Banks collapsing has many worried about recession

Can companies in your portfolio weather the storm?

3️⃣ simple metrics to give you the answer⤵️

Can companies in your portfolio weather the storm?

3️⃣ simple metrics to give you the answer⤵️

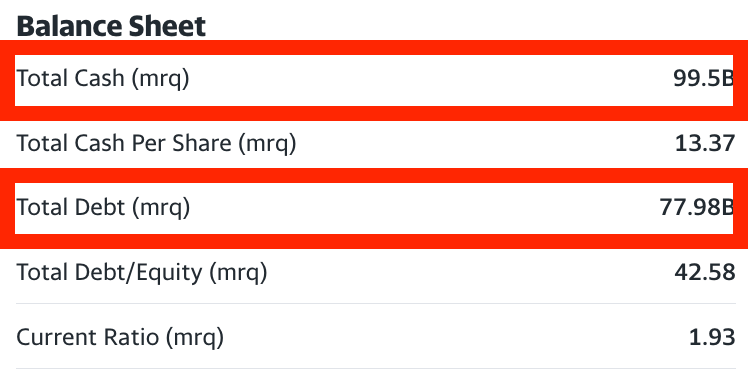

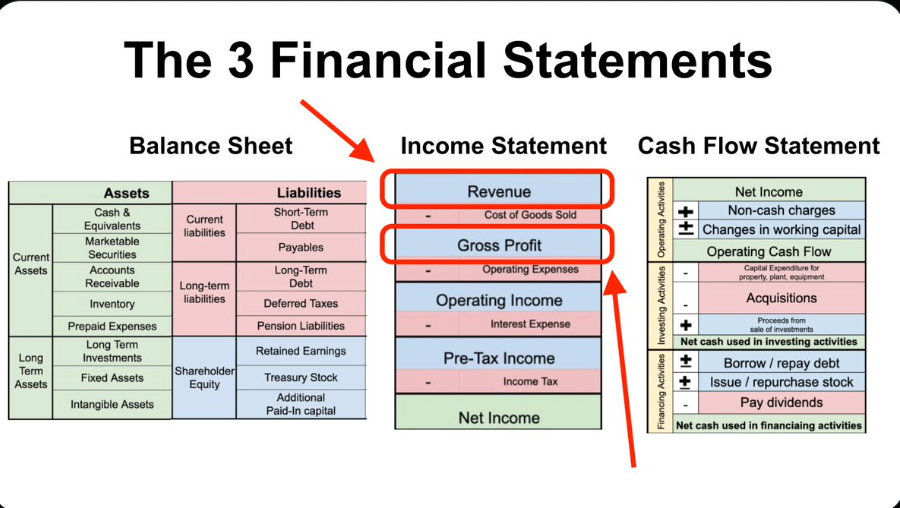

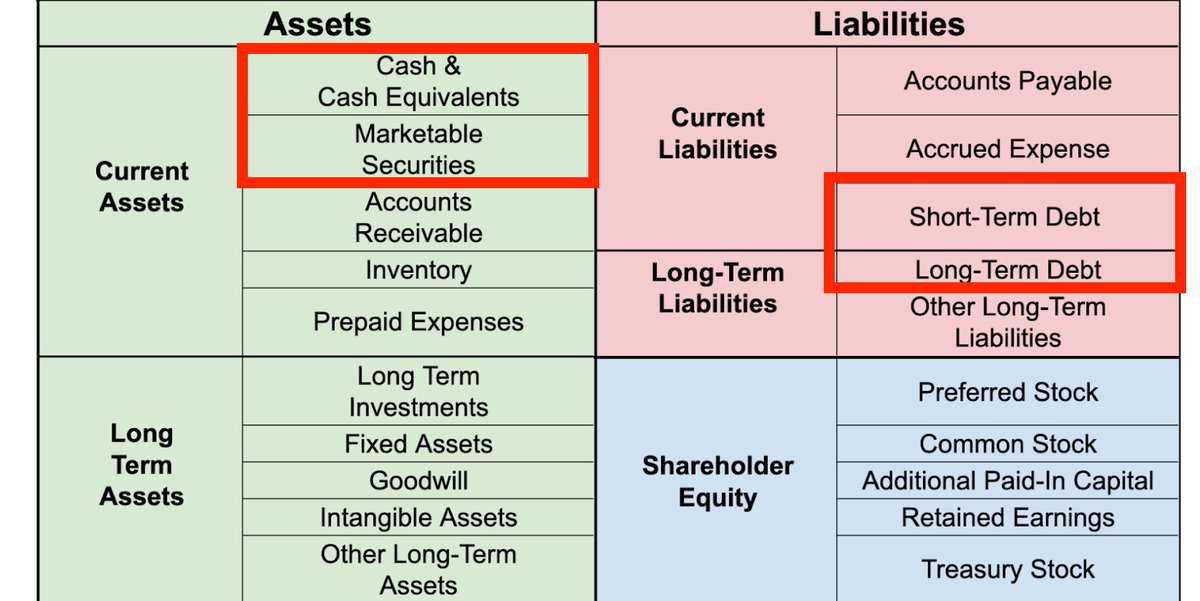

The first two metrics come from the BALANCE SHEET

1️⃣ Cash & Short-Term Investments

2️⃣ Debt (especially Long-Term)

This tells you a company's NET CASH position.

➕ Net Cash means more cash than debt

➖ Net Cash means more debt than cash

1️⃣ Cash & Short-Term Investments

2️⃣ Debt (especially Long-Term)

This tells you a company's NET CASH position.

➕ Net Cash means more cash than debt

➖ Net Cash means more debt than cash

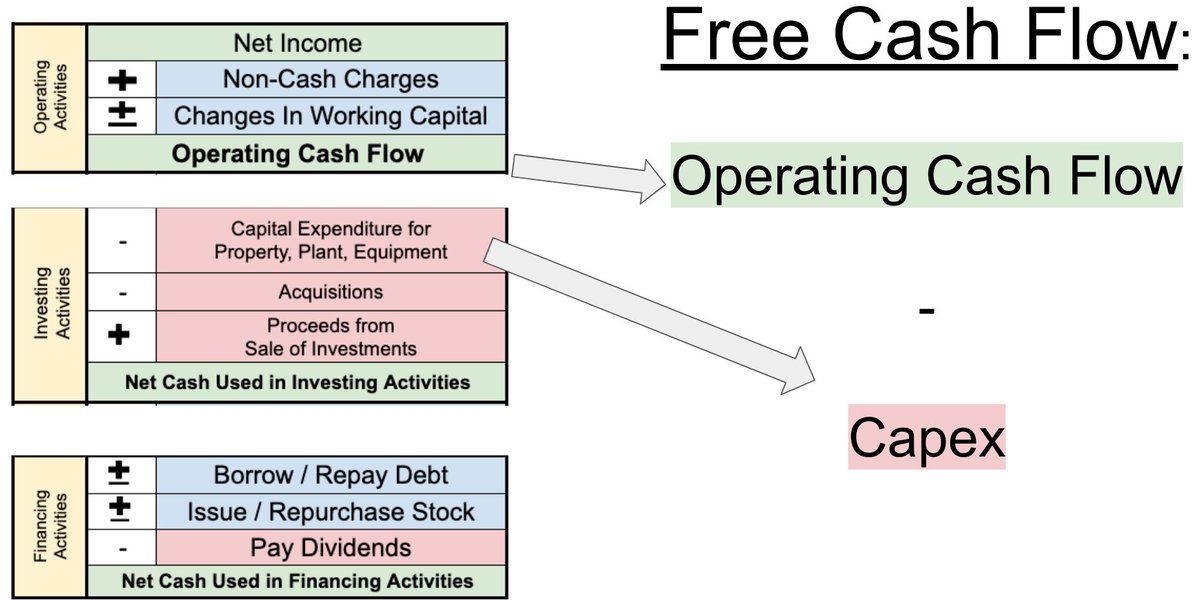

Think about it this way:

👉 The NET CASH position tells you if there's any gas sitting in the tank

👉 Free Cash Flow tells you if gas is GOING INTO or OUT OF the tank

The higher the net cash and FCF are, the better

👉 The NET CASH position tells you if there's any gas sitting in the tank

👉 Free Cash Flow tells you if gas is GOING INTO or OUT OF the tank

The higher the net cash and FCF are, the better

Put in one of 3 buckets

👉 FRAGILE: ➖ Net Cash & ➖ FCF

These will suffer when a crisis hits

👉 ROBUST: ➕ Net Cash & ➕ FCF

These will survive a crisis, but not get stronger

👉ANTIFRAGILE: ➕➕ Net Cash & ➕➕ FCF

These will get stronger BECAUSE OF the crisis. Here's how⤵️

👉 FRAGILE: ➖ Net Cash & ➖ FCF

These will suffer when a crisis hits

👉 ROBUST: ➕ Net Cash & ➕ FCF

These will survive a crisis, but not get stronger

👉ANTIFRAGILE: ➕➕ Net Cash & ➕➕ FCF

These will get stronger BECAUSE OF the crisis. Here's how⤵️

If you have TONS of cash and LOTS of FCF, you can do things others can't:

1️⃣ Acquire distressed competitors

2️⃣ Buyback your own shares on the cheap

3️⃣ Sell your products at a loss -- which you can survive, but drives the competition into bankruptcy

1️⃣ Acquire distressed competitors

2️⃣ Buyback your own shares on the cheap

3️⃣ Sell your products at a loss -- which you can survive, but drives the competition into bankruptcy

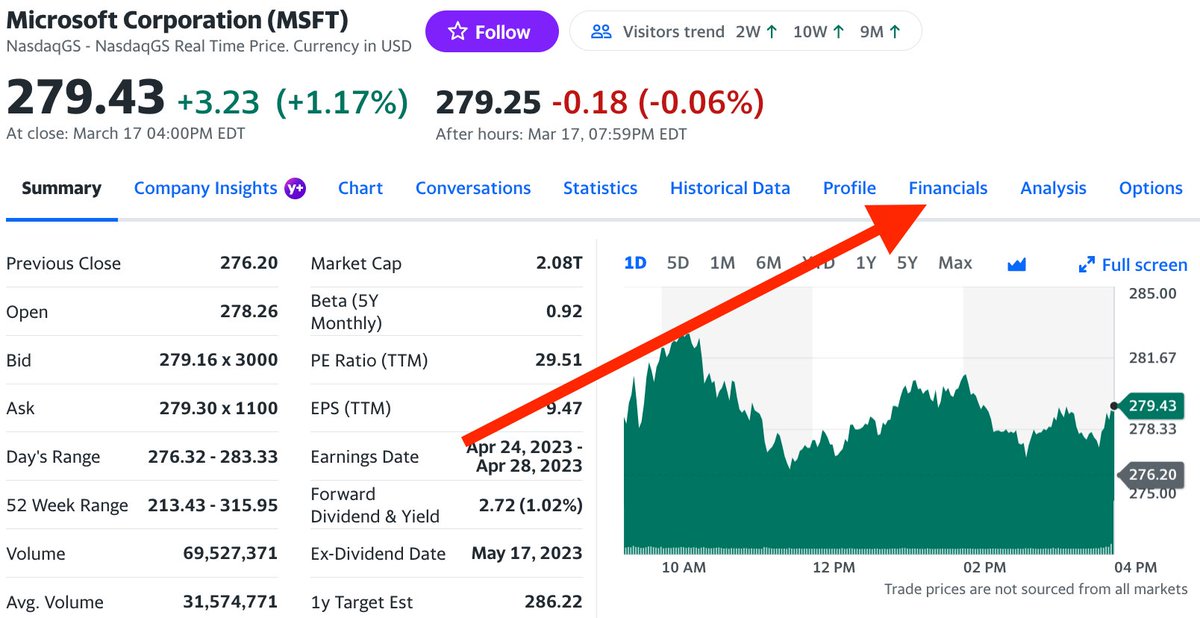

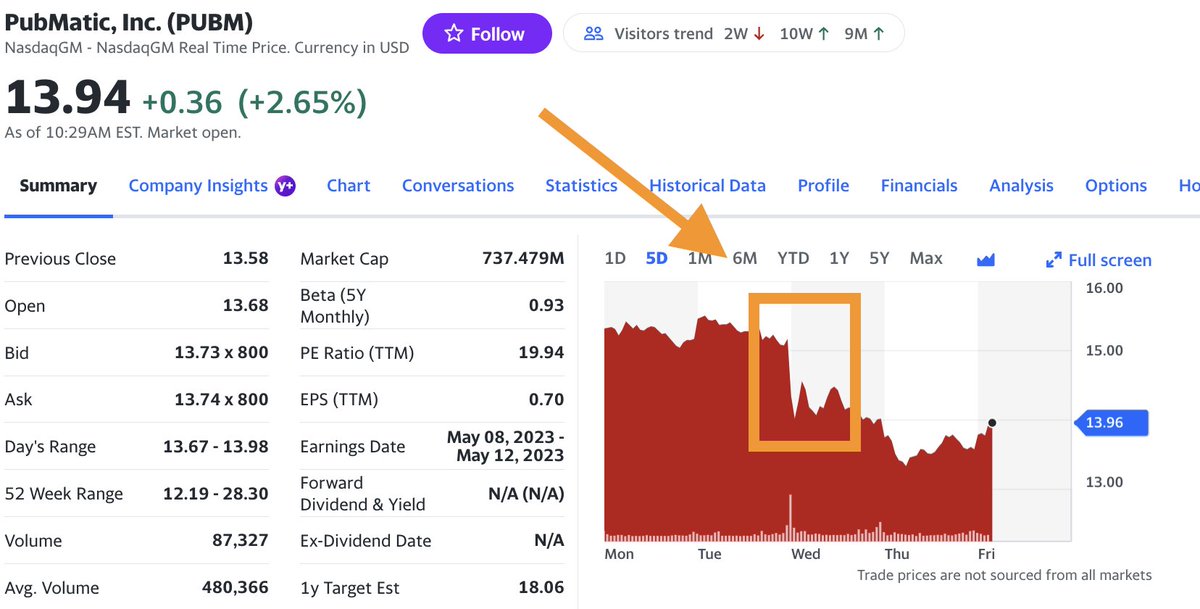

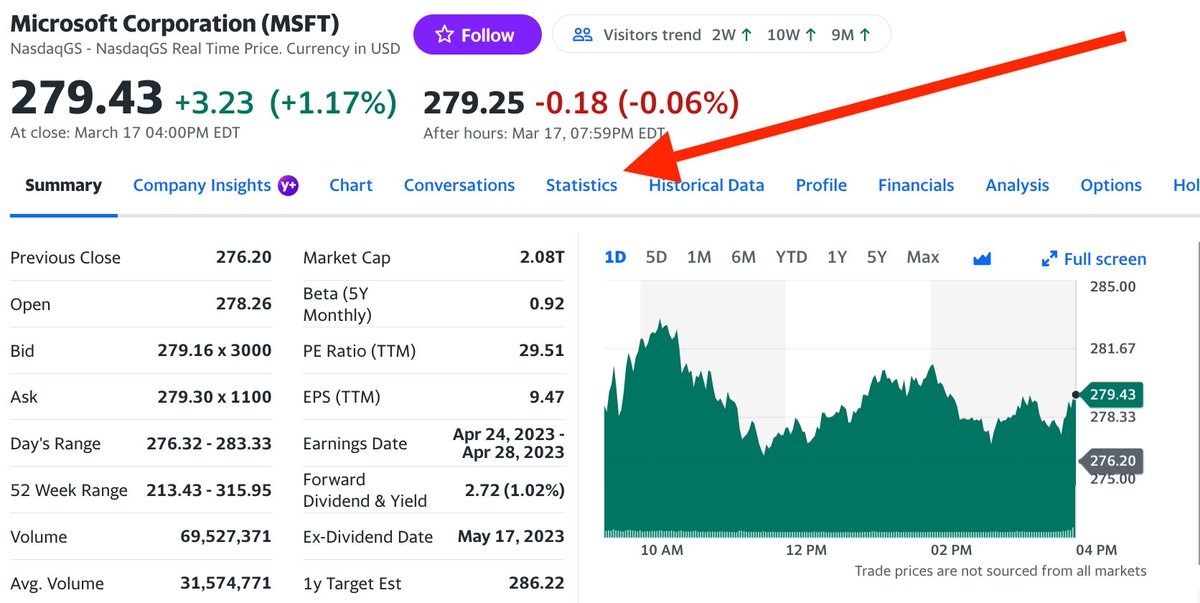

You can find all of these on Yahoo! Finance.

Let's use $MSFT as an example.

Click on the Statistics tab first

Let's use $MSFT as an example.

Click on the Statistics tab first

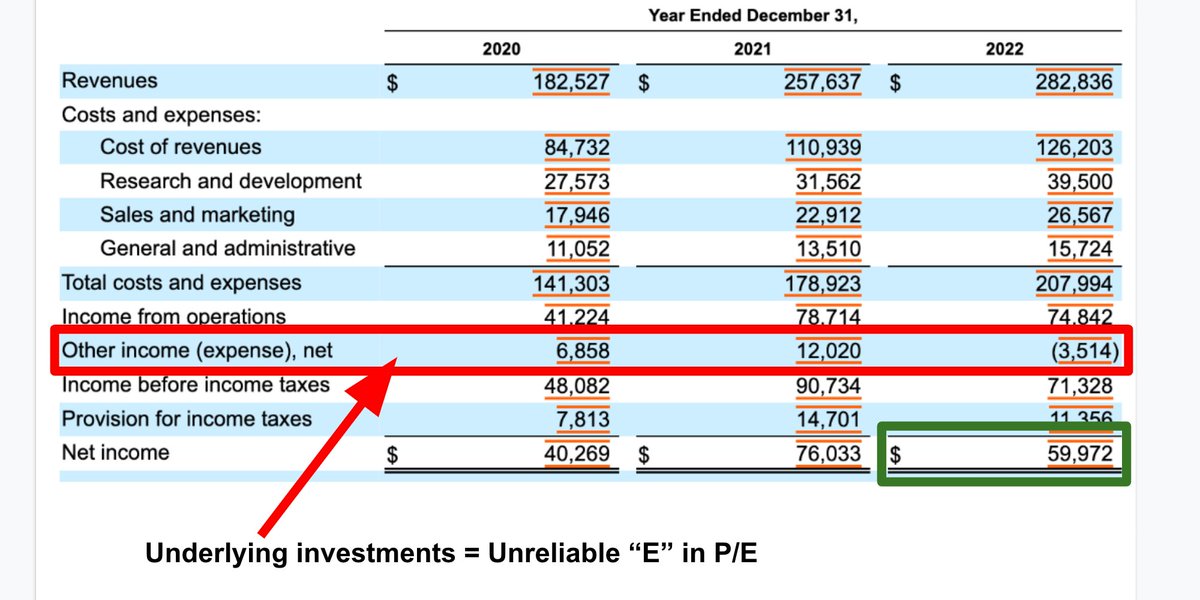

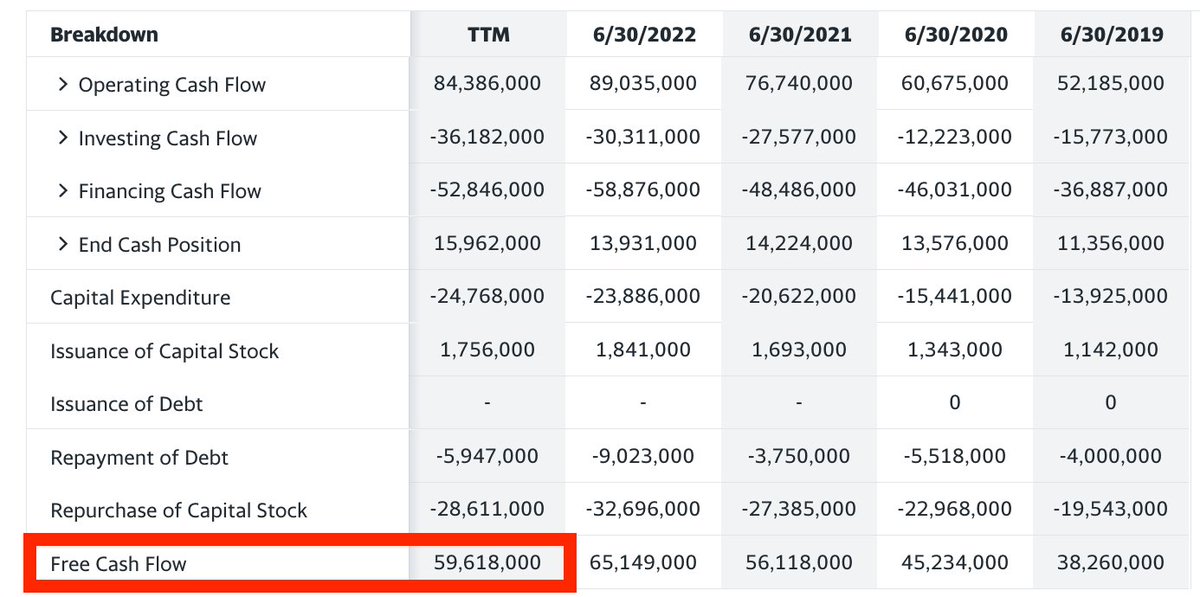

Scroll down and Free Cash Flow over the trailing twelve months (TTM) is calculated for you.

For $MSFT that's.....👀$60 Billion👀

Yes, you read that right. It has $60 Billion flowing into its accounts ANNUALLY right now

For $MSFT that's.....👀$60 Billion👀

Yes, you read that right. It has $60 Billion flowing into its accounts ANNUALLY right now

That does NOT mean $MSFT stock won't go down in a recession.

It DOES mean $MSFT will be able to do things others can't in a downturn.

And in the LONG-RUN, that *will* have a positive effect on $MSFT stock

It DOES mean $MSFT will be able to do things others can't in a downturn.

And in the LONG-RUN, that *will* have a positive effect on $MSFT stock

If focusing on the LONG-RUN matters to you as an investor, you'll love my FREE weekly, newsletter. 50,000+ investors are already subscribed.

Join us by entering your email here:

brianstoffel.com

Join us by entering your email here:

brianstoffel.com

To review

Check:

1️⃣ Cash & Short-Term Investments

2️⃣ Debt (especially Long-Term)

3️⃣ Free Cash Flow

Companies go in one of three buckets

👉 FRAGILE: Lots of debt, little cash, negative FCF

👉 ROBUST: Positive net cash, some FCF

👉 ANTIFRAGILE: MUCH more cash, LOTS of FCF

Check:

1️⃣ Cash & Short-Term Investments

2️⃣ Debt (especially Long-Term)

3️⃣ Free Cash Flow

Companies go in one of three buckets

👉 FRAGILE: Lots of debt, little cash, negative FCF

👉 ROBUST: Positive net cash, some FCF

👉 ANTIFRAGILE: MUCH more cash, LOTS of FCF

• • •

Missing some Tweet in this thread? You can try to

force a refresh