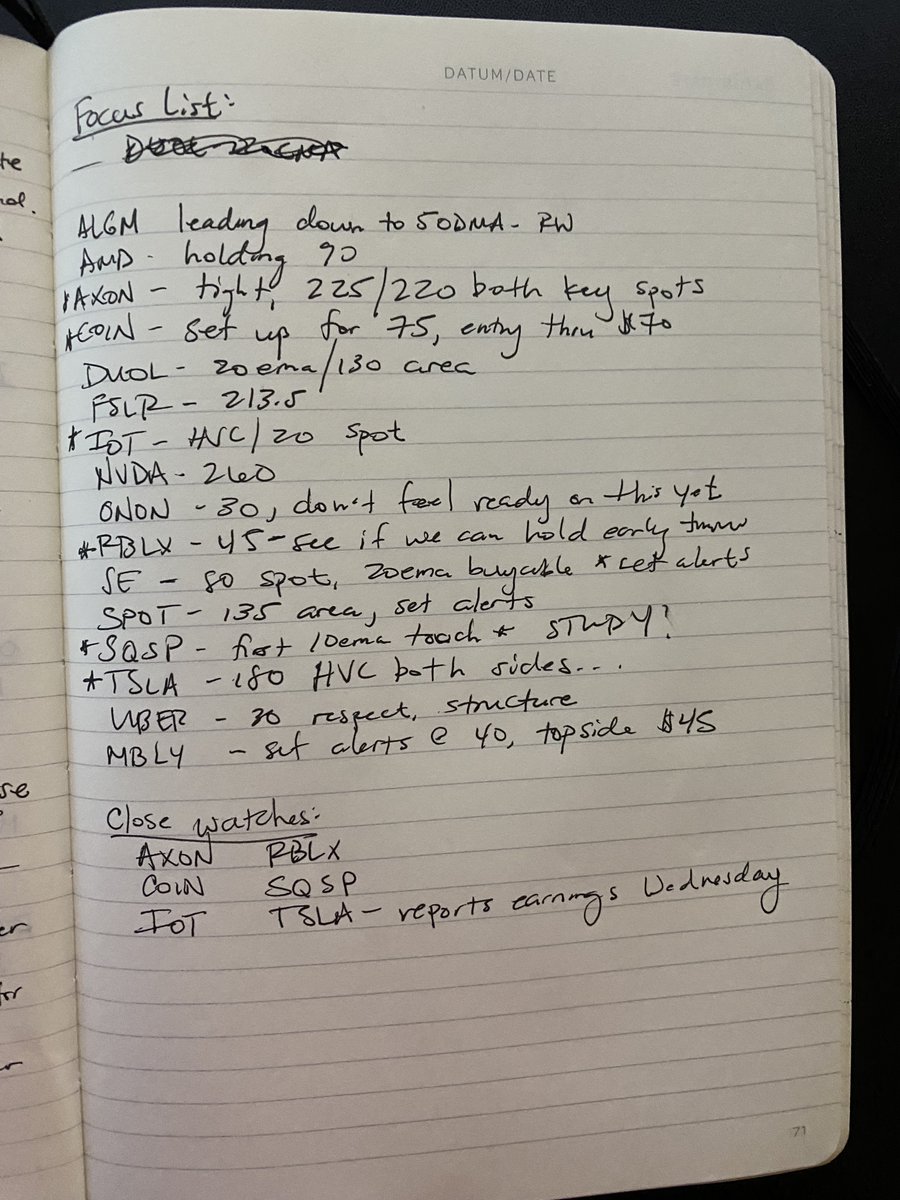

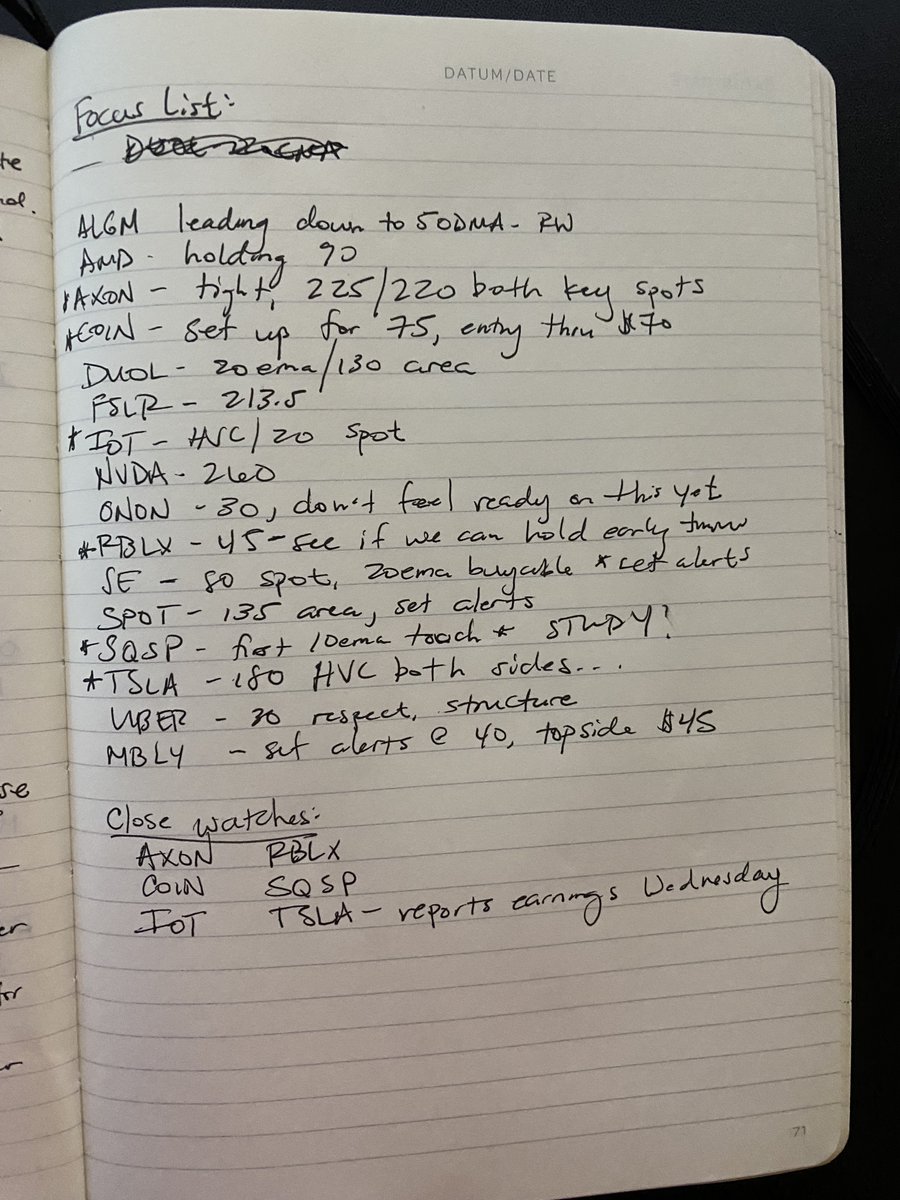

$ALGM leading down to the 50DMA, see if it can get some support here and move up back through the $46 area

$ALGM leading down to the 50DMA, see if it can get some support here and move up back through the $46 area